Cash on cash return, cash on cash yield and cash on cash ROI (return on investment) all mean the same thing: what percent of your actual cash investment do you get back every year.

More specifically for cash on cash return for real estate, it’s a rental property’s net operating income minus its mortgage payment (principal and interest), divided by the cash invested (equity, closing costs and any renovation expenses).

We’ll define what cash on cash return means in detail in the following article, plus give you the exact formula along with an interactive calculator to calculate cash on cash return. We’ll also do a real world example of an actual listing that’s currently marketed for sale.

Cash on cash return definition

Cash on cash return is defined as the percentage of the initial cash outlay that is returned to the investor annually via pre-tax cash flows. Basically, your annual cash flow on the investment divided by the amount of cash you invested.

In other words, it tells you how much cash you are making on your investment relative to the amount of cash you initially put into the investment.

Remember that this is a cash flow metric, and should not be confused for an accounting or taxable income metric. That’s because the annual cash flow figure we use is calculated from subtracting mortgage principal & interest, as well as all other cash expenses like property taxes, common charges, home insurance premiums, maintenance & repair costs and so on from annual rental income.

In plain English, this means if you bought a rental property for $1,000,000 using 80% leverage, then your initial cash outlay is $200,000 plus the cost of any renovations you do post-closing and your buyer closing costs. For the purposes of this example, let’s assume you signed up for a Hauseit Buyer Closing Credit which covered your closing costs and the minor renovations you did.

And let’s say your annual cash flow is $10,000 after the aforementioned cash expenses, then your cash on cash return would be 5%.

Cash on cash return meaning

Cash on cash return is a financial performance metric used to evaluate the return on investment (ROI) of a real estate property. It is calculated by dividing the annual pre-tax cash flow generated by the property by the total amount of cash invested in the property, and expressing the result as a percentage.

The annual pre-tax cash flow is the net operating income (NOI) generated by the property, which is calculated by subtracting all operating expenses (such as property taxes, insurance, maintenance costs, and property management fees) from the property’s gross rental income.

The total amount of cash invested in the property includes the down payment, closing costs, and any other out-of-pocket expenses associated with the purchase of the property like renovation costs.

The cash on cash return is a useful metric for real estate investors because it provides a clear picture of the actual return on their investment, as it only takes into account the cash invested in the property, rather than the total value of the property. This makes it easier to compare the performance of different real estate investments and to make informed decisions about future investments.

Cash on cash return formula

The formula for calculating cash on cash return on a rental property is as follows:

(Annual pre-tax cash flow – Annual mortgage payments) ÷ Total cash invested = Cash on Cash Return

Each of the components of the above formula need to be calculated as follows:

-

Annual pre-tax cash flow is the total cash flow generated by the property in one year, before taxes.

-

Annual mortgage payments are the total payments made toward the mortgage in one year, including principal and interest.

-

Total cash invested includes the down payment, closing costs, and any other out-of-pocket expenses associated with the purchase of the property (i.e. renovations).

In short, it’s net operating income less the full mortgage payment, divided by the cash equity you invested on an annual return basis.

The formula can be broken down into three parts:

Part 1: Calculate the annual pre-tax cash flow. This is commonly referred to as Net Operating Income.

Annual pre-tax cash flow = Rental income – Operating expenses

Part 2: Calculate the annual mortgage payments, including both principal and interest.

Annual mortgage payments = Monthly mortgage payment x 12

Part 3: Calculate the cash on cash return

Cash on Cash Return = (Annual pre-tax cash flow – Annual mortgage payments) ÷ Total cash invested

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

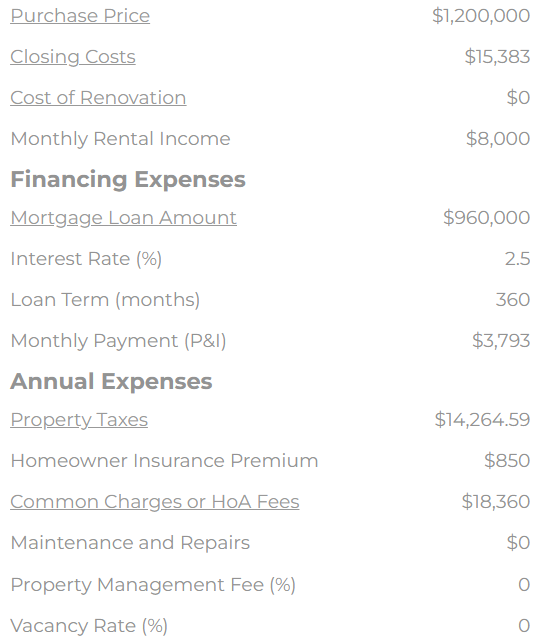

Purchase Price

Closing Costs

Cost of Renovation

Monthly Rental Income

Mortgage Loan Amount

Interest Rate (%)

Loan Term (months)

Property Taxes

Homeowner Insurance Premium

Common Charges or HoA Fees

Maintenance and Repairs

Property Management Fee (%)

Vacancy Rate (%)

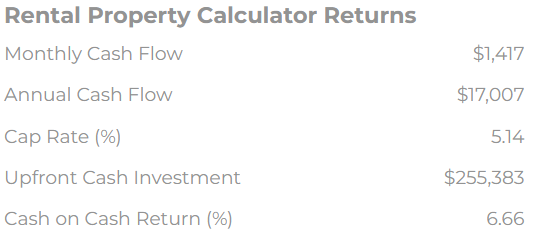

Monthly Rental Income

Financing Expenses

Interest Rate (%)

Loan Term (months)

Monthly Payment (P&I)

Annual Expenses

Homeowner Insurance Premium

Maintenance and Repairs

Property Management Fee (%)

Vacancy Rate (%)

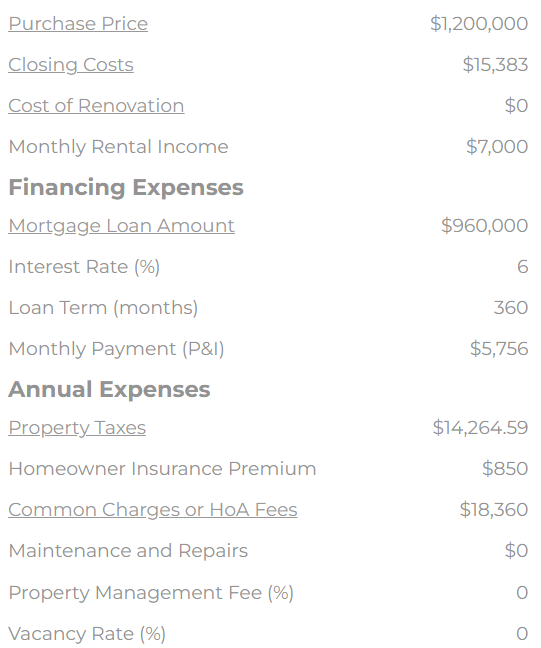

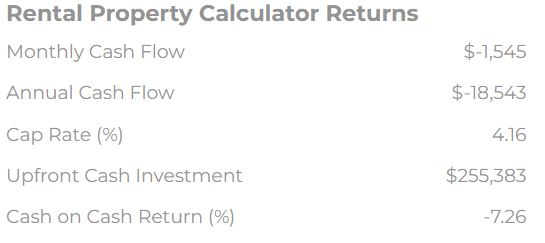

Rental Property Calculator Returns

Monthly Cash Flow

Annual Cash Flow

Cap Rate (%)

Upfront Cash Investment

Cash on Cash Return (%)