It’s a common misconception among buyers in NYC that a board package is only required for a co-op apartment. While a condo does not have the same broad discretion as a co-op to reject buyers, most condos still require buyers to complete and submit a board package.

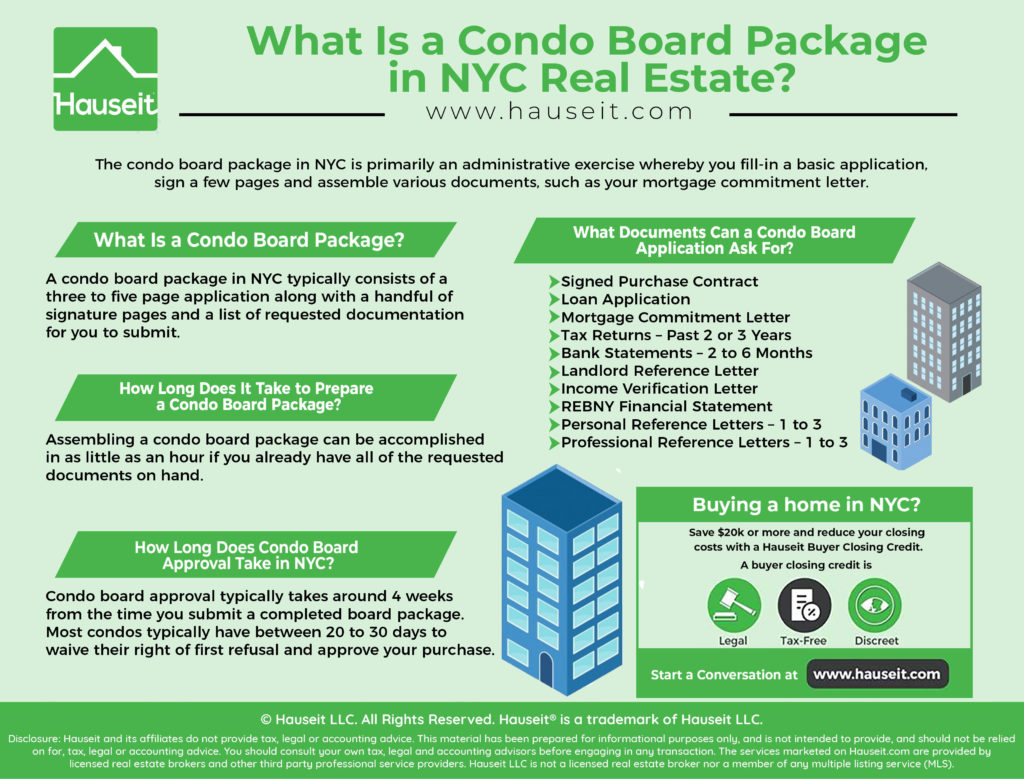

The condo board package in NYC is primarily an administrative exercise whereby you fill-in a basic application, sign a few pages and assemble various documents, such as your mortgage commitment letter. While a condo cannot reject you unless it agrees to buy the apartment, a condo board does have grounds to delay your closing indefinitely if you refuse to complete the purchase application.

Table of Contents:

A condo board package in NYC typically consists of a three to five page application along with a handful of signature pages and a list of requested documentation for you to submit.

The application itself usually requests basic information about the proposed transaction (sale price, down payment, etc.) as well as the full contact details of the buyer, seller, brokers and real estate lawyers working on the deal.

The condo purchase application may also ask for your residence history, employment history, potential occupants of the apartment, emergency contact information as well as the name of your references (if the application asks for reference letters).

You can view a sample condo board application here.

The signature pages in a condo board application may consist of the following:

-

Window Guard Disclosure

-

Lead Paint Disclosure

-

Pet/Wildlife Rider

-

Bed Bug Disclosure

-

Occupancy Rider

-

Notification of Legal Mailing Address

-

Emergency Contact Information Form

-

Signed Financial Statement

-

Credit Check Authorization

-

House Rules Acknowledgment

-

Condo Power of Attorney

-

Fire Safety Acknowledgment Rider

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

The documentation requested as part of the typical condo board package process in NYC has become increasingly complex over the years.

It’s not uncommon to find condo applications in larger buildings which are virtually identical in scope to what a co-op would ask you for.

With that said, there is still a key difference between condo and co-op board applications:

A condo cannot reject your purchase unless the condo building itself agrees to buy the apartment for the same price as your proposed transaction.

The act of a condo buying an apartment is called right of first refusal, and it’s something which rarely happens in NYC given how expensive apartments are today.

Here are some examples of typical documentation you may be asked to submit as part of the condo board application in NYC:

-

Signed Purchase Contract

-

Loan Application

-

Mortgage Commitment Letter

-

Tax Returns – Past 2 or 3 Years

-

Bank Statements – 2 to 6 Months

-

Landlord Reference Letter

-

Income Verification Letter

-

REBNY Financial Statement

-

Personal Reference Letters – 1 to 3

-

Professional Reference Letters – 1 to 3

Condo boards have broad leeway in their board package documentation requirements. If your condo building’s documentation requirements are particularly onerous, there’s not much you can do about it.

Smaller buildings (especially self-managed condos) usually have a very small board application with little or no documentation requirements outside of asking to see the contract of sale.

This isn’t always the case however, as small buildings often have incredibly domineering condo board with owners who think they live in a co-op.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Assembling the various documentation for a condo board package can be accomplished in as little as an hour if you’ve done your homework.

As the buyer, you’ll already have access to most of the information requested such as tax returns and bank statements. How quickly you can put everything together depends on how efficient your record-keeping is.

If the condo board application asks for reference and/or verification letters, it’s always a good idea for you to request these the moment you have a signed contract.

The same goes for the mortgage application: you should complete this as quickly as possible once you’ve signed the purchase application.

In most cases, you will not be able to submit your condo board package until the bank has issued a commitment letter. This process usually takes at least three weeks.

It’s a good idea to prepare everything else during this interim period such that you will be in a position to submit the application within a day or two of receiving the mortgage commitment letter.

If the condo board package asks for seller signature pages or any application fees or deposits, it’s a good idea to request these items as early as possible to prevent delays.

Condo board approval typically takes around 4 weeks from the time you submit a completed board package.

Most condos typically have between 20 to 30 days to waive their right of first refusal and approve your purchase.

Here’s where it gets interesting:

While a condo cannot reject you outright without buying the apartment, they can delay issuance of the waiver of right of first refusal if you submit an incomplete board package.

Each time the condo requests more information, the clock usually resets. This means that a condo could conceivably wait 30 days, ask you for more information, receive the information, wait another 30 days, ask you for more information and keep doing this.

In practice, this rarely never happens. However, it’s a good reminder that you and your buyer’s broker should proofread your board package multiple times before submission.

Depending on a condo’s by-laws, a condo may automatically waive its right of first refusal if they do not respond to you within a certain number of days of receiving the application.

Therefore, it’s always a good idea to send your board package by certified mail and try to keep copious email records of when the managing agent confirms receipt of the application and when they forward it to the condo board for review.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Virtually all condo buildings charge buyers an application fee between $300 to $1,000. Buildings usually ask for a move-in fee and/or a move-in deposit as well as a move-out fee and/or a move-out deposit from the seller.

The typical move-in or move-out fee is ~$500, while the average deposit is between $500 to $2,000.

Unfortunately, there is steep inflationary pressure on condo board package application fees in NYC. This is because most of the fees are set by the managing agents hired by buildings to oversee day-to-day operations.

Managing agents use the condo board package as an opportunity to charge exorbitant fees, since most owners don’t realize or care that that the fee for new buyers is so high.

Published: 9/19/18 | Last Updated: January 29th, 2020

Disclosure: Hauseit® and its affiliates do not provide tax, legal, financial or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, financial or accounting advice. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided.