Purchase CEMA Savings Calculator for NYC

Outstanding Seller Loan Principal

Buyer Loan Size

Sale Price

Property Type

Learn More to Save More

Glossary

Purchase CEMA

A Purchase CEMA is a strategy for reducing your closing costs when buying or selling a condo or house in New York City. A Purchase CEMA is also known as a Purchase Consolidation Extension Modification Agreement.

The Purchase CEMA itself is the act of assigning a seller’s existing mortgage to the buyer. The CEMA reduces the amount of new loan money which must be originated, and this reduces two closing costs: the buyer’s Mortgage Recording Tax bill and the seller’s New York State Transfer Tax bill. Because a Purchase CEMA requires the permission of the seller and the buyer saves more than the seller, most sellers will use this leverage to propose an equal split of the total savings between the buyer and seller.

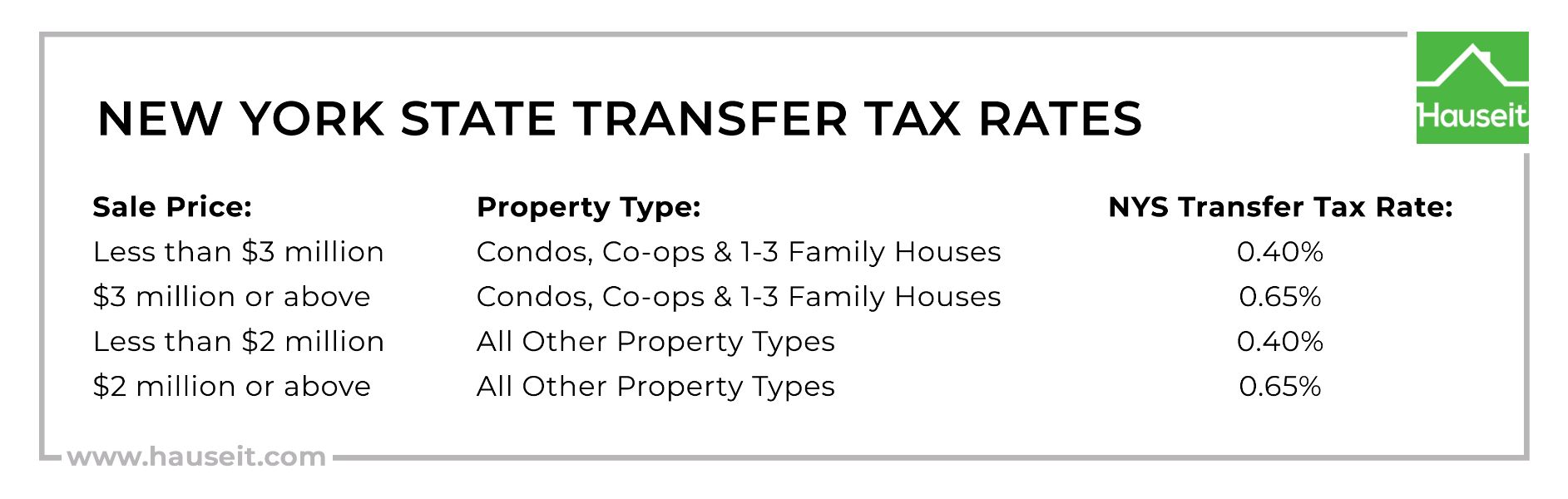

Seller Savings with a Purchase CEMA

Under a Purchase CEMA, the seller does not have to pay the New York State Transfer Tax on any existing loan amount which is assigned to the purchaser. The NY State Transfer Tax is currently 0.4% for most residential sales below $3 million, and 0.65% for sales of $3 million or more.

Buyer Savings with a Purchase CEMA

Under a Purchase CEMA, the buyer does not have to pay the Mortgage Recording Tax on any existing loan amount which is assigned from the seller to the buyer. The Mortgage Recording Tax for most residential transactions is currently 2.05% for loans under $500k and 2.175% for loans of $500k or more, however most lenders cover 0.25% of the tax (excluding commercial transactions).

Mortgage Recording Tax

The NYC Mortgage Recording Tax is a buyer closing cost which is 2.05% for loans below $500k and 2.175% for loans of $500k or more. Most lenders cover 0.25% of the tax (excluding commercial transactions). The amount of the Mortgage Recording Tax is based on the amount of new loan being underwritten. This means your MRT bill will continue to go down as you increase the size of your down payment. You can reduce the amount of the Mortgage Recording Tax by negotiating a Purchase CEMA with the seller.

NYS Transfer Tax

The New York State Transfer Tax is 0.4% for sales below $3 million and 0.65% for sales of $3 million or more. The higher rate of 0.65% kicks-in at a lower threshold of $2 million for commercial transactions and residential properties with 4 or more units. Prior to the New York Tax Law amendments in 2019, the NYS Transfer Tax was previously a fixed 0.4% regardless of the sale price. The New York State Transfer Tax is authorized by New York Consolidated Laws, Tax Law – TAX § 1402.

FAQ

What is a Purchase CEMA?

A Purchase CEMA is a strategy for reducing your closing costs when buying or selling a condo or house in New York City. The Purchase CEMA itself is the act of assigning a seller’s existing mortgage to the buyer. The Purchase CEMA, also known as Purchase Consolidation Extension Modification Agreement, reduces the amount of new loan money which must be originated, and this reduces two closing costs: the buyer’s Mortgage Recording Tax bill and the seller’s New York State Transfer Tax bill.

How much money can I save with a Purchase CEMA?

A buyer saves between 1.8% and 1.925% in Mortgage Recording Tax on their loan size. A seller saves between 0.4% to 0.65% in New York State Transfer Taxes on the amount of loan the assign to the purchaser. Because a Purchase CEMA requires consent of the seller, both parties typically negotiate and agree to split any savings equally.

How much are buyer closing costs in NYC?

Buyer closing costs in NYC are approximately 4% for condos and houses, 2% for co-ops and 6% or more for new developments, assuming you are financing. Closing costs may be lower for an all-cash purchase. You can reduce your closing costs and save up to 2% on your purchase by requesting a Hauseit Buyer Closing Credit, also known as a buyer agent commission rebate.

Is it possible to reduce my buyer closing costs in NYC?

Yes. You can reduce your buyer closing costs and save up to 2% on your purchase by requesting a buyer agent commission rebate through Hauseit. Rebates are a legal and non-taxable way to reduce your buyer closing costs while receiving traditional, full-service representation from a seasoned buyer’s agent throughout the purchase process.

How much can I save with a commission rebate?

At Hauseit, we offer buyers the ability to save up to 2 percent and reduce buyer closing costs through the largest broker commission rebate in NYC. The buyer of a $2 million property in NYC can save $40,000, assuming that the buyer agent commission being offered is 3 percent.