The 421g tax abatement was created in the mid 1990’s to incentivize developers to convert old downtown office buildings into residential use as businesses migrated to Midtown.

The 421g tax abatement covers Lower Manhattan, meaning most areas south of Murray Street, City Hall and the Brooklyn Bridge.

Table of Contents:

The 421g program provides tax exemptions for 12 years for non-landmark buildings, and tax exemptions of 13 years for landmark buildings.

Non-landmark buildings are fully exempt under 421g during the first 8 years post-construction, after which the exemption amount decreases by 20% per year until the property becomes fully taxable.

Landmark buildings are fully exempt for the first 9 years post-construction, after which the exemption amount decreases by 20% per year until the property becomes fully taxable.

Keep in mind that the 421g tax abatement provides a shorter construction period exemption of only 1 year, vs 3 years on average for its cousin the 421a tax abatement.

That’s because many of the projects under 421g were condominium conversions vs new construction which means less time required for construction.

Remember that many 421g projects were former Financial District office buildings that have been converted into multiple dwelling residential use.

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

Buyers should research how many years of 421g tax abatement are left before submitting an offer on an apartment advertising such a tax incentive.

If the property for sale is a re-sale condo or co-op, then it may not have many years of tax exemption left.

Furthermore, the owner most likely knows this and is desperate to advertise it with lower, tax abated monthly costs before property taxes increase.

Even if the property is a condominium conversion or new development, be careful to check how many years of post-construction tax abatement are remaining.

Due to the short, 1 year construction period tax exemption, even many condo conversions may experience delays in completion and as a result use up the post-construction benefit period.

An excellent example is 42 Ann Street, a landmarked re-development in the Fulton Street and South Street Seaport neighborhoods.

Monthly taxes were advertised as $279 for each of the 7 full, floor, 2,708 square foot lofts which seems unreasonably low.

If you look up the property tax bills for the units on the NYC Department of Finance website you’ll notice that the tax before exemptions and abatements is $22,785.

This figure is then decreased by $4,207 through “Resid-Conv. Low Manh” and $11,381 through “Residential Conversion Abatement.” This leaves the annual property tax post abatements and exemptions at $7,197. This is still high compared to the originally advertised figure, but not too far off.

If we check out the tax abatements and exemptions website referenced earlier, we’ll see that the benefit year for 42 Ann Street is currently year 9 out of 13. Since the building is landmarked, year 9 should be the last year that the building is eligible for a 100% property tax exemption under 421g.1

Interestingly enough, the benefit start date was July 01, 2010 and the benefit end date is June 30, 2023. This means the developer must have suffered some sort of delay in construction because the first closing appears to have been sometime in early 2015 per ACRIS public records.

This means buyers of this condo conversion missed out on almost 5 years of the 421g tax abatement.

This example demonstrates that you must carefully diligence how many years are left in the 421g tax abatement, even if you’re buying a new development condo!

1Why are the property taxes not zero in our example? That’s because per the NYC Department of Housing Preservation and Development, the benefits post-construction include a “12-year (8 full years + 4 years phase out) exemption from the increase in real estate taxes resulting from the work and a 14-year (10 years full + 4 years phase out) abatement based on the existing real estate taxes in year one of the benefit term. New York City landmarked projects get one additional year of full benefits.”

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Sellers should consider listing their property before their 100% tax exemption begins phasing out in order to advertise the lowest possible property taxes to potential buyers.

Even though buyers will discover that the building’s 421g tax abatement will soon run out during due diligence, you will have attracted a wider net of potential buyers by having more attractive, lower monthly carrying charges to begin with.

Sellers should also be wary of assessed property values increasing unchecked during the abatement period.

That’s because many owners will be too lazy to dispute assessed property value increases during the abatement period.

However, once the abatement ends, they may be faced with a rude surprise in the form of dramatically higher assessed values and property taxes than they expected.

As a result, it’s a good idea to proactively dispute unreasonable increases in assessed values through a tax certiorari firm, even if your building is currently enjoying a tax abatement. It may be easier to convince the city government to reduce your property’s assessed value if you dispute it regularly, vs all at once after your abatement ends.

Tax certiorari firms typically take a percentage of the winnings, i.e. the reduced property taxes. We’ve seen quotes of up to 15% of the property taxes reduced, only payable if the case is successful.

Many popular, public real estate search websites focused on New York City will automatically add a notification to your listing if the building is still under a tax abatement such as 421g. However, it is up to buyers to conduct due diligence and figure out the details themselves, with the assistance of their lawyers.

Remember that properties in New York are generally sold as is, and the principle of caveat emptor, or buyer beware, applies in this state.

Let’s do an example together and look at 75 Wall Street, Apt 38M, New York, NY 10005. This building has a 421g tax abatement in place.

First, look up the unit’s property tax information on the NYC Department of Finance website. You can find the site simply by searching the web for “property tax bill nyc” or “bbl lookup.”

You’ll see the main screen below. We recommend clicking on “Property Address Search” unless you happen to know your BBL (Borough, Block and Lot) number.

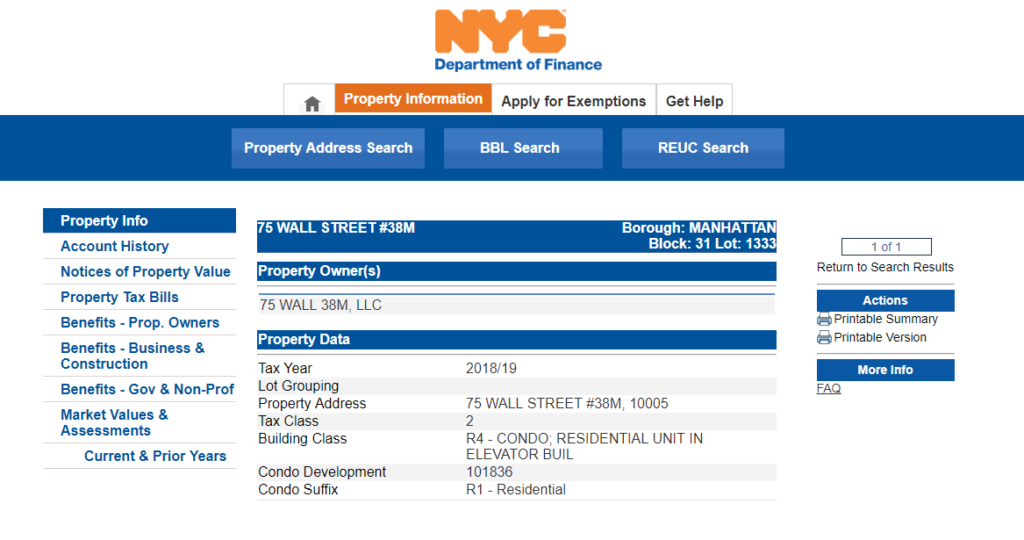

Enter the unit’s address per the instructions on the following page. Remember to enter the full address or you’ll encounter an error. The system is a bit finicky at the moment, and won’t accept variations such as 140th Street vs 140 Street which it will accept. Hit search.

On the following screen, you’ll see a summary of the unit and different tabs which will show you the unit’s property tax bills, notices of property value as well as abatement and assessment information.

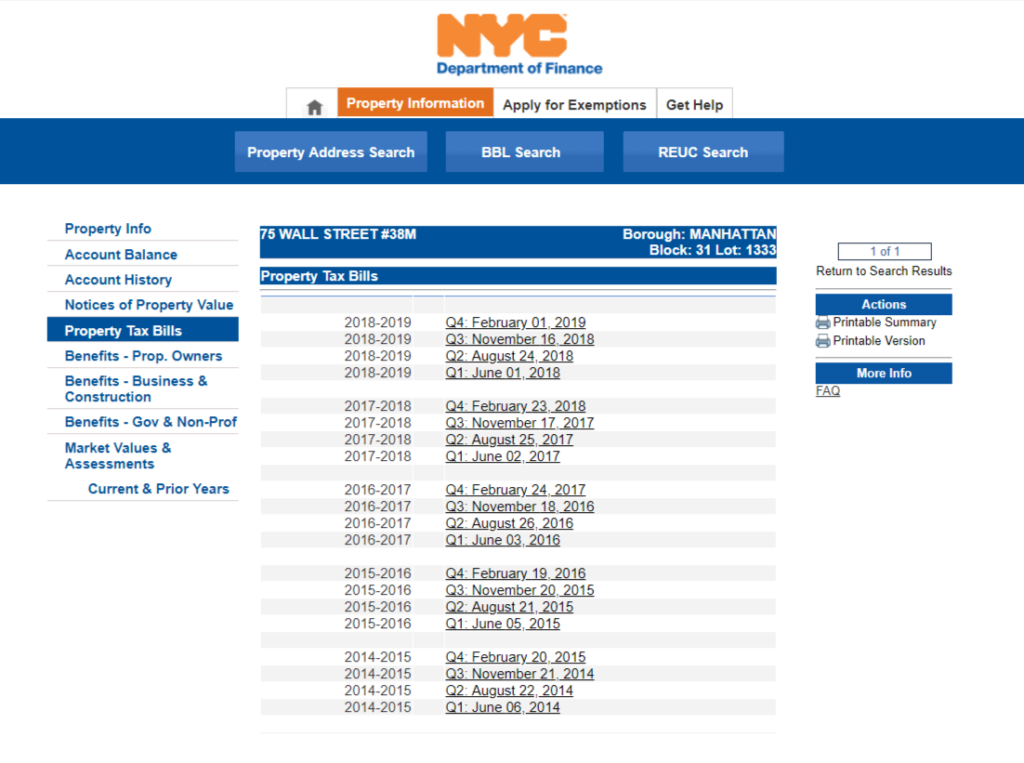

Click on the Property Tax Bills tab and check out the unit’s most recent quarterly property tax bill (Q4: February 01, 2019).

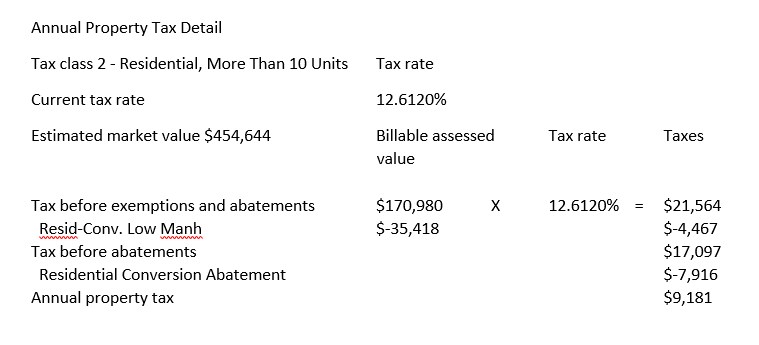

What this section means is that the property tax before the 421G is $21,564. However this tax bill is reduced by both an exemption which reduces the assessed value, as well as an abatement which reduces the remaining property taxes on a dollar for dollar basis.

More specifically, the condo’s assessed value of $170,980 is reduced by the exemption portion of the 421G program by $35,418. This equates to a reduced assessed value of $135,562, and at a 12.6120% tax rate the property tax becomes $17,097.

Now remember that the 421g also has an abatement portion, which is a dollar for dollar decrease in actual taxes owed. The abatement is $7,916, and once you subtract that from the $17,097 of remaining property taxes, you get a final property tax bill of only $9,181.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Let’s continue with our example and inspect the summary page for the 421g tax benefit for our target apartment. Click the “Benefits – Business & Construction” tab and you’ll see the below screen:

Now remember from what the NYC Department of Housing Preservation & Development says about the 421g tax incentive:

Construction period exemption of 1 year. 12-year (8 full years + 4 years phase out) exemption from the increase in real estate taxes resulting from the work and a 14-year (10 years full + 4 years phase out) abatement based on the existing real estate taxes in year one of the benefit term. New York City landmarked projects get one additional year of full benefits.

As you can see from the screen above, this building is in its 10th benefit year. That means the exemption portion of the tax incentive is halfway phased out, and there won’t be any reductions in assessed values within 2 years.

This also means that the abatement portion of the tax incentive is just beginning to phase out, and will do so within 4 years.

Take a look at the unit’s property tax bills by clicking the “Property Tax Bills” tab and you’ll see the screen below. Note how the quarterly tax bills are grouped together according to New York’s fiscal year, which overlaps two years at a time.

Fortunately for us, the abatement and exemption figures will be the same for each entire fiscal year. This means you can more easily ascertain the changes in 421g abatement and exemption numbers by year.

At the end of the latest fiscal year (Q4: February 01, 2019 Statement) you’ll see that the exemption amount was $35,418 and the abatement amount was $7,916.

In the prior fiscal year, you can see that the exemption amount was $47,224 and the abatement amount was still $7,916.

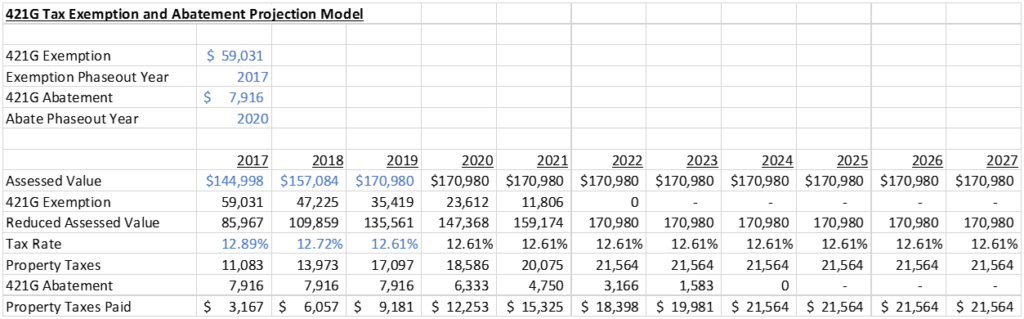

Finally, in the three fiscal years before that, the exemption amount was $59,031 and the abatement amount was still $7,916.

This ties out to expectations because the exemption is in the process of being phased out. Notice that the exemption is decreasing from a starting level of $59,031 by 20%, or $11,806, per year.

You can expect the same phase out schedule for the abatement portion of the 421g tax incentive starting with the next fiscal year. The starting level of the abatement is $7,916 and this is expected to phase out by 20%, or $1,583, per year.

Remember that New York’s fiscal year runs from April 1st to March 31st of the following year. As a result, our summary model shows years ending on March 31st of the end of each fiscal year.

As you can see, we’ve conservatively assumed that headline assessed values will not increase in the forecast years, which is certainly optimistic.

However, even if assessed values remain stable, the taxes on this unit are expected to increase significantly as both the exemption and the abatement portions of the 421g tax incentive expires!

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

Disclosure: Hauseit® and its affiliates do not provide tax, legal, financial or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, financial or accounting advice. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided.