Buying in a seller’s market requires both patience and discipline. Buyers need to be patient and make offers on multiple properties as they’ll often lose out to competing bidders in a seller’s market. Buyers also need discipline in not becoming emotionally invested in a single property and chasing the price up in a real estate bidding war.

Table of Contents:

A seller’s market is characterized by scarce housing inventory and high demand, typically fueled by low interest rates. Sellers have much more control of the process and will often hold highest and best offer processes and receive multiple offers at or above their listing price.

The US real estate market in general and the NYC real estate market in particular experienced a seller’s market after the Great Financial Crisis of 2007-2008 (GFC) when interest rates were lowered to rock bottom.

As a result, buyers and investors could finance their purchases very cheaply, and inventory was becoming scarce since the housing construction industry had not fully recovered from pre-crisis excesses.

As a result, low housing inventory and low mortgage rates produced a crazed seller’s market in the immediate years after the GFC, and we saw prices of some properties increase more than 100% in the course of a year or two.

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

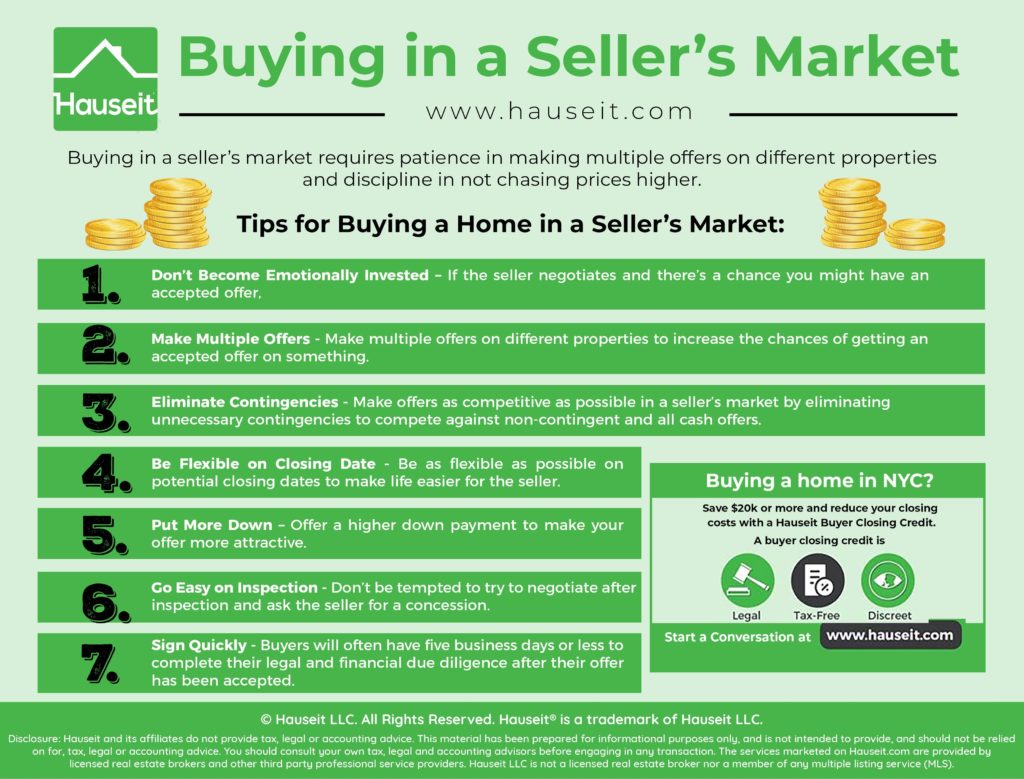

Buying in a seller’s market requires patience in making multiple offers on different properties and discipline in not chasing prices higher.

Don’t Become Emotionally Invested

It’s very easy for buyers to become emotionally invested in a property that they like and have placed an offer on.

If the seller negotiates and there is a chance that the buyer might get it, the buyer could easily drop focus on anything else and only concentrate on this one offer.

This is a terrible idea as you have no assurance that your offer will ever progress to a signed contract.

Make Multiple Offers

Buyers should make multiple offers on different properties to increase their chances of getting an accepted offer on something. This saves the buyer time vs only bidding on one property at a time.

In a seller’s market, this strategy is terrible as your one offer has a very high chance of being beaten by a competing bidder. As a result, keep your options open and make competitive offers on as many listings as you can!

Eliminate Contingencies

Buyers should make their offers as competitive as possible in a seller’s market. They should eliminate unnecessary contingencies to compete against non-contingent and all cash offers.

Contingencies that are superfluous or uncustomary for the region should absolutely be eliminated. Remember, an offer doesn’t really mean anything, even after it’s been accepted.

As a result, try to make your offer as easy to digest and accept as possible so you can get a head start on the due diligence process!

Be Flexible on Closing Date

Buyers should offer to be as flexible as possible on an anticipated closing date in a seller’s market. Being flexible could make or break your offer, and may be a tip a seller into choosing your offer over someone else’s.

This is especially true if you find out that the seller has a special situation, such as needing to stay past closing before their new home purchase closes. If you’re currently renting, try to get your landlord to agree to extend your lease on a month by month basis so you can have the utmost flexibility!

Put More Down

Buyers can make their offers more attractive by offering to do a higher down payment.

This lowers their Debt-to-Income Ratio and will make it less likely that the buyer will get rejected by the board because of specific coop financial requirements.

Even if you are buying a condo or a house, a higher down payment is attractive as it’ll make it easier for the bank to approve your loan, and may result in less execution risk.

Go Easy on Inspection

It’s uncommon for buyers of condos and coops in big cities like NYC to get a home inspection; however, it’s quite normal to get a home inspection if you are buying free-standing property such as a house or a townhome.

However, you should remember that most states follow New York’s example in that properties are typically sold in as is condition.

This will be especially the case in a seller’s market. As a result, don’t be tempted to try to negotiate after inspection and ask the seller for a concession because you found a minor issue. If you do so, the seller could easily tell you to buzz off and accept a competing bidder’s offer instead.

Sign Quickly

Buyers will often have five business days or less to complete their legal and financial due diligence after their offer has been accepted. In a tight seller’s market, buyers are often expected to review, negotiate and sign a purchase contract within 5 business days of receiving it.

Even if the seller doesn’t explicitly give you a deadline, you should certainly expedite the contract signing process. After all, the only time a deal becomes real and binding is after both parties have signed the contract!

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

The difference between a buyer’s and seller’s market is in who has more leverage and pricing power.

In a seller’s market, inventory is scarce and sellers have the power and can demand premium pricing for their properties.

In a buyer’s market, buyers themselves are scarce, and a bona fide buyer can pick and choose and often successfully bid below the listing price.

You can easily deduce whether your local real estate market is a buyer’s market or a seller’s market by searching online, reading the news or asking a local real estate broker.

For example, it’s very obvious to New Yorkers that NYC is currently in a buyer’s market as of this writing in November 2019. Not only can they see the orgy of new construction in the skyline, but it’s also hard to miss it on any news publication.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Disclosure: Hauseit® and its affiliates do not provide tax, legal, financial or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, financial or accounting advice. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided.