The Florida Homestead Exemption lowers property taxes for qualifying Homestead Property homeowners in Florida. The Homestead Exemption reduces property taxes by reducing assessed value by up to $50,000 and capping the annual increase in assessed value.

Ad valorem property taxes are calculated by multiplying the local tax (millage) rate by assessed value, so anything which lowers assessed value (or caps increases in assessed value over time) reduces property taxes.

Based on a hypothetical property tax rate of 2%, a $50,000 reduction in assessed value equates to annual property tax savings of $1,000.

This aspect of the Homestead Exemption is called Save Our Homes (SOH).

Over time, the SOH benefit can result in huge disparities between market value and assessed value for tax purposes which ultimately lowers property taxes.

Florida Homestead Exemption FAQ:

What is a Homestead Property in Florida?

How does the Homestead Exemption lower property taxes?

What is Save Our Homes and how does it lower property taxes?

How is a homestead property’s assessed value affected by additions or improvements?

What other protections are offered by the Florida Homestead Act?

To qualify as a homestead property, the property must be the homeowner’s primary residence and the homeowner must hold legal title to the property.

How does the Homestead Exemption lower property taxes?

The Homestead Exemption lowers property taxes by reducing a home’s assessed value for tax purposes by up to $50,000.

The Homestead Exemption consists of a $25,000 Homestead Exemption and a Second Homestead Exemption of $25,000, for a total of up to $50,000. Note that the Second Homestead Exemption does not apply to School Board taxes.

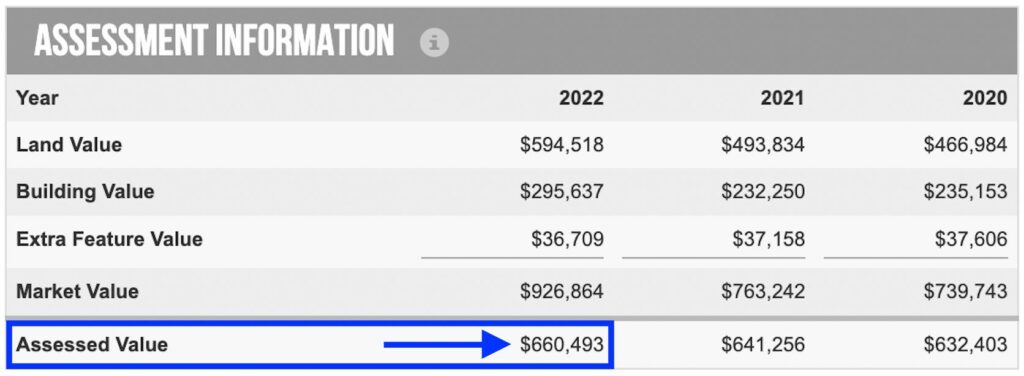

Let’s look at an example of how the Homestead Exemption reduce a home’s assessed value. Here we see that the property’s assessed value is $660,493:

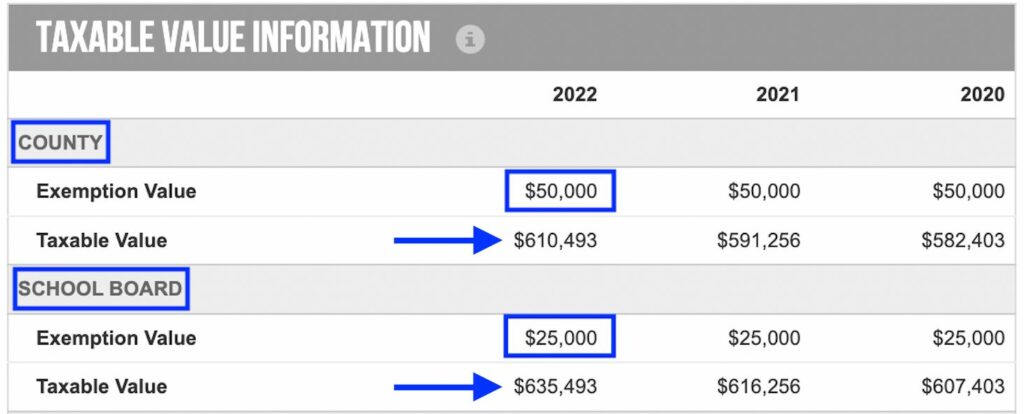

However, taxable value and assessed value are not the same. The ‘Taxable Value’ is $610,483 for County taxes and $635,493 for School Board taxes as shown below:

The County assessed value of $610,483 reflects both the $25k Homestead Exemption and the $25k Second Homestead Exemption, for a total reduction in assessed value of $50,000.

The School Board assessed value of $635,493 reflects a $25,000 Homestead Exemption. This is the maximum allowable exemption, as the Second Homestead Exemption is not applicable to the portion of property taxes levied by the School Board taxing authority.

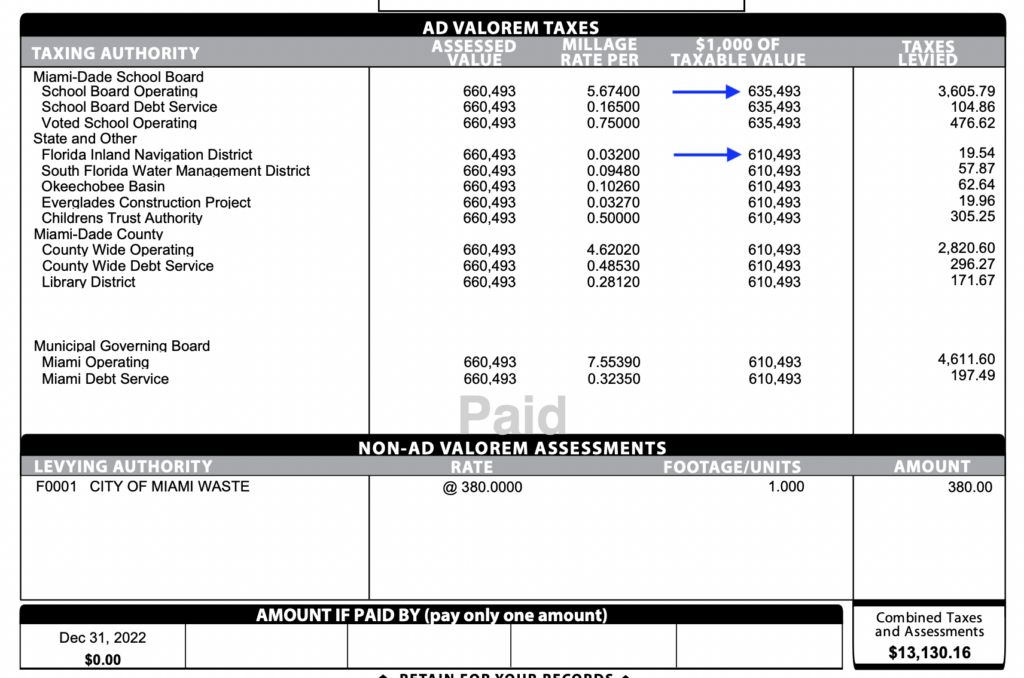

The different assessed values for School Board vs. other taxing authorities is also reflected in the actual property tax bill calculations:

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

How is a homestead property’s assessed value affected by additions or improvements?

Additions or improvements are assessed at market value in the year of construction and the value is added to your capped assessment. The additional value will be capped under SOH (Save Our Homes) starting from the following tax year.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

What is Save Our Homes and how does it lower property taxes?

Save Our Homes (SOH) is a property tax exemption for qualifying Homestead Property homeowners in Florida which lowers your property taxes. SOH works by capping the annual increase in assessed value for tax purposes.

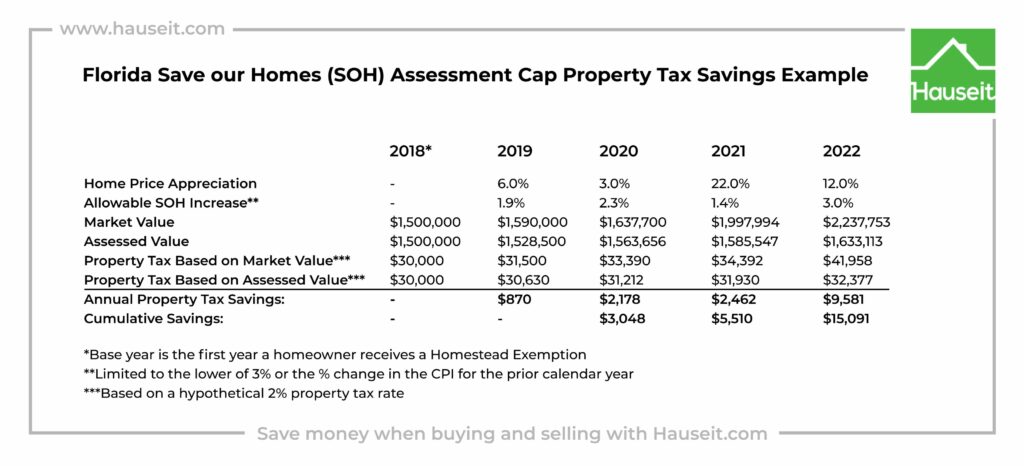

Beginning the year after you receive homestead exemption, your home’s assessed value for tax purposes may not increase by more than the lesser of 3% or the change in the Consumer Price Index. For example, if your home increases in value by 10% in a year and the change in the CPI is 6%, your home’s assessed value may not increase by more than 3%.

Over time, the SOH assessment limitation can result in huge disparities between market value and assessed value which lowers one’s property taxes.

Note the increase in annual and cumulative property tax savings in the example below:

While you may port your SOH benefit to a new homestead property, the purchaser of your old homestead does not receive your accumulated SOH exemption.

A property is re-assessed at market value as of January 1 of the year following a change of ownership. However, the new owner may port their accrued SOH benefit (if applicable).

What other protections are offered by the Florida Homestead Act?

The Florida Homestead Act also provides protection from forced sale of a person’s primary residence, known as the homestead, under certain circumstances. The act safeguards the homestead property from being sold to satisfy most types of creditors’ claims or judgments.

The homestead protection shields the property from being sold to satisfy most creditors’ claims or judgments. This means that in most situations, creditors cannot force the sale of the homestead to collect on debts owed by the homeowner.

However, the following exceptions apply:

-

Mortgage or Home Equity Loans: If there is a mortgage or home equity loan on the homestead, the lender can foreclose on the property in the event of default on loan payments.

-

Property Taxes and Assessments: Unpaid property taxes or assessments can result in a tax lien on the homestead, which could lead to the forced sale of the property to satisfy the outstanding amounts.

-

Construction Liens: Contractors or suppliers who have provided labor or materials for the construction or improvement of the homestead may have the right to enforce a construction lien and potentially force the sale of the property to satisfy the debt.