How strict are condo rental rules in NYC? Are there any landlord rules or special condo rules I must follow before renting out my apartment? What are some examples or samples of condo rental rules?

We’ll explain in this article how to rent out a condo while abiding by the condominium rules in your building!

Table of Contents:

While condominium apartments are considered real property and do allow owners to rent out their apartments, they can often have some of the same restrictions as a co-op’s house rules.

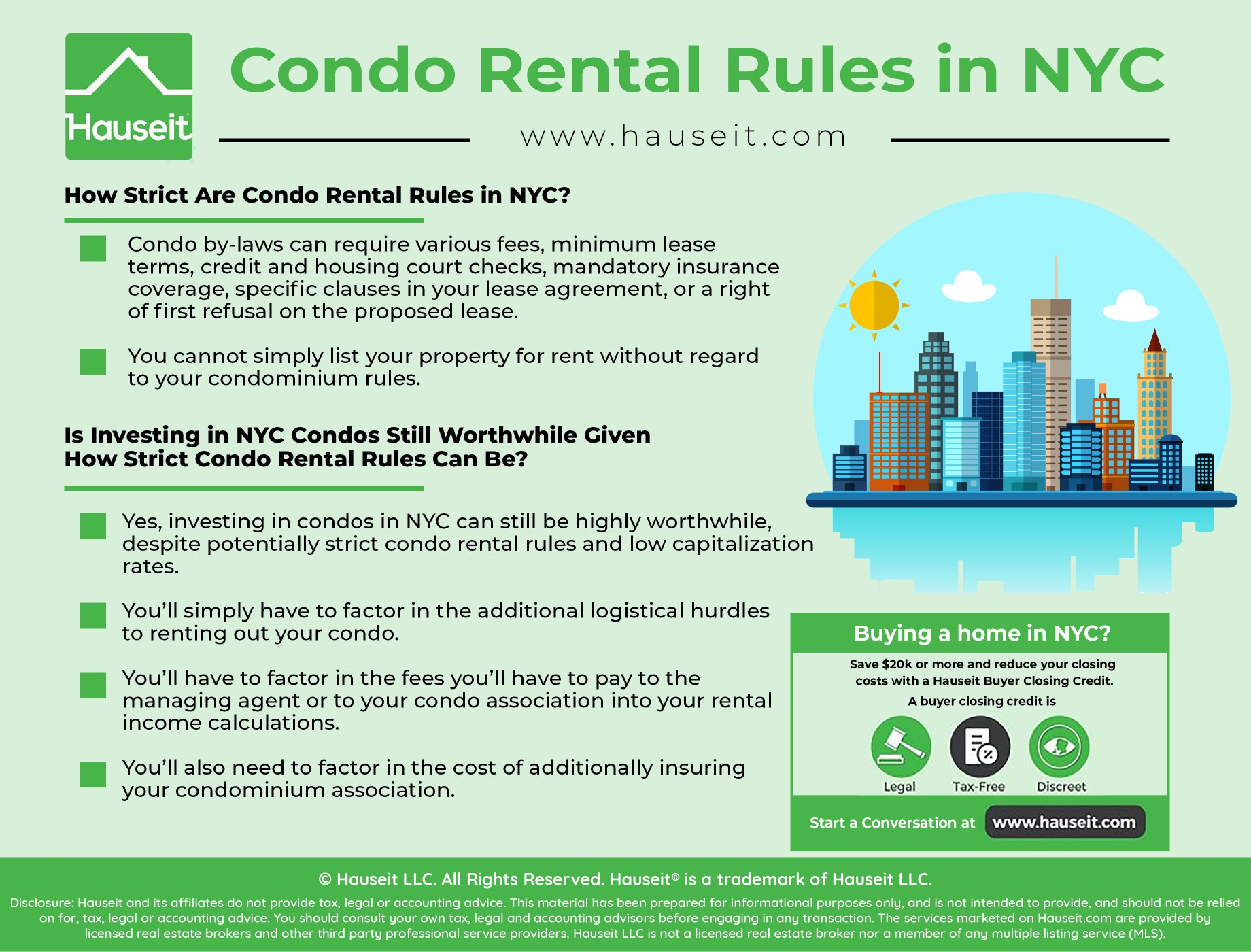

As you’ll see from the sample condo rental rules included in this article, condominium by-laws can require various fees, minimum lease terms, credit and housing court checks, mandatory insurance coverage, specific clauses in your lease agreement, or a right of first refusal on the proposed lease.

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

The By-Laws of [Condominium Building] (Article 3) provides that any apartment owner who wishes to sell their unit or lease their unit or a portion of their unit, must first give notice to the condominium of said contemplated sale or lease, and seek the board’s waiver of the right of first refusal.

This notice must be sent to the managing agent and must include the terms of the proposed transaction.

The documentation required shall include the attached Application For Residents, completed and signed by each of the proposed purchaser(s) or lessee(s), the proposed date of closing or occupancy, the purchase or lease price and a copy of the proposed contract of sale or lease fully executed by all parties. Any lease must contain the provisions detailed in paragraph 25 of the rules and regulations of the condominium and attached hereto.

Any lease must be for at least a one year period. The fee for processing a proposed sale of a unit is $500 or the proposed lease of a unit is $400, payable to the managing agent. Should a proposed purchaser or lessee include more than one individual, there will be an additional charge of $30 per person. For leased units, the above fee is per lease or per calendar year, whichever is shorter, even if the lease is for more than a 12 month period and/or if the same tenant renews his lease for subsequent periods or years. The credit report and housing court search described above is to protect the condominium. The Fair Credit Reporting Act prohibits our sharing these reports with the seller or the lessor, so you will need to do your own investigation and due diligence to determine if the proposed purchaser(s) or lessee(s) is acceptable to you.

A unit owner who wishes to lease their unit must first obtain a rental condominium unit owner’s policy of insurance covering the rental of their unit. This policy must have liability coverage of no less than $1 million. If the unit contains a washer and/or dryer or if the unit owner wants to allow a washer and/or dryer to be installed in their unit during the term of the proposed lease, this insurance policy must cover flood and/or mold damage from said washer and/or dryer. The managing agent must be provided, before any waiver of the right of first refusal can be issued, with a certificate of insurance naming the “[Condominium Association Legal Name]” with an address of [Building Address] as an “Additional Insured”. The insurance certificates should be faxed to [Fax Number] and the originals mailed to [Building Management Company]. Certificates of Insurance Shall provide that thirty (30) days written notice, by registered mail with return receipt requested, prior to cancellation, expiration, or material change be given to any additional insured’s.

Name of Certificate Holder: [Condominium Association Legal Name]

Holder’s Address: [Building Address]

Fax Number to send Certificate to: [Fax Number]

Email to send certificate to: [Email Address]

Name of Additional Insured: [Condominium Association Legal Name]

The strict enforcement of these provisions of our By-Laws will increase the security and safety of our building for everyone. Please note that any sale or lease that is not first brought to the attention of the board (through the managing agent) shall be voidable at the election of the board. I would like to thank all unit owners in advance for their cooperation in this matter.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Apartment number:

Applicant name:

Social Security Number:

Phone number:

Current address:

Email address:

Landlord’s name and phone number:

Time at present address: Monthly rent:

Previous address:

Employer:

Employer’s phone number:

Salary: Length of employment:

Previous employer:

Name and phone number of a personal reference:

The undersigned certifies that the foregoing is true and hereby authorizes [Managing Agent] to use this information to obtain credit information, references, and housing court information (TENANT SCREENING REPORT) on the applicant named above. The undersigned releases all parties named above to provide such information as it is requested. [Managing Agent] uses [Credit Report Agency] for its credit reports and housing court searches.

SIGNED: DATE:

(A) SECTION 339-Z LIEN – Owner and Tenant acknowledge and agree that if Tenant defaults in the performance of Tenant’s obligations under this Lease or if Owner fails to pay the common charges or any special assessment or other charge payable pursuant to the Condominium Documents and as a result the lien granted by section 339-Z of the Real Property Law of the State of New York is foreclosed or a deed in lieu of foreclosure is given by the Board of Managers of the Condominium, then the Board of Managers shall have the right to cancel this lease on written notice to Tenant. In the event the Board of Managers exercises such right of cancellation, this Lease shall terminate and come to an end effective on the date specified in such cancellation notice but in no event less than fifteen (15) days after the giving of such cancellation notice, and Owner shall return to Tenant any rent paid in advance on a pro-rata basis.

(B) CONDOMINIUM DUTIES – The Apartment is in a condominium building, the [Condominum Building]. Tenant must comply with all of the Rules and Regulations of the Condominium, attached hereto as Schedule A. Tenant agrees to faithfully observe and comply with the Condominium Documents, other than those provisions pertaining to the payment of common charges, special assessments and/or other charges not required to be paid by Tenant pursuant to this Lease to the Board of Managers of the Condominium. Tenant agrees that Tenant has reviewed the Condominium Documents or waived examination thereof. Tenant agrees this Lease shall inure to the benefits of, and be enforceable by, the Board of Managers of the Condominium.

(C) RE-CONDITIONED OR USED MATRESSES AND BOXSPRINGS AND OTHER FURNITURE – Residents of the condominium are not allowed to bring into the condominium re-conditioned or used mattresses, boxsprings or bedding. This does not prevent a resident from bringing into the condominium one of these items that has been previously used only by them, so long as the item(s) was brand new when the resident first started to use it and so long as this item(s) of bedding was never treated previously for bed bugs. Any item of bedding or furniture that was at any time treated for bedbugs is NOT allowed to be brought into the condominium.

(D) SHORT TERM RENTALS, SUBLETTING & GUESTS WHO PAY TO STAY – Short term rentals are not permitted in our building. The minimum lease term for any new lease is 12 months. Owners and Tenants may not exchange their units with others (apartment swapping) for short periods of time or for any period of time. Tenants may not sublet their units or any portion of their unit for any period of time under any circumstances. Owners and Tenants may not use AirBnB or any similar service to rent out their unit for any period of time. This would preclude an Owner or Tenant from going away for the summer or for a weekend and allowing a guest who pays you to use your unit while the Owner or Tenant is away. Owners and Tenants may not have guests in their units unless they are present in their unit at all such times that said guests are present. The Board Of Managers will impose a $3,000 fine for any violation of the provisions of this paragraph.

(E) NO SMOKING – No resident, tenant, guest, servant, or employee of any unit that is rented out may ever smoke inside of the leased unit or in any other place in our building.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Yes, investing in condos in NYC can still be highly worthwhile, despite potentially strict condo rental rules and low capitalization rates.

You’ll simply have to factor in the additional logistical hurdles to renting out your condo in NYC. Furthermore, you’ll have to factor in the fees you’ll have to pay to the managing agent or to your condo association into your rental income calculations. You’ll also need to factor in the cost of additionally insuring your condominium association.

We hope you’ve learned from this article that you cannot simply list your property for rent without regard to your condominium rules.

So is buying a condo in NYC worthwhile? Does it still make sense to be a landlord given that NYC real estate taxes are already high?

Before you make that determination, you should read our article on some of the cons and considerations to buying an apartment in NYC, such as the high cost of living and high income taxes.

However, there are also many pros to buying a condo in NYC such as the benefit of depreciation on your investment property which acts as a tax shelter against your rental income, and potentially your other active income if you are a qualified real estate professional in the eyes of the IRS.

Learn more about how depreciation for rental properties work by reading Publication 527 from the IRS.

Co-op apartments are generally cheaper, and some of them do have more flexible sublet policies, but is buying a co-op a good investment in NYC?

The answer will depend on how you intend to use the property, and how long you expect to hold the property. If you are only looking to live in a co-op apartment for a few years before needing to move or upgrade, it may not be such a good investment due to higher closing costs and more restrictions on subleasing co ops vs condos. If however, you are intending to reside in an apartment for a long time, a coop may be a better choice due to coops being 10% to 40% cheaper than comparable condos of the same size and quality.

Disclosure: Hauseit® and its affiliates do not provide tax, legal, financial or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, financial or accounting advice. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided.

I have a question concerning the new rental laws on NYC as far as city programs

Can the condo board decide not to rent them just by rejecting there application without giving a purpose

Hi Connie, condo units are individually owned, so it’s up to the unit owner to determine which applicant to accept/deny based on financial qualifications. Remember that unlike a co-op board, a condo board doesn’t have the right of approval. A condo board only has the right of first refusal, meaning they can either waive their right of first refusal (i.e. and essentially give the go ahead) or exercise their right of first refusal (i.e. buy or lease the unit on the same terms as the prospective buyer or renter).

As you can imagine, condo boards almost never exercise their right of first refusal, primarily because it would be inordinately hard to raise funds from all the owners to buy or lease a unit in the building.

Question…Who pays for the background check for the rental of a condo, the owner, the renter, or is it shared?

Marie, I believe the new NYC rent laws that came out in 2019 only allow the listing broker to charge the tenant $20 maximum in application etc. fees. I know in the past rental listing brokers have regularly asked for more, such as $100, which will cover the cost of a background check. But I’ve also seen owners pay for it, so perhaps it’s simply negotiable like most anything in real estate.