Westchester Seller Closing Cost Calculator

Sale price

Housing type

Existing mortgage?

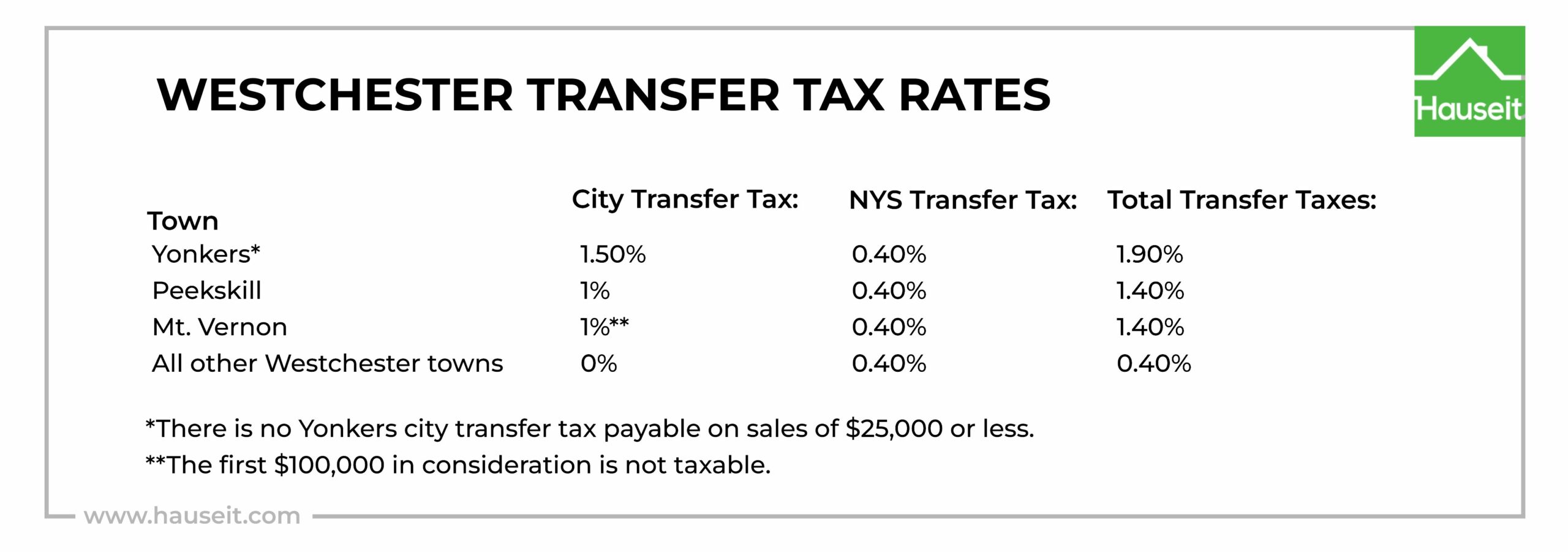

Are you selling in Yonkers, Mt. Vernon or Peekskill?

Seller power of attorney?

Broker commission (%)

Seller's attorney fee

Building flip tax

Estimated Closing Costs

Broker commission

Seller's attorney fee

Mortgage satisfaction recording fee

Bank loan satisfaction fee

Property condition disclosure waiver fee

Seller Power of Attorney recording fee

Buuilding move-out fee

Building managing agent closing fee

Building flip tax

Co-op UCC-3 termination fee

Co-op transfer tax filing fee

Co-op stock transfer tax

Total Seller Closing Costs

Net Sale Proceeds