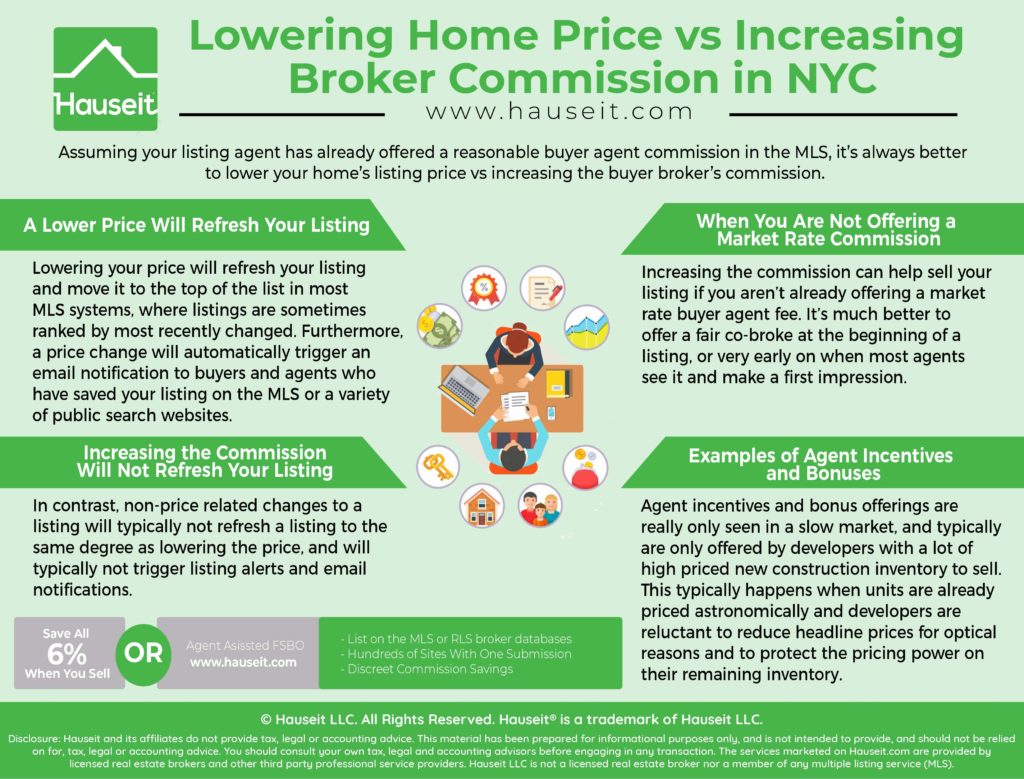

Assuming your listing agent has already offered a reasonable buyer agent commission in the MLS, it’s always better to lower your home’s listing price vs increasing the buyer broker’s commission.

A change in listing price will trigger search alerts, email notifications and refresh your listing in the MLS.

In contrast, a change in broker commission will only be visible to brokers and will typically not trigger search alerts.

Table of Contents:

Lowering your price will refresh your listing and move it to the top of the list in most MLS systems, where listings are sometimes ranked by most recently changed.

Furthermore, a price change will automatically trigger an email notification to buyers and agents who have saved your listing on the MLS or a variety of public search websites.

Even better, if your property fits the criteria of agents’ and buyers’ automatic search alerts, they will automatically get an email notification upon your price change.

A price change is also permanently logged in almost all MLS systems and most public real estate websites, meaning buyers and brokers and easily see the recent activity on your listing’s page.

A Signal of Availability

This is beneficial because the recent activity informs buyers and agents that your listing is probably still available, and saves people time from having to ask whether the listing is still available.

The Real Estate Market is Transparent

Just remember that price is the most important component of marketing for any home sale. The market is very transparent these days with all manner of data, from recent sales to comparable listings, at the fingertips of any interested party.

This means that a buyer’s agent has a much harder time these days persuading a buyer to purchase an overpriced home, no matter how well incentivized the agent may be. It’s hard to fool someone when all of the data is readily available online.

Furthermore, it’s against the fiduciary duty of the buyer’s agent to act in the best interests of his or her client to do so in the first place.

Having a lower price, and especially one that is attractive relative to the market, is the most effective way to get your home noticed and eventually sold.

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

In contrast, non-price related changes to a listing will typically not refresh a listing to the same degree as lowering the price.

In NYC, the REBNY RLS and most real estate search websites like the New York Times and StreetEasy will not send out an email alert for a non-price related change to a listing.

In fact, consumer facing real estate search websites won’t even know what commission is being offered in the first place because they don’t have access to that type of MLS data.

As a result, it will only be brokers who will be able to find out if the commission on your listing has changed.

Keep in mind that although some broker databases may pop a listing up to the top of the list for any listing change, they will typically not alert brokers with an email notification unless there has been a price change.

Commission Changes are Hard to Notice

As a result, it takes an active effort by a broker specifically looking for your listing for him or her to ascertain whether there’s been a change in the commission.

Furthermore, many broker databases don’t show the history of commission changes on a listing, so even if a broker knows that a listing has been changed somewhat, he or she may not even know that it’s the commission that has been altered.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Increasing the commission can help sell your listing if you aren’t already offering a market rate buyer agent fee.

From our partner brokers’ experience, most buyer agents in the city would prefer to see a 3% co-broke, but most would not complain for 2.5%.

However, you must have already heard complaints if you’ve offered anything less, especially if you’ve instructed your listing agent to co-broke less than 2%.

Offer a Market Rate Co-Broke from the Start

It’s much better to offer a fair co-broke at the beginning of a listing, or very early on when most agents see it and make a first impression.

If the co-broke at the beginning is insultingly low, then many agents will never bother with the listing again, nor perhaps the discount broker who listed it.

Furthermore, as we’ve discussed it’s much harder to get the word out that you have raised the commission on your listing.

This means many agents who have dismissed your listing at the outset will never know or perhaps care that you came to your senses.

However, it’s better late than never to offer something reasonable to attract the 90% of buyers who are represented by agents.

Lower the Price and Increase the Commission

The best way to get the word out is to lower the price, even if by a tidbit, along with a change in commission.

This triggering of search alerts and email notifications might encourage some buyer’s agents to take another look at your listing and the commission you’re offering in MLS.

Send an Email Blast

Another great method is to have your listing agent send out an email blast to the real estate community informing them of the listing’s new changes, preferably structured as a notice of change in price with a side note about the commission being offered.

Agent incentives and bonus offerings are really only seen in a slow market, and typically are only offered by developers with a lot of high priced new construction inventory to sell.

This typically happens when units are already priced astronomically and developers are reluctant to reduce headline prices for optical reasons and to protect the pricing power on their remaining inventory.

As a result, sponsors may get the bright idea to discreetly offer a 4% co-broke to buyers’ agents, or perhaps a gift card of $10,000 for bringing a buyer and doing a deal.

Bonuses Might Come with Deadlines

Sometimes developers will have a deadline for the bonus in order to create a sense of urgency.

For example, a developer may offer the higher co-broke only if contracts are signed before a certain date.

Because these types of agent incentives are typically not widely broadcasted, the effectiveness of these incentives really depend on how the seller is able to get the word out. This is typically done by mass email marketing to the real estate community.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Disclosure: Hauseit® and its affiliates do not provide tax, legal, financial or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, financial or accounting advice. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided.