Combined NYC and NYS Transfer Taxes for sellers in New York City is between 1.4% and 2.075% of the sale price. Both NYC and New York State charge a separate transfer tax.

Calculate Seller Transfer Taxes in NYC:

Purchase Price:

Housing type:

NYC Transfer Tax (%):

NYC Transfer Tax ($):

NYS Transfer Tax (%):

NYS Transfer Tax ($):

Total Transfer Tax (%):

Total Transfer Tax ($):

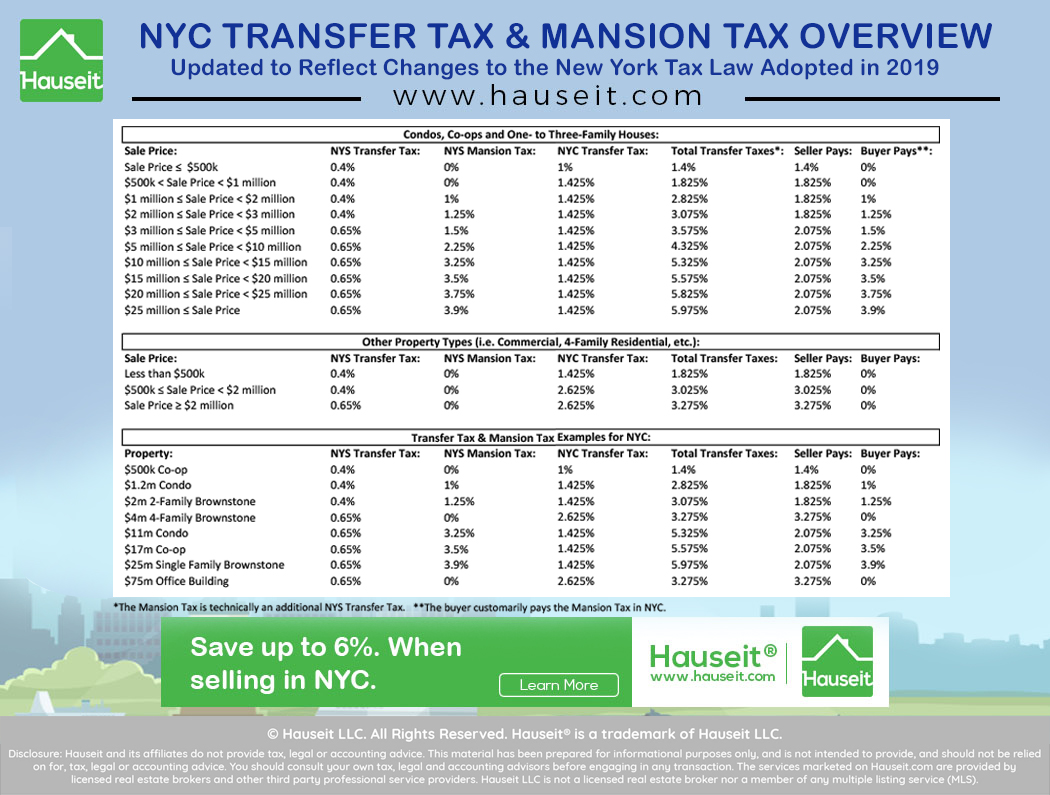

The NYC Real Property Transfer Tax (RPTT) is 1% to 1.425% for residential deals. The higher rate of 1.425% applies to sales above $500k. Higher rates apply for commercial deals, vacant land and sales of multifamily properties of 4-or-more units.

Complete NYC Real Property Transfer Tax rates are as follows:

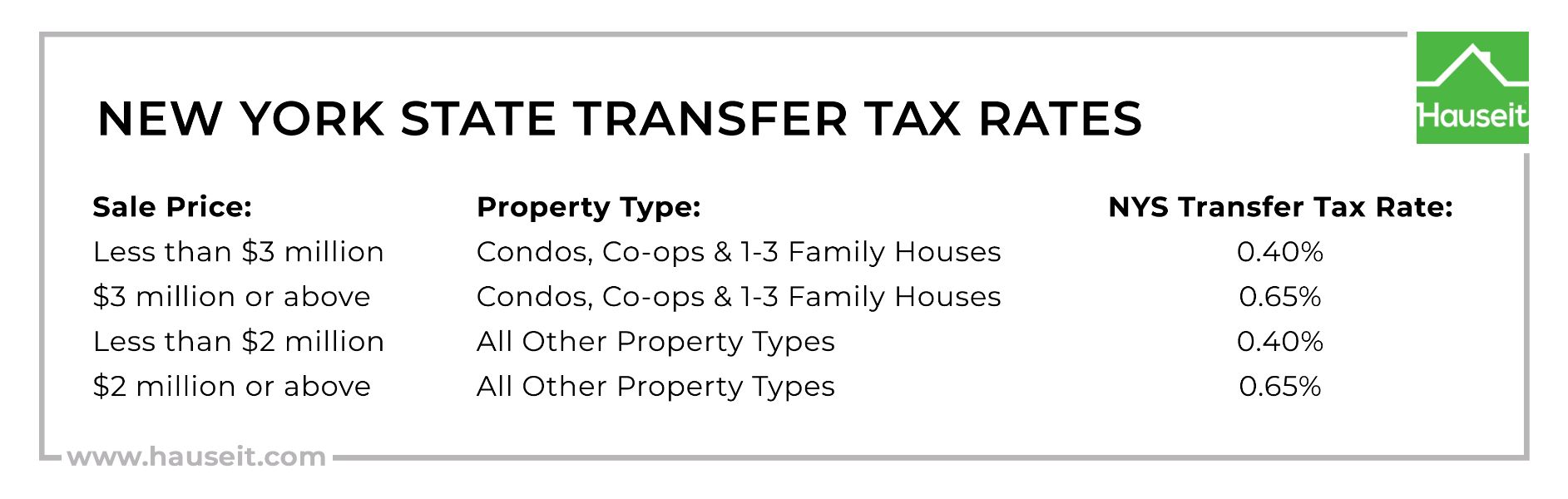

The New York State Transfer Tax is 0.4% for sales below $3 million and 0.65% for sales of $3 million or more. The higher rate of 0.65% kicks-in at a lower threshold of $2 million for commercial transactions and residential properties with 4 or more units.

Complete NYS Real Property Transfer Tax rates are as follows:

For a more detailed estimate of seller Transfer Taxes in NYC, visit Hauseit’s Interactive Transfer Tax Calculator.

Buyers of residential properties priced at $1 million or more in NYC are also required to pay an additional NYS Transfer Tax called the Mansion Tax. The Mansion Tax is between 1% and 3.9% of the sale price, and there are 8 tax brackets which increase based on the sale price.

The highest tax rate of 3.9% applies to sales of $25 or more. Since the Mansion Tax is customarily paid by buyers, it’s not usually included when referring to ‘Transfer Taxes’ in NYC real estate.

NYC and NYS Transfer Taxes are the second largest closing cost for sellers aside from broker commissions. According to the NYS Department of Taxation and Finance, sellers in NYC paid a total of $716,208,726 in NYS Transfer Taxes in fiscal year 2018. The NYC component of the RPTT (Real Property Transfer Tax) raised $1.775 billion for NYC in 2016 according to the NYC Office of Management and Budget.

NYC’s RPTT (Real Property Transfer Tax) is authorized by the New York Tax Law Section 1201(b) and enacted by Title 11 (Chapter 21) of the New York City Administrative Code. The New York State Transfer Taxes (including the Mansion Tax) are authorized by New York Consolidated Laws, Tax Law – TAX § 1402.

Table of Contents:

What is the NYC Real Property Transfer Tax?

How Much Is the NYC Real Estate Transfer Tax?

Who Pays the Property Transfer Tax in NYC?

How Is the NYC Transfer Tax Calculated?

How Are NYC & NYS Transfer Taxes Different?

Are There Transfer Tax Exemptions in NYC?

How to Reduce Seller Closing Costs in NYC

What Is the History of the NYC Real Property Transfer Tax?

How Much Is the Transfer Tax on Vacant Land in NYC?

What is the NYC Real Property Transfer Tax?

The NYC Real Property Transfer Tax is a seller closing cost of 1.4% to 2.075% which applies to the sale of real property valued above $25,000 in New York City. Although it’s commonly referred to by brokers, buyers and sellers simply as the ‘NYC Real Property Transfer Tax,’ this jargon technically includes two separate Transfer Taxes: a NYS Transfer Tax and a NYC Transfer Tax.

There are three specific NYC & NYS Transfer Tax rates for residential property which are as follows:

-

1.4%: sales below $500k

-

1.825%: sales of $500k or more and less than $3 million

-

2.075%: sales of $3 million or more

The NYC & NYS components of these Transfer Tax rates are as follows:

-

1.4%: 0.4% for NYS, and 1% for NYC

-

1.825%: 0.4% for NYS, and 1.425% for NYC

-

2.075%: 0.65% for NYS, and 1.425% for NYC

The ‘Mansion Tax’ on sales above $1m is technically an extra Transfer Tax charged by New York State on sales of residential properties in cities having a population of 1 million or more. Since the only city in New York with a population above 1 million is NYC, the NYS Mansion Tax is essentially a NYC specific Transfer Tax which is collected by New York State.

Because the Mansion Tax is customarily paid by sellers, it’s generally discussed separately from Transfer Taxes which are usually paid by sellers.

As per the NYC Department of Finance, “The Real Property Transfer Tax (RPTT) also applies to the sale or transfer of at least 50% of ownership in a corporation, partnership, trust or other entity that owns/leases property and transfers of cooperative housing stock shares.”

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

How Much Is the NYC Real Estate Transfer Tax?

The ‘NYC Real Estate Transfer Tax’ generally refers to the combination of New York State and New York City transfer taxes payable by seller on a real estate transaction.

There are three specific NYC & NYS Transfer Tax rates for residential property which are as follows:

-

1.4%: sales below $500k

-

1.825%: sales of $500k or more and less than $3 million

-

2.075%: sales of $3 million or more

The NYC & NYS components of these Transfer Tax rates are as follows:

-

1.4%: 0.4% for NYS, and 1% for NYC

-

1.825%: 0.4% for NYS, and 1.425% for NYC

-

2.075%: 0.65% for NYS, and 1.425% for NYC

The combined NYC & NYS Transfer Tax Rates are slightly higher for commercial transactions as well as for properties with 4 or more individual units.

There are three specific NYC & NYS Transfer Tax rates for commercial property which are as follows:

-

1.825%: sales below $500k

-

3.025%: sales of $500k or more and below $2 million

-

3.075%: sales above $2 million

The NYC & NYS components of these Transfer Tax rates are as follows:

-

1.825%: 0.4% for NYS, and 1.425% for NYC

-

3.025%: 0.4% for NYS, and 2.625% for NYC

-

3.075%: 0.65% for NYS, and 2.625% for NYC

The RPTT also applies to the transfer or sale of 50% or more ownership in a partnership, corporation, trust or other business entity that owns and/or leases property.

These sorts of transactions would also be covered by the higher Transfer Tax rates of 1.825% to 3.025%.

If you’re buying a multifamily property with four or more units, you’d pay the higher commercial Transfer Tax rates of 1.825% to 3.075% as opposed to the residential rates of 1.4% to 2.075%.

In summary, the NYC Transfer Tax Rates are as follows:

Who Pays the Property Transfer Tax in NYC?

It’s customary for sellers to pay the RPTT (Real Property Transfer Tax) when it comes to the sale of condos, co-ops and houses. The most common exception to this is in the case of sponsor sales. A sponsor sale refers to the first time a property is sold from the original owner/developer to a buyer.

Unlike for traditional private resales, the transfer tax is usually paid by buyers in the case of sponsor units. Furthermore, buyers also typically pay seller legal fees when buying a sponsor unit.

The NYC Transfer Tax is calculated by multiplying the sales price by the applicable Transfer Tax rates from the tables below:

Combined NYC & NYS Residential Transfer Tax Rates:

-

1.4%: sales below $500k

-

1.825%: sales of $500k or more and less than $3 million

-

2.075%: sales of $3 million or more

Combined NYC & NYS Commercial Transfer Tax Rates:

-

1.825%: sales below $500k

-

3.025%: sales of $500k or more and below $2 million

-

3.075%: sales above $2 million

Both NYC and NYS charge a Transfer Tax on the sale of real property. The NYS transfer tax is between 0.4% and 0.65% of the sale price. The higher rate of 0.65% applies to residential sales of $3 million or more and commercial transactions priced at $2 million or more.

NYS also charges an extra Transfer Tax called the ‘Mansion Tax’ for sales of $1 million or more.

The Mansion Tax was previously a fixed rate of 1%, however it was amended in April 2019 to include 8 individual, progressive brackets. The highest Mansion Tax rate is currently 3.9% which applies to purchase prices of $25 million or more.

The NYC Transfer Tax is between 1% to 1.425% for sales of condos, co-ops and one- to three-family houses. The lower rate applies to sales of $500k and below. NYC levies a higher Transfer Tax rate of 2.625% for sales of $500k or more. The commercial NYC Transfer Tax rate is 1.425% for sales of $500k or less.

Most real estate professionals in NYC simply refer to the combined NYC & NYS Transfer Tax bill as the ‘NYC Transfer Tax.’

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Although it’s not possible to avoid paying the NYC and NYS transfer taxes, you can reduce or fully eliminate the largest seller closing cost which is the traditional 6% NYC broker fee. Seller commissions in NYC have traditionally been non-negotiable, and virtually all sellers still agree to pay 6%.

Here are a few ways you can substantially reduce your seller commission bill or eliminate broker fees altogether when selling in NYC:

Save up to 6%: Hauseit Agent Assisted FSBO

Selling FSBO in NYC is likely the first thing which comes to mind if you are thinking of ways to save money on broker commissions. Unfortunately, traditional FSBO does not work well in NYC since most buyers have agents who search for listings in RLS (which FSBO sellers can’t access).

Hauseit’s NYC Flat Fee MLS (RLS) listing service uses the same listing syndication technology as traditional, full-service agents who charge 6% in commission.

Your FSBO listing will receive the same marketing exposure as if you had hired and paid 6% to a traditional listing agent.

Because your listing will appear just like every other traditional, RLS-listed property, you will be able to ‘co-broke’ more-effectively with the buyer’s agents who control 75% of the buyers in NYC. Hauseit’s listing service also helps reduce the traditional NYC FSBO broker harassment.

Why sell For Sale by Owner in NYC?

-

Save up to Six Percent in NYC Real Estate Agent Commissions

-

List on RLS, StreetEasy and Over a Dozen Websites

-

Engage the 75% of Buyers Represented by Agents

-

Avoid FSBO Broker Harassment and Solicitation

-

Receive Two Complimentary Open Houses

-

Work with NYC’s Largest and Most Trusted FSBO Company

Hauseit’s NYC Flat Fee MLS product lists your home on the RLS (REBNY Listing Service) broker database, StreetEasy, Zillow, Trulia, Brownstoner and many more for 0% seller’s broker commission.

Hauseit 1% Full Service

Don’t have time to sell FSBO in NYC? Save thousands in commission by listing with a full-service, REBNY member listing agent in New York City for just 1% commission.

Why should you have to pay 6% just because you don’t have the time or motivation to sell FSBO in NYC? Our 1% full service listing option is identical in every way to what you’d expect if you paid 6%.

What’s Included?

1. Professional Pricing Analysis and CMA

2. Custom Photography and Floor Plans

3. Listing on RLS (NYC MLS), StreetEasy and dozens of websites

4. Professionally Managed Open Houses and Private Showings

5. Offer Screening, Negotiation and Professional Advice

6. Board Package Application and Closing Assistance

The 1% full service listing option may be a good fit if you fancy the idea of saving on commission but do not necessarily have the time, patience or energy to manage the entire sale process on your own.

To learn more, request a free consultation.

NYC exempts Federal, State and City entities from the payment of RPTT as well as the filing requirement. In addition, the RPTT does not apply to any of the following deeds:

-

A deed, instrument or transaction by or two the United Nations or any other global organization of which the United States is a member

-

A deed, instrument or transaction by or two any entity operated exclusively for charitable, educational or religious purposes or for the purposes of preventing cruelty to children and animals

-

A deed or instrument given solely as collateral/security for a debt/loan.

New York City has collected the RPTT (Real Property Transfer Tax) since 1959.

The city raises approximately $1-2 billion annually from the transfer tax alone. According to the city’s tax revenue forecasting documentation, the RPTT accounted for 2.2% of the city’s overall tax revenue in 2012.

Here is a brief timeline of the history of New York’s Real Property Transfer Tax:

-

1959 – RPTT enacted with a tax rate of 0.5% of the sale price

-

1968 – NYS enacts its own transfer tax of 0.4% on residential and commercial property

-

1971 – RPTT tax rate raised from 0.5% to 1.0%

-

1982 – RPTT tax rate raised from 1% to 2% for commercial transfers on/above $500k

-

1989 – NYS imposes a Mansion Tax of 1% on the sale of residential real property valued above $1 million

-

1989 – NYC raises the RPTT tax rates and expands the tax base to include the sale of residential co-operative apartments

-

1997 – NYC enacts a RPTT reduction for the amount of any mortgage assumed by the transferee (buyer)

-

2019 – NYS updates the Mansion Tax to a progressive system with 8 individual tax brackets ranging from 1% on sales above $1m and below $2m and 3.9% on sales of $25 million or more. NYS also increases the NYS Transfer Tax from .04% to 0.65% on residential sales of $3 million or more and commercial sales of $2 million or more.

How Much Is the Transfer Tax on Vacant Land in NYC?

Vacant land in NYC has higher transfer tax higher rates compared to condos, co-ops and 1-3 family homes. The NYC Transfer Tax rate for vacant land is 1.425% for sales of $500k or less or 2.625% for sales above $500k.

For example, the NYC Transfer Tax rate on a parcel of vacant land being sold for $500k is 1.425%. If the sale price is $501,000, the NYC Transfer Tax rate is 2.625%.

However, vacant land may be taxed at at the lower rates of 1% ($500k or less) and 1.425% (more than $500k) under certain conditions, as outlined by the NYC Department of Finance:

Additional FAQ:

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Who Pays Property Transfer Tax in New York?

Both the New York State and New York City property transfer taxes are typically paid by the seller. The exception would be in the case of buying new construction or buying a sponsor unit, whereby the buyer traditionally pays the transfer tax as well as the sponsor (seller) legal fees.

How Much Is Transfer Tax in NY?

The NY transfer tax is 0.4% of the sale price for most transactions, however it’s a higher 0.65% for residential sales of $3 million or more and commercial transactions of $2 million or more. NY also levies an additional Transfer Tax called the Mansion Tax on sales of $1 million or more.

The NY transfer taxes are charged in addition to the separate NYC transfer tax. Transfer taxes are typically paid by the seller, however the NY Mansion Tax component of the NY Transfer Tax is traditionally paid by the buyer.

When Is the NYC RPTT Payable?

The RPTT payable at the time the deed is registered with the City Register. If the transaction does not involve a deed, then the RPTT must be paid directly to the NYC Department of Finance (DOF). The taxpayer must file a return and pay the RPTT within 30 days after the date of the transfer.

Who Pays Real Estate Transfer Tax in New York?

Both the New York State and NYC real estate transfer taxes are typically paid by the seller. The exception would be in the case of new construction or a sponsor sale, whereby the buyer traditionally pays the transfer tax as well as the sponsor (seller) legal fees. The mansion tax on sales above $1 million is usually paid by the buyer.

Transfer Taxes When Selling Combined Apartments

NYC will by default charge sellers the higher transfer tax rates for non-residential properties if you sell two or more units within the same building within a 12 month period.

This can impact many sellers of combined apartments who have not fully merged the apartments in the eyes of New York City.

To fully combine two apartments, you will first of course need approval from your building’s board. Then you will need the NYC Department of Building’s approval. After the renovations are complete, you will need a Letter of Completion as well from them. If have condominium units, you will also need to amend the condo declaration in order to merge the tax lot. For condo owners, only after this step is done will they begin receiving a single property tax bill vs a property tax bill for each unit.

If you haven’t merged the tax lot, our partner lawyers have had a 100% success rate so far in appealing a higher transfer tax rate. You will need a affidavit from an architect demonstrating that the combined units are truly one apartment.

Disclosure: Hauseit® and its affiliates do not provide tax, legal, financial or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, financial or accounting advice. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided.

Hi. I would like to transfer my Co-op Apartment shares to my Revocable Living Trust. Is this a taxable event, and if so, what taxes will I have to pay?

(I have read on-line “Remember, you are changing ownership of both the Coop shares and the proprietary lease (if you live there), so this is a transfer. This is NOT a sale, so there should be no requirement to re-submit eligibility paperwork unless you try to add someone new to ownership under the Trust. Once you have submitted the Trust and Amendment and approve any additional paperwork required for the transfer of the Shares and Lease, you schedule the Closing.” Does this mean I do not have to pay the NYC and NYS Transfer Taxes?)

Thank you.

what is the new york city transfer ta rate on vacant land in the city ( bronx )

Thank you for the presentation.

I do have one question that I am unclear about .

Does a Transfer Tax apply to a refinancing of a Co-Op.

Early on in your presentation, it stated that Transfer Fees do NOT apply to Co-ops.

However- in several of the charts, I see Transfer Taxes do apply to NYC Co-Ops.

Lastly- does the mortgage recording tax apply to a refi of a NYC Co-Op.

Thanj you

Jeremy Orden

Hi Jeremy, the transfer tax does indeed apply to co-ops. A transfer tax does not apply for a loan or mortgage refinancing, otherwise refinancings would be much too expensive for New Yorkers!

The mortgage recording tax applies whenever a new mortgage is recorded, but if you are refinancing with a different bank this tax can usually be avoided with a refinance CEMA. The fee to do this will usually be less than $1,000. You can learn more about the fees and costs of refinancing in this article: https://www.hauseit.com/should-you-refinance-your-mortgage/

Good evening, We are in talks with a builder in regards buying a new construction home in upstate NY precisely orange county. I was told by my real estate agent in regards nys transfer taxes which I as the buyer needs to incur. I did visit your website so as to educate myself in regards nyc and nys transfer taxes. So my question is do I have to pay nyc and nys transfer taxes even though i will be purchasing the property in orange county ny which is not a part of nyc. Please advise. Thank you for your time.