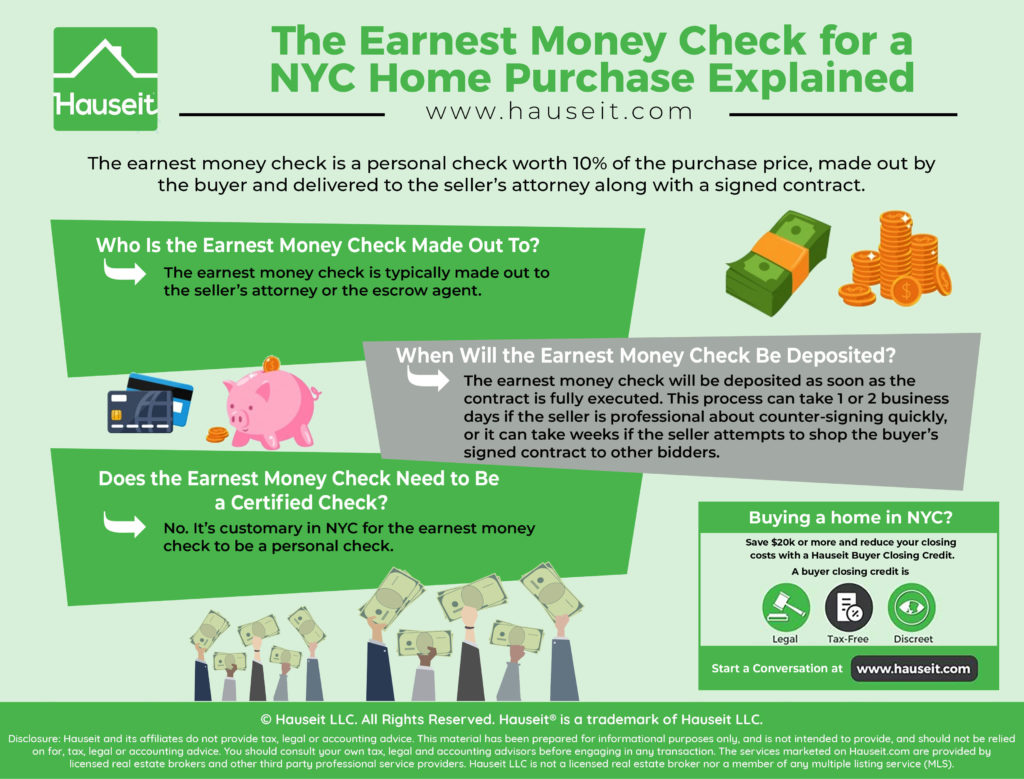

The earnest money check is a personal check worth 10% of the purchase price, made out by the buyer and delivered to the seller’s attorney along with a signed contract. The earnest money check is deposited after the seller has counter-signed and fully executed the contract.

Table of Contents:

The earnest money check is typically made out to the seller’s attorney or the escrow agent. In NYC, the seller’s attorney typically acts as the escrow agent and will deposit the buyer’s earnest money check into their escrow account as soon as the contract has been counter-signed by the seller and thus fully executed.

For example, here are some real life instructions from a buyer’s attorney to the buyer regarding the earnest money deposit, often called the contract deposit or good faith deposit in NYC:

Regarding the Contract Deposit, kindly provide a check (personal is fine) in the amount of $400,000.00, made payable to “Darnell Thompson, Esq., as Escrow Agent.” The check may be dropped off at our office or, alternatively, if you are in Manhattan and provide an address, we can arrange for messenger pickup.

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

The earnest money check will be deposited as soon as the contract is fully executed. This typically happens after the seller counter-signs the contract, the seller’s attorney messengers the fully executed contract to the buyer’s attorney, and the buyer’s attorney confirms receipt in writing.

This process can take 1 or 2 business days if the seller is professional about counter-signing quickly, or it can take weeks if the seller attempts to shop the buyer’s signed contract to other bidders. Since the contract is only binding once fully executed, the seller could find a better offer and sell it to another buyer, in which case the earnest money check from the first buyer would never be deposited.

Depending on the language negotiated by the attorneys, a buyer could be on the hook as soon as the seller’s attorney is in receipt of the signed contract and earnest money check.

In theory, the seller could counter-sign at any moment and instruct the seller’s attorney to deposit the earnest money check.

This can be emotionally taxing for the buyer if the seller takes his or her time to counter-sign the contract.

A good buyer’s attorney will try to mitigate the seller’s advantage of being last to act by negotiating that the contract is only to be considered fully executed once the buyer’s attorney has given written confirmation of receipt of a fully executed contract.

The buyer’s attorney could negotiate that the buyer could cancel the contract and ask for the earnest money check back at any point before the buyer’s attorney provides written notice of receipt of the counter-signed contract.

This would in theory make the buyer the last to act, as the buyer could technically instruct the buyer’s attorney to not provide written confirmation of receipt of a fully executed contract, and thus cancel at the last minute and ask for the earnest money check back. We’ve never seen this happen in practice however!

Here is an excerpt from a standard co-op contract used in New York City on when technically the earnest money check is due:

The purchase price is payable to seller by purchaser as follows: the contract deposit at the time of signing this contract, by purchaser’s good check to the order of escrowee; and the balance at closing, only by cashier’s or official bank check or certified check of purchaser payable to the direct order of seller. The checks shall be drawn on and payable by a branch of a commercial or savings bank, savings and loan association or trust company located in the same city and county as the unit. Seller may direct, on reasonable notice prior to closing, that all or a portion of the balance shall be made payable to persons other than seller.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

No. It’s customary in NYC for the earnest money check to be a personal check. This is in contrast to the checks used at closing which must all be certified or bank checks.

However, just because the earnest money check is a personal check does not mean buyers should take this process lightly. Buyers should sell securities and move funds around to make sure that there is sufficient cash in their checking account to cover the full earnest money check amount.

In the unlikely event that an earnest money check bounces when the seller’s attorney attempts to deposit it into escrow, the buyer should remedy the situation immediately as this could be an event of default under the contract.

In the event any instrument for the payment of the contract deposit fails collection, seller shall have the right to sue on the uncollected instrument. In addition, such failure of collection shall be a default under this contract, provided seller gives purchaser notice of such failure of collection and, within 3 business days after notice is given, escrowee does not receive from purchaser an unendorsed good certified check, bank check or immediately available funds in the amount of the uncollected funds. Failure to cure such default shall entitle seller to the remedies set forth in the previous section and to retain all sums as may be collected and/or recovered.

However, keep in mind that damages against the purchaser is typically limited to the amount of the contract deposit. Here’s an excerpt from a standard co-op apartment contract:

In the event of a default or misrepresentation by purchaser, seller’s sole and exclusive remedies shall be to cancel this contract, retain the contract deposit as liquidated damages and, if applicable, seller may enforce the indemnity referenced below as to brokerage commission or sue if a contract deposit fails collection as described previously. Purchaser prefers to limit purchaser’s exposure for actual damages to the amount of the contract deposit, which purchaser agrees constitutes a fair and reasonable amount of compensation for seller’s damages under the circumstances and is not a penalty. The principles of real property law shall apply to this liquidated damages provision.

Disclosure: Hauseit® and its affiliates do not provide tax, legal, financial or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, financial or accounting advice. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided.

Earnest money as first deposit can’t be 10%. More likely 1%.

Brian, we agree it sounds high! However, in NYC it’s fairly standard to see contract deposits (i.e. earnest money deposit or check) be 10% of the contract sale price. And keep in mind this is 10% of the average $2 million apartment in New York City. Often times, this is the largest personal check a buyer has ever written in his or her life!

Is it required by law in NYS

Hi Darina, it’s customary in NYC for the contract deposit to be 10% of the contract price. There isn’t something on the books that we’re aware of that stipulates that it must be exactly 10%, and norms can vary across the country. If you have any further questions, please feel free to consult one of our partner lawyers: https://www.hauseit.com/real-estate-lawyer-partners/