Should you refinance your mortgage or should you wait? This is a very personal decision based on your own financial circumstances and your forecast for future mortgage rates and broader markets. We’ll discuss in the following article the pros and cons of refinancing vs waiting vs paying it off completely.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

The cost of refinancing can be quite high

The most important factor to consider when deciding whether to refinance your home’s mortgage are all the various fees involved. Fees are charged not only by banks, but by appraisers, attorneys and title companies.

Here’s a real life example of fees that were quoted by a major, New York City based lending institution for a refinancing of a condominium apartment in Lower Manhattan. The anticipated loan amount to be refinanced was approximately $675,000:

-

Bank application / processing fee: $900

-

Property appraisal fee: $1,000

-

Bank’s attorney fee: $995

-

Title policy re-issuance fee: $3,000

-

CEMA fee: $600

Total fees in this example? $6,495 on a $675,000 loan, or 0.96% of the loan amount.

So there you have it, in this fairly typical example, it costs approximately 1 point (i.e. 1 percent) in fees to refinance a mortgage.

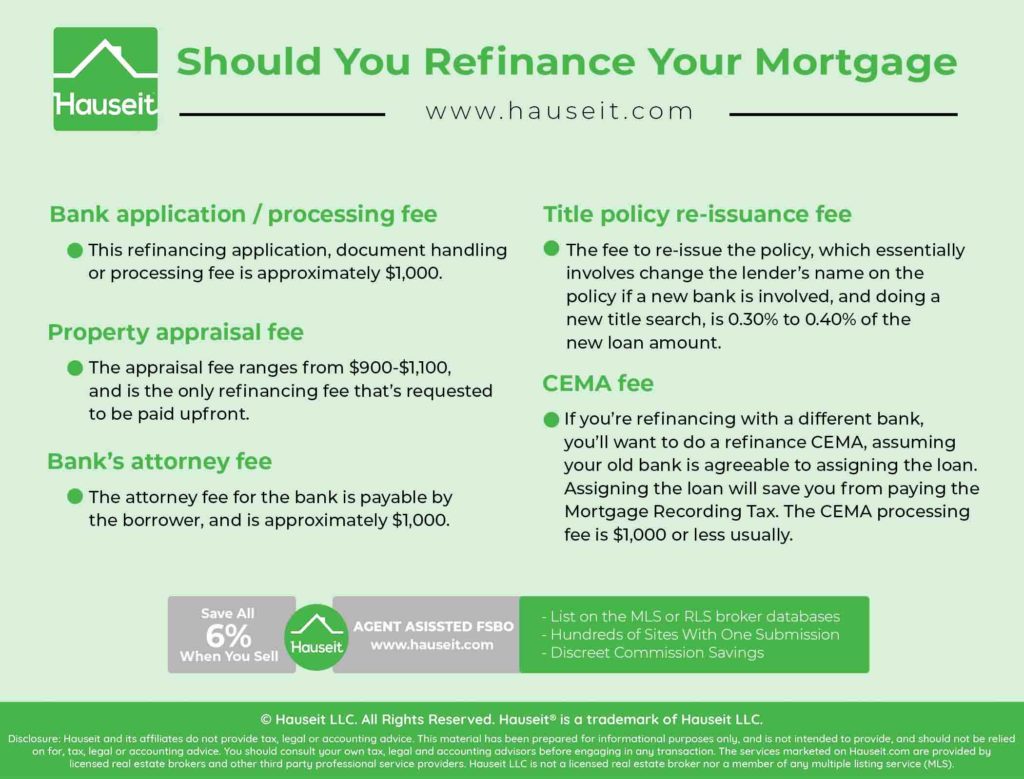

Bank application / processing fee

Commonly known as the “basic bank fee” in industry parlance, this refinancing application, document handling or processing fee is approximately $1,000 and goes to the bank to cover administrative costs with handling your refinancing. This fee is not required to be paid upfront, and can often be added to the new mortgage balance if you have enough equity in your home.

Property appraisal fee

The bank needs a 3rd party appraisal done every time it lends against a property, even if it’s for a refinancing. The need for a refinancing makes even more sense if you will be refinancing with a different bank, because the new bank will not have underwritten your home yet.

The appraisal fee ranges from $900-$1,100 as of this writing, and is the only refinancing fee that’s requested to be paid upfront, typically within the first two weeks of the process. Every other fee in contrast can simply be added to the new mortgage balance if the borrower has enough home equity. Most banks will refund the appraisal fee if the borrower’s loan application is declined for some reason.

Bank’s attorney fee

The bank’s attorney is automatically assigned for transactions post the Great Financial Crisis of 2007-2008, just like appraisers and title insurance companies. As a result, your mortgage banker won’t have leeway to call a favorite attorney and ask for a favor to haircut the fee like they used to be able to do.

Title policy re-issuance fee

Title insurance companies charge the biggest fee of all when it comes to refinancing a mortgage. Their fee to re-issue the policy, which essentially involves change the lender’s name on the policy if a new bank is involved, and doing a new title search, is almost as steep as the title insurance premium charged for a new home purchase.

Just like for new home purchases, the title insurance re-issuance fee is composed of both floating and fixed costs, with the formula being something of a closely held secret. From multiple examples we’ve gathered, we estimate this fee to be in the range of 0.30% to 0.40% of the loan amount being refinanced.

Here are a few real world examples:

-

$6,000 for a $2 million condo loan in NYC, or 0.30%

-

$3,000 for a $675,000 condo loan in Lower Manhattan, or 0.44%

-

$3,800 for a $1,400,000 single family house loan in Westchester, or 0.27%

-

$1,800 for a $400,000 loan for a NYC condo, or 0.45%

Mortgage bankers have told us that even though they aren’t able to pick a title insurance company, the customer is allowed to pick their own title insurance company if they’re not happy with the one that is auto-assigned.

Therefore, if you’re able to source a title insurance company that’s willing to knock off some of these so called “junk fees,” in industry parlance, then you may be able to pay significantly less.

This is most plausible for industry professionals who may be able to promise referrals or other business to these title companies in exchange for lower fees.

CEMA fee

If you’re refinancing with a different bank, you’ll want to do a refinance CEMA, assuming your old bank is agreeable to assigning the loan.

Being able to assign the loan and do a CEMA is enormously important if you wish to avoid paying the New York Mortgage Recording Tax all over again, which really should only be paid on a new mortgage (i.e. for a purchase, though you can defray the tax using a purchase CEMA).

It’s important to note that it’s the old bank being asked to assign the loan that charges a CEMA processing fee, whereas the new bank being assigned the loan typically will not charge anything for the CEMA. This flat fee will vary, but will typically be $1,000 or less.

Reasons not to refinance your home

You may move and sell your home soon

A great reason to not refinance your home is if you plan on moving in the near future and selling your home. If you will be selling your home in the next several years before your interest rate resets or your loan otherwise becomes due, then it’s usually better to avoid the costs associated with a refinancing.

Even if your interest rate resets and you have to pay a higher interest rate for a year or two, it’ll usually be more beneficial to not refinance until you’re able to sell.

Generally speaking, the fees associated with refinancing will not be worthwhile vs any interest rate savings you might achieve with a refinancing if you intend to sell in the near future.

You may get a big bonus soon that’ll enable you to pay it off

One reason you may wish to delay a refinancing and all the fees associated with it is if you foresee yourself getting a big bonus, gift or other form of payout in the near future that will enable you to significantly reduce or eliminate your debt.

If this happens, then the best course of action may well be to pay off your mortgage completely. After all, fees are hard costs that you pay for, even if they can be deferred by being added to the loan balance. Remember, borrowed money is by no means free, so if you can, why not pay it off?

For example, a star banker, trader or tech worker may anticipate a big payout at the end of the year which will enable him or her to pay off the loan completely.

In this situation, and especially if there aren’t other great opportunities to invest the windfall, then it may make complete sense to pay off the mortgage vs incurring additional fees to refinance, and to continue paying interest.

You want to re-deploy money from the stock market

With equity indices at all time highs, you may believe it’s time to take some of your chips off the table. If you believe that stock markets can’t go much higher and you wish to cash in your gains, then it may make sense to sell some of your stock holdings and translate those paper gains into actual gains by paying off your mortgage.

Not only will you reduce your debt, but you’ll reduce your negative cash flow by any interest and principal payments you were previously making on a monthly basis.

Lower interest payments over a long term

One of the main reasons to refinance your mortgage is to take advantage of lower current interest rates vs the interest rate you are currently paying. For example, if you got a 30 year mortgage 15 years ago at an interest rate of 6%, then it could make a whole lot of sense to refinance that mortgage if the current rate on a 30 year mortgage is only 3.5%.

Spread over many years, the savings from lower interest rate payments will considerably outweigh any upfront fees associated with a refinancing. Essentially, the longer you’ll be able to take advantage of the new rate, and the bigger the rate drop, the more worthwhile a refinancing is.

Extending an interest only or adjustable rate mortgage

Another reason a borrower might want to refinance is if their interest only period or the fixed interest rate period of their adjustable rate mortgage is expiring soon.

For example, an adjustable rate mortgage (ARM) may have an interest only (IO) feature where the borrower is only required to pay interest, but not any principal, for the first say 5 to 10 years. After the IO period ends however, the loan balance fully amortizes over the remaining term of the loan, which is typically 30 years in length to begin with.

Furthermore, many ARMs feature a lower, fixed “teaser” rate for the first say 5 to 10 years of the loan. This initial fixed rate will often be significantly lower than the rate for a conventional, amortizing 30 year fixed rate mortgage.

However, after the teaser rate period expires, the interest rate becomes variable and begins to “float” vs an interest rate index.

In the floating rate period of the loan, the interest rate will typically reset every year against a widely used interest rate index, such as 1 year LIBOR.

An ARM will typically have a margin that is added to whatever the index interest rate is, for example 1 year LIBOR + 2.25%.

As you can imagine, as interest rates rise, the significantly increased monthly payment for a ARM that becomes floating can come as quite a shock to a borrower, especially if principal payments become required as well. This is in fact what happened to many borrowers during the Great Financial Crisis of 2007-2008, many of whom defaulted en masse on their subprime loans.

Sample notice of interest rate changes

Changes to Your Mortgage Interest Rate and Payments on August 1, 2020

Under the terms of your Adjustable-Rate Mortgage (ARM), you had a eighty four month period during which your interest rate stayed the same. That period ends on July 1, 2020, so on that date your interest rate changes. After that, your interest rate may change every twelve months for the rest of your loan term. Any change interest rate may also change your mortgage payment.

|

|

Current Interest Rate and Monthly Payment |

New Estimated Interest Rate and Monthly Payment |

Interest Rate |

2.62500% |

4.25000% |

Principal |

-none- |

-none- |

Interest |

$1,477.05 |

$2,391.42 |

Escrow |

$1,038.32 |

$971.05 |

Total Monthly Payment |

$2,515.37 |

$3,362.47(due August 1, 2020) |

Interest Rate: We calculated your interest rate by taking a published “index rate” and adding a certain number of percentage points, called the “margin”. We round the result of this addition to the nearest one eighth of one percentage point (0.12500%). Under your loan agreement, your index rate is 1.94325% and your margin is 2.25000%. Your “One-Year Libor” index is published daily by the Wall Street Journal.

Interest Rate Limits: On the first Change Date your interest rate cannot go higher that 4.62500% or lower that 2.25000%. Thereafter, your interest rate cannot go higher that 7.62500% or lower than 2.25000% during the life of the loan. Your interest rate can increase on this Change Date buy no more than 2.00000%. Your interest rate can decrease on this Change Date by no more than 0.37500%.

New Interest Rate and Payment: The table above shows our estimate of your new interest rate and new monthly payment. Your amounts are based on the “One-Year Libor” index, your margin, a projected loan balance of $675,225.00, and your remaining loan term of 276 months. Your current loan balance may be greater than the amount projected in this notice. Refer to your billing statement for your outstanding unpaid loan balance. However, if the index has changed when we calculate the exact amount of your new interest rate and payment, your new interest rate and payment 2 to 4 months before the first new payment is due, if your new payment will be different from your current payment.

Interest Only Payments: Your new payment will not cover any principal. Therefore, making this payment will not reduce your loan balance. Your Interest Only period is due to expire on August 1, 2023.

Payment Penalty: None.

If You Anticipate Problems Making Your Payments:

-

Contact New York Mortgage Bank at (800) 212-1212 as soon as possible.

-

If you seek an alternative to the upcoming changes to your interest rate and payment, the following options may be possible (most are subject to lender approval):

-

Refinance your loan or another lender;

-

Sell your home and use the proceeds to pay off your current loan;

-

Modify your loan terms with us;

-

Payment forbearance temporarily gives you more time to pay your monthly payment.

-

-

If you would like contact information for counseling agencies or programs in your area, call the U.S. Department of Housing and Urban Development (HUD) at 800-569-4287 or visit www.hud.gov/officres/hsg/sfh/hcc/hcs.cfm. If you would like contact information for a state housing finance agency, contact the U.S. Consumer Financial Protection Bureau (CFPB) at www.consumerfinance.gov

If you have question or concerns about your upcoming change, please call us at the number listed in the account information box.

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

Disclosure: Hauseit® and its affiliates do not provide tax, legal, financial or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, financial or accounting advice. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided.