What is a real estate closing statement? What does a closing statement for an apartment purchase in NYC look like? What checks do I need to bring on closing day?

We’ll go through a sample real estate closing statement with you in the article below and explain what you’ll need to do before closing day.

Table of Contents:

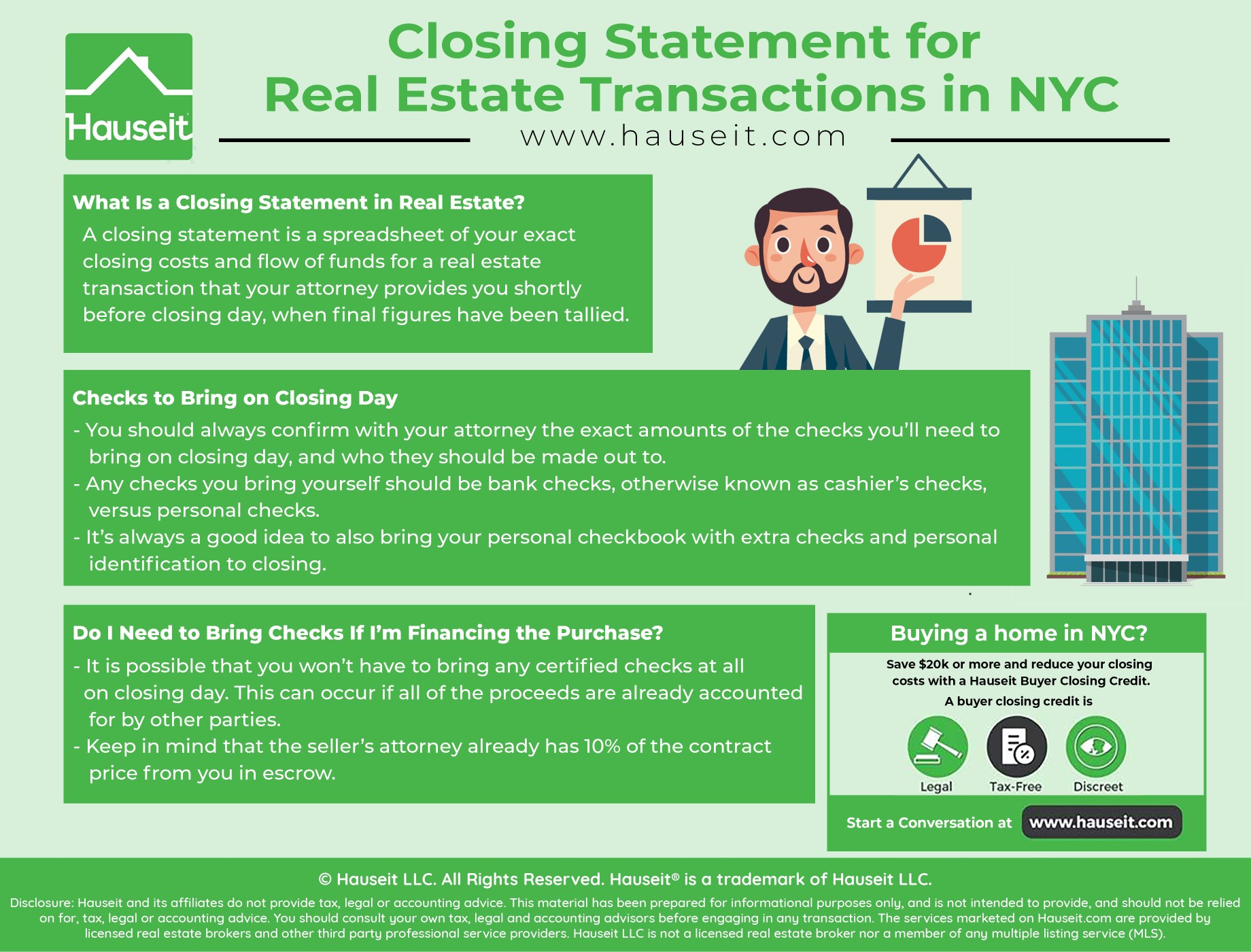

A closing statement is a spreadsheet of your exact closing costs and flow of funds for a real estate transaction that your attorney provides you shortly before closing day, when final figures have been tallied.

Until a real estate closing statement has been prepared by your attorney, you will only be able to estimate what your NYC closing costs will be. Closing cost figures provided by your real estate broker and mortgage broker or bank are only estimates.

Your Actual Closing Costs

The official closing statement that your attorney prepares right before closing is what you’ll actually need to cut checks for closing day. There is no standard template for what a closing statement for real estate transactions in NYC should look like.

Most attorneys will manually create an Excel spreadsheet for each transaction and email it over to their client a few days before closing.

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

This sample real estate closing statement illustrates a hypothetical all cash purchase of a HDFC coop apartment in NYC. For the sake of simplicity, we’ve assumed that the buyer is not utilizing financing for this purchase.

Because the apartment for sale is a HDFC coop, you can see that a large portion of the seller’s proceeds will be going back to the HDFC corporation due to the high flip taxes associated with HDFC coop buildings.

| Total Proceeds Due Seller at Closing From Purchaser: | ||||

| Sales Price | $450,000.00 | |||

| Credits: | ||||

| TO SELLER | March 2016 Maintenance Adjustment | $425.00 | ||

| ($850/30 x 15 days) | ||||

| Subtotal: | $425.00 | |||

| Debits: | ||||

| TO PURCHASER | Contract Deposit | ($45,000.00) | ||

| Subtotal: | ($45,000.00) | |||

| Net Credits and Debits Subtotal: | ($44,575.00) | |||

| TOTAL DUE SELLER AT CLOSING: | $405,425.00 | |||

| Balance Due Seller Paid as Follows: | ||||

| Seller’s Brokerage | $13,500.00 | |||

| Buyer’s Brokerage | $13,500.00 | |||

| Attorney Name LLP | $38,000.00 | |||

| Sample Street Housing Development Fund Corporation (HDFC) | $100,000.00 | |||

| Estate of Recently Deceased Person | $240,425.00 | |||

| Subtotal: | $405,425.00 | |||

| Purchaser’s Expenses at Closing: | ||||

| Title Fees: | ||||

| Title Company – Falcon 3 Policy (F3-NY-123531) | $940.00 | |||

| Owner’s Policy | $700.00 | |||

| Bankruptcy Searches | $100.00 | |||

| OFAC Searches | $30.00 | |||

| Tax Searches | $50.00 | |||

| Sales Tax | $30.00 | |||

| Courier/Wire Fee | $30.00 | |||

| Title Closer Fee | $250.00 | |||

| Subtotal | $1,190.00 | |||

| Purchaser Legal Fees: | ||||

| Buyer Legal Representation LLC | $2,555.00 | |||

| Attorney Fees | $2,500.00 | |||

| Disbursements | $55.00 | |||

| Subtotal | $2,555.00 | |||

| TOTAL PURCHASER’S EXPENSES AT CLOSING | $3,745.00 | |||

| TOTAL PURCHASE PRICE AND EXPENSES | $453,745.00 | |||

| LESS: DEPOSIT | ($45,000.00) | |||

| LESS: GROSS LOAN | $0.00 | |||

| TOTAL PURCHASER FUNDS NEEDED AT CLOSING | $408,745.00 | |||

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

You should always confirm with your attorney the exact amounts of the checks you’ll need to bring on closing day, and who they should be made out to.

Any checks you bring yourself should be bank checks, otherwise known as cashier’s checks, versus personal checks.

Bank checks must be taken out at your local bank branch by speaking with a bank teller. Bank checks cannot bounce because the funds are withdrawn at the time the certified check is created.

Bring a Personal Checkbook

With that said, it’s always a good idea to also bring your personal check-book with extra checks and personal identification to closing.

This will be critical in case of unforeseen, miscellaneous payments that need to be paid. You don’t want to hold up your closing over a missing $100!

In the sample real estate closing statement above, the buyer was advised by her attorney to take out certified checks for the following:

Balance Due Seller Paid as Follows:

Seller’s Brokerage $13,500.00

Buyer’s Brokerage $13,500.00

Attorney Name LLP $38,000.00

Sample Street Housing Development Fund Corporation (HDFC) $100,000.00

Estate of Recently Deceased Person $240,425.00

Subtotal: $405,425.00

Keep in mind that what checks you will cut and whether you will even have to cut any checks at all will vary depending on your transaction. In our hypothetical HDFC coop apartment purchase, the buyer cut the checks herself because she was buying all cash and did not deposit the funds in advance into her attorney’s escrow.

It is possible that you won’t have to bring any certified checks at all on closing day.

This can occur if all of the proceeds are already accounted for by other parties, meaning your lawyer has the balance of your down payment in escrow and your mortgage lender will be showing up with the balance of the funds. This is quite common for buyers receiving gifts or other wire transfers of funds.

Pay the Balance

Keep in mind that the seller’s attorney already has 10% of the contract price from you in escrow, so you would only need to provide the remainder of your down payment if you are buying with a mortgage.

As always, please confirm with your attorney after receiving the real estate closing statement what checks if any you should bring on closing day.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Disclosure: Hauseit® and its affiliates do not provide tax, legal, financial or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, financial or accounting advice. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided.