A NYC co-op board may legally reject a buyer because the contemplated sale price is deemed to be too low. While a co-op board doesn’t have the unconditional right to regulate sale prices, courts have typically upheld a board’s right to reject a buyer under the “business judgment rule” when the contemplated sale price was significantly below fair market value.

Technically, a co-op which rejects a transaction with a below-market price is exercising sound business judgment because the board’s action is preventing other units in the building from being devalued.

That being said, a co-op does not have the right to impose an unreasonable restraint on an owner’s ability to sell a unit by taking extreme measures such as setting the sale price or requiring that a unit be sold at a price which is above fair market value.

Fortunately, there’s an easy workaround if you suspect that the co-op board may reject a deal due to the sale price. This strategy involves amending the contract itself to reflect a higher sale price while keeping the underlying economics based on the originally agreed upon price. Click on the sections below to learn more.

Estimate your buyer closing costs in NYC using Hauseit’s interactive calculator, and consider requesting a Hauseit Buyer Closing Credit to reduce your closing costs and save money on your purchase.

Please also refer to Hauseit’s NYC Buyer’s Guide for a comprehensive overview of the home buying process in NYC from start to finish as well as Hauseit’s separate guide to submitting an offer on a NYC co-op.

A common workaround to avoid a board rejection based on a ‘low’ sales price is for the buyer and seller to draft a contract with a higher price which is more acceptable to the co-op. Upon closing, the seller agrees to credit the buyer in the amount by which the contract price was increased.

Let’s say the true price agreed between buyer and seller is $2,600,000.

In order to appease the board’s expectation of a higher sale price, the contract reads $3,500,000. The seller agrees to give a $900,000 credit to the buyer upon closing. Aside from closing cost implications, this results in identical economics for the buyer and seller while satisfying the co-op board’s demands for a higher recorded sale price.

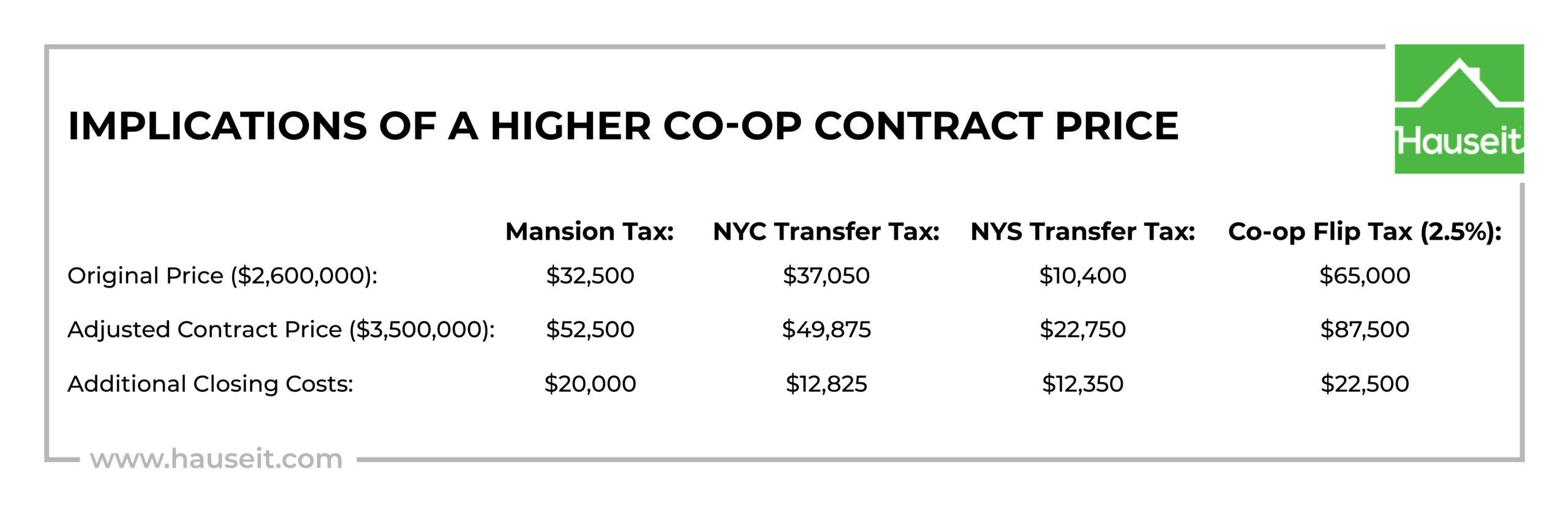

As we’ve hinted, the primary drawback with this approach is that the inflated contract price results in higher closing costs. Specifically, the following closing costs are higher since they’re directly linked to the contract price:

-

Mansion Tax

-

NYC & NYS Transfer Taxes

-

Co-op Flip Tax

Here is an example of the additional closing cost implications for a co-op sale with an actual sale price of $2,600,000 but a higher ‘contract price’ of $3,500,000 in order to appease the co-op board: