NYC Title Insurance Calculator

Property Details

Purchase Price

Mortgage Amount

Residential Property Type Title insurance is typically not required when buying a co-op.

Are you buying with an LLC?

Add optional market value rider? A Market Value Rider increases the amount of title insurance coverage to match home price appreciation over time.

Learn More

Glossary

Title Insurance

Title insurance is an insurance policy against any defects or future claims against the title for issues which were unknown at the time of purchase when the original title search was conducted. This means you’ll be protected if a previous owner comes out of the woodwork ten years after your purchase, and claims that there was a mistake in the chain of title and that he never sold the property to the seller of your property, which means the seller of your property didn’t have a right to sell it to you.

Title insurance comes in the form of an owner’s policy (which protects your home equity based on the purchase price) and a lender’s policy which insures your mortgage lender from any title-related losses on your loan’s principal balance. You can also purchase an additional insurance policy called a Market Value Rider which will automatically step-up the amount of your Title Insurance policy coverage to match appreciation in the market value over time.

FAQ

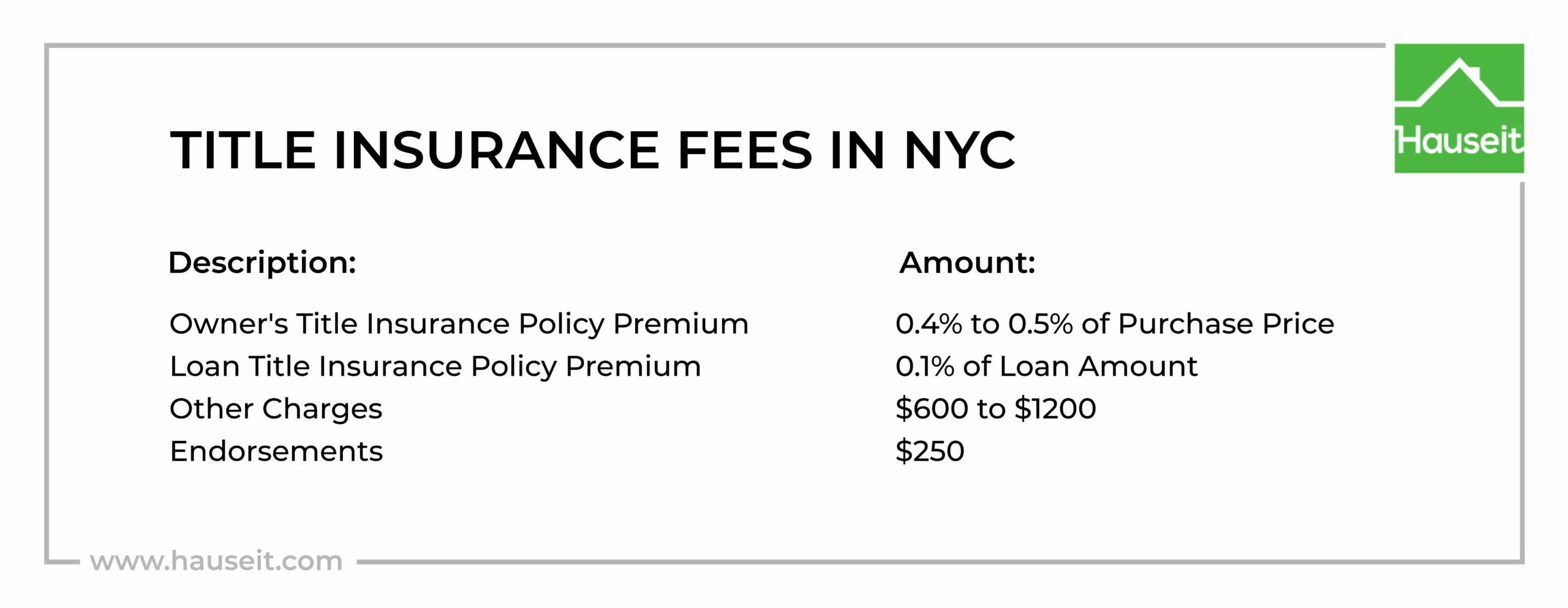

How much is title insurance in NYC and who pays for it?

Title insurance in NYC is approximately 0.5% to 0.7% of the purchase price. Title insurance is paid by the buyer. Title insurance consists of the owner’s policy premium, search and endorsement fees as well as the lender’s policy premium if you’re financing. Title insurance is not required when buying a co-op.

Is it possible to reduce my buyer closing costs in NYC?

Yes. You can reduce your buyer closing costs and save up to 2% on your purchase by requesting a buyer agent commission rebate through Hauseit. Rebates are a legal and non-taxable way to reduce your buyer closing costs while receiving traditional, full-service representation from a seasoned buyer’s agent throughout the purchase process.