There is too much misinformation on the web about whether offers to purchase real estate are binding or not.

We’ve seen too many search results tell first time home buyers in NYC that sellers will sue them if they back out of an accepted offer. As we’ll explain in the following article, that is complete nonsense and simply not true in New York.

Table of Contents:

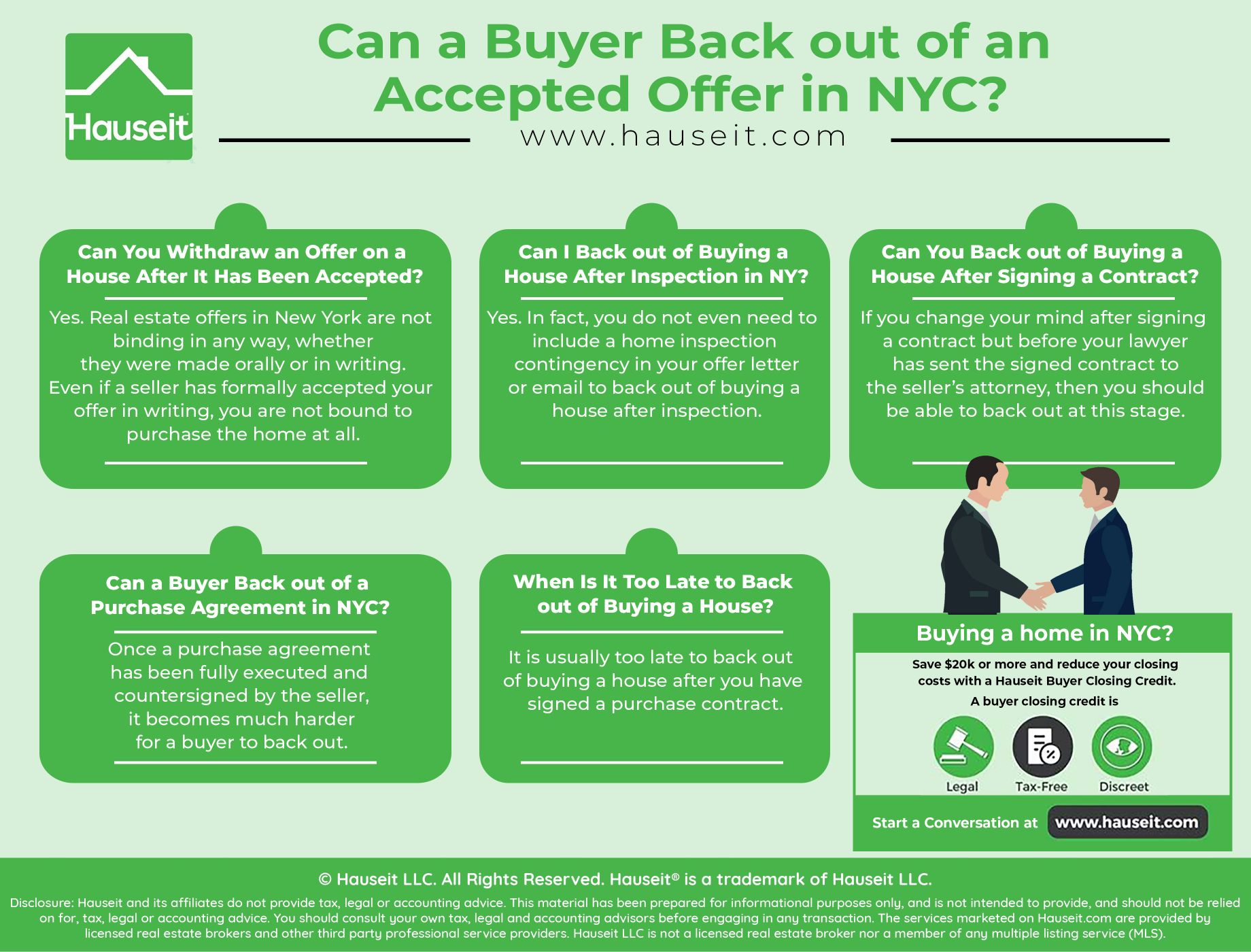

Yes. Real estate offers in New York are not binding in any way, whether they were made orally or in writing.

Even if a seller has formally accepted your offer in writing, you are not bound to purchase the home at all. Even if you won a best and final offer process that the seller held, your winning offer is not binding whatsoever.

Even if you have begged the seller to accept your offer and the seller does, you are still not bound. Therefore, you are free to withdraw your offer at any time, before or even after it has been accepted by the seller.

Simply have your buyer’s agent inform the listing agent that you have changed your mind and that you are withdrawing your offer. However, even if you didn’t bother to update the seller that you are withdrawing your offer, you still wouldn’t be bound.

To be clear, a real estate purchase offer is completely nonbinding in New York, so much so that even if you didn’t withdraw your offer you still wouldn’t be bound. If you become unresponsive, the seller will at some point just realize that you have effectively lost interest and as a result withdrawn your offer.

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

Yes. A buyer is free to back out of an accepted offer at any point.

That means a buyer can back out of an accepted offer from the moment the buyer hears about the accepted offer, to having a deal sheet circulated to all parties, to his lawyer having completed legal and financial due diligence, to his lawyer having negotiated the purchase contract to satisfaction.

As long as the buyer has not signed a purchase contract and handed over the contract deposit, the deal is considered to be in the accepted offer stage, and a buyer is free to back out at any point of the accepted offer stage.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Yes. In fact, you do not even need to include a home inspection contingency in your offer letter or email to back out of buying a house after inspection.

As we’ve discussed previously, a buyer is free to back out of an accepted offer at any point before the buyer has signed a purchase contract and handed over the contract deposit.

A home inspection is usually conducted after an offer has been accepted but before purchase and sale contracts have been signed. If the home inspection report finds any hidden issues or defects with the property which the buyer did not see in the initial property viewing, the buyer may ask for concessions from the seller.

Please keep in mind that properties are typically sold as is in New York, meaning the seller will rarely agree to make repairs or renovations as a condition of closing.

If your home inspector found bona fide issues with the property and the seller is desperate to sell, you may be able to secure a price concession from the seller. If the seller disagrees, you can either agree to suck it up and take the property as is, or walk away. You should negotiate this type of concession through your real estate attorney who will be heading up your contract, legal and financial due diligence.

If you change your mind after signing a contract but before your lawyer has sent the signed contract to the seller’s attorney, then you should be able to back out of buying a house at this stage.

This is highly risky and not advised, but your lawyer has a fiduciary duty to you. Therefore, if you accidentally signed a contract but your lawyer hasn’t sent the contract yet to the seller’s attorney, then you are free to rip up the accidentally signed contract.

Since the seller doesn’t even know that you signed the purchase contract, and has no proof of you having done so, it shouldn’t matter and it will be as if you hadn’t signed it in the first place.

Needless to say, you should never sign contracts without consulting your attorney, and you should never take the act of signing a contract lightly.

If for some reason your lawyer has sent a copy of your signed contract to the seller’s attorney without the contract deposit, and you wish to change your mind, the situation becomes a lot more grey.

That’s because you would be in default of the contract if they counter-sign and you simply wish to back out because you’ve changed your mind.

However, it may not be worthwhile for the seller to enforce since they don’t have easy access to collateral, i.e. your contract deposit. In this situation, the seller may simply play nice and let you off the hook.

Please note that this is extremely risk and not something that your lawyer would likely recommend you do. That’s because the seller could also decide to litigate against you for defaulting on the purchase contract.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Once a purchase agreement has been fully executed and counter-signed by the seller, it becomes much harder for a buyer to back out.

A buyer will need to think twice about changing his or her mind about buying the property because 10% of the purchase price will typically be held hostage in the form of a contract deposit. This good faith deposit is typically held in escrow by the seller’s attorney.

The only time a buyer can back out of a mutually executed purchase agreement is if the buyer’s lawyer has negotiated certain contingencies in the contract which are then activated.

If this happens, then the buyer can either decide to waive the contingency and stay in the deal, or walk away with their contract deposit.

Such contingencies might include the financing or mortgage contingency which is the most common contract contingency seen in New York. The financing contingency may include language for minimum appraised value or minimum loan amount, which will protect a buyer if the appraised value comes in low as the bank will lend off of the appraised value vs contract price.

If the buyer needs to sell their existing home in order to purchase, they might have negotiated a sale or Hubbard contingency into the contract. This is rarer as sellers are usually unwilling to accept an offer that has a sale contingency attached.

A buyer’s lawyer may also attempt to negotiate a funding contingency whereby the buyer can exit the contract if the bank fails to fund the purchase on closing day, even if they’ve issued a mortgage commitment letter.

For co op apartment purchases, a standard contingency is coop board approval. For obviously reasons, the buyer cannot be expected to stay in the contract if the board has rejected the buyer’s coop board application.

It will be extremely hard to back out of buying a house before closing.

After the purchase contract is mutually executed by both the buyer and the seller, the only way you’ll be able to back out of buying a house before closing is if a contingency in the contract is activated. For example, a typical mortgage contingency might give the buyer 30 or 45 days to apply for financing and to receive a mortgage commitment letter.

If the buyer has made a bona fide attempt to apply for financing and has gotten rejected by their mortgage broker or bank within the time frame specified, then they are free to cancel the contract and walk away with their contract deposit.

Barring a lucky break like this, it’ll be very difficult for a buyer to back out of buying a house before closing if they want to keep their contract deposit without a fight.

In rare examples, we’ve heard of buyers being able to walk away and back out of buying a house before closing due to sellers being sympathetic. In one recent example, a buyer agent rebate customer lost his job at a big bank in NYC only days after signing a contract.

Our veteran partner broker called the listing agent to explain the situation, and the seller was unexpectedly gracious and allowed the buyer to walk away with his deposit in full.

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

It is usually too late to back out of buying a house after you have signed a purchase contract.

Once the seller’s attorney has your signed contract and your contract deposit, you are bound to purchase the house unless a contingency in the contract is hit.

You should not sign a contract expecting to be able to back out due to a contract contingency being activated. For example, a seller can become quite furious if they found out that you did not make a bona fide attempt to apply for financing in order to get out of a contract via the mortgage contingency.

This can result in legal action if the seller is angry enough, and the seller may sue you for damages incurred for time wasted on market with your offer.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Disclosure: Hauseit® and its affiliates do not provide tax, legal, financial or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, financial or accounting advice. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided.