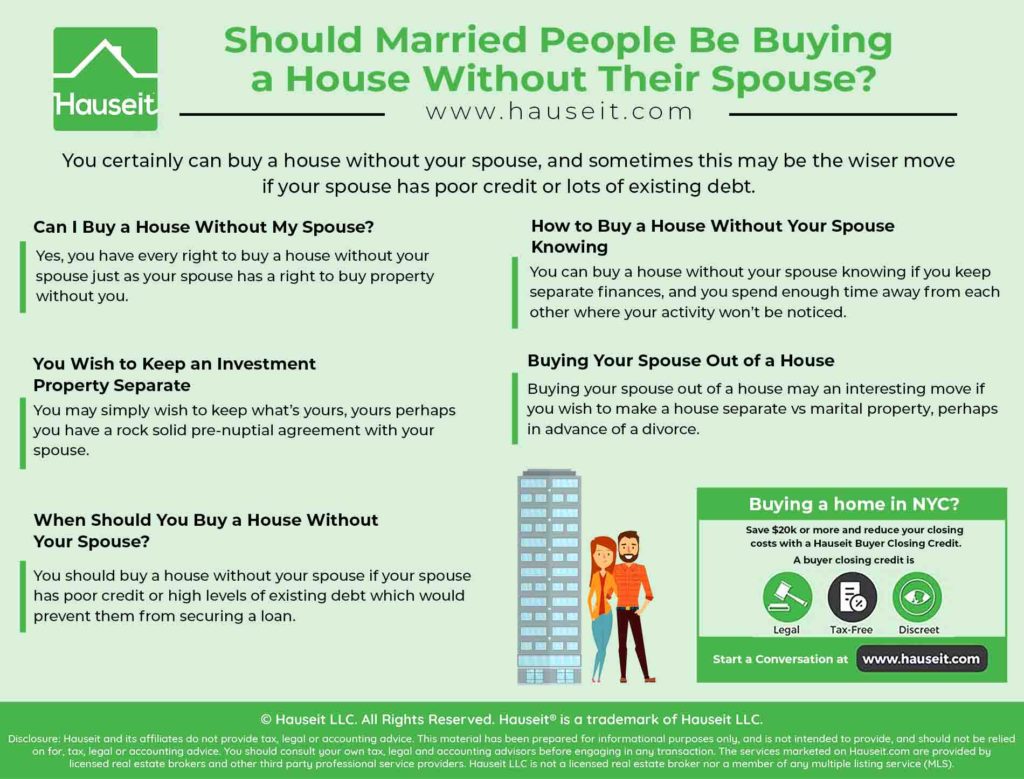

You certainly can buy a house without your spouse, and sometimes this may be the wiser move if your spouse has poor credit or lots of existing debt. However, whether you should buy a house without your significant other depends on your pre-nuptial agreement, state laws around community property and the state of your relationship.

Table of Contents:

Yes, you have every right to buy a house without your spouse just as your spouse has a right to buy property without you.

Whether your spouse will appreciate you doing so is another matter entirely. However, some pre-nuptial agreements will allow spouses to individually buy and own separate property as long as the money used is also separate property.

If you do decide to do so, you should explain it as being no different than spouses having separate brokerage or retirement accounts. A house is an asset just like a stock or bond, thus it shouldn’t be that big of a deal for you to own a house on your own.

With that said, if it’s a house that you will both be living in, then that might cause more problems as that won’t simply be an investment asset.

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

You should buy a house without your spouse if your spouse has poor credit or high levels of existing debt which would prevent them from securing a loan.

You should also consider buying a house without your spouse if you simply want to keep an investment property as separate vs marital property, assuming that your pre-nuptial agreement allows it.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Your Spouse Has Bad Credit

Your spouse might have bad credit or simply a lot of existing debt which would make it hard for them to secure a loan. Worse still, your spouse’s poor financial condition may affect your ability to get a loan if you applied together as co-borrowers.

As a result, sometimes it makes more sense to simply exclude one spouse from the loan application and to apply for a mortgage individually.

Keep in mind however this often will mean that your spouse won’t be allowed on the title as well. Most banks will require everyone on the title for a property to also be a co-borrower.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

You Wish to Keep an Investment Property Separate

You may simply wish to keep what’s yours, yours. Perhaps you have a rock solid pre-nuptial agreement with your spouse that allows property purchased separately with individual funds to be kept as separate property.

Make sure to check whether your state is a community property state: Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington and Wisconsin.

If you live in one of these 9 community property states, then all marital property is equally split in a divorce.

Other states are “equitable distribution” states, where divorce settlements do not need to be equal, but rather equitable (i.e. fair, based on each individual’s circumstances).

You can buy a house without your spouse knowing if you keep separate finances, and you spend enough time away from each other where your activity won’t be noticed.

Whether this is healthy for a marriage is a different topic, and there aren’t many situations where we advise this type of behavior.

Perhaps the only time this might be normal is if you are a real estate investor, and buying houses is part of your day to day business.

Furthermore, if you have a pre-marital agreement that allows you to keep your real estate investments as separate vs marital property, then it could be conceivable that you don’t have any personal obligation to inform your spouse of your day to day business dealings.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Another rare situation where this might be appropriate is if you’re secretly planning to buy a house for the both of you to live in, and you wish for it to be a surprise to your spouse.

In this rather sweet example, we recommend making up excuses as to why you need to be away from home whenever you need to see properties.

However, a home purchase will still be very hard to keep a secret if you have any sort of joint finances because you’ll need to typically put down an earnest money check worth 10% of the purchase price.

Unless your spouse pays zero attention to household finances or you are putting down the contract deposit with separate vs marital funds, it’s going to be hard not to notice.

Buying your spouse out of a house may an interesting move if you wish to make a house separate vs marital property, perhaps in advance of a divorce.

This can be advantageous if you do plan on getting a divorce, as this will preclude any messy fights about the ownership of a house, and who gets to live in it.

If you do decide to pursue this route, first check your pre-nuptial agreement to make sure that this type of transaction is allowed, especially if the house is marital property.

Your pre-nuptial agreement should specify whether marital, jointly owned property can be made back into separate property.

Once this is confirmed, then it’s up to you and your spouse to determine a fair value for the house. Read our guide on how to price my home for sale so you can learn how to do a comparative market analysis and come up with a reasonable price for your home.

Once you’ve done that, you can then simply offer to pay your spouse a pro rata share of the valuation.

Alternatively, you can hire an appraiser or simply get price opinions for free from several brokers. You can also take things a step further by actually listing the home for sale, and seeing what the open market will bear.

Keep in mind that testing the market can be risky if you’ve signed a traditional Exclusive Right to Sell Listing Agreement because you may be forced to pay your broker commission as long as a “ready, willing and able” buyer is found at your listing price.

As a result, you could inadvertently force yourself to sell, or pay a typical broker commission in NYC of 6% of the sale price!

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Disclosure: Hauseit® and its affiliates do not provide tax, legal, financial or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, financial or accounting advice. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided.