Enhanced STAR is one of several property tax exemption programs which are available to qualifying homeowners in NYC. Qualified recipients of the Enhanced STAR exemption save approximately $650 in NYC property taxes each year.

Enhanced STAR is available to owners of condos, houses and co-ops who are 65+ with annual income of $90,550 or less who use the property as as a primary residence. About 650,000 New Yorkers receive Enhanced STAR every year, according to the NYS Department of Taxation and Finance.

Enhanced STAR is different from Basic STAR (School Tax Relief), which is a less lucrative yet more widely available income tax credit for owners of houses, co-ops and condos with annual income of $500,000 or less who use a property as a primary residence. While Enhanced STAR has an age requirement of 65+, Basic STAR does not.

Prior to legislative changes in 2016, Basic STAR was an exemption (as opposed to a credit) for qualifying homeowners earning $250k or less.

Current recipients of the Basic STAR exemption who earn $250k or less can continue to receive it, but new applicants must apply for the Basic STAR credit. Learn more about Basic STAR in this article.

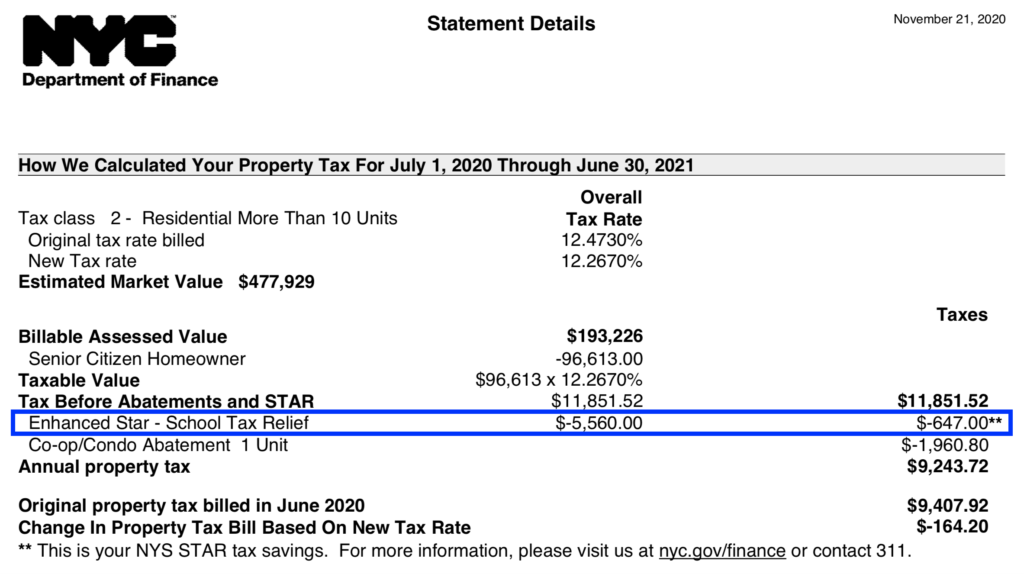

Enhanced STAR works by reducing the assessed value of a property for the purposes of calculating school taxes. Here is an example of a property tax bill for a NYC condo which shows the Enhanced STAR benefit:

To qualify for Enhanced STAR, all owners must be at least age 65 as of December 31 of the year of the exemption, except where the property is jointly owned by only a married couple or only siblings, in which case only one owner needs to meet the age requirement.

Surviving spouses can retain an existing Enhanced STAR benefit if they’re at least age 62 as of December 31 in the year the benefit will continue. Otherwise, they may receive the Basic STAR benefit.

The annual income limit of $90,550 applies to the combined incomes of all owners (residents and non-residents), and any owner’s spouse who resides at the property.

Income for STAR purposes means federal adjusted gross income minus the taxable amount of total distributions from IRAs (individual retirement accounts and individual retirement annuities).

As part of legislative changes enacted in 2019, first time Enhanced STAR recipients are required to participate in the Enhanced STAR Income Verification Program (IVP).

In the first year, the property tax assessor verifies eligibility based on the income information submitted by the applicant.

In subsequent years, the New York State Department of Taxation and Finance automatically verifies eligibility.

Once IVP enrollment is complete and a qualifying owner begins receiving the Enhanced STAR exemption, homeowners are not required to reapply each year, as the NYS Department of Taxation and Finance automatically verifies income eligibility each year.

To apply for Enhanced STAR in NYC, submit the following forms:

-

Form RP-425-IVP, Supplement to Form RP-425-E (include the Social Security numbers of all owners of the property and any of their spouses who reside at the property)

-

Form RP-425-E, Application for Enhanced STAR Exemption

If a qualifying homeowner is also receiving the Senior Citizen Homeowners’ Exemption (SCHE), she or he must continue to renew that benefit on an annual basis.

Whereas prior to the legislative change in 2019, owners who qualified for SCHE were automatically granted the Enhanced STAR exemption, that is no longer the case. Due to changes in New York State law, beginning with applications for 2019, qualifying homeowners must apply separately for the Senior Citizen Homeowners’ Exemption (SCHE) and the Enhanced STAR exemption.

A married couple can receive only one STAR benefit regardless of how many properties they own, unless they are legally separated.