On November 1st of each year, the property taxes owed for that tax year are released (both online and by mail). If you pay your property taxes before November 30th, you get a 4% discount for paying early. It’s important to pay your property taxes even if you disagree with your home’s assessed value and plan to dispute it.

However, you may be wondering what all the columns and rows mean in the relatively complex “Combined Tax Memorandum Notice.” We’ll go over an example of a condo that has the Non-Homestead Cap in place and explain to you what it all means.

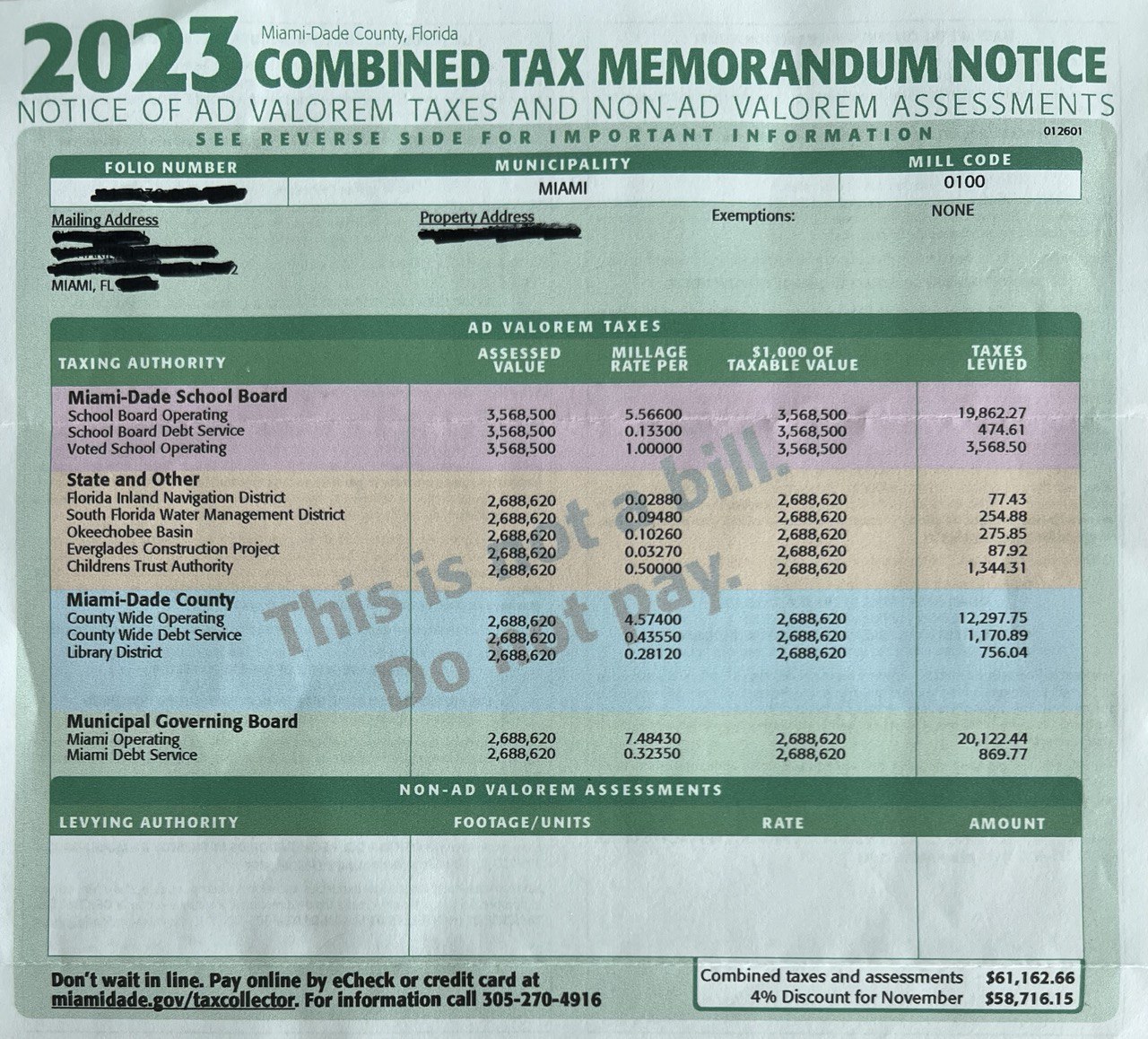

Example Combined Tax Memorandum Notice

You’ll find below an example notice of Miami Florida real estate taxes for 2023. This property is a condo in the City of Miami, Miami-Dade County. Notice how the taxable value is different for the Miami-Dade School Board portion of the taxes.

This is because this property has the Non-Homestead Cap in place, which caps assessment increases at 10%, with the exception of the School Board portion of taxes which are taxed at full market value. We’ll explain this in more detail later.

Notice also that there are no Non-Ad Valorem Assessments levied on this property. We’ll explain this later in more detail. Lastly, notice how you can get a 4% early bird discount if you pay your property taxes before November 30th!

What percent of taxes are for the School Board?

As you can see from the table below, the Miami-Dade School Board portion of property taxes for 2023 is 32.6%, when we compare its millage rate vs the total millage rate across all taxing authorities.

Keep in mind that the percent of total, actual property taxes paid may vary for homes that have the Non-Homestead Cap in place, as in this example. That’s because the taxable value is different for the School Board portion (uncapped) vs the other line items (capped).

| Millage Rate | Percent of Total | |

| School Board Operating | 5.566 | 27.1% |

| School Board Debt Service | 0.133 | 0.6% |

| Voted School Operating | 1 | 4.9% |

| Miami-Dade School Board | 32.6% | |

| Florida Inland Navigation District | 0.0288 | 0.1% |

| South Florida Water Management District | 0.0948 | 0.5% |

| Okeechobee Basin | 0.1026 | 0.5% |

| Everglades Construction Project | 0.0327 | 0.2% |

| Childrens Trust Authority | 0.5 | 2.4% |

| State and other | 3.7% | |

| County Wide Operating | 4.574 | 22.3% |

| County Wide Debt Service | 0.4355 | 2.1% |

| Library District | 0.2812 | 1.4% |

| Miami-Dade County | 25.7% | |

| Miami Operating | 7.4843 | 36.4% |

| Miami Debt Service | 0.3235 | 1.6% |

| Municipal Governing Board | 38.0% | |

| Total | 20.5564 | 100.0% |

With that said, the above percentages will be accurate for homes without any kind of tax exemption in place, and for those with the Save Our Homes Cap in place.

Pro Tip: Check out our guide on How Much Is Property Tax in Miami to learn more about what you should expect to pay on a go forward basis after buying.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

What are Ad Valorem Taxes?

Ad valorem taxes in Miami-Dade County are based on the assessed value of real estate property. They are calculated as follows:

-

Market Value: Determined by the Comparable Sales Approach, Cost Approach, or Income Approach.

-

Assessed Value: Capped under certain conditions (Homestead Exemption Cap limits assessed value increases, Portability allows transfer of assessment differential, Non-Homestead Cap limits non-homesteaded property assessed value increases).

-

Taxable Value: Market value minus exemptions, assessment caps, and portability.

These taxes are typically used to fund public services like schools, infrastructure, and public safety.

From what we’ve heard from the Miami-Dade Property Appraiser’s Office as well as tax certiorari lawyers is that the comparable sales approach is most often used.

When checking for sales comps for your condo building or house, make sure to also check the Property Appraiser’s website for any sales that might have been done off of the MLS, as the Property Appraiser’s office will be going off of recorded sales that they see.

Also, we’ve heard from tax certiorari lawyers that the Miami-Dade County Property Tax Appraiser’s office will typically consider sales closed all the way until the end of Q1 of the following tax year, because those sales might have gone into contract before Jan 1 of that tax year.

Pro Tip: Make sure to apply for your Homestead Exemption as soon as possible, so you can get the Save Our Homes Cap the following year. If you’re moving, you can transfer some or all of your homestead exemption benefit. Check out our Homestead Exemption Portability Calculator to figure out how much you can carry over to your new primary residence.

In Miami-Dade County, non-ad valorem taxes are special assessments or service charges levied for property-related benefits which are not based on property value. There are three main types:

-

Community Development Districts (CDDs): These are special-purpose governments that manage and finance infrastructure to support community development, like roads and utilities. The cost is repaid by property owners over 10 to 30 years.

-

Special Taxing Districts: Areas where property owners allow public improvements and services beyond typical government provisions, such as street lighting and security services, to be paid via non-ad valorem assessments.

-

Property Assessed Clean Energy (PACE) Districts: Offer long-term, low-cost financing for property improvements aimed at energy efficiency, renewable energy, and storm protection. The loans, which may last for 30 years, are secured by property liens and continue to be the responsibility of the new owner upon sale unless paid off as required by some lenders.

Non-Ad Valorem Taxes are more often seen for new development communities, for example a new single-family residential neighborhood where lots of new infrastructure needs to be put into place.

Here are some examples for each type of non-ad valorem assessment in Miami-Dade County:

-

Community Development Districts (CDDs): Infrastructure such as storm sewers, roads, water supply, utilities, swimming pools, clubhouses, and parks.

-

Special Taxing Districts: Services like street lighting, security services, multipurpose maintenance, and capital improvements.

-

Property Assessed Clean Energy (PACE) Districts: Financing improvements for energy efficiency (like solar systems and efficient HVAC systems), water conservation, storm protection (like hurricane impact windows and doors), and seismic upgrades.