NYC & NYS Transfer Tax Calculator for Sellers

Sale Price

Property type

Learn More

Glossary

NYC Transfer Tax

The NYC Transfer Tax is a seller closing cost of 1% for sales below $500k and 1.425% for sales of $500k or more. Higher rates apply for commercial transactions and multifamily properties with 4 or more units. In addition to the NYC Transfer Tax, sellers in NYC must also pay New York State Transfer Taxes. The combined NYC and NYS Transfer Taxes are the second largest closing cost for sellers aside from broker commissions.

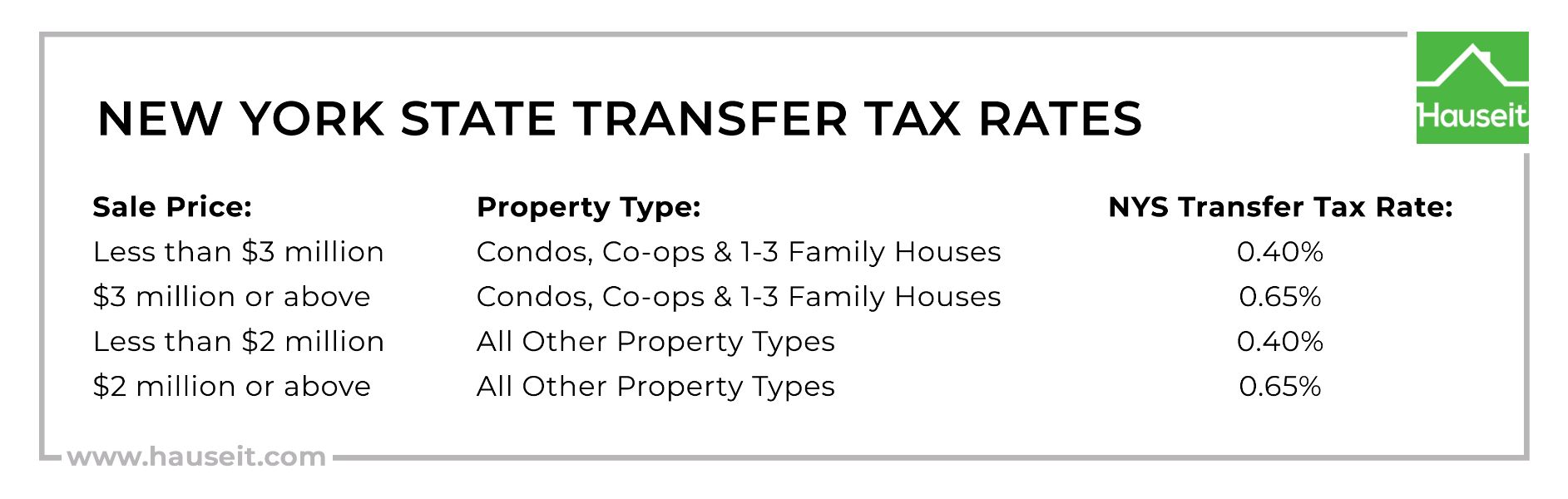

NY State Transfer Tax

The New York State Transfer Tax is 0.4% for sales below $3 million and 0.65% for sales of $3 million or more. The higher rate of 0.65% kicks-in at a lower threshold of $2 million for commercial transactions and residential properties with 4 or more units. Prior to the New York Tax Law amendments in 2019, the NYS Transfer Tax was previously a fixed 0.4% regardless of the sale price. The New York State Transfer Tax is authorized by New York Consolidated Laws, Tax Law – TAX § 1402.

Mansion Tax

The New York City Mansion Tax is a progressive buyer closing cost which ranges from 1% to 3.9% of the purchase price on sales valued at $1 million or more. The Mansion Tax itself consists of 8 individual tax brackets, with the lowest rate of 1% applying to purchases at or above $1 million and less than $2 million. The highest Mansion Tax rate of 3.9% applies to purchases of residential property valued at $25 million or more. Prior to the 2019 update, the Mansion Tax was a fixed rate of 1% for all purchases of $1 million or more.

FAQ

How much are NYC & NYS seller transfer taxes?

The combined NYC and NYS Transfer Tax for sellers is between 1.4% and 2.075% depending on the sale price. Sellers pay a combined NYC & NYS Transfer Tax rate of 2.075% for sale prices of $3 million or more, 1.825% for sale prices above $500k and below $3 million, and 1.4% for sale prices of $500k or less. View all NYC & NYS Transfer Tax rates, including the higher rate for commercial and 4-or-more family homes here.

How much are seller closing costs in NYC?

Seller closing costs in NYC are between 8% to 10% of the sale price. Closing costs include a traditional 6% broker fee, combined NYC & NYS Transfer Taxes of 1.4% to 2.075%, legal fees, a building flip tax if applicable as well as building and miscellaneous fees. Save up to 6% when selling through Hauseit’s Assisted FSBO Listing Service, or consider 1% Full Service for a traditional yet lower cost sale experience.

Is it possible to reduce my seller closing costs in NYC?

Yes. You can save up to 6% when selling through Hauseit’s Assisted FSBO Listing Service, or consider 1% Full Service for a traditional yet lower cost sale experience. It’s also possible to further reduce your seller closing costs through a Purchase CEMA if you’re selling a condo or house with an existing loan balance and the purchaser is financing.

How much money can I save with a Hauseit® Assisted FSBO Listing?

Save all 6% in broker commission if you find a direct buyer, meaning you’ll owe nothing at closing. If you decide to sell to a buyer represented by an agent, only pay the commission you chose to offer in the MLS which is typically no more than 3%. Learn more here.

Can I save money when buying real estate in NYC?

Yes. You can reduce your buyer closing costs and save up to 2% on your purchase by requesting a buyer agent commission rebate through Hauseit. Rebates are a legal and non-taxable way to reduce your buyer closing costs while receiving traditional, full-service representation from a seasoned buyer’s agent throughout the purchase process.