Florida Documentary Stamp Tax Calculator

Purchase Рrice

Loan Amount

Is the property in Miami-Dade County?

Is the property a single-family house?

Results

Florida Documentary Stamp Tax (Buyer):

Florida Documentary Stamp Tax (Seller):

Learn More to Save More

Glossary

Florida Documentary Stamp Tax

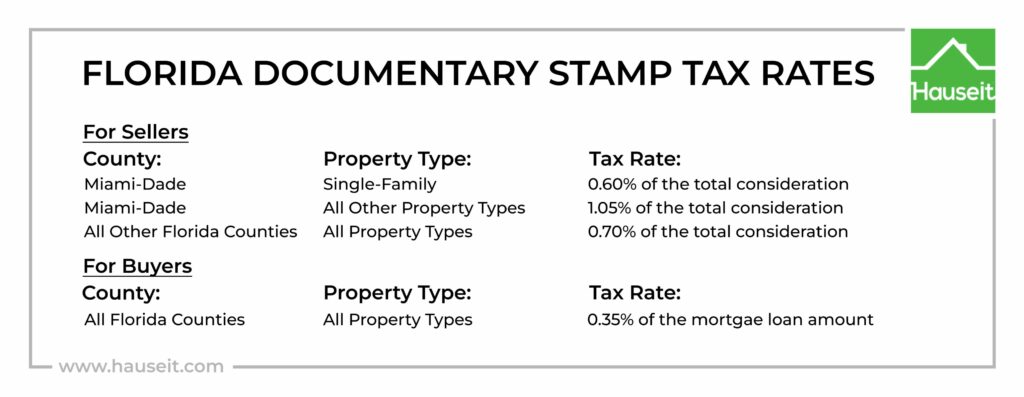

The Florida Documentary Stamp Tax is a both buyer and seller closing cost in the state of Florida. The Florida Documentary Stamp Tax is levied both on deeds, customarily paid by sellers, as well as on mortgages, typically paid by buyers.

Florida levies a Documentary Stamp Tax on deed transfers, also known as a transfer tax, on sellers when real property is sold. In all Florida counties except Miami-Dade, the tax rate is 0.7% of the total consideration. In Miami-Dade county, the tax rate is 0.6% on single-family home sales and 1.05% on anything else.

Buyers customarily pay the Florida Documentary Stamp Tax on the loan amount if they are purchasing with a mortgage. The Florida Documentary Stamp Tax rate is different for buyers and sellers. Similar to the Mortgage Recording Tax seen in NYC, the Florida Documentary Stamp Tax rate is 0.35% of the loan amount.