Evaluating condo and coop building financial statements is an extremely important part of the due diligence process before buying an apartment in NYC.

You’ll want to confirm that the building’s cash flow from operations is positive, meaning that the building has sufficient cash flow to pay for the obligations of the building. Analyzing building financial statements can also help you identify the risk of a future increase in common charges or maintenance fees beyond ordinary increases for inflation.

Table of Contents:

Building Accountant’s Opinion Letter

Do Condo and Coop Financial Statements Need to Be Audited?

The Building’s Balance Sheet

Income Statement and Cash Flow Statement

What Constitutes the Building’s Income?

Is a High Percent of Tax Deductibility for Maintenance Good?

General Guidelines for Coop Building Expense Ratios

Notes to the Financial Statement

The Accountant’s Opinion Letter at the beginning of the building financial statements is addressed to the condo or coop’s Board of Directors. You’ll want to look for key words such as “presents fairly” which is a good sign of a healthy set of financials. You won’t want to see restrictive language such as “subject to” or “except for.” Such reservations warrants greater scrutiny by you and your real estate attorney and will often lead to issues being unearthed.

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

Buildings in New York City are not required to have audited financial statements. This is fortunate for smaller buildings because audited financial statements are much more expensive to compile vs unaudited financial statements.

Audited financial statements are typically prepared by an independent, Certified Public Accountant (CPA) who has followed specific, independent confirmation and diligence procedures to verify that the information they are signing off on is accurate.

Audited financials are expensive. Because of the greater expense of getting financial statements officially audited, you would only expect to see buildings with at least 20 to 25 units pay up for audited financial statements.

If a larger building does not have audited financial statements, you should consider this to be a red flag that warrants additional scrutiny. Smaller buildings will typically have what’s called a compilation or review statements. This simply means the condo or coop board gave information to a CPA who created the financial statements without independent verification.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

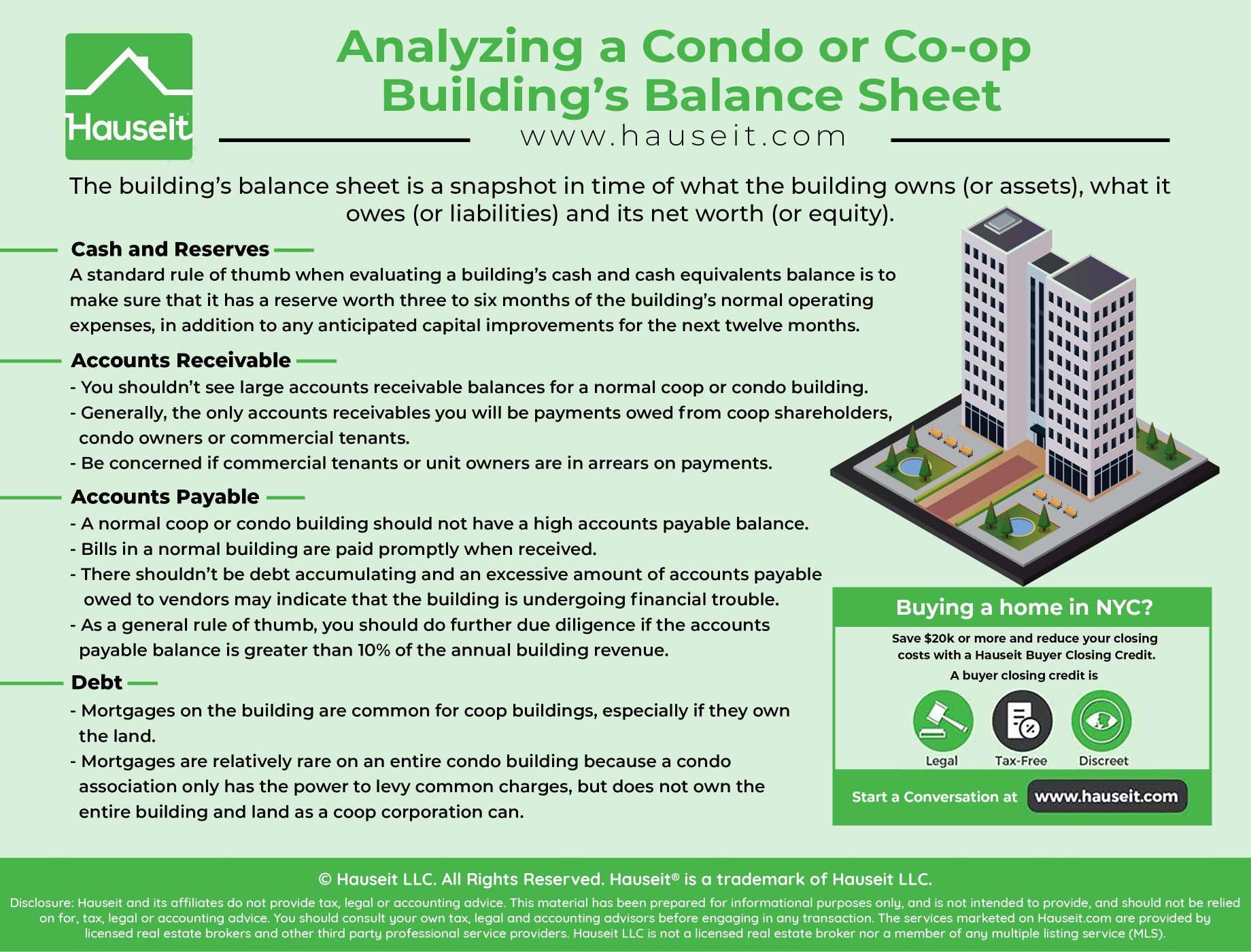

The building’s balance sheet is a snapshot in time of what the building owns (assets), what it owes (liabilities) and its net worth (equity). This snapshot is typically taken at December 31st of each year. Keep in mind that New York City’s tax year actually runs from July 1st to June 30th, and property taxes are paid quarterly.

Cash and Reserves – A standard rule of thumb when evaluating a building’s cash and cash equivalents balance is to make sure that it has a reserve worth three to six months of the building’s normal operating expenses, in addition to any anticipated capital improvements for the next twelve months.

If there is simply a plan to deal with any anticipated capital improvements over the next twelve months, such as a planned special assessment, then that works as well.

Note that some buildings will keep large cash balances in an operating account while other buildings will prefer to keep their cash reserve in investment accounts (i.e. typically safer holdings such as certificates of deposit, commercial paper or money market funds). A coop or condo board does have a fiduciary duty to keep cash in secure investments that are preferably insured, so don’t expect to see risky investments!

Accounts Receivable: You shouldn’t see large accounts receivable balances for a normal coop or condo building. Generally, the only accounts receivables you might see will be payments owed from coop shareholders, condo owners or commercial tenants. It is concerning if you do have commercial tenants or unit owners in arrears on their payments.

Any such arrears or large accounts receivable balances should be scrutinized further.

Accounts Payable: A normal coop or condo building should not have a high accounts payable balance. Bills in a normal building are paid promptly when received. There shouldn’t be debt accumulating and an excessive amount of accounts payable owed to vendors may indicate that the building is undergoing financial trouble.

As a general rule of thumb, you should do further due diligence if the accounts payable balance is greater than 10% of the annual building revenue.

Debt: Mortgages on the building are common for coop buildings, especially if they own the land. Mortgages are relatively rare on an entire condo building because a condo association only has the power to levy common charges, but does not own the entire building and land as a coop corporation can.

Mortgages on coop buildings are often five year interest only loans these days. If you see that a mortgage will expire in four or five months, then a refinancing should have been completed already. In practice, there is very little risk of a coop building not being able to refinance its mortgage.

A coop building may have to pay a higher interest rate or set aside more cash in reserves to satisfy the bank, but it typically can always refinance if it wants to. Note that the balance sheet will divide the debt balance into two sections, one reflecting the current portion and the other reflecting the long term portion.

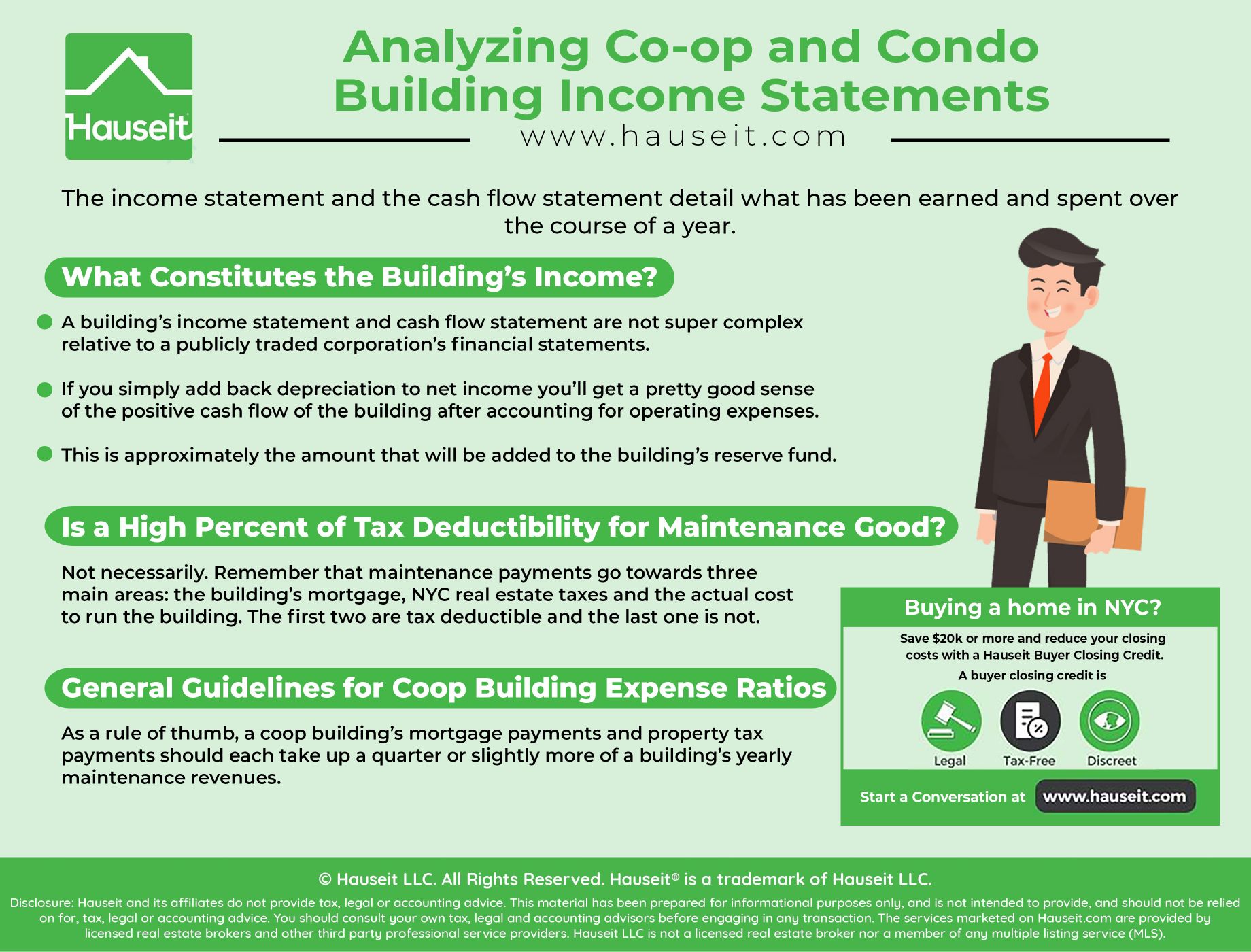

The income statement and the cash flow statement detail what has been earned and spent over the course of a year. Unlike publicly traded corporations which must come out with quarterly, audited financial statements, coops and condos generally only release financial statements anually.

It’s important to realize that unlike a for profit business corporation, a building’s aim is not to make a profit. A building would ideally like to raise just enough revenue through common charges or maintenance fees to cover its expenses and build an adequate reserve. Excess profits would be subject to income tax which would be pointless considering that the building could have just lowered monthly charges for everyone.

As a result, it’s normal to see a negative net income figure for most co op buildings. That’s because a co op building tries to only levy enough maintenance fees to cover its expenses, and because a co op building can utilize depreciation which is a non-cash expense to make its net income negative. A coop building is able to depreciate all of the common elements.

For example, if a building’s boiler has a useful life of 20 years, then a coop building can depreciate 1/20th of the cost basis every year assuming straight line depreciation.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Does it come from other sources besides the unit owners? Is there income from a commercial tenant? Fees from the laundry room? A flip tax? You’ll want to be very careful in analyzing the sources of a coop or condo building’s income and decide whether it is recurring or not. For example, a building that relies heavily on flip tax income and has on average 15 sales a year might be okay.

However, what if a building has a big flip tax but very few sales a year? In that case, just because the building had a big flip tax income last year does not mean it will be replicated going forward.

In fact, any source of income greater than 10% of the annual building revenue should be investigated.

For example, if a coop building gets more than 10% of its annual revenue from one commercial tenant, then the commercial lease should be thoroughly investigated. For example, when does the commercial lease expire?

A coop building’s income statement and cash flow statement are not super complex relative to a publicly traded corporation’s financial statements. If you simply add back depreciation to net income you’ll get a pretty good sense of the positive cash flow of the building after accounting for operating expenses. This is approximately the amount that will be added to the building’s reserve fund.

Not necessarily. Remember that maintenance payments go towards three main areas: the building’s mortgage, NYC real estate taxes and the actual cost to run the building. The first two are tax deductible and the last one is not. However, only the last part benefits your qualify of life in the building. So it’s not necessarily a good thing to have a high percentage of tax deductibility for your co-op maintenance payments.

That would mean the majority of your monthly payment is going to the bank and the government! From a 2018 Hauseit survey of real estate lawyers, the consensus is that around 60% of maintenance is deductible for the average co op building in NYC. This figure can of course vary for the same building from year to year.

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

As a rule of thumb, a coop building’s mortgage payments and property tax payments should each take up a quarter or slightly more of a building’s yearly maintenance revenues. A building’s payroll, payroll taxes and benefits should take up a quarter or slightly less of a building’s yearly maintenance revenues. Similarly, other operating expenses of the coop building should take up a quarter or slightly less of a building’s yearly maintenance income.

With that said, these shouldn’t be treated as hard and fast rules and there are plenty of excellent buildings that will vary from these guidelines.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

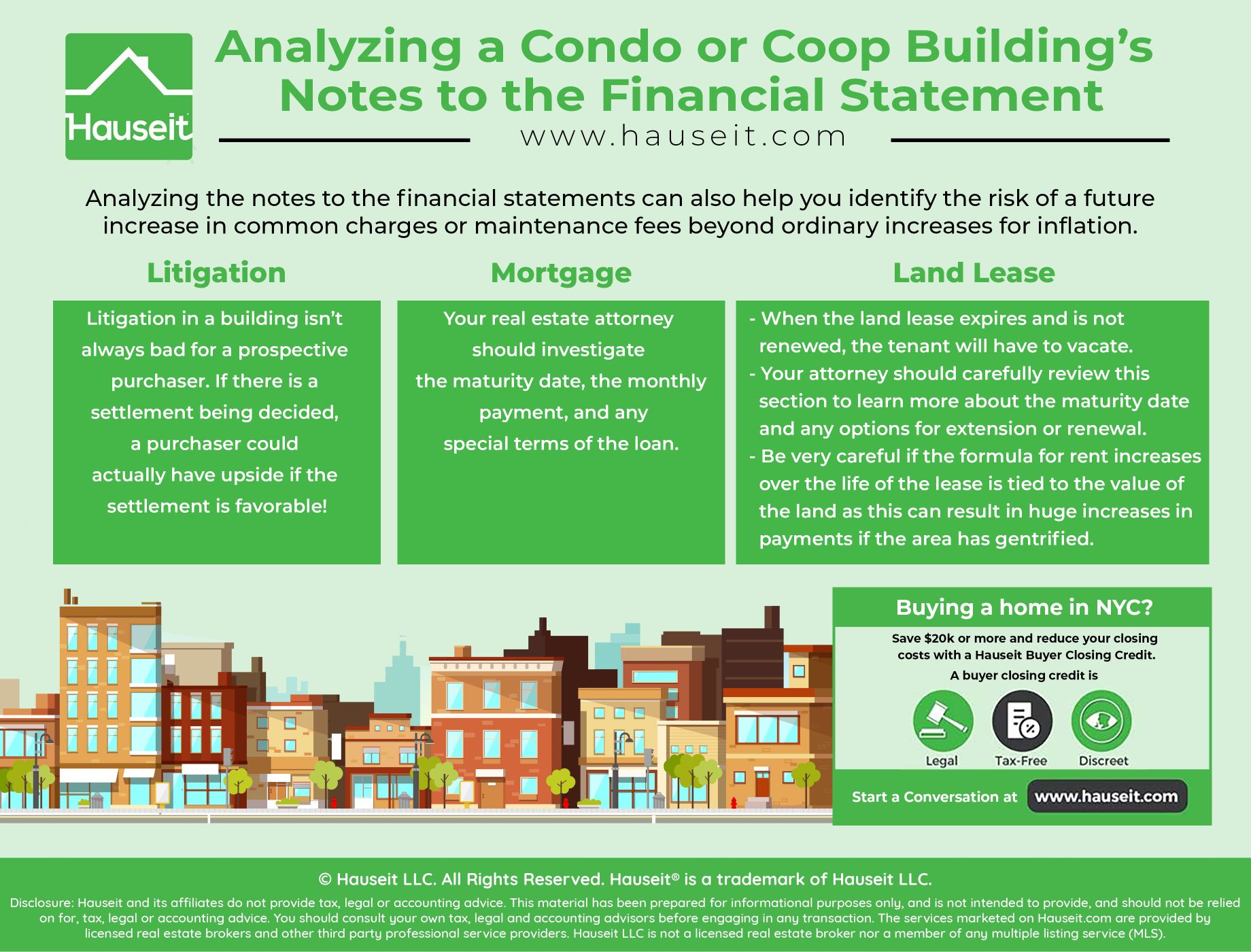

The Notes to the Financial Statement is a section that can be found at the end of the building’s annual financial statements. This section details and clarifies the information provided in the previous sections. Even though the entire section is important to read, it’s especially important to scrutinize the sections on legal issues, the building’s mortgage and the building’s land lease, if applicable.

Litigation

Litigation in a building isn’t always bad for a prospective purchaser. For example, what if the building initiated the lawsuit as the plaintiff and has already paid all expenses? If there is a settlement being decided, a purchaser could actually have upside if the settlement is favorable!

However, litigation can also be bad and most banks will need to know what’s going on with the case in order to approve a loan. For example, litigation against a sponsor for faulty construction, or the building next door suing the building for accidental damages isn’t great.

Fortunately, most of the time legal costs will be covered by the building’s various insurance policies if it is the defendant. However, if the building initiated the lawsuit and a settlement is pending, then there may be annual legal costs that can weigh down a building’s financials.

Mortgage

Your real estate attorney should investigate the maturity date, the monthly payment, and any special terms of the loan. For example, does the mortgage have a fixed or variable interest rate? Is it an interest only mortgage or are both principal and interest payments required? Interestingly enough, a lot of coop building mortgages these days are of the interest only variety, and thus similar to a term loan issued by a for profit business corporation.

You should also evaluate concentration risk within the building. For example, how many units does the sponsor still own if any? In general, banks will raise a red flag if any single entity owns more than 10% of the outstanding shares in a coop corporation.

Let’s say the sponsor still owns twelve out of twenty total units within a building. That can be an issue when it comes time for the building to refinance its mortgage. Of course, exceptions can be made and a bank would have to diligence the financial health of the sponsor or entity to minimize concentration risk.

Land Lease

Does the building own the land that it sits on? If not, then it’ll be in a similar situation to the tenant of a rental apartment unit. When the land lease expires and is not renewed, the tenant will have to vacate.

As a result, your attorney should carefully review this section to learn more about the maturity date and any options for extension or renewal. Furthermore, land leases have periodic increases in rent, either tied to some sort of inflation or consumer price index or to the value of the land. Be very careful if the formula for rent increases over the life of the lease is tied to the value of the land as this can result in huge increases in payments if the area has gentrified.

You should also diligence who the landlord is. Most real estate lawyers won’t be so concerned if the land owner is a government entity such as the Battery Park City Authority who isn’t likely to throw home owners out on the street. However, what if it’s a small building on a private land lease? Worse still, what if the land lease has only 20 years remaining and there is animosity between the land owner and the building?

In this case, you should definitely run for the hills if it seems like the land lease definitely won’t be renewed. Furthermore, banks typically won’t lend if there is less than 30 years left on a land lease!

Disclosure: Hauseit® and its affiliates do not provide tax, legal, financial or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, financial or accounting advice. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided.