Buyer closing costs in Westchester are roughly 3% if you’re financing and 2% if you’re paying cash. Westchester buyer closing costs are lower than in NYC.

The largest buyer closing costs in Westchester include the Mansion Tax, Mortgage Recording Tax and title insurance.

Additional Westchester buyer closing costs include attorney fees, lender fees if you’re financing, survey and inspection fees, recording fees and building fees if you’re purchasing a condo or co-op.

Click on the sections below to learn about each buyer closing cost in Westchester.

Westchester Buyer Closing Costs:

Westchester Mortgage Recording Tax

The Mortgage Recording Tax in Westchester is 1.3% of your loan size. If you’re buying a one or two family dwelling, deduct $30.

Here’s an example of how to calculate the Westchester Mortgage Recording Tax:

Institutional lenders typically contribute 0.25% towards the Mortgage Recording Tax. This means that the effective Mortgage Recording Tax rate in Westchester is 1.05% of your loan size as opposed to 1.3%.

In the example above, the lender would pay $4,000 (0.25% of the loan size) and the borrower would pay $16,770 (1.05% of the loan size) for a total MRT of $20,770 (1.3% of the loan amount less $30).

Note that a higher Mortgage Recording Tax Rate of 1.8% applies to properties in Yonkers. Similar to Westchester, deduct $30 from this calculation if you’re buying a one or two family home.

Remember that institutional lenders typically contribute 0.25% towards the buyer’s Mortgage Recording Tax. Therefore, the effective Mortgage Recording Tax rate in Yonkers paid by purchasers is 1.55% (as opposed to the headline rate of 1.8%).

For mortgages of $10,000 or less on one or two family homes, the Mortgage Recording Tax rate is 1% in Westchester and 1.5% in Yonkers.

The Westchester County Clerk states that “In calculating the tax, amounts of $50.00 or below can be rounded down to the lower hundred and amounts of $50.01 should be rounded up to the next hundred.”

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

The Westchester Mansion Tax applies to all residential real property or interest in residential real property which includes condos, co-ops as well as one to three family houses.

The Mansion Tax in Westchester is customarily paid by purchasers. Keep in mind that just about everything, including who pays the Mansion Tax, is negotiable in a Westchester real estate transaction. Nevertheless, don’t expect a seller to agree to pay the Mansion Tax unless you have a tremendous amount of leverage.

The easiest way to avoid the Mansion Tax when buying a home in Westchester is to work with a buyer’s agent who offers a broker commission rebate.

A buyer’s agent who agrees to offer you a rebate will pay you a portion the commission that the buyer’s agent receives from the seller at closing. The rebate you receive can reduce or fully eliminate your Mansion Tax bill on the purchase.

The Westchester Mansion Tax is much lower than in NYC where it’s as high as 3.9% for the most expensive properties.

Title Insurance

Title Insurance is approximately 0.4% to 0.5% of the purchase price. It’s a one-time fee which provides you with an insurance policy against defects or future claims against the title of the property you’re buying which were unknown at the time of purchase. Title insurance rates are regulated by the government.

Title insurance consists of a lender’s policy if you’re financing, an owner’s policy as well as issuance related fees such as policy endorsements and municipal search fees.

The lender’s policy covers the principal amount lent to you and protects the lender. The policy coverage amount will decrease as you pay down the mortgage.

The owner’s policy protects you against the full purchase price and coverage does not decrease over time.

A standard title insurance policy provides a fixed amount of coverage which does not increase over time as your home appreciates in value. However, many title insurance companies sell an optional add-on called a Market Value Rider (MVR) which increases your coverage to match home appreciation over time. The cost of a Market Value Rider 10% of the owner’s policy premium.

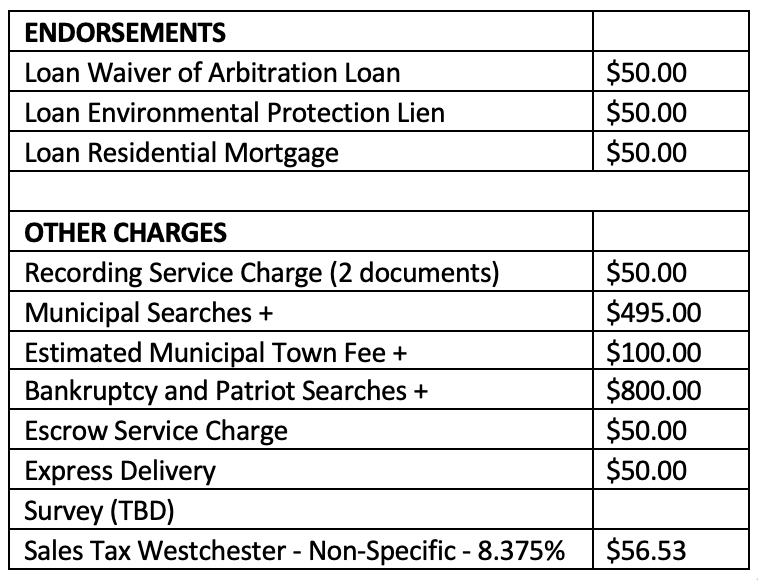

Here is an example of the miscellaneous fees associated with the issuance of a title insurance policy in Westchester:

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Lender Fees

You will need to pay a handful of mortgage-related fees if you’re financing. These include an application fee, an appraisal fee, bank attorney fees and a mortgage recording fee.

The typical bank loan application fee is under $1,000, and the appraisal fee is usually around ~$750. Specific fees vary by bank.

The mortgage recording fee in Westchester is usually $250. Expect to pay more if your transaction involves a Purchase CEMA due to the additional documents which must be recorded (assignment, CEMA and a Section 255 Affidavit).

If you have private client status with a bank, you may be qualify for a reduced application fee or a discount on your interest rate.

Most real estate attorneys in Westchester operate on a flat fee basis which includes contract negotiation, buyer due diligence and the closing.

However, you may incur additional flat fees or hourly fees for add-ons such as arranging a power of attorney or for highly complex and non-standard work required to complete the transaction.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Recording Fees

Recording fees on a home purchase in Westchester are approximately $200. The specific breakdown is as follows:

-

Statutory Recording Fee: $45

-

Additional Fee Per Page: $5

-

TP-584 (NYS Transfer Tax) Filing Fee: $5

-

RP-5217 (Real Property Transfer Report) Filing Fee: $125 or $250

The RP-5217 filing fee is $125 for residential and farm property. The fee for all other property is $250.

Here’s an example of how to compute recording fees in Westchester:

Survey and Inspection Fees

Expect to pay around $1,000 to $1,500 in total for a home inspection and a survey.

Home inspection

Home inspections are typically done pre-contract, so it’s not technically a closing cost since it’s paid prior to closing and before you sign the contract. While the need for an inspection with a freestanding home or townhouse is paramount, home inspections are rarely done for condos and co-ops.

A home inspector will typically examine the property’s foundation, roof, plumbing, electrical systems, heating and cooling systems, and appliances.

The inspector will also look for signs of pests, such as termites, and for other potential issues, such as mold or water damage.

The inspector provides a report detailing the condition of the property and any issues that were identified. If any substantial issues are discovered, these can be remediated pre-contract by way of the seller agreeing to make repairs or by offering a pricing concession.

Survey

A survey verifies that the home you’re buying is not encroaching on land owned by neighbors or by the municipality with fences, decks or other structures. The survey also confirms that the property has appropriate setbacks for any structures on the property.

Doing a proper survey is one of the most important pieces of due diligence when buying free-standing property such as a house or townhouse. There is no need to do a survey if you’re buying a condo or co-op apartment.

Even though most lenders don’t require a survey to close, the buyer’s real estate attorney almost always forces (or at a minimum strongly encourages) the purchaser to do a survey.

If the seller has a legible copy of a previous survey and the surveyor is still in business, the buyer may be able to have the surveyor ‘update’ the existing report. It’s less expensive to update an existing survey compared to doing a new one. Figure less than $500 to update an old survey vs. $500 to $1,000 for a completely new survey.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Building Fees

Condos and co-ops charge buyers a handful of fees at the time of purchase.

These fees may include:

-

Board application fee: typically around $500

-

Credit check fee: typically $100 or less

-

Move-in fee: $1,000 or less

-

Move-in deposit (refundable or non-refundable): varies

-

Reserve fund contribution: often one month of common charges or maintenance