How do I calculate the maximum HDFC coop income limit? What are HDFC coop income limits and rules in NYC?

We’ll go through sample HDFC coop income limit rules and calculations with you in this article so you’ll know exactly what you’re getting into before you decide to make an offer on a HDFC co op apartment in New York City.

Table of Contents:

Competition for HDFC coop apartments in NYC can be fierce. That’s because HDFC coop apartments are generally cheaper on a price per square foot basis vs comparable co op or condo units.

HDFC co op apartment prices are generally lower due to the high flip taxes charged by HDFC buildings and the strict income limitations for buyers.

Asset Rich and Income Poor

Despite these additional hurdles, there are many buyers in the NYC real estate market who have low income but substantial assets who qualify.

These may include people with large inheritances, savings or who are able to get gifts from family.

As a result, you may see students or other people with low income but the ability to compete effectively for HDFC coops by making all cash offers!

As a result, prices have trended up for HDFC coop housing in recent years, and it’s important for buyers to analyze whether valuations make sense before purchasing.

Part of the analysis should focus on how strict the HDFC building’s income limits are and how high the HDFC building’s flip taxes are. If the maximum allowable income for buyers is extremely low, it will be tougher to resell the apartment in the future given the more limited pool of eligible buyers.

A higher co op flip tax will also effect resale value, not only by reducing the seller’s profit but by deterring would be buyers.

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

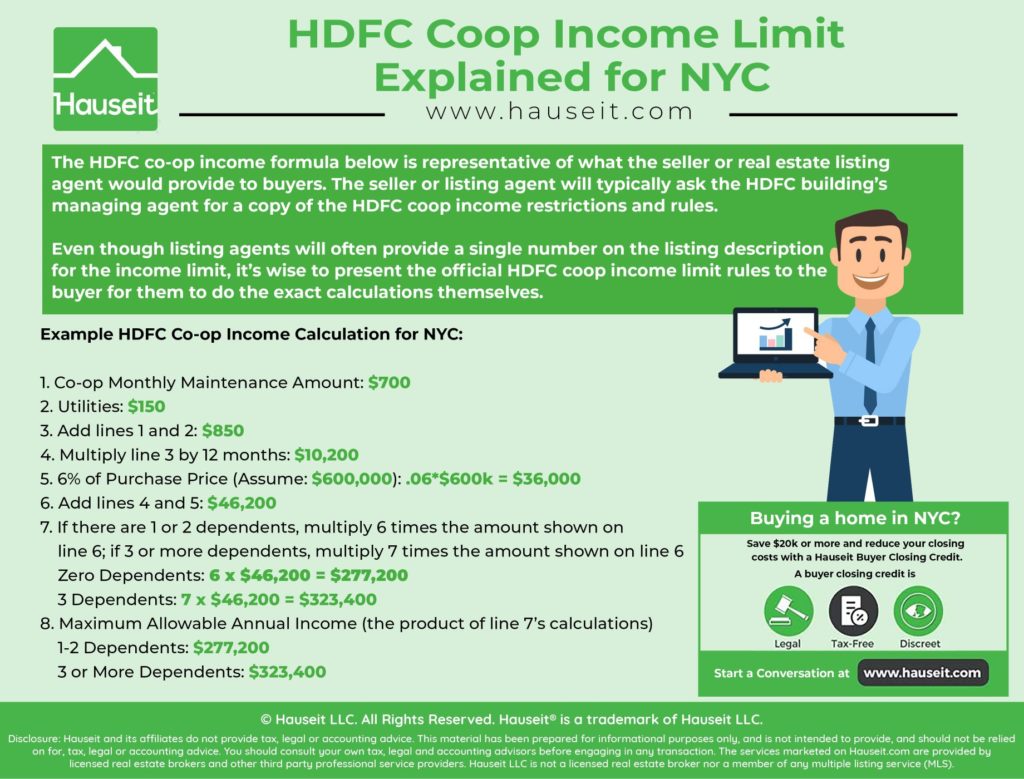

These sample HDFC coop income limit rules are representative of what the seller or real estate listing agent would provide to buyers. The seller or listing agent will typically ask the HDFC building’s managing agent for a copy of the HDFC coop income restrictions and rules.

Even though listing agents will often provide a single number on the listing description for the income limit, it’s wise to present the official HDFC coop income limit rules to the buyer for them to do the exact calculations themselves.

Statement of Maximum Income Allowed to Become a Shareholder and/or Tenant

Pursuant to the Certificate of Incorporation of the HDFC, apartments in the building are only available to persons of low income.

The HDFC makes no representations as to what constitutes low income which can only be determined by the New York City Department of Housing Preservation and Development. However for the benefit and guidance of potential members, it may be that the definition contained in Section 576(1)(b) of the Private Housing Finance Law may be applied. It states as follows:

Dwellings in any such project shall be available for persons or families whose probable aggregate annual income does not exceed six times the rental (including the value or cost to them of heat, light, water and cooking fuel) of the dwellings to be furnished such persons or families, except that in the case of persons or families with three or more dependents, such ratio shall not exceed seven to one. For purposes of this paragraph, tenants in a house project of a housing development fund company organized under the provisions of the business corporations law and this article shall have added to their annual carrying charges an amount equal to six per centum of the original investment of such person or family in the equity obligations of such housing company.

To compute maximum yearly income under section 576 of Private Housing Finance Law (see the Instructions Sheet attached hereto):

1. Estimated Monthly Rental (Apt. __ )

2. Utilities ($__ per room per month x __ Rooms)

3. Add lines 1 and 2

4. Multiply line 3 by 12 months

5. 6% of Purchase Price

6. Add lines 4 and 5

7. If there are 1 or 2 dependents, multiply 6 times the amount shown on line 6; if 3 or more dependents, multiply 7 times the amount shown on line 6

8. Maximum Allowable Annual Income (the product of line 7’s calculations)

Affidavit

State of New York, County of New York

__, (collectively) being duly sworn, deposes and says:

I (We) hereby certify to the above named Housing Development Fund Corporation that I (we) have read the above Statement of Maximum Income Allowed to Become a Member, and understand the nature thereof. I (We) have compared the Maximum Allowable Annual Income shown on line 8 above with my (our) present probable aggregate annual income. I hereby further certify that my (our) present probably annual income does not exceed the Maximum Allowable Annual Income shown above.

Sworn to before me this day of 23rd day of April, 2018

Notary Public Signature:

Instruction Sheet

Line 1 Rental – Means the HDFC’s monthly maintenance for the apartment at time of application. The appropriate amount will be provided by the HDFC.

Line 2 Utilities – This is an estimate of your monthly cost for the utilities you must pay for and which is not included in the monthly maintenance. The appropriate amount will be provided by the HDFC.

Line 5 Purchase Price – The amount of the purchase price of the coop apartment in the Contract of Sale between yourself and the Seller.

Line 7 Dependents – The number of persons except yourself for whom “Exemptions” are taken on your New York State Income Tax Return who will be occupying the apartment. If there are fewer than 3 dependents, multiply by six. If the applicant has no dependents, multiply by 6.

Line 8 Maximum Allowable Annual Income – Your “probable aggregate annual income” (defined below) cannot exceed this amount.

Probable Aggregate Annual Income. Defined in the Private Housing Finance Law, Section 2 (29), as “the total income as reported in the New York State income tax return, less such personal exemptions and deductions for medical expenses as are actually taken by the taxpayer.” In order for you to compute what this amount is for you, use the following worksheet.

(A) Total New York State reported income (on the NYS Tax Form IT-201 or IT-200) from prior year

(B) “Personal Exemptions” (the total taken on NYS Tax Forms – see “Dependents” above)

(C) “Medical and Dental Expenses” (itemized deductions from Schedule “B” of NYS Tax Forms)

(D) Total Deductions (add lines B and C)

(E) Aggregate Annual Income (subtract line D from line A)

Before signing the affidavit compare Line E of this worksheet with Line 8 of the affidavit page. Sign the affidavit only if Line E is less than Line 8.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

In this section we’ll do an example calculation based on the sample HDFC coop income limit rules from the previous section.

The first step is to establish what the HDFC building’s income limit is. Sections 1 and 2 (Estimated Monthly Rental and Utilities) are further defined in the Instruction Sheet. You’ll see that the Estimated Monthly Rental is simply the apartment’s maintenance fee at the time of application.

Cost of Utilities

The Utilities are simply the monthly cost of utility bills that you must pay which is not included in your monthly co op maintenance charges.

While you can easily do a rough estimate with information on hand, please note that these figures are to be officially provided by the HDFC building. For this example, let’s assume that the monthly maintenance is $700 and the monthly utility bills sum to $150.

Per the instructions on Line 3, you would add these two up to get $850. Line 4 asks you to multiply this figure by 12 to get $10,200. Let’s assume the purchase price is $600,000 for Line 5. So 6% of the purchase price is $36,000. Line 6 asks you to add up Lines 4 and 5 to get $46,200.

The next part is interesting. You can multiply $46,200 by 6 or 7 depending on how many dependents there are. If there are 3 or more dependents, you can multiply by 7. If there are 1 or 2 dependents, you can multiply by 6. It’s important to examine in Instruction Sheet to notice that even if you have 0 dependents, you can still multiply by 6!

Let’s assume the buyer is single and will be the only applicant and occupant. In this case, we will multiply $46,200 by 6 to get $277,200. Per Line 8, $277,200 is the Maximum Allowable Annual Income for this specific HDFC co op building!

Don’t let anyone fool you into thinking that the process of buying or selling a HDFC coop vs a regular coop is much more complicated.

Sure, the board will obviously need to be very careful around co op board approval in regards to checking that the buyer’s income is within limits. This is obvious given the severe consequences of approving buyers that do not meet the income guidelines which include the loss of special NYC real estate tax breaks for HDFC coop buildings.

HDFC Coop Buying Process

However, the process of buying a HDFC coop apartment is otherwise pretty similar to the process of buying a coop that does not have income restrictions.

You’ll still need to submit a co op board package and pass a co op board interview. Read our Complete Guide to Buying a Coop in NYC to learn much more!

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Disclosure: Hauseit® and its affiliates do not provide tax, legal, financial or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, financial or accounting advice. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided.

For the income restrictions, does HDFC measure an individual’s gross or the net income?

Hmm, I believe it’s gross income, but let me double check. I do know that it’s a 2 year look-back on your income to see if you qualify. They ask for your last 2 years’ tax returns as proof in the HDFC purchase application.

Ironically, the most successful buyers seem to be the elderly (low income, lots of assets) and students (low or no income, gifted assets from parents).

One last thing to note, you can be rejected if you have another home in the NYC metro area. Remember this is meant for primary residency / affordable housing. There’s kind of a “mileage requirement” when it comes to second homes. If you have another home let’s say a hour away, you may be disqualified. But if your second home is 3 hours away in upstate New York, you may be able to get away with it.

I am wondering how can I be qualified. You said, the HDFC board ask a 2 years income statement. But, I am a new comers from another country with employment based green card. Should I wait 2 years before been reviewed?

Maintenance + Utilities $850 x 12 = $10,2000 x6 = $61,000

6% of $600,000 = $36,000

$61,000 + $36,000 = $97,000

The maximum income allowed under Section 576 restrictions is $97,000. Certainly not $277,000.

Mitchell Hall