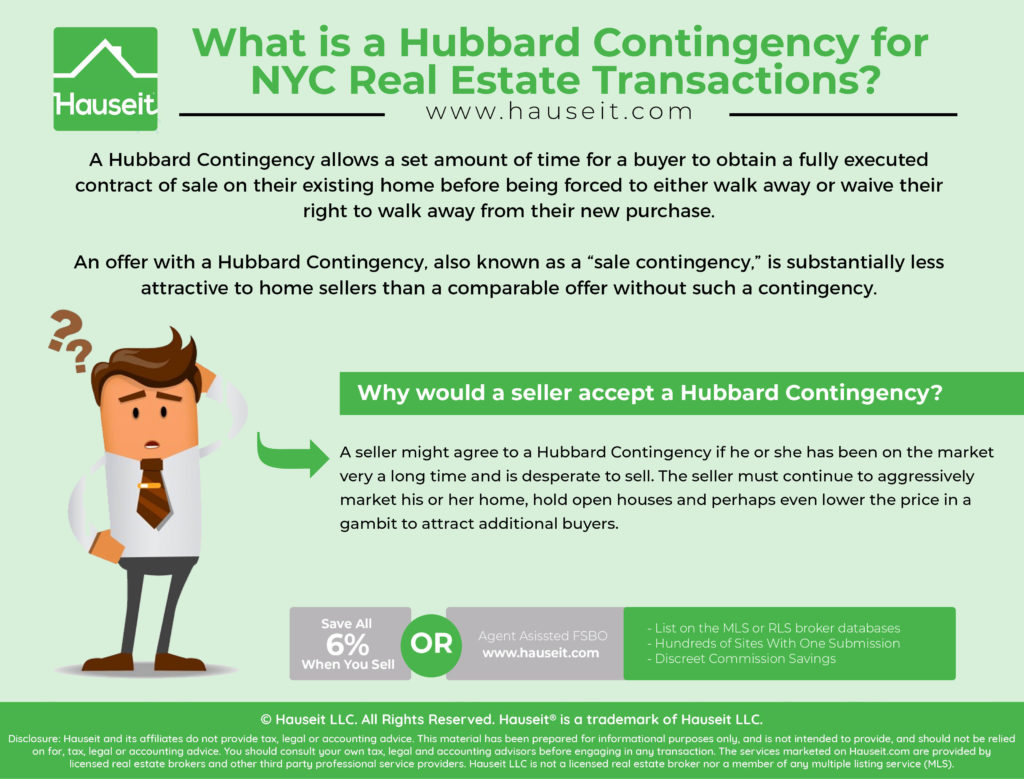

A Hubbard Contingency is another way to describe a sale contingency in a purchase contract. A sale or Hubbard contingency allows a set amount of time for a buyer to obtain a fully executed contract of sale on their existing home before being forced to either walk away or waive their right to walk away from their new purchase.

An offer with a Hubbard Contingency is significantly less attractive to a seller compared to a non-contingent or a mortgage-contingent offer.

Table of Contents:

A Hubbard Contingency allows a set amount of time for a buyer to obtain a fully executed contract of sale on their existing home before being forced to either walk away or waive their right to walk away from their new purchase.

If negotiated properly with the help of a veteran real estate attorney, a home buyer who needs to sell his old home first won’t have to face the uncertainty of whether he’ll be able to procure the sale proceeds from his old home in time to buy his new property.

This is normally a scary prospect for buyers who need the money from selling their old home in order to buy, especially if they are in contract on their new place but haven’t found a buyer yet on their old home. They run the risk of forfeiting their 10% of the contract price “good faith deposit” if they are unable to complete the purchase!

An offer with a Hubbard Contingency, also known as a “sale contingency,” is substantially less attractive to home sellers than a comparable offer without such a contingency.

This is because the seller has little information on how likely the buyer’s existing apartment will sell, how long it will take and what stage of the process the buyer is in.

Furthermore, it is not entirely clear per Real Estate Board of New York rules whether a listing that is in contract with a Hubbard Contingency must change its status to “in contract.”

If that is indeed required, then the seller is at a severe disadvantage because although the seller is allowed to solicit better offers until the contingency is satisfied or waived, the number of buyer inquiries will be dramatically reduced if a property is listed as “in contract.”

Even if a property has a Hubbard Contingency but isn’t listed as “in contract,” the seller still might lose interested buyers who learn that there is already an accepted offer, or that the accepted offer level is at a certain price.

This might discourage buyers who say they’re not seriously searching and those overly polite buyers who say they don’t want to waste anyone’s time. However, these buyers often times do turn into real offers so it’s best to encourage as many viewings as possible.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Why would a seller accept a Hubbard Contingency?

A seller might agree to a Hubbard Contingency if he or she has been on the market very a long time and is desperate to sell.

In that case, an offer with a sale contingency might be better than nothing. However, any smart seller will realize that the deal is not binding as the buyer will have a myriad of ways to make sure his existing home doesn’t sell if the buyer wanted to back out.

Therefore, the seller must continue to aggressively market his home, hold open houses and perhaps even lower the price in a gambit to attract additional buyers.

We’ve included a sample “rider,” or addendum to a purchase contract in New York City.

In other parts of the country where purchase agreements are standard forms, the Hubbard Contingency is typically a separate, simple one page form with content similar to the below.

HUBBARD CONTINGENCY RIDER

THIS RIDER is incorporated as a part of the contract between [seller name], as seller, and Buyer for the sale of [address]. For the purposes of this Rider, “Buyer,” Buyer’s existing home, and the “Hubbard Contingency Date” are the following:

Buyer(s):

Buyer’s existing home is the home located at:

Hubbard Contingency Date:

-

This Contract is contingent upon Buyer obtaining a non-contingent contract for the sale of Buyer’s existing home, subject to and in accordance with the further provisions of this Rider. For the purposes of this Rider, a “non-contingent contract” for the sale of Buyer’s existing home shall mean a contract that may not be unilaterally terminated by the purchaser as a result of any condition to be satisfied by the purchaser.

-

Buyer will diligently pursue procurement of a non-contingent contract for the sale of Buyer’s existing home and promptly give Seller written notice if, as, and when such contract is obtained and that the Hubbard Contingency has been satisfied. If Buyer has not been able to obtain said non-contingent contract on or before the Hubbard Contingency Date, Buyer may terminate this Contract by giving written notice to Seller, which notice must be received by Seller not sooner than the Hubbard Contingency Date and later than two business days after the Hubbard Contingency Date, and the notice must unequivocally state that Buyer has not obtained a non-contingent contract on or before the Hubbard Contingency Date and is terminating this Contract as a result.

-

If, prior to satisfaction of the Hubbard Contingency, Seller finds another buyer to purchase a condominium unit that is the subject of the within Contract, Seller may give notice to Buyer so stating. If Buyer desires keep the within Contract for Buyer’s purchase in effect, Buyer may do so by giving written notice to Seller that unequivocally states that Buyer is waiving the Hubbard Contingency, which notice must be received by Seller within forty-eight (48) hours of receipt by Buyer of Seller’s notice. If Seller gives Buyer notice under this paragraph and Buyer does not waive the Hubbard Contingency in the manner provided herein, Seller have the option, in Seller’s sole and absolute discretion, to terminate this Contract, in which event, Seller shall be free to sell the premises to another party.

-

If the Contract is duly terminated in compliance with the provisions of this Rider, Seller shall promptly return Buyer’s deposit, without interest. If the Contract is not so terminated, the Hubbard Contingency shall be deemed satisfied and no longer a condition of the contract.

IN WITNESS WHEREOF, the parties hereto have executed this Rider.

Buyer Seller

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

Disclosure: Hauseit® and its affiliates do not provide tax, legal, financial or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, financial or accounting advice. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided.