Westchester Transfer Tax FAQ:

How much are transfer taxes in Westchester County?

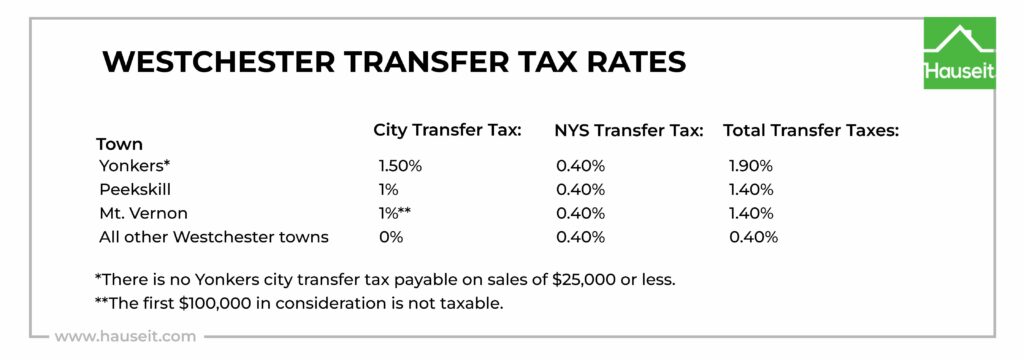

The real estate transfer tax rate in Westchester County, NY is 0.4% of the sale price. The Westchester transfer tax is also known as the NYS Transfer Tax. The NYS Transfer Tax is a seller closing cost.

A handful of cities in Westchester charge sellers a city transfer tax on top of the NYS Transfer Tax. These cities include Yonkers, Peekskill and Mt. Vernon.

Yonkers charges its own transfer tax of 1.5% on top of the standard 0.4% NYS Transfer Tax, for a total of 1.9% of the sale price.

Peekskill charges a city transfer tax of 1% in addition to the NYS Transfer Tax rate of 0.4%, for a total of 1.4% in seller transfer taxes.

Mt. Vernon levies a city transfer tax of 1% on consideration in excess of $100,000 in addition to the 0.4% NYS Transfer Tax on the entire purchase price. The combined city and state transfer tax rate in Mt. Vernon is approximately 1.4%.

Note that the additional city transfer taxes imposed by Yonkers, Peekskill and Mt. Vernon do not apply to co-ops.