There is little advantage to not having a buyer’s agent in NYC. This is primarily because sellers pay 100% of all commissions in NYC, and sellers typically agree to pay a fixed total commission regardless of whether or not the buyer has a buyer’s agent.

This means that an offer from an unrepresented buyer is economically equivalent to an offer from a represented buyer since the total commission being paid by the seller is usually the same in either case. Thinking that you’ll get a lower sale price if you are unrepresented is a common myth in NYC real estate.

Table of Contents:

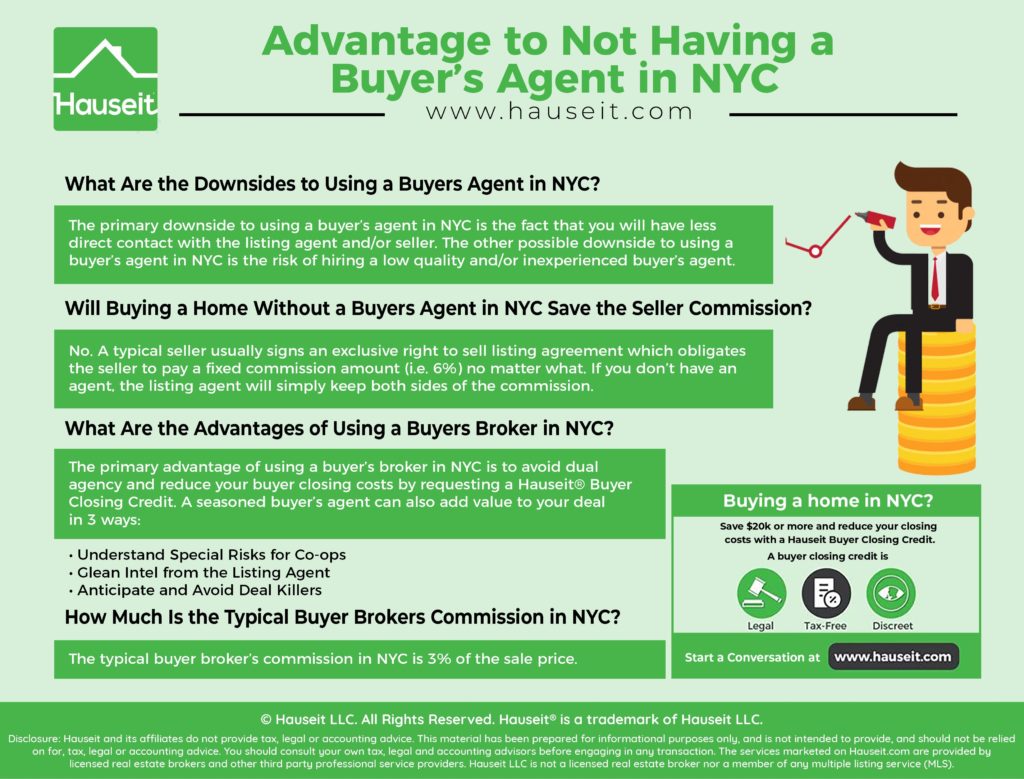

The primary downside to using a buyer’s agent in NYC is the fact that you will have less direct contact with the listing agent and/or seller.

If you’re a hands-on person and need to have direct and complete control over everything in your life, having a buyer’s agent negotiate on your behalf may be frustrating.

With that said, it’s generally accepted that intermediaries are better negotiators than principals in a transaction since intermediaries are less emotionally involved in a specific deal and therefore less likely to make mistakes or act impulsively when negotiating.

The other possible downside to using a buyer’s agent in NYC is the risk of hiring a low quality and/or inexperienced buyer’s agent.

With over 50,000 agents in NYC, there is a huge range in terms of experience (and ethical standards) when it comes to buyer’s brokers. We explain how to find a great buyer’s agent in this article.

While a seasoned buyer agent can make even the most difficult deals go through without a hitch, a newbie buyer broker can easily blow up the most straightforward transaction.

NYC real estate is a high-intensity and high-stakes environment, and the quality of your buyer’s broker can literally make or break your deal.

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

On average, no. The commission structure for sellers in NYC is among the steepest and most onerous in the world.

A typical seller usually signs an exclusive right to sell listing agreement which obligates the seller to pay a fixed commission amount (i.e. 6%) no matter what.

While the 6% commission is intended to be split equally between the listing agent (3%) and the buyer’s agent (3%), the average NYC listing agreement does not reduce the 6% figure if the buyer happens to be unrepresented.

Therefore, a seller in NYC usually does not save any money if a buyer happens to be unrepresented.

In rare instances, a seller may save a miniscule amount on commission such as 0.25% if a buyer is unrepresented.

Even if this is the case, there’s no way for a buyer to: a) find out how much the seller saves, and b) ensure that the buyer has received a proportionate discount on the purchase price which is in line with the seller’s commission savings.

Furthermore, any savings negotiated by a direct buyer as a result of a seller’s lower commission structure will be dwarfed by the size of the average Hauseit Buyer Closing Credit.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

The primary advantage of using a buyer’s broker in NYC is to avoid dual agency and reduce your buyer closing costs by requesting a Hauseit® Buyer Closing Credit.

A seasoned buyer’s agent can also add value to your deal in 3 ways:

Understand Special Risks for Co-ops

A seasoned buyer’s agent can help you navigate the complexity and uncertainty of co-op financial requirements and the board approval process.

The attitude and approach of each co-op towards prospective buyers varies greatly, and in many cases the listing agent him or herself is not fully aware of how the building and board operate.

Having an experienced buyer’s broker can help you avoid wasting time by thoroughly vetting a co-ops policies and financial requirements before you invest time in submitting an offer, signing a contract and completing a board application.

Glean Intel from the Listing Agent

Listing agents take different approaches in speaking with buyers and buyer agents. Because buyers are usually less familiar with the purchase process, listing agents often try to stretch the truth when speaking about other bidders, the ease of the purchase process, and the risks of dual agency.

A seasoned buyer’s agent who calls a listing agent on your behalf will almost always be able to glean more valuable and truthful intelligence about other offers and the seller’s strategy going forward.

This additional insight can help you prepare a more strategic approach to offer submission and possibly give you better guidance on what offer amount to submit.

Anticipate and Avoid Deal Killers

An experienced buyer’s broker can help you anticipate and avoid possible risks and delays to your deal throughout the entire purchase process.

For example, a seasoned buyer’s agent may anticipate requests for additional documentation from a board by proactively asking you to include certain items in a board application which are not listed in the documentation requirements.

A seasoned buyer’s agent knows that most buildings and managing agents rarely bother to update their board application procedure and materials.

Going a step further, an experienced buyer’s agent may try to find out exactly when the board’s monthly meeting is held in order to guide you towards a timely submission.

The typical buyer broker’s commission in NYC is 3% of the sale price. Over 90% of deals in NYC are done between two agents (a listing agent and buyer’s agent) who split the total commission being paid by the seller.

REBNY member listing agents in NYC are legally required to co-broke (aka split) no less than half of the total commission being paid by a seller with a cooperating buyer’s agent.

The co-broking procedures are spelled out in the REBNY RLS Universal Co-Brokerage Agreement.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Disclosure: Hauseit® and its affiliates do not provide tax, legal, financial or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, financial or accounting advice. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided.