Almost all co-op apartments in NYC have subletting rules which apartment owners, also known as shareholders, must follow. A typical coop building in NYC will allow you to sublet your apartment for one or two years every few years.

Most co-ops charge apartment owners a subletting fee, and it’s also customary for co-ops to require a new owner to live in his or her unit for one to two years before being permitted to sublet.

Sublets are subject to co-op board approval. This means that there’s no guarantee you will be permitted to sublet even if you’re in compliance with the building’s subletting policy.

Table of Contents:

Sometimes. The specific sublet policies of co-op apartments in NYC vary widely by building. Although NYC co-ops are primarily intended for owner occupancy, most buildings do permit shareholders to sublet their units from time to time.

The most common sublet policy for co-ops in NYC allows one to two years of subletting after one to two years of initial occupancy.

Here are some examples of common co-op sublet policies in NYC:

There are a number of different types of coop sublet policies in NYC. They range from outright prohibitions on all subletting at one end to unlimited subletting at the other end.

In most cases, the actual NYC coop sublet policy falls somewhere in the middle of those two extremes. Almost all coops charge shareholders some sort of upfront or ongoing sublet fee in addition to the standard application, credit/criminal background check, and move-in / move-out fees.

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

What Types of Co-op Sublet Policies Exist in NYC?

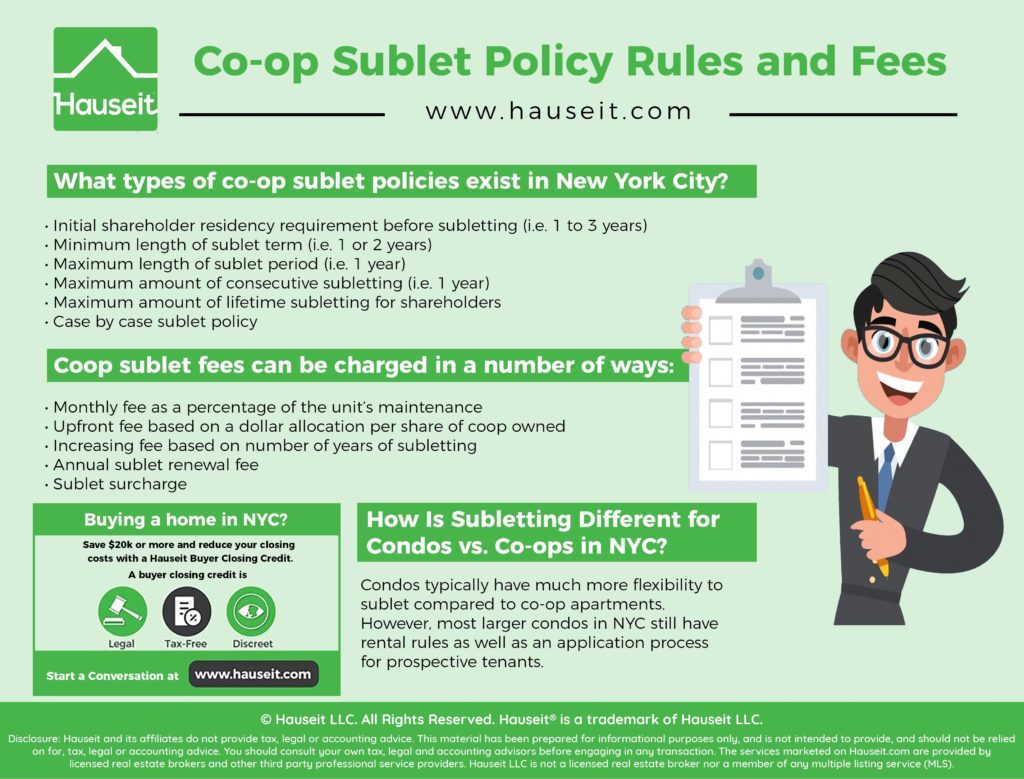

Co-op sublet policies in NYC may include some or all of the following guidelines:

Initial Shareholder Residency Requirement Before Subletting

Many NYC coops impose an initial residency requirement on new shareholders before permitting them to sublet. This is designed to encourage owner-occupancy and prevent an influx of investors.

In the most extreme cases, a coop will not permit subletting until the shareholder has lived in the coop for at least three years. The most common initial residency requirement we’ve seen calls for initial, consecutive residency between one to three years before subletting is permitted.

Once the shareholder satisfies the initial occupancy requirement, she or he may be permitted to either sublet for no more than 1-3 years during a 5-year period, sublet for 1-3 years during their lifetime of ownership, or sublet for an unlimited number of years.

It’s important to note that board approval is always almost required for sublets. At a minimum, a co-op will usually require a shareholder to notify the managing agent of any proposed sublet before it takes place.

Minimum Length of Sublet Term (i.e. 1 or 2 Years)

Most co-ops in NYC impose minimum lease term requirements for sublets. This is designed to prohibit short-stay tenants or guests, such as those which originate from Airbnb and VRBO. It’s quite common in NYC for both co-op and condo buildings to have anti-Airbnb policies, as many owners find short-term sublets to be disruptive to the broader building community and quality of life.

Almost all co-ops and many condo buildings stipulate a minimum sublet lease term of one year. At the less extreme end, the occasional more flexible co-op or condo building may establish a one-month minimum term or simply not provide any guidance regarding a minimum lease term.

Here’s an example of a short term sublet policy for a coop in Chelsea:

Maximum Length of Sublet Period (i.e. 1 Year)

NYC coop buildings often cap the duration of a sublet arrangement. The most common limit we’ve seen is 1 year. After the initial year expires, the shareholder and the tenant must re-apply for a sublet renewal directly with the coop board.

Here’s an example of a coop sublet policy for a building on the Upper West Side:

Maximum Amount of Consecutive Subletting (i.e. 1 Year)

Most co-ops in NYC impose restrictions on the maximum amount of consecutive subletting permitted before a shareholder (owner) must either move back into the unit, leave it empty or sell the co-op.

Here’s an example of a NYC coop sublet policy which officially caps consecutive subletting at two years but provides a window for the board to approve a third year:

Maximum Amount of Lifetime Subletting for Shareholders

NYC coops which cap the maximum number of years of consecutive subletting usually restart the cycle after five years. For example, a co-op may permit up to two years of subletting in a five-year period. Once the sixth year begins, the shareholder will be permitted to sublet again.

In other cases, some NYC coops prohibit all further lifetime sublets for the shareholder once he or she has used up the sublet allowance (i.e. 1-2 years).

Case by Case Sublet Policy

Some NYC coops have ‘case by case’ sublet policies, which means that sublets are only possible if there’s a very good reason. Most co-ops with this sort of policy discourage subletting, but they leave open the remote possibility of subletting for shareholders in the case of financial hardship or other extenuating circumstances.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

What Are the Typical Co-op Sublet Fees in NYC?

Most co-ops charge a sublet fee which is either a flat fee, a flat fee per number of co-op shares owned or a percentage of your monthly or annual co-op maintenance bill. Co-ops usually charge subletting fees as a way to raise revenue while also discouraging owners from subletting in the first place.

Types of Co-op Sublet Fees in NYC:

Monthly fee as a percentage of the unit’s maintenance: the shareholder is charged an additional monthly fee such as ~25% of their existing monthly coop maintenance bill.

Upfront fee based on a dollar allocation per share of coop owned: a shareholder is charged an upfront fee which is calculated by multiplying the number of shares allocated to his or her apartment by a per-share fee amount set by the co-op. This fee is usually charged upfront for each year of the sub-tenancy.

Increasing fee based on number of years of subletting: co-ops which don’t have outright restrictions on the number of years of subletting often charge shareholders an increasing fee over time. This is done to encourage a shareholder to minimize the length of time he/she sublets the unit.

Here is a good example of a variable, increasing NYC coop sublet fee:

Annual sublet renewal fee: many coops in NYC charge shareholders a fixed ‘annual sublet renewal fee.’

Sublet surcharge: some NYC coops impose sublet ‘surcharges’ based on the size of the unit being sublet. Here’s an example of this type of coop sublet fee:

Unauthorized sublet penalties: coops often levy fees against shareholders who engage in the practice of illegal subletting. For example, if a shareholder violates the sublet policy he or she may incur a penalty of twice the building’s sublet fee.

All of the fee structures discussed above are charged in addition to the the standard application, credit/criminal background check, and move-in / move-out fees which are levied by both condos and coops.

The easiest way to find a co-op’s sublet policy is to ask the listing agent or your buyer’s broker. Listing agents in NYC do not usually disclose the sublet policies in listing descriptions. Even if a description mentions the sublet policy in passing, it likely won’t be very specific and may exclude important considerations such as the amount of the sublet fee.

Your buyer’s broker will typically request the sublet policy from the listing agent. If the listing agent is unsure or provides an overly generic summary of the sublet policy, your buyer’s agent may reach out directly to the co-op’s managing agent.

Coops also have other policies which vary from building to building, such as the house rules, alteration agreement, and the board application procedure.

Given the complexity, it’s quite common to encounter NYC listing agents who aren’t fully aware of all of a co-op’s various policies.

As a buyer, it’s very important that you have accurate and complete information on a co-op’s various policies before submitting an offer. It’s especially important to familiarize yourself with the co-op’s financial requirements for buyers, as you’ll need to satisfy these as a precondition for receiving board approval.

The best approach is to request all important policies in writing. Your real estate attorney will also review the various co-op building rules and policies as part of buyer due diligence before you sign a purchase contract. This is helpful, as building policies can change over time and it’s possible that the listing agent may have provided you with older versions of the building documents.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

How Is Subletting Different for Condos vs. Co-ops in NYC?

Condos are are far more flexible for of home ownership which means you typically have much more flexibility to sublet compared to a co-op. However, most larger condos in NYC still have rental rules as well as an application process for prospective tenants.

Compared to condos, coops generally encourage high rates of owner-occupancy and maintain a greater emphasis on the quality of the coop community.

Therefore, coops almost always discourage excessive subletting through the restrictive sublet policies, fees and procedures we described above. This is why co-ops in New York City are not considered to be ‘investor friendly.’

Condos, on the other hand, almost always have zero restrictions on an owner’s ability to sublet. Therefore, condos are much more desirable for investors who are looking for the optionality to rent immediately and/or continue renting and generating cash flow for an indefinite period of time.

Because there are more coops than condos in NYC and the latter attracts both residents and investors, co-ops are significantly cheaper than condos. If you are looking for a primary residence or pied-a-terre, it’s typically less expensive to buy a co-op.

Investors or buyers looking for a primary residence with optionality to sublet or hold as an investment indefinitely should elect for a true condo or a flexible condop, which is a hybrid between a condo and a traditional NYC co-op.

Sometimes. The most common condo sublet rule in NYC stipulates a minimum 30 day lease term. Condo buildings are increasingly adopting similar regulations in an attempt to restrict short-term rentals originated on platforms such as Airbnb and VRBO.

Larger condo buildings will almost always require unit owners and prospective tenants to submit a rental application to the condo’s board of managers along with an application fee and possibly a move-in deposit and/or move-in fee.

The condo rental application itself in larger buildings can be extremely detailed and time consuming. In addition, the high application fees can make it more difficult for you to find a tenant. If you’re thinking of buying a condo in NYC for investment, it’s a good idea to review the sublet application and fee schedule for the building you’re considering.

Despite the cost and inconvenience, the condo sublet application itself is merely a formality. This is because a condo board does not have the same leeway a co-op to deny a sublet application. A condo board may only reject a prospective renter if the condo building itself agrees to rent the apartment from the unit owner on the same terms as negotiated with the rental applicant.

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

If I am the owner of a co-op apt and rent it out, is that considered subletting?

Yes Amber, that’s correct! That’s because co op apartments are technically real property. Remember that the co op corporation actually owns the entire building, and you are a shareholder who holds a proprietary lease to your apartment. That makes you a tenant technically. So if you then rent out your apartment, you are subleasing it out.

I am in the process of subletting an apartment in a NY coop for 1 year during which I am on a sabbatical. I am from Canada, where coops are rare, so I’m surprised at the information that the Coop Board, through the rental agency, is asking me to to supply as someone who is subleasing from a shareholder. Providing letters of reference and employment seems reasonable, but should I expect to provide my Social Security # and to supply extensive financial information? What is normally required? Can the person subletting be asked to pay the sublet fee, or is this the shareholder’s responsibility? Thank you.

The rental agency you’re referring to is typically referred to as the managing agent here in New York. It’s the property management company that’s a general agent of the co-op or condo board and manages the building on the owners’ behalf.

Unfortunately, sublease applications can often times be the exact same onerous application as the purchase application. Sometimes it can be a shorter or different application. But yes, co-ops unfortunately are known to be quite intrusive and you should be prepared to reveal everything about you. Some co-ops will ask for all LLCs and organizations you are a part of, including any secret societies. You can’t make this stuff up!

The short answer is yes, it’s common for them to ask for extensive personal financial information, along with supporting documentation such as bank statements etc.

Thanks so much for the response. Most helpful, especially for someone coming from another country!

My neighbor of 15 yrs has been a subtenant to our sponser/owner with $150-200 annual Inrease and comes with 1 year lease.. this is a 52 unit APT bldg with 15% shareholders. Does my neighbor have ANY rights HERE in the County of QUEENS, my 11104, thank you for your time, do Sunnyside, ny

Please note that subletting in coops is ultimately determined by the Proprietary Lease and By-Laws. Despite the fact that many coops, especially high-end ones, are very restrictive, others are not. Also, if the By-Laws specify that the board and its management co. can only charge “reasonable” fees to cover actual expenses, then there are strict limits to sublet fees.

Are there typically limits to the number or percentage of units that can be sublet at the same time? Does the size of the building come into play? My situation is an 8-unit self-managed co-op, and my concern is that if many units are sublet simultaneously it will place an unfair management burden on the remaining resident lessees.

This is a great question Cheryl! We believe this is more a financing issue with banks, which is why some co-ops will have limits on the percent of units that can be rented out. For example, some banks might not want to finance purchases of apartments in a building if more than 50% of the units are not owner occupied, i.e. are rented out. As a result of concerns that many banks will have, we think co-ops have decided to institute their own controls on how many units can be sublet at one time. Hope this helps!

How much can a landlord thats subleasing an aprtment go up in rent peryear with there tenant if the tenant has been subleasing for 14 years? Does it go for the same as any other building that somebody rents from which is the one and a half percent for one year lease and the two and a half percent raise for 2 year lease?

Hi Jen, it depends on whether the apartment is free market, or if it’s rent stabilized or rent controlled. If an apartment is a regular, free-market unit, then there are no price controls and rent can increase however much the landlord wants and the market will bear.

If the apartment is rent controlled or rent stabilized however, that’s a different story. Please check out our forum to learn more about rent stabilization and rent control, and check out our forum for an upcoming article on this topic. Thanks!

According to my coop management, the new my state law that called housing stability and tenant protection act doesn’t allow renters to pay any administrative fee such as lease application fee. This fee used to be paid by renters. Is this correct?

Effective January, 2020, my coop board raised the sublet fee by more than 50% from the 2019 fee. This was decided in December, 2019. This is a non rent stabilized or controlled apartment. The question is can the rate of increase exceed that rate of increase permitted in the new NYS June, 2019 rental laws?

You write: “Unauthorized sublet penalties: coops often levy fees against shareholders who engage in the practice of illegal subletting. For example, if a shareholder violates the sublet policy he or she may incur a penalty of twice the building’s sublet fee.” Given our current sublet fee structure, this seems like a small penalty when we have a shareholder in our building who repeatedly is listing her unit on AirBnB using pseudonyms to try and escape detection. May our co-op extract a much higher penalty to get this activity to stop? What if we were to charge her a penalty that is equivalent to the full amount of what she’s has been charging her illegal “guests”?

What constitutes 1 year of residency, legally? Is there a legal norm? A place I’m looking at allows subletting after 1 year for something like 2 or 3 years. Thanks!

Hi Mark – 1 year of residency typically means you’ve actually lived-in the apartment for 12 consecutive months. Assuming you move-in shortly after closing, this effectively means you cannot sublet until 12 months from the closing date of your purchase. However, if you don’t physically move in for several months after closing, the building may insist that you actually occupy the apartment for 12 months before being allowed to sublet. Hope this helps!

I’ve been subletting my apartments in the same building for many many years. Originally there was no sublet fee. Some years ago coop board instituted one……the equivalent of one months maintenance fee per year. Last year when I received my monthly bill I noticed it had tacked on several thousand dollars. When I called Management I asked what this was about. Apparently for 4 years they didn’t bill me for one apartment and forgot to bill me for two years on another. I spoke with the accountant at the Management Company and asked what had happened. He apologized and said he was told my tenant had moved out. I then asked how could he go on hearsay and not contact me first. In any case, I told him I’d pay the back fees but was unable to all at once. Because of their accounting error to pay it all at once would be an undue burden. He thanked me and every month I paid a few hundred extra to my bill to get the charges paid off. Property manager just got wind of this and now told me they will not allow me to sublet until all charges paid off. I currently have one apartment available for rent. My statement is…………trying to resolve this. I could pay the outstanding charges off quicker if I’m able to rent the other one and get more income in. Can they legally do that? The apartment in question is in New York City.

Hi Leanore, we’re so sorry to hear about this! It sounds like you have a few co-op apartments for rent in the same co-op building right? I would say given the tendency for co-ops to favor primary residency, you’re already in a good spot in being able to sublet multiple units. Unfortunately, co-op boards do have a lot of power and if it’s allowed by the by-laws, house rules etc. then there’s really nothing you can do about it.

Hello there, thank you for responding but the question I asked was specific to my case whereby Management failed to charge me sublet fees for several years, only to discover they had made a mistake and expected me to pay all back fees all at once. I’m not refuting the charges but feel since it took them years to catch up with their mistake I should be given some pay to pay it off. I’m not questioning the charges, but just need some time. What you sent me as a response was already printed articles which I’m aware of and read previously but doesn’t apply to my unique situation. I’m looking for some sort of response to their mistake and I’m trying to work out a reasonable deal with them. The property manager was unaware I was making payments every month to my basic bill and incorporating extra to pay down the balance. Now he wants all fees paid up and has directed me that I can not sublet my apartment (which the extra income would help pay off the fees sooner) until all fees current. In a unique case like this can I negotiate a payment plan? Have you ever had anyone run into this problem before?

Sincerely, Leanore Sansone

Hi Leonore, this definitely sounds like a difficult situation you’re being put in by your condo board and managing agent. We haven’t seen something like this before, but aren’t necessarily surprised either given how much power co-ops have over their tenant shareholders. You can of course try to negotiate a payment plan, as it certainly sounds reasonable from our outside perspective. If you’d like some advice on this, we recommend reaching out instead to one of our partner lawyers: https://www.hauseit.com/real-estate-lawyer-partners/

When it comes to these subletting costs, such as 25% of the maintenance bill – where does this money go? Is it just added to the buildings cash account? Who is receiving this additional maintenance bill? Are we given any guarantees that these additional maintenance costs are not going into the pockets of the board making these rules? I’m trying to understand what happens to this additional fee once you sublet and where it goes once you pay it.