The original 421a tax abatement program began in 1971 and is named after section 421-a of the New York Property Tax Law.

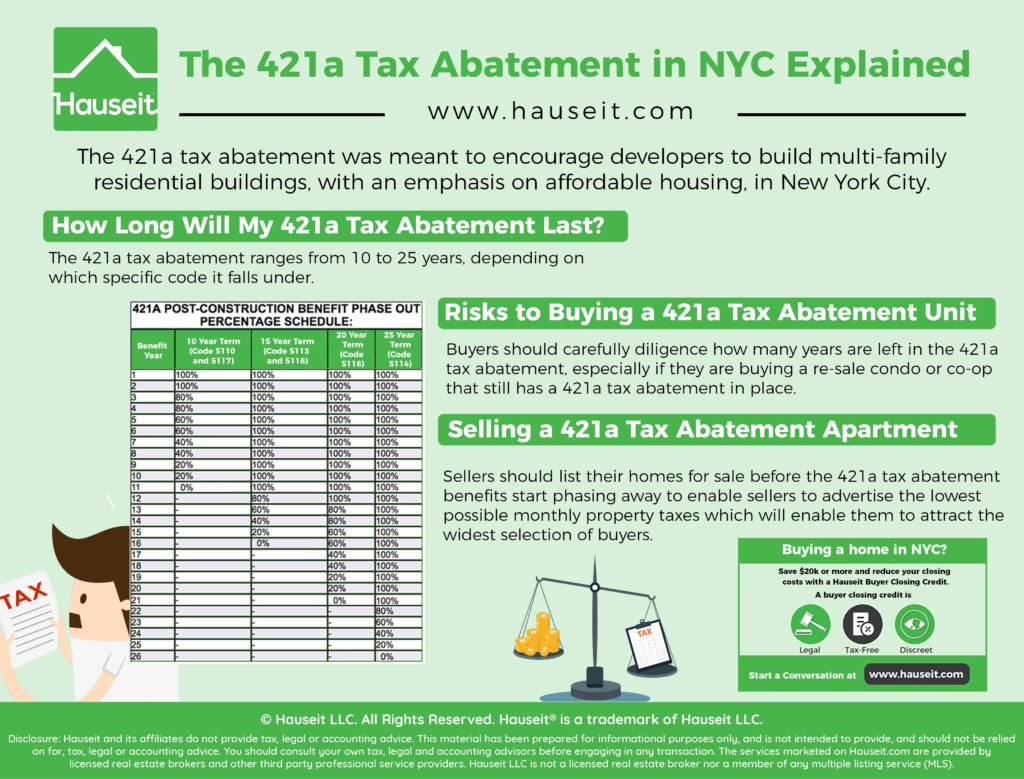

The tax abatement was meant to encourage developers to build multi-family residential buildings, with an emphasis on affordable housing, in New York City.

There are multiple variations of the 421a tax abatement, ranging from terms of 10 to 25 years.

Table of Contents:

The 421a tax abatement on a property ranges from 10 to 25 years, depending on which specific code it falls under.

Codes 5110 and 5117 offer a 10 year term. Codes 5113 and 5118 have a 15 year term. Code 5116 offers a 20 year term. Lastly, Code 5114 offers a 25 year term.

If you don’t know the property’s BBL (Borough, Block and Lot) number, you can also search by the property’s address using the second search option.

You can see from the table below what percent of property taxes are abated for each specific year of a 421a tax abatement code’s term, post-construction:

Let’s do an example together. 550 Vanderbilt Avenue #PHS is a new development condo for sale in Prospect Heights, Brooklyn. The advertised monthly property taxes are $152, which seems extraordinarily low for a penthouse condo apartment with a listing price close to $8 million.

The listing description states that a 25 year 421-a tax abatement has just been officially approved, which may explain why StreetEasy doesn’t have any sort of notification on the property page that the building has a 421a tax abatement yet.

If we go back to that NYC Exemptions and Abatements website, we’ll see that the unit has a 421a exemption in place: “421A-Newly Constructed Multiple Dwelling Residential Property (Code 5114).” You’ll also notice that the current benefit type is “Construction” and that the benefit year is “Year 3 of 3” as of this writing. This simply means the property hasn’t started the 25-year post-construction benefit term yet, which is a great thing for potential buyers.

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

Buyers should carefully diligence how many years are left in the 421a tax abatement, especially if they are buying a re-sale condo or co-op that still has a 421a tax abatement in place.

A seller could be desperate to sell because he or she knows that the exemption is about to expire and that their property taxes will be spiking in a couple of years.

Furthermore, the owners and building management of the condo or co-op building may not have contested assessed values with the tax authorities during the exemption period.

As a result, assessed values for tax purposes may have inflated dramatically over the years, which will result in a massive increase in taxes when the exemption period ends.

You can see current and past NYC property tax bills and a history of a unit’s assessed values here. In our above example for 550 Vanderbilt Avenue #PHS, you can see that the annual property tax before exemptions and abatements is $42,290, but the 421a exemption lowers the property tax by $40,679.

As a result, the remaining annual property tax is only $1,611 which isn’t too far off from the monthly taxes of $152 advertised.

Keep in mind that the math won’t be perfect when calculating exemptions and abatements due to the arcane nature of NYC taxes.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Sellers should list their homes for sale before the 421a tax abatement benefits start phasing away. This enables sellers to advertise the lowest possible monthly property taxes which will enable them to attract the widest selection of buyers.

Even if most buyers and their attorneys will figure out that the unit’s 421a tax abatement is about to expire during due diligence, the sellers will still have managed to attract the initial attention of the maximum amount of potential buyers.

As a result, some buyers may not care about the higher monthly outlay in the future and may still wish to buy the unit.

In contrast, if a seller waits too long to list their property, and does so during the end of their exemption period, they’ll be forced to advertise much higher monthly property taxes.

And don’t even think about asking your listing agent to advertise the previously abated tax figures as that could easily incur a lawsuit from an angry buyer down the road.

The best thing that a potential seller can do is to work with their building management company to hire a good tax certiorari firm to dispute increases in assessed values on behalf of the entire building.

A tax certiorari firm may take a percentage of any tax reductions, but assuming you’re giving away a reasonable 15% or less of the benefit as a legal fee, that still represents an enormous amount of savings in property taxes.

This is possibly one of the only ways to reduce your headline property tax figure if you wish to sell a property with a 421a tax exemption that is going away.

Disclosure: Hauseit® and its affiliates do not provide tax, legal, financial or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, financial or accounting advice. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided.