Buying a pre-construction condo can be advantageous primarily because of better pricing vs a project that is ready for immediate occupancy. However, buying a pre-construction condo also comes with many risks such as delayed completion, abrupt notices to close, variances in construction and more.

Table of Contents:

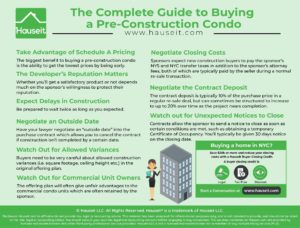

The biggest benefit to buying a pre-construction condo is the ability to get the lowest prices by being early. Developers need to hit milestones early on and show progress to their lenders, and as a result often have more flexibility on price for the earliest buyers.

These early pre-construction condo buyers can take advantage of what’s known as Schedule A pricing, which is typically the lowest pricing available to the public.

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

The developer’s reputation is extremely important when it comes to buying a pre-construction condo, because whether you’ll be delivered a satisfactory product or whether you’ll end up in court depends much on whether the sponsor has a reputation to maintain.

While a well-known, sometimes publicly traded developer will have a significant amount of brand equity to protect, a small-time developer may literally dissolve their LLC the instant all the closings are done with so they can abscond with the money. No joke, we’ve seen this happen before on shady condominium conversions in NYC where the conversion was more of a light, “botox job” vs a full re-habilitation.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Don’t naively believe the expected completion dates you’re told. As with anything construction related, be prepared to wait twice as long as you expected. This means that you shouldn’t be desperate to move in by a certain time, especially if you are buying a pre-construction condo where there is very little certainty on a move-in date.

The worst thing you could do is to sell your former home and then desperately need to move into a pre-construction condo as your new home. The timing will be extremely hard to line up, and you’ll have literally no control on when the sponsor finishes their work.

Since construction will likely take much longer than expected, you should expect your contract deposit to be tied down for months and possibly years. As a result, you should have your lawyer negotiate an “outside date” into the purchase contract which allows you to cancel the contract if construction isn’t completed by a certain date.

This way, if construction is extremely delayed, you can cancel the contract and get your money back. This can be very useful if there’s a market downtown and you wish to get your deposit back and re-deploy it into the market or another property.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Buyers of pre-construction condos need to be very careful about allowed construction variances in the original offering plan. A shady developer will take maximum advantage of the allowed variances in the governing documents to rip buyers off as much as possible.

For example, offering plans will typically allow a variance of plus or minus 5% on many key factors such as square footage and ceiling height. So just be prepared for a shady, small-time developer ensuring that you get 5% less than advertised on various key metrics.

One of the dangers of buying a new build condo in a mixed use building is that the offering plan will often give unfair advantages to the commercial condo units, which are often retained by the sponsor.

For example, the offering plan might state that the commercial condo unit owners are only responsible for 2% of the building’s shared utility expenses (i.e. common area electrical bill) when they take up 20% of the building’s total floor space. Or the offering plan might state that the commercial condo unit owners are maximally liable for $10,000 in special assessments per year, meaning the cost of major façade repairs might fall entirely on the residential unit owners.

Does any of this sound fair? Absolutely not. But the truth is ground floor commercial units bring in enormous amounts of rental income and are extremely attractive for developers to retain for themselves. As a result, many commercial condo units within new construction buildings are either directly owned by the sponsor or a related party. So just be careful when buying in a mixed use new development building because the sponsor wrote the offering plan which governs the building!

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

Buying a pre-construction condo typically means you’ll have more negotiating room, especially in a weak market where developers are nervous about offloading inventory and keeping lenders happy. Remember that sponsors typically expect new construction buyers to pay the sponsor’s NYS and NYC transfer taxes in addition to the sponsor’s attorney fees, both of which are typically paid by the seller during a normal re-sale transaction.

Well, not only can you negotiate these extra, new construction related closing costs, but you can negotiate other closing costs as well such as the buyer’s NYC Mansion Tax.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

The contract deposit is typically 10% of the purchase price in a regular re-sale deal, but can sometimes be structured to increase to up to 20% over time as the project nears completion when buying a new construction home in NYC.

Fortunately, the amount of the contract deposit is negotiable just like everything else in real estate, especially in a weak real estate market where developers are more eager to negotiable.

Since a pre-construction condo purchase may take many months or even years to close, buyers can easily be surprised by a notice to close from the sponsor because they’ve forgotten about their purchase.

It’s important to understand that new construction purchase contracts allow the sponsor to send a notice to close as soon as certain conditions are met, such as obtaining a temporary Certificate of Occupancy. You’ll typically be given 30 days notice on the closing date, which can be an issue if you’re on a long vacation. Make sure your lawyer negotiates the right to adjourn for 10 or 15 days without penalty.

Pro Tip: Learn more in our article on the special risks to buying a new construction home in NYC, and pay special attention to the subsection titled “the sponsor can force you to close.” You can see the closing notice language for yourself in this sample NYC real estate purchase contract template.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Disclosure: Hauseit® and its affiliates do not provide tax, legal, financial or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, financial or accounting advice. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided.