Learn More to Save More

Glossary

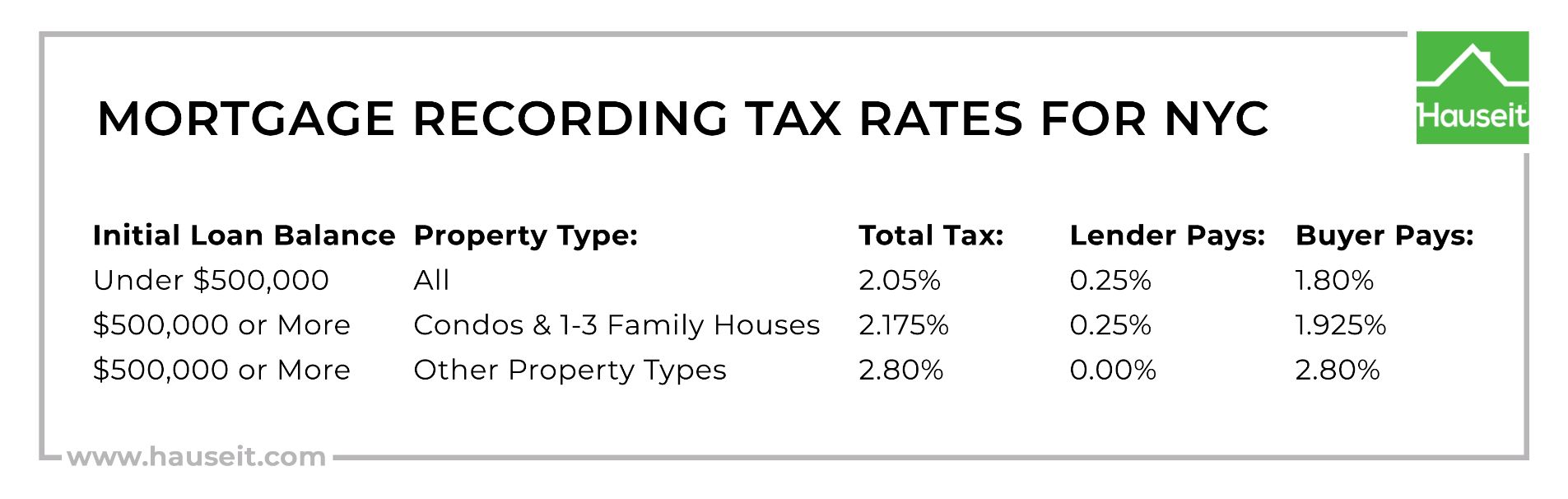

Mortgage Recording Tax (MRT) Rates in NYC

New York State imposes a Mortgage Recording Tax on real property located within the state. In addition, New York City, Yonkers, and various counties impose local taxes on mortgages that are recorded in those jurisdictions. Because co-ops are not considered to be ‘real property,’ the Mortgage Recording Tax does not apply to co-op apartments. This is a major reason why buyer closing costs are lower for condos vs. co-ops.

The Mortgage Recording Tax (MRT) Rates below for NYC include both the state and local components of the tax:

FAQ

How much is the Mortgage Recording Tax in NYC?

The NYC Mortgage Recording Tax (MRT) is 1.8% for loans below $500k and 1.925% for loans of $500k or more. The MRT is the largest buyer closing cost in NYC. How much Mortgage Recording Tax you pay is based on the size of your loan as opposed to the purchase price. The NYC Mortgage Recording Tax does not apply to co-op apartments.

How much are buyer closing costs in NYC?

Buyer closing costs in NYC, including the Mansion Tax, are approximately 4% for condos and houses, 2% for co-ops and 6% or more for new developments, assuming you are financing. Closing costs may be lower for an all-cash purchase. You can reduce your closing costs and save up to 2% on your purchase by requesting a Hauseit Buyer Closing Credit.

Is it possible to reduce my buyer closing costs in NYC?

Yes. You can reduce your buyer closing costs and save up to 2% on your purchase by requesting a buyer agent commission rebate through Hauseit. Rebates are a legal and non-taxable way to reduce your buyer closing costs while receiving traditional, full-service representation from a seasoned buyer’s agent throughout the purchase process.

How much can I save with a commission rebate?

At Hauseit, we offer buyers the ability to save up to 2 percent and reduce buyer closing costs through the largest broker commission rebate in NYC. The buyer of a $2 million property in NYC can save $40,000, assuming that the buyer agent commission being offered is 3 percent. Better yet, IRS has issued an opinion letter stating that closing credits and commission incentives provided by real estate brokers are generally not taxable.

How do buyer agent commission rebates work?

We pair you with an experienced, local partner buyer’s agent who will not only serve the role as a traditional, full-service buyer’s broker but who has already agreed to discreetly write you a check for up to 2 percent of the purchase price at closing, which comes out of the commission paid by the seller. Hauseit’s partner brokers are traditional brokerage firms and agents based locally in NYC who never openly discount or offer rebates online. Learn more here.