A post-closing possession agreement, also known as a residential leaseback agreement, is used when a seller would like to temporarily remain in the property after the transfer of ownership has occurred.

The four most commonly negotiated terms of a post-closing possession agreement in NYC real estate are the duration, rental rate, escrow amount and the holdover fee.

Table of Contents:

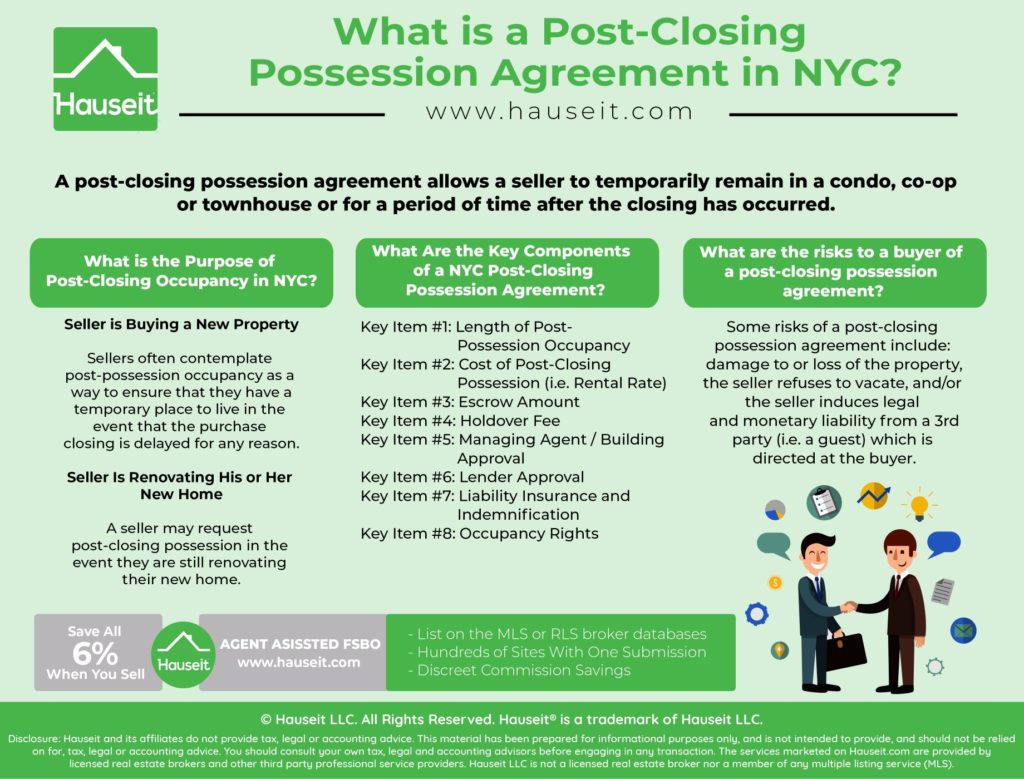

A post-closing possession agreement allows a seller to temporarily remain in the condo, co-op or townhouse or for a period of time after the closing has occurred.

Because of the risk it involves for buyers, the use of a post-closing possession agreement only occurs when the seller requires post-possession occupancy as a condition for agreeing to the sale.

The most commonly negotiated terms of a New York City post closing possession agreement include the length of post-possession occupancy, the cost of the post closing occupancy, the escrow amount as well as the holdover fee.

If you are buying/selling a co-op or if bank lenders are involved, you must ensure that you receive co-op board approval and lender sign off for the length of the post-closing possession agreement.

A post closing possession agreement is also known as a post occupancy agreement or a residential sale leaseback agreement.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Here are some reasons why a seller may be interested in a post closing possession arrangement:

Reason #1: Seller is buying a new apartment and waiting to close

Most NYC home owners looking to move need the proceeds from the sale of their existing home to be able to close on their new property.

In addition, lenders typically require proof of the previous sale and previous loan payoff before releasing the funds for the new mortgage.

Because of the difficulty of timing back-to-back sale and purchase closings, sellers often contemplate post-possession occupancy as a way to ensure that they have a temporary place to live in the event that the purchase closing is delayed for any reason.

In other words, a post-closing possession agreement is an easy way for a seller to solve any unexpected timing/logistical issues surrounding the sale and purchase closings.

Reason #2: Seller is renovating his or her new home

A New York City home seller may also request post-closing possession in the event he or she is still renovating another property.

In some remote instances, a seller may ask for post-closing possession to allow for renovation time on a property he or she has not closed on (or even signed a purchase contract on) yet. A situation like this may involve a purchase contingency in addition to the post-possession agreement.

Because of the risk of cost and time overruns with renovation work, permitting post-possession occupancy for the purpose of renovations is a risky proposition for the buyer.

Even if the post closing possession agreement has onerous escrow and holdover fees, the bank and/or co-op board may have issues with any post-closing possession period greater than 60 days.

The most commonly negotiated terms of a New York City post closing possession agreement include the length of post-possession occupancy, the cost of the post closing occupancy, the escrow amount as well as the holdover fee.

The buyer’s attorney will typically also ensure that the agreement obligates the seller to maintain liability insurance for the duration of the post-closing possession period.

Here is an in-depth look at the most commonly negotiated items of a New York City post-closing possession agreement:

Key Item #1: Length of Post-Possession Occupancy

The longest post-closing possession agreement is typically 60 days. This is driven by the fact that most co-op buildings and lenders will not permit anything greater than sixty days. If you are buying a co-op in NYC and the seller has requested more than 60 days, an experienced buyer’s attorney will confirm with the managing agent whether this is permitted by the board/building.

Key Item #2: Cost of Post-Closing Possession (i.e. Rental Rate)

The ‘rental’ rate of the post-closing possession is negotiable. As a general rule of thumb, the rental rate is typically the carrying cost of the property for the buyer: the monthly maintenance and mortgage payment.

Key Item #3: Escrow Amount

The amount of escrow is also negotiable, however it’s typically at least 2-3% of the contract price.

Under a post-closing possession agreement, a portion of the sale proceeds are withheld in an escrow account in order to protect the buyer during the period of post-possession occupancy.

The escrow proceeds are not released to the seller until the seller vacates the premises and leaves it in the condition stipulated in the post-closing possession agreement.

As a buyer, you should push for the largest practical escrow amount possible.

Sellers often attempt to extensively negotiate down the escrow amount, so you should bear in mind that negotiating too aggressively on the escrow terms could kill your deal.

Key Item #4: Holdover Fee

A holdover fee is the daily, weekly or monthly rate charged to a seller who overstays the length of the post-closing possession agreement.

When negotiating the holdover fee, you should aim for a holdover rate which is not exorbitant but actively motivates the seller to move out in a timely manner. For example, charging $10,000 a day for a $1m apartment is not reasonable. Something like $400, however, may be reasonable because it’s more expensive than what a hotel would cost.

The fees associated with a seller overstaying the agreement are deducted from the escrow account along with any other expenses for damages, unpaid utility bills, etc.

Key Item #5: Managing Agent / Building Approval

The rules regarding post-closing possession will vary by each NYC co-op and condo building. As a general rule of thumb, most buildings will think twice before agreeing to post-closing possession longer than 60 days.

Key Item #6: Lender Approval

Most lenders, just like co-op buildings, will have an issue with a post-closing possession agreement longer than 60 days. From their perspective, are just too many risks and conflicts of interest involved when a seller is permitted to stay longer than two months.

Key Item #7: Liability Insurance and Indemnification

Any buyer who agrees to post-closing possession will require the seller to maintain liability insurance and indemnify the purchaser. Agreeing to post-closing possession without these terms will put the buyer at virtually limitless monetary risk.

Key Item #8: Occupancy Rights

Who has the right to occupy the property post-closing? The buyer should ensure that the post-closing possession agreement specifies who exactly is entitled to occupy the property during the term of the agreement.

Agreeing to any form of a post-closing possession is risky for a buyer.

However, the reality is that some NYC home owners won’t agree to sell unless they are permitted to remain for some time after closing. A well negotiated post-closing possession agreement can help mitigate risk for the buyer while allowing the deal to proceed.

Some risks of a post-closing possession agreement include:

Damage to or loss of the property, the seller refuses to vacate, and/or the seller induces legal and monetary liability from a 3rd party (i.e. a guest) which is directed at the buyer.

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

Disclosure: Hauseit® and its affiliates do not provide tax, legal, financial or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, financial or accounting advice. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided.