What is the appraisal contingency in real estate contracts in NYC? Is the appraisal contingency standard and included within the financing contingency?

We’ll explain everything you need to know about the appraisal contingency, go over common negotiating points and show you sample contract language in this article.

Table of Contents:

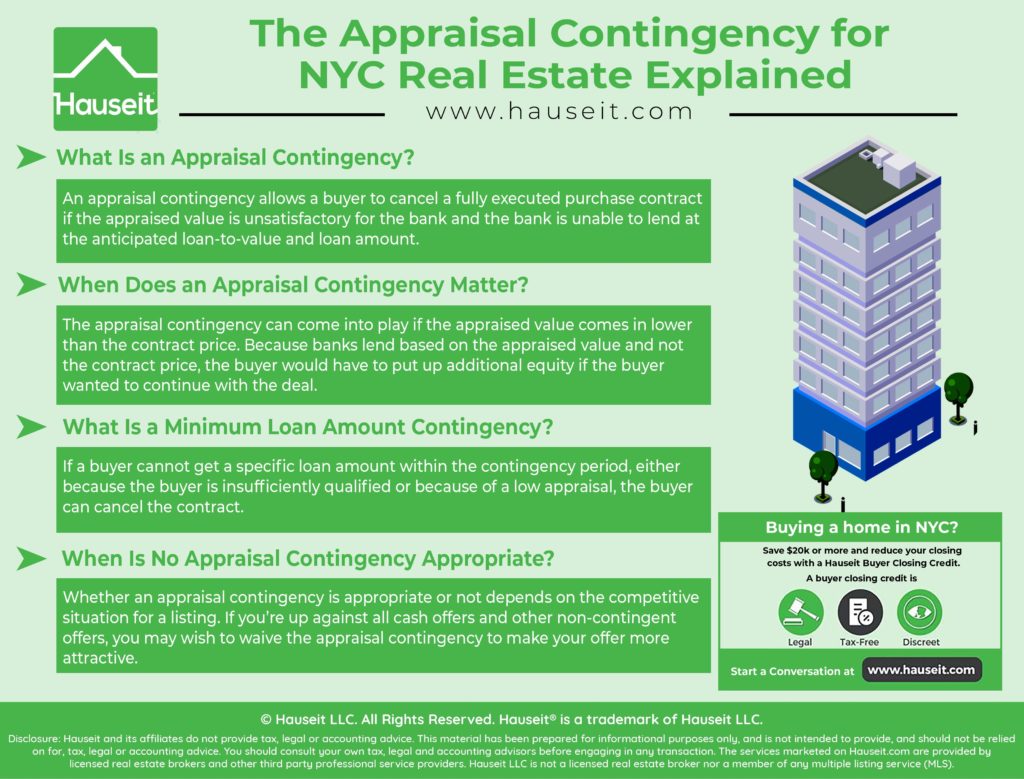

An appraisal contingency allows a buyer to cancel a fully executed purchase contract if the appraised value is unsatisfactory for the bank and the bank is unable to lend at the anticipated loan-to-value and loan amount.

Is the Appraisal Contingency Standard?

Contrary to popular belief, there is appraisal contingency language built into the mortgage or financing contingency sections of the New York Bar Association condo and coop contracts of sale.

Please keep in mind that in NYC, real estate attorneys representing buyers and sellers will typically negotiate a standard purchase contract with “riders” of additional negotiating points attached to the main contract.

For example, you’ll see something like the following in a standard condo contract of sale:

And you might see something like this in typical coop purchase and sale contracts:

The appraisal contingency can come into play if the appraised value comes in lower than the contract price.

Because banks lend based on the appraised value and not the contract price, the buyer would have to put up additional equity if the buyer wanted to continue with the deal.

If the buyer doesn’t wish to put up additional equity and the bank is unwilling to increase the loan-to-value to make up for the shortfall, then the buyer can walk away from the deal.

Please read our tips on the mortgage loan process in NYC, especially the section on appealing an appraisal, to learn that the appraisal will typically come in at the contract price or above unless the appraiser really thinks that the contract price significantly overvalues the property.

As a result, the appraisal contingency can be extremely useful for first time home buyers who are either unrepresented or working with an inexperienced buyer’s agent.

If you have no idea what you’re doing and end up dramatically over paying for a property, an appraisal contingency may indeed save you from a poor purchase.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

A minimum loan amount contingency is built into the commonly used New York Bar Association contracts of sale for both co ops and condos. As you’ll see below, the standard co op or condo contract states the loan amount that the buyer will be seeking.

As a result, if a buyer cannot get such a loan amount within the contingency period, either because the buyer is insufficiently qualified or because of a low appraisal, the buyer can cancel the contract.

The minimum loan amount mortgage contingency may look like this for a co-op:

For condos, you’ll see language like this:

Remember that real estate attorneys representing the buyer and the seller can and typically do negotiate the language that comes with standard contracts via riders.

For example, see below for sample language that allows a seller to make up for a shortfall in the appraised value so a deal can still happen:

Alternatively, language can be negotiated which puts the burden of a low appraisal on the purchaser:

In this example, let’s say the contract price is $1,000,000 and the contract loan amount is $800,000. If the appraisal comes in low at say only $900,000, and the bank refuses to lend more than the original 80% loan-to-value, then the buyer will only be getting a $720,000 loan. That’s an $80,000 shortfall and therefore this clause wouldn’t apply to the buyer, and the buyer would likely be able to cancel the contract.

However, in this same example let’s assume that the appraisal came in at $990,000. 80% loan-to-value equates to $792,000 of debt. That’s an $8,000 shortfall which would need to be covered by the buyer with additional equity per the above language.

Whether no appraisal contingency is appropriate or not depends on the competitive situation for a listing.

If a property is clearly under-priced and receiving a lot of interest, then the seller may hold a best and final offer process.

Negotiating Leverage

In a bidding war scenario, you’ll want to make your offer as competitive as possible if you actually want to win and buy an apartment in NYC.

You may be up against all cash offers and other non-contingent offers.

As a result, you may wish to waive the appraisal contingency to make your offer easier to accept.

Please consult your lawyer and learn more about waiving the mortgage contingency in NYC before doing so!

In contrast, an appraisal contingency is something you might be able to keep in the contract if you’re bidding on a property listing that has a desperate seller, multiple price reductions and over a hundred days on market.

In this case, the property is probably overpriced and it may make a lot of sense for you to make sure the appraisal contingency stays in place. After all, it’s not like the seller has another option!

Disclosure: Commissions are not set by law or any Realtor® association or MLS and are fully negotiable. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided. Square footage numbers are only estimates and should be independently verified. No legal, tax, financial or accounting advice provided.

Best answer I’ve seen on the appraisal contingency for the NYC market, thank you. I’ve always been confused about the difference between the mortgage contingency, the appraisal contingency and the financing contingency. Thank you for explaining it!