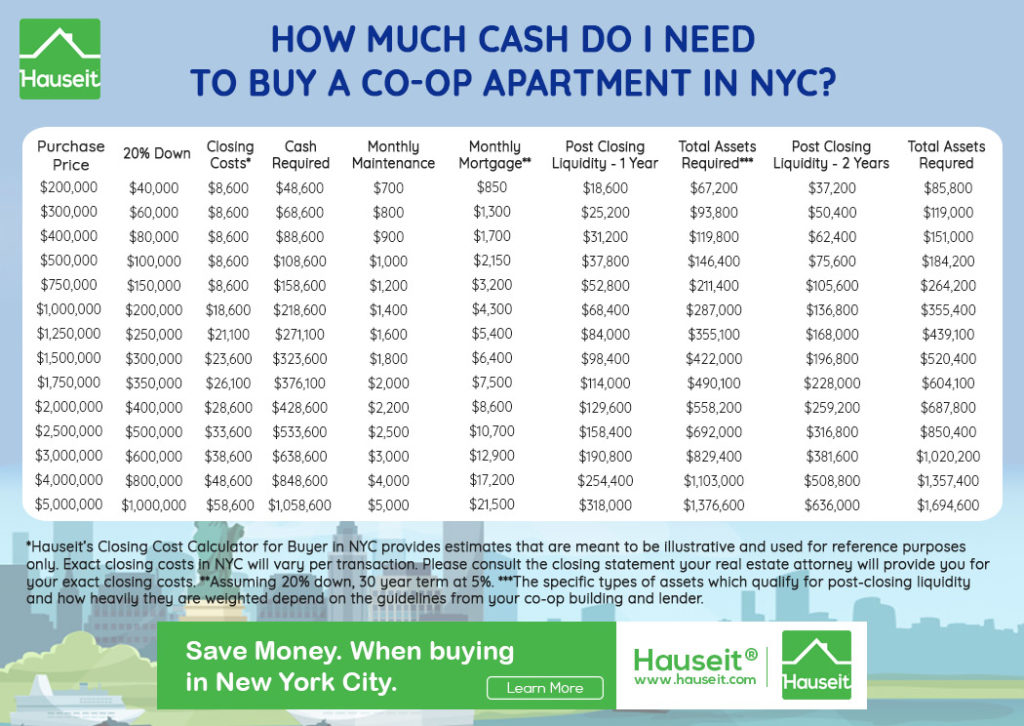

How much cash you need to buy a co-op apartment in NYC depends on your co-op building’s down payment and post-closing liquidity requirements. To buy a co-op in NYC, you need to have 21% to 22% of the purchase price in cash (assuming 20% down). This excludes any post-closing liquidity requirements by your lender and the co-op.

Buyer closing costs for coop apartments in NYC are between 1% to 2% of the purchase price, and most co-ops have a minimum down payment requirement of 20%. Typical post-closing liquidity requirements for co-op buildings in NYC are between one to two years of housing expenses. However, the specific types of assets which qualify for post-closing liquidity and how heavily they are weighted varies by co-op.

Table of Contents:

The vast majority of co-op apartment buildings in NYC require at least 20% down.

Even if a co-op building does not have a stated minimum down requirement, an offer to purchase with less than 20% down is usually frowned upon by sellers and co-op boards.

Co-op boards have discretion in whether or not to approve a prospective purchaser, so the overall strength of a buyer’s offer is an important consideration.

What this means is that a co-op board may reject a deal if they feel that the purchase price is too low or the buyer isn’t putting enough down on the purchase.

If a co-op board likes a candidate but has financial concerns after reviewing the board application, the board could ask the purchaser to put down more money or leave some amount of monthly maintenance payments in an escrow account.

However, there is no guarantee that a co-op board will offer an applicant a pathway towards board approval versus rejecting him or her outright.

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

Co-op buyer closing costs in NYC are between 1% to 2% of the purchase price. The largest co-op buyer closing cost is the Mansion Tax of 1% which applies to purchases where the total consideration is $1 million or more.

Aside from the mansion tax, co-op buyer closing costs in NYC consist of co-op building fees, your real estate attorney’s fee and bank fees such as the application and appraisal fees.

Buyer closing costs for co-op apartments in NYC are actually quite low compared to what you’d pay when buying a condo in New York City.

This is especially true if you’re taking out a mortgage since the Mortgage Recording Tax does not apply to co-op apartments.

When selling, the reverse is the case: condo apartments have lower seller closing costs compared to co-op apartments. This is because many co-op buildings charge sellers a Flip Tax.

The flip tax is essentially another transfer tax. A common flip tax in NYC for a co-op building is 1% to 3% of the sale price.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Post-closing liquidity is a measure of how much in liquid assets you have after closing on your co-op, factoring in your down payment and closing costs. Although most lenders require at least 6 months of post closing liquidity, co-ops typically have much stricter guidelines.

A typical co-op building in NYC will be looking for one to two years of post-closing liquidity. Some co-ops do not spell out an exact requirement for post-closing liquidity.

In such a scenario, the co-op will look holistically at your overall financials and evaluate factors such as the consistency of your income, your debt-to-income ratio and the type of assets you hold.

Here’s an example of how to calculate post-closing liquidity:

Sometimes. Gifting is on a case-by-case basis for co-op buildings in NYC.

With that said, most reasonable co-ops are open to gifts because they expand the potential buyer base and therefore strengthen property values in the building.

Gifts also help fortify the finances of applicants, and this ultimately strengthens the financials of the overall building by reducing the chances that a new purchaser will fall behind on maintenance payments and create financial strain within the building.

The procedure for receiving a gift when buying a co-op apartment in NYC is straightforward.

You prepare a co-op gift letter, submit it with your offer and include it in the co-op purchase application once you’ve accepted an offer and signed a purchase contract.

Aside from gifting, other purchase and ownership structures which vary by co-op include co-purchasing, parents buying for children, children buying for parents, pied-a-terre usage and guarantors.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Published: 9/17/18 | Last Updated: January 29th, 2020

Disclosure: Hauseit® and its affiliates do not provide tax, legal, financial or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, financial or accounting advice. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided.