The typical real estate commission in NYC is 5% to 6% of the sale price. Broker commissions are the highest seller closing cost in New York City.

While commissions have been steadily falling in other parts of the country for many years, real estate commissions have remained stubbornly fixed between 5 to 6 percent in NYC.

While it’s more common to see lower commission rates in Queens and neighborhoods in Brooklyn which are further away from Manhattan, broker commissions in Manhattan remain the highest in the country and some of the highest worldwide.

To put it in perspective, the typical real estate commission rate for sellers in London is less than 2%. That’s one third of what you pay for the same service in NYC.

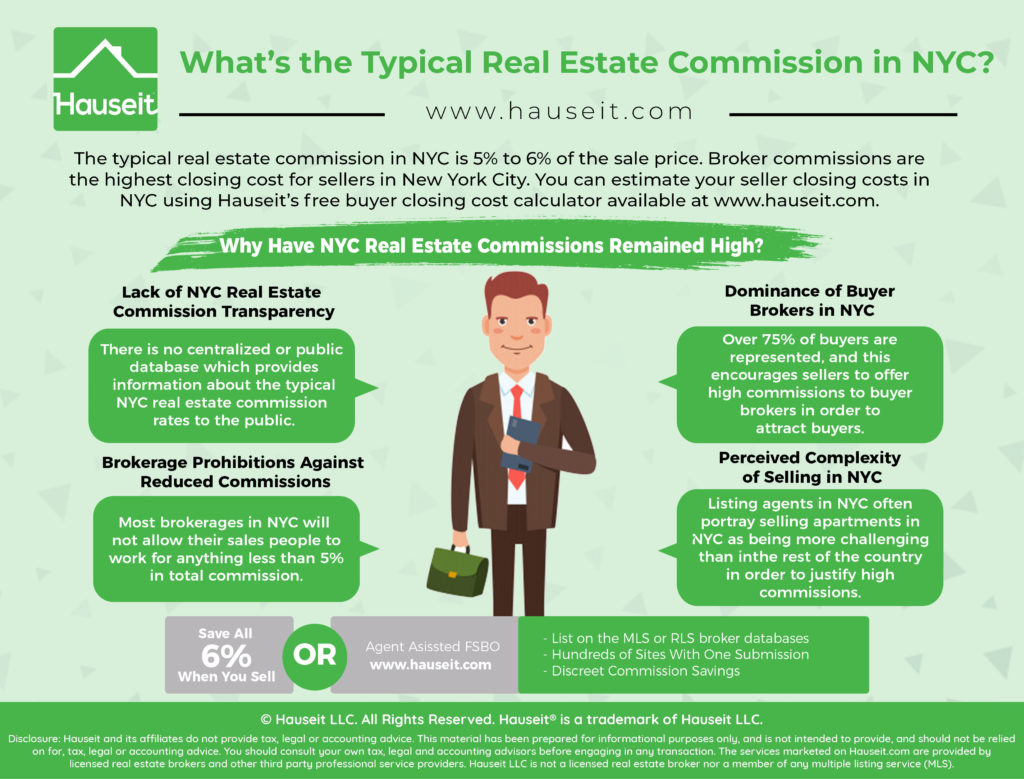

Reasons for high commission rates in NYC include the dominance of buyer brokers, the perceived complexity of selling in NYC (especially for co-ops), brokerage prohibitions against reduced commissions and a general lack of transparency on commission rates.

Table of Contents:

What’s the Average Real Estate Commission in NYC?

Why Have NYC Real Estate Commissions Remained High?

Has the Typical NYC Real Estate Rate Commission Gone down Recently?

How Is the Typical Real Estate Commission Rate in New York City Shared Between the Listing Agent and Buyer’s Agent?

How Can You Reduce or Eliminate the Traditional NYC Real Estate Commission When Selling?

The average real estate commission in NYC is between 5% to 6% of the sale price.

According to recent articles by the New York Times and The Economist, the national average real estate commission charged by real estate agents to sell a home stood at 5.4%. Real estate commission rates are the highest in Manhattan and nearby neighborhoods in Brooklyn and Queens, such as Park Slope, Brooklyn Heights and Long Island City.

Estimate your seller closing costs in NYC using Hauseit’s interactive closing cost calculator for sellers.

Because commission rates and the average sales price in NYC are some of the highest globally, this means that the dollar amount of commission earned by brokers is the highest worldwide. The top brokers in NYC have made and continue to make so much money that some have become celebrities in their own right with successful TV shows and A-list celebrity status to match.

There are no reliable statistics

However, the truth is that there is no official record or statistic for what the average real estate commission in NYC actually is.

The reason is that most brokered sales have their final sales prices and NYC commission amounts recorded in private inter-broker databases like REBNY’s (Real Estate Board of New York’s) RLS Broker Database, MLS Long Island or Hudson Gateway MLS. These broker databases do not publish data on real estate commission amounts to the public.

To make matters worse, most MLS broker databases only record the buyer agent ‘co-broke’ commission instead of the total commission rate.

This makes it impossible to know how much the listing agent is paid and what the total commission rate actually is.

Buyer agent commission data in MLS is typically no longer visible once a deal closes. This means that even real estate professionals with MLS access are unable to view historical commission data being charged by fellow listing agents in NYC.

Moreover, NYC listing agents will typically avoid publicly answering any questions involving what the normal or average real estate commission is in NYC as it can be a sign of collusion and price-fixing.

Due to the lack of transparency on commission rates being charged by NYC listing agents, it’s extremely difficult for potential sellers to know how much commission fellow NYC home sellers are actually paying.

Most NYC sellers will reluctantly sign a 6% commission listing agreement after hearing from a handful of agents, friends and neighbors that 6% is going rate.

The average real estate commission rate in New York City has remained elevated for a number of reasons which include:

Lack of NYC Real Estate Commission Transparency

There is no centralized or public database which provides information about the typical NYC real estate commission rates to the public. Therefore, most potential sellers are not easily able to determine how much in NYC real estate commissions other sellers are actually paying.

This lack of transparency, combined with the incessant references NYC listing agents make to “6% commission” result in most busy NYC sellers begrudgingly agreeing to pay something very close to 6% in total NYC real estate agent commissions.

Secret NYC Brokerage Prohibitions Against Reduced Commissions

Although commission rate fixing and collusion among real estate brokerages is illegal under antitrust laws, we have heard from many Hauseit Assisted FSBO sellers that most brokerages simply will not permit any agent to sign a listing agreement for anything less than 5% in total commission.

It’s worth mentioning that many of clients we’ve heard this from interviewed a number of traditional 6% brokers before deciding to list through a Flat Fee RLS listing service. We’ve also heard these same words uttered directly from many brokers/salespeople who are associated with these firms.

In short, a key reason why the average NYC real estate commission remains high is that many brokerages in NYC simply won’t permit their agents to work for low commissions. For most brokerages, charging 1% for full-service is a non-starter.

Dominance of Buyer Brokers in NYC

One of the main reasons why commissions remain elevated in NYC is because the vast majority of buyers work with buyer agents.

Even though well over 90% of today’s home buyers may start their search online, they eventually end up purchasing their home through a buyers’ agent over 80% of the time. In short, buyers’ brokers still dominate the NYC real estate market.

The typical 5% to 6% commission paid by the seller is intended to be split equally between the listing agent and the buyer’s agent.

Sellers are averse to offering less than 2.5% to 3% to a buyer’s agent because it may have an impact on how much demand the listing sees from represented buyers (who account for over 75% of the buyer base).

Sellers in NYC typically sign an exclusive listing agreement which stipulates a fixed commission rate to be paid at closing.

Use It or Lose It

If a buyer is unrepresented in NYC, the total commission paid by the seller is simply pocketed by the listing agent instead of being split with a buyer’s agent.

Buyers are therefore incentivized to work with buyer agents because it’s perceived to be a free service since sellers are paying a fixed total commission no matter what.

This creates a chicken and egg situation whereby sellers feel compelled to offer high commissions to buyer agents while buyers feel compelled to work with buyer brokers since it doesn’t cost them anything.

In order to access buyers represented by agents, sellers need to list their property in the city’s broker database (called RLS in NYC).

Because all REBNY member brokerages have signed a Universal Co-Brokerage Agreement, it means that when you list on RLS all 15,000+ buyer agents automatically know that you are contractually offering a commission if they procure a buyer for your home.

Unfortunately, the vast majority of sellers in NYC think that the only way to list in RLS and fully market their home is to hire a traditional 6% listing agent who will post the property in RLS.

Many sellers are not aware that they can list their home in RLS (and everywhere online) for zero percent listing agent commission through a Flat Fee RLS Listing Package.

Perceived Complexity of Selling in NYC (Especially for Co-ops)

Listing agents in NYC often portray selling apartments in NYC as being more challenging than in the rest of the country and something which only a seasoned listing agent is capable of handling successfully.

From vetting the financials of prospective buyers to preparing the co-op board package, there are a lot of seemingly difficult tasks which traditional listing agents want you think that only they’re capable of handling.

While it’s true that selling a co-op in NYC is more difficult than selling a condo in another city, the reality is that it’s not rocket science. Through our agent-managed NYC FSBO Listing Service (Flat Fee RLS), we’ve helped hundreds of NYC home sellers succeed without the assistance of a traditional, full-service real estate agent.

If you do your homework as a FSBO seller in NYC, you will have no difficulty in preparing a co-op board application, coaching your buyer for the coop board interview and managing the overall sale process.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Yes and no. While most traditional brokerages refuse to openly discount their commission rates, there are a number of proven, reduced commission options for sellers which have entered the market over the past few years.

These include listing FSBO in NYC or listing full-service for just 1% commission. There are more options for sellers today than what there was 10 years ago.

However, the typical seller in NYC who does not do his or her homework will still likely end up paying 5% to 6% in total commission.

Only recently has the average NYC real estate commission rate started to fall more in line with what’s charged in the rest of the country and in London.

With the advent of competition on the listing agent side with NYC flat fee MLS listing services like Hauseit and the legalization of buyer rebates in NYC, real estate commissions in NYC have become compressed on all sides.

The bad news is that seller closing costs are 8% to 10% of the sale price. The good news is that the bulk of those closing costs are broker commissions which are the easiest closing cost to reduce and/or fully eliminate.

Better yet, you can significantly reduce your buyer closing costs by requesting a buyer closing credit.

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

The typical real estate commission in NYC is split equally between the listing agent and the buyer’s agent. For a 6% commission deal, this means both agents will earn 3%. If there is no buyer’s broker, the listing agent will generally collect the entire 6% commission.

Before you decide whether a commission charged to you by a traditional NYC listing agent is fair or not, first you must understand how a normal real estate commission in NYC is shared among all parties. Over 95% of NYC listings are sold by agents, which almost always means the seller has agreed to sign an “exclusive right to sell” with the listing, or seller’s, agent.

In an “exclusive right to sell” arrangement, the seller is obligated to pay a real estate commission in NYC to the listing broker if the property is sold during the term of the agreement, regardless of who finds the buyer. This means that even if the owner tells a close friend or neighbor about his property, and that neighbor ends up buying the property, the listing agent will still collect the full 6% commission.

In the event that a buyer’s agent procures the buyer, the traditional 6% commission is split equally between the listing agent and the buyer’s agent. Each brokerage firm will earn 3% of the sale price on the transaction.

When a listing agent is hired by a seller, the agent will typically post the listing along with the real estate commission in a local NYC brokerage database so other agents will see it and try to find a buyer. If another agent finds a buyer that ends up purchasing the apartment, the listing agent will be obligated to share, or co-broke, half of the real estate commission in NYC to the buyers’ agent.

It’s important to understand that the real estate commission in NYC earned by a typical real estate salesperson will be less than the nominal commission percentage (6% or 3%) because a salesperson will have to share some amount of the real estate commission in NYC with the brokerage that he or she works for.

It is quite easy to get a real estate salesperson’s license in NYC. In fact, there are over 27,000 real estate agents in NYC.

However, it’s more difficult to acquire a real estate broker’s license in NYC. The latter requires 2-3 years of real estate experience based on a points system (1750 points required to become a broker, 250 points accumulated per closed condo/co-op transaction). Real estate salespersons are required to work for a broker and can only collect fees via their supervising broker.

The real estate commission in NYC is split on a case by case basis for each brokerage. The split usually starts at 60/40 in favor of the brokerage and becomes more favorable as the salesperson proves himself. Some brokerages have no split but instead charge agents a periodic desk fee to be a part of the brokerage and utilize its marketing resources.

Therefore, it is important to understand that after splitting half of the real estate commission in NYC with their brokerage, the real estate agent will only take home 1.5% per typical transaction before tax.

While 6% may make sense in most of the country where the average home value is around $250,000, in NYC the typical 6% commission equates to roughly $100,000. Regardless of a broker’s commission split and other operating expenses, the typical agent in NYC earns disproportionately more in commission than what agents earn in other parts of the country.

You can save up to 6% in broker commissions as a NYC home seller by listing your home FSBO through Hauseit’s NYC flat-fee MLS listing service.

Whether you’re selling a coop or a condo, Hauseit’s Flat Fee MLS listing service offers your property the same listing syndication and exposure offered by a traditional NYC 6% listing agent without having to actually hire and pay 6% to a traditional, full-service listing agent.

Better yet, our agent-assisted FSBO service allows you as a NYC FSBO seller to maintain full control of the sale process.

Hauseit’s Flat-Fee MLS listing service offers NYC FSBO sellers the same advertising exposure and reach as they’d have through a traditional listing agent.

This means co-broking in the REBNY RLS Broker Database (providing access to represented buyers) and syndicating their listing to over a dozen websites like StreetEasy, The New York Times and Realtor.com, for a small, flat fee instead of a 6% commission.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Yes. If you’re looking to save money but you don’t have time to sell FSBO, your best option is to consider Hauseit’s 1% full service listing option.

This service is identical to what you’d receive if you hired a traditional full-service listing agent and paid 6%.

You can expect to save 3-5% in New York City real estate commissions as a seller when using this option.

Yes. You can save money as a buyer by requesting a Hauseit buyer closing credit. A buyer closing credit allows you to pocket some of the commission paid to your buyer’s agent by the seller.

Receiving a buyer closing credit is the only way to extract commission from the sale price for a seller who has agreed to pay a fixed total commission amount at closing.

Price competition on home buyer representation in NYC has slowly emerged as well.

Good post, thanks OP. Clearly, the average New York City real estate commission rate is astronomically high on a global and national level. I’m glad to see that you are another positive force for change in this out of touch industry!

The average real estate commission in NYC is way too high. Closing costs are outrageous in this city…

The problem is that it’s not any cheaper to rent in NYC either! Once you factor in 15% broker fee, moving costs, etc. it’s still probably cheaper to buy than rent in NYC over the long term (even considering buyer closing costs like the mansion tax).

Can a seller be obligated to pay a brokers commission if he only gets a verbal full price offer? Can a seller change his mind and not be obligated to pay a brokers commission. If he decides not to sell after receiving a verbal full price offer? BrandonEWolfe@aol.com

Hi Brandon, generally speaking no commission is payable on a real estate transaction in NYC unless an actual closing occurs. However, this may or may not be the case depending on the language in the contract you signed with the listing agent. You’d need to speak with an attorney to review whatever documentation you signed or to analyze the discussion/oral agreement you had with the agent. Did you sign anything with the agent?

Hi Brandon, this depends entirely on the language in your Exclusive Right to Sell Listing Agreement with your listing agent’s brokerage.

Believe it or not, some “old school” listing agreements will stipulate that a seller owes commission as long as a “ready, willing and able” buyer has been procured. However, even with this harshest of language, you’d still typically need an offer to be in writing, and submitted with the usual documentation (i.e. REBNY Financial Statement, mortgage pre-approval letter, any contract contingencies etc.) to be considered serious or real.

Fortunately for sellers, our partner brokers are all very reasonable, and our agreements stipulate that commission is owed only at closing. So if you don’t sell or change your mind, you won’t owe any commission.