If you’re borrowing money from parents for your home purchase down payment, lenders will want to see a gift letter for mortgage approval in NYC.

Many first time home buyers in NYC need a little help with their down payment. Often times parents or other family members will be able to step in to save the day.

It’s important to keep in mind that banks today will want to see typically 2 or 3 months of statement history for your bank accounts. If your gift was received more than 2 or 3 months ago, then you will likely not need a gift letter.

However, if the gift was recently received or if it is still in your parents’ account, then you’ll need a gift letter for mortgage to verify that the gift is bona fide and comes with no strings attached.

Even if you’re purchasing a property all cash without a mortgage, a seller or co-op board may want to see a gift letter to explain your source of funds.

This is less common when buying a condo in NYC, but should be expected if you’re buying a co-op in NYC.The co-op board will be reviewing all of your finances during the purchase application process and will want a gift letter if you’re receiving help from family members, even if you don’t plan on getting a mortgage.

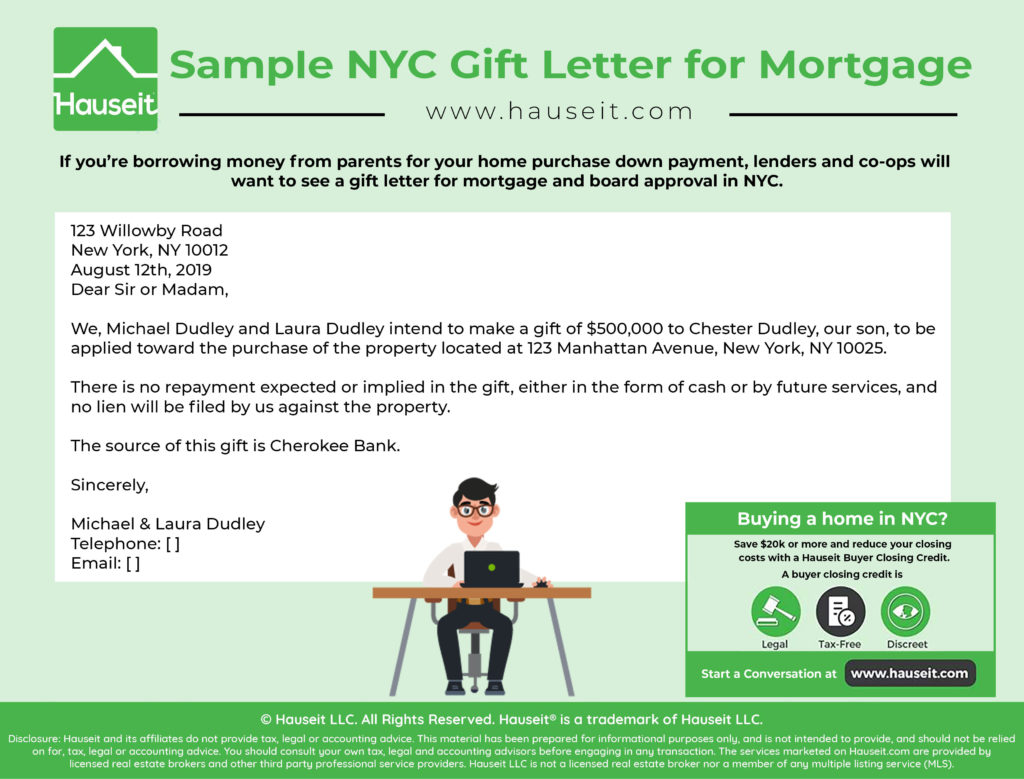

Sample Gift Letter for Mortgage

Feel free to write something more personal and informal if the gift letter is only for a co-op board or seller who wants to verify the gift. Please see below for a sample gift letter for mortgage for a New York City real estate transaction.

123 Willowby Road

New York, NY 10012

August 12th, 2015

Dear Sir or Madam,

We, Michael Dudley and Laura Dudley intend to make a gift of $500,000 to Chester Dudley, our son, to be applied toward the purchase of the property located at 123 Manhattan Avenue, New York, NY 10025.

There is no repayment expected or implied in the gift, either in the form of cash or by future services, and no lien will be filed by us against the property.

The source of this gift is Cherokee Bank.

Signatures of Donors

Michael Dudley

Laura Dudley

Telephone number: 212-215-8484

Sample Gift Letter for Mortgage - Bank Template

If the gift letter is for your mortgage lender, they’ll typically want to see something more formal on a standardized form like the one we’ve included below.

Gift Letter

Each section of the Gift Letter must be fully completed including dates and signatures of donor and recipient (borrower). Read this form carefully and be prepared to follow these instructions exactly.

I. General Information

I, [Donor(s)] of [Donor’s Mailing Address] [Donor’s phone] will give (or have given) a gift of $[Amount] to [Recipient (borrower)] my [Relationship – if not a relative, state clearly defined interest in borrower] in time to close the mortgage transaction on the purchase of the property located at [Address]

II. Location of Funds

The location of funds must be indicated unless the donor is an immediate family member providing equity credit on the property being sold.

If funds are verified on deposit as of the date of application, the funds are in the borrower’s account at: [Borrower’s Account Information: Depository name, address and account number]

OR

If funds are given after application, the funds are in the donor’s account at: [Donor’s Account Information: Depository name, address and account number]

III. Donor/Recipient Certification

This is a bona-fide gift, and there is no obligation, expressed or implied either in the form of cash or future services, to repay this sum at this time. The funds given to the homebuyer were not made available to the donor from any person or entity with an interest in the sale of the property including the seller, real estate agent or broker, builder, loan officer, or any entity associated with them.

WARNING: Section 1010 of Title 18, U.S.C. Department of Housing and Urban Development Transactions provides, “Whoever, for the purpose of … influencing in any way the action of such Department… makes, passes, utters, or publishes any statement, knowing the same to be false… shall be fined not more than $5,000 or imprisoned not more than two years, or both.”

Donor Signature | Date

Recipient Signature | Date

IV. Documentation

Documentation verifying availability, transfer, and receipt may be required. Review the Lenders Commitment Letter for any specific required documentation.

Please Return to: [Address]

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

Disclosure: Hauseit® and its affiliates do not provide tax, legal, financial or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, financial or accounting advice. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided.