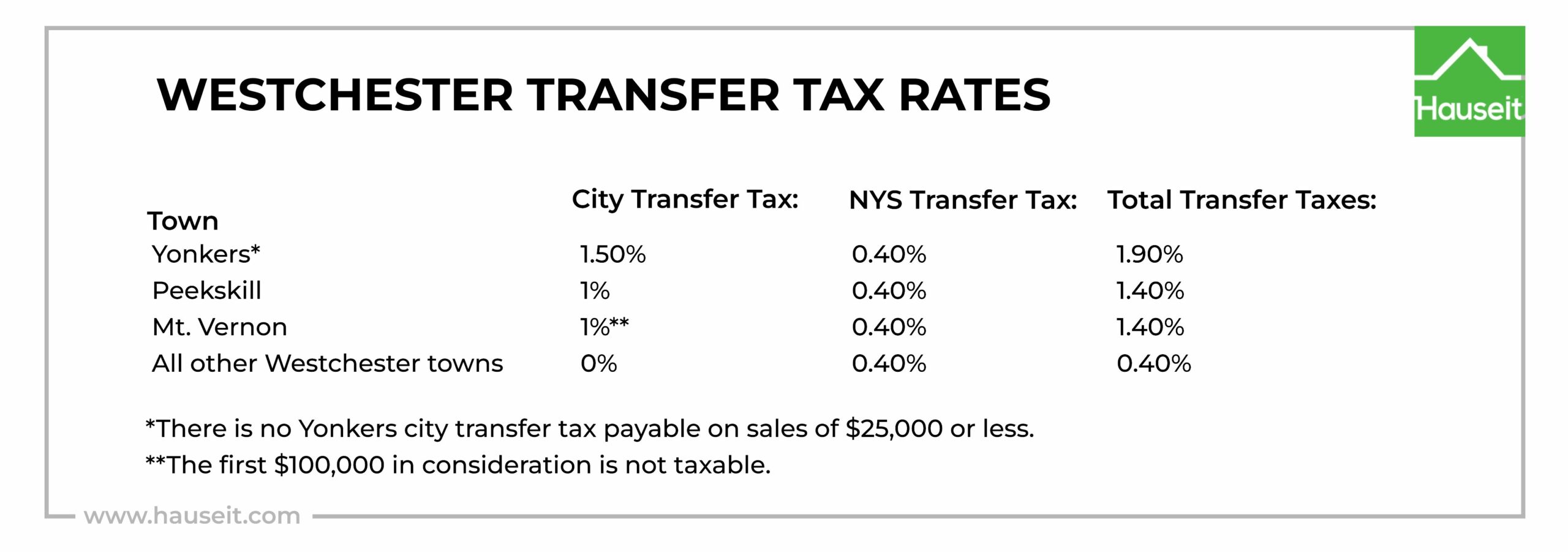

The real estate transfer tax rate in Westchester County, NY is 0.4% of the sale price. The Westchester transfer tax is also known as the NYS Transfer Tax. The NYS Transfer Tax is a seller closing cost.

A handful of cities in Westchester charge sellers a city transfer tax on top of the NYS Transfer Tax. These cities include Yonkers, Peekskill and Mt. Vernon.

Yonkers charges its own transfer tax of 1.5% on top of the standard 0.4% NYS Transfer Tax, for a total of 1.9% of the sale price.

Peekskill charges a city transfer tax of 1% in addition to the NYS Transfer Tax rate of 0.4%, for a total of 1.4% in seller transfer taxes.

Mt. Vernon levies a city transfer tax of 1% on consideration in excess of $100,000 in addition to the 0.4% NYS Transfer Tax on the entire purchase price. The combined city and state transfer tax rate in Mt. Vernon is approximately 1.4%.

Note that the additional city transfer taxes imposed by Yonkers, Peekskill and Mt. Vernon do not apply to co-ops.

How is transfer tax calculated in Westchester?

Calculate the NYS Transfer Tax in Westchester by rounding the sale price up to the nearest $500 and multiplying the result by 0.4%. Here’s an example:

Unless otherwise negotiated, the seller is responsible for paying the NYS Transfer Tax on a home sale in Westchester County. Keep in mind however that it’s customary for purchasers to pay transfer taxes (as well as seller legal fees) when it comes to new construction.

Remember that additional city transfer taxes apply if you’re selling in Yonkers, Mt. Vernon or Peekskill:

-

Yonkers: 1.5%

-

Peekskill: 1%

-

Mt. Vernon: 1% on consideration above $100,000

Note that there is no rounding convention when calculating city transfer taxes as is the case with the NYS Transfer Tax (round the sale price up to the nearest $500).

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

How much is the transfer tax in Yonkers?

The combined real estate transfer tax rate in Yonkers is 1.9%. Yonkers charges both a city and state transfer tax. The Yonkers city transfer tax rate is 1.5%, and the NYS Transfer Tax rate in Yonkers is 0.4%, for a combined transfer tax rate of 1.9%.

Here’s an example of how to calculate transfer taxes on a sale in Yonkers:

There is no Yonkers city transfer tax payable on sales of $25,000 or less.

Per the city commissioner, “The (transfer) tax is due and payable to the City of Yonkers, within seven (7) days after delivery of the deed by the grantor to the grantee but before the recording of such deed.”

Moreover, “A return must be filed by both the grantor and the grantee whether or not a tax is due and although the consideration for the deed is $25,000 or less.”

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

What is the transfer tax in Mt. Vernon?

The combined real estate transfer tax rate for sellers in Mt. Vernon is 1.9%. Mt. Vernon charges both a city and state transfer tax. The Mt. Vernon city transfer tax rate is 1%, and the NYS Transfer Tax rate in Mt. Vernon is 0.4%, for a combined transfer tax rate of 1.4%.

The first $100,000 of consideration is exempt from Mt. Vernon city transfer taxes.

Here’s an example of how to calculate transfer taxes on a sale in Mt. Vernon:

The city of Mount Vernon requires the filing of a Real Property Transfer Tax Return whether or not a tax is due thereon and although the consideration for the deed is $100,000 or less.

How much are seller transfer taxes in Peekskill?

The combined real estate transfer tax rate for sellers in Peekskill is 1.9%. Peekskill charges both a city and state transfer tax. The Peekskill city transfer tax rate is 1%, and the NYS Transfer Tax rate in Peekskill is 0.4%, for a combined transfer tax rate of 1.4%.

Here’s an example of how to calculate transfer taxes on a sale in Peekskill:

How are Westchester and NYC Transfer Taxes different?

NYC Transfer Taxes are typically higher compared to what sellers pay in Westchester. Combined NYC and NYS Transfer Taxes for sellers in New York City is between 1.4% and 2.075% of the sale price versus just 0.4% in most of Westchester.

However, transfer taxes in Yonkers, Peekskill and Mount Vernon are comparable to those in NYC due to the additional city taxes levied by these towns.

Yonkers charges a combined 1.9% in city and state transfer taxes, and Peekskill and Mount Vernon charge approximately 1.4%.

The NYS Transfer Tax rate in Westchester does not vary by sale price or property type as is the case with NYC Transfer Taxes.

In addition to having its own city-specific seller transfer tax, NYC has a higher state transfer tax rate of 0.65% which applies to residential sales of $3 million or more and commercial transactions of $2 million or more.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit