Home ownership in NYC can be expensive, and it’s not always smooth sailing. In addition to having to make your mortgage payment every month, you’ll have to deal with neighbors and successfully navigate the house rules and politics of your condo or co-op building.

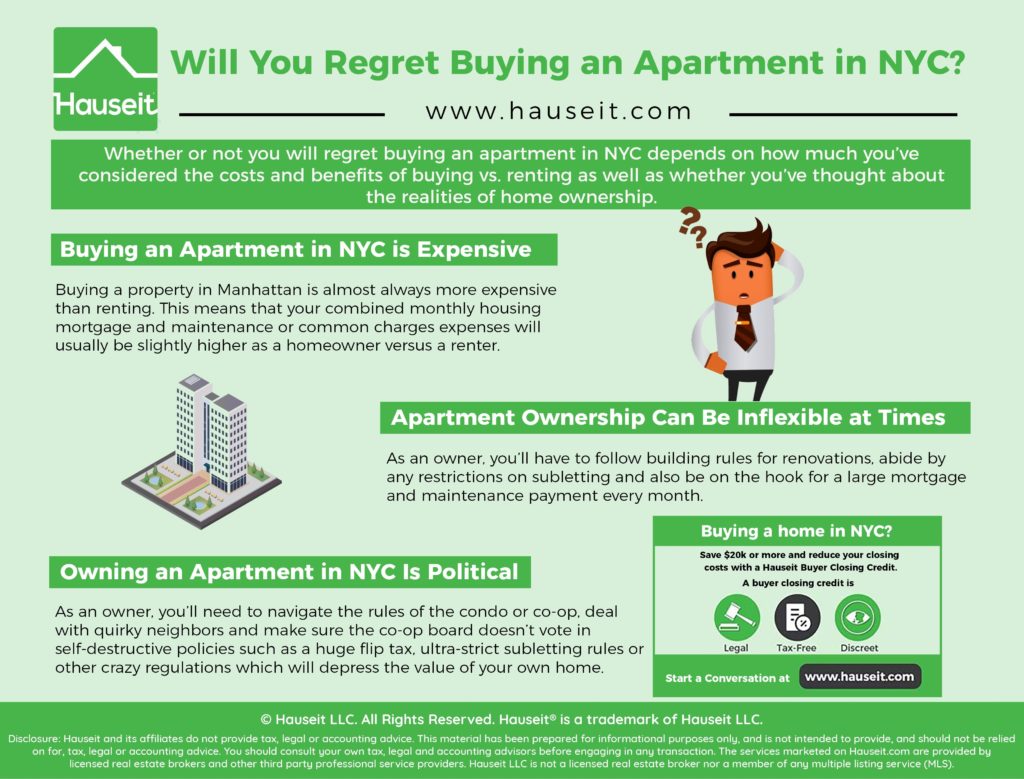

Whether or not you will regret buying an apartment in NYC depends on how much you’ve considered the costs and benefits of buying vs. renting as well as whether you’ve thought about the realities of home ownership. These realities include unanticipated expenses, the politics of your condo or co-op building and the potential lack of lifestyle flexibility caused by home ownership.

Table of Contents:

Buying a property in Manhattan is almost always more expensive than renting. This means that your combined monthly housing mortgage and maintenance or common charges expenses will usually be slightly higher as a homeowner versus a renter.

In addition to being more expensive than renting, buying is also a much more permanent lifestyle decision. This is because most financed buyers have essentially agreed to make 30 years’ worth of mortgage payments compared to a renter who has only signed up for a year or two of rent payments.

The long-term responsibility of having a mortgage payment means that you’ll need to consistently generate large income for decades on end.

This is very different from being a renter, whereby you have the flexibility at the end of your lease term to rent a less expensive apartment, move out of NYC and/or quit your high paying job for something more flexible without any real consequences.

In other words, buying a property in Manhattan is signing up for 30 years of having to make a huge payment. This is very different from signing a one or two year lease, after which you have the flexibility to take a lower paying job, go on a sabbatical or move to another city without having to take into consideration any debt obligations.

The obvious benefit of buying is that you are building equity and paying down some principal each month compared to throwing everything away in rent. New York City real estate almost always goes up in value over the long term, and this means that you’ll grow your net worth while not wasting money on rent.

If your mortgage burden becomes too much to bear, you can also sell your apartment or rent it out in order to cover most of your mortgage and apartment maintenance payment.

However, selling is costly and it can be tricky if you happen to be selling in a buyer’s market. If you rent out your co-op, most buildings will charge you a fee which will erode you rental income.

The key takeaway is that there are far fewer headaches when it comes to renting versus buying in NYC.

Buying real estate also offers other benefits such as portfolio diversification and the emotional feeling of stability and purpose. To many New Yorkers, owning an apartment is also the ultimate status symbol and reflection of career and personal success.

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

Owning an apartment in NYC can be inflexible and constraining at times. As an owner, you’ll have to follow building rules for renovations, abide by any restrictions on subletting and also be on the hook for a large mortgage and maintenance payment every month. Co-ops can also derail your future plans by arbitrarily rejecting financially qualified buyers without providing any reason.

Buying a co-op in NYC is the most affordable path to home ownership in NYC since they’re usually much less expensive than condo apartments. With that said, co-op apartments have subletting restrictions and other rules which impair your ability to fully utilize your home.

Other more extreme co-ops may further restrict permitted usage of your apartment by prohibiting overnight guests if you’re also not residing in the apartment with them. These rules and restrictions impair your ability to use and monetize your apartment over the years as your lifestyle changes.

If you relocate for work or simply wish to move out of NYC for good, you’ll ultimately need to sell your apartment (and pay huge seller closing costs). This is because most co-ops do not allow you to sublet indefinitely. If you happen to max out your subletting usage and real estate prices are in a downturn, you’ll either be forced to sell at a loss or leave your apartment empty without generating any rental income.

Both condo and co-op buildings also have rules and regulations for apartment renovations and alterations. The primary downside of renovation rules and building alteration agreements is that they’ll obligate you to hire licensed and fully insured contractors.

In this case of smaller projects, this means you’ll have to pay top dollar versus being able to bring in an excellent and relatively inexpensive handyman. If you take the risk of bringing in a handyman, you’ll have to worry about neighbors reporting you to the managing agent and trying to fine you.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

There is a certain sense of independence when living in a rental building, as you probably won’t have the same neighbor for more than a few years. This means you don’t really have to think too far ahead when thinking about how to deal with problematic neighbors. Once you buy an apartment however, you may need to deal with the same neighbors for years and decades.

For example, let’s say you are renting and your neighbor constantly makes noise after hours. Assuming you are well behaved, you can easily and consistently report them to 311 and your landlord without any real fear of backlash from them.

This is because you won’t really ever need your neighbor’s cooperation, as rental buildings don’t permit renovations and subletting anyway.

As an owner, you’ll need to navigate the rules of the condo or co-op, deal with quirky neighbors and make sure the co-op board doesn’t vote in self-destructive policies such as a huge flip tax, ultra-strict subletting rules or other crazy regulations which will depress the value of your own home.

Many first-time home buyers are shocked at the level of politics which are present within a condo or co-op building, especially in the case of smaller ones. You’ll discover as an owner that various owners have different priorities for what to advocate for and complain about. Some owners want to spend money to improve the building and others don’t.

Being a smart condo or co-op owner is all about thinking ahead before making any immediate decisions which can affect your relationship with neighbors. For example, let’s say you plan on engaging in a lengthy renovation which will undoubtedly create noise for your neighbors.

If one of these neighbors happens to make noise until 4am on a Saturday, would it make sense to report them when you’re about to start a gut renovation of your bathroom? The answer is no! By ratting on your neighbor for only a few hours of misbehavior, you’ll give them a reason to scrutinize every move your contractor makes and give you months of headaches.

Posted: 11/5/18 | Last Updated: January 30th, 2020

Disclosure: Hauseit® and its affiliates do not provide tax, legal, financial or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, financial or accounting advice. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided.