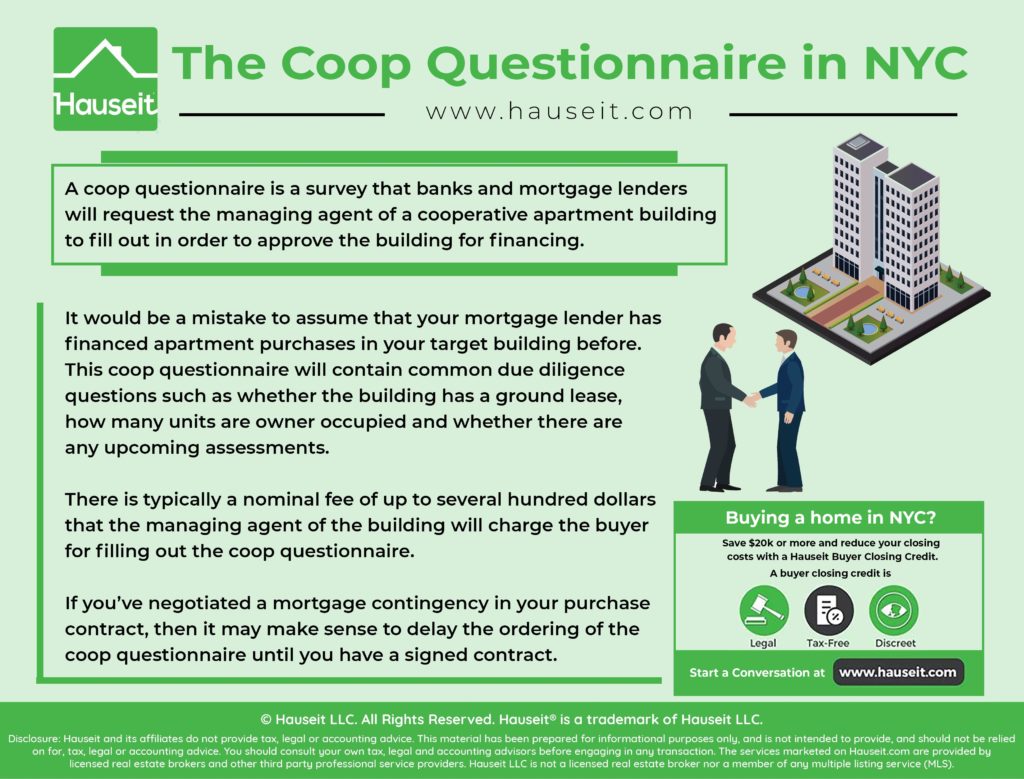

A coop questionnaire is a survey that banks and mortgage lenders will request the managing agent of a cooperative apartment building to fill out in order to approve the building for financing.

It would be a mistake to assume that your mortgage lender has financed apartment purchases in your target building before.

If they have not, then the building won’t be approved in their systems and they will need the managing agent of the building or an officer of the co-op corporation to fill out a coop questionnaire.

This coop questionnaire will contain common due diligence questions such as whether the building has a ground lease, how many units are owner occupied and whether there are any upcoming assessments.

There is typically a nominal fee of up to several hundred dollars that the managing agent of the building will charge the buyer for filling out the coop questionnaire. If you’ve negotiated a mortgage contingency in your purchase contract, then it may make sense to delay the ordering of the coop questionnaire until you have a signed contract.

Similarly, you may want to avoid further expenditures by delaying the ordering of the bank’s appraisal of the property until you have a signed contract. Otherwise, because real estate offers are not binding until both the buyer and the seller sign the contract, you may be wasting money on a deal that gets away from you!

Sample Coop Questionnaire for a NYC Co-op

Address of Cooperative:

Seller(s):

Buyers(s):

Please verify the number of shares for this unit:

Name of current holders of stock and lease:

Please confirm the monthly maintenance fee:

Have there been amendments to the offering plan:

How many amendments have there been to the offering plan:

What utilities, if any, are included in the monthly maintenance:

Amount and tenor of current assessments, if any:

Amount and tenor of upcoming assessments, if any:

Type of tax abatement the building currently receives, if any:

Did the seller qualify for the abatement:

If the seller didn’t qualify, how much was the seller charged last cycle as non-qualifying shareholders:

Amount of flip tax and who pays it (seller or buyer), if any:

In which year was the building built:

How many floors does the building have:

How many units are in the building:

How much are transfer fees due at or prior to closing:

Is storage available in the building:

Is parking available and is there a waiting list:

Is bicycle storage available in the building:

Is this a non-smoking building:

– If yes, are individual units non-smoking:

– If yes, are there any smoking areas in the building:

What are the restrictions on moving (i.e. Monday through Friday, 9am to 5pm):

When does the proprietary lease expire:

Has the proprietary lease been renewed:

Is this a landmark building:

Does this building have lot line windows:

– If yes, which windows are lot line windows:

Have the house rules been modified since the offering plan?

– If so, when was the most recent modification?

What is the sublet policy?

What is the building’s pet policy?

Are pied a terres allowed?

Are parents allowed to buy for children?

Is gifting allowed?

Is purchasing in a trust allowed and what are the requirements for doing so:

Is purchasing under a LLC allowed and what are the requirements for doing so:

What is the current operating account balance:

What is the current reserve account balance:

Have there been any bed bug infestations in the past 12 months:

– If yes, which floors:

– If yes, has the problem been eradicated:

Does this building have a land lease and when does it expire:

Is there any threatened or pending litigation against the building:

What is the owner occupancy ratio:

How many units are subleased:

How many are sponsor owned units:

How many commercial units are there, if any:

What is the maximum amount of financing allowed:

Have building wide improvements been made to the following? If yes, please describe when and what improvement was made:

– Roof:

– Boiler:

– Plumbing:

– Electric:

– Lobby:

– Elevator:

– Gas to electric conversion:

Is there any upcoming worked planned? If so, please indicate if the costs are known, a contract is in place, if an assessment will be issued, and how the work will be paid for:

Is there a Certificate of Occupancy for the subject unit:

Is there a valid unexpired Temporary Certificate of Occupancy for the subject unit:

Are there any DOB and/or HPD violations against this unit, another unit in the building or the building itself? If so, please explain:

What is the status of Local Law 11:

– When were Cycles 7 and 8 completed:

How often is the building treated for pest control:

Please indicate if you are aware of any of the following in the building:

– Mold:

– Leaks:

– Noise complaints:

– Odor complaints:

– Neighbor complaints:

– Security issues:

– Rodent issues:

How often does the board meet to review co-op purchase applications:

Is there a live-in superintendent in the building:

Is this building in a flood zone:

Preparer’s name and title:

Signature and date signed:

Please forward a copy of the Certificate of Insurance for the building

Please forward a copy of the co-op purchase application

Please forward a copy of the current year and previous year’s building budgets

Please forward a copy of the 2 most recent years of the co-op’s financial statements

Please forward a copy of the sublet application, if applicable

Please forward a copy of the alteration agreement

Please forward a copy of the most recent co-op tax deduction letter

Please forward a copy of the unit’s floorplan

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

Disclosure: Hauseit® and its affiliates do not provide tax, legal, financial or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, financial or accounting advice. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided.

The attorney questionnaire is a great way to get some direct answers if the board meeting minutes are overly succinct or vague. Remember however, the co-op board is not required to answer any or all of your questions, or to do anything to divulge sensitive information.

Even the information disclosed in the coop board meeting minutes is a pure courtesy, particularly in high end co-ops where privacy is paramount.

But generally, in my years of experience, my questionnaires have usually been answered. The golden rule when dealing with managing agents during due diligence is to be diplomatic and have a good attitude!