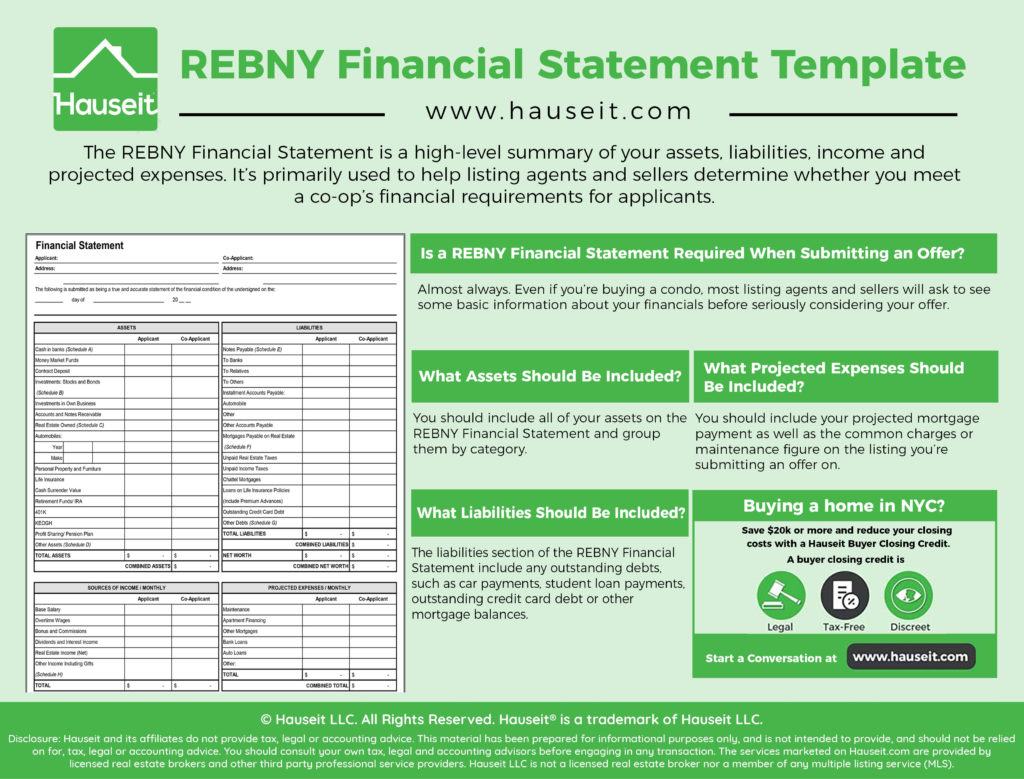

The REBNY Financial Statement is almost always required when submitting an offer on a co-op apartment in NYC. The REBNY Financial Statement is a high-level summary of your assets, liabilities, income and projected expenses.

Submitting a REBNY Financial Statement along with your other offer documentation allows the listing agent and seller to ascertain whether you meet the co-op’s financial requirements. These financial requirements usually consist of the debt-to-income ratio and post-closing liquidity.

Table of Contents:

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

A REBNY Financial Statement provides an overview of your assets, liabilities, income and projected expenses. The purpose of the REBNY Financial Statement is to allow a listing agent and a seller to determine whether you meet the co-op board’s financial requirements for applicants.

Completing a REBNY Financial Statement is actually beneficial to you as a buyer, as it will also allow you to make sure that your finances won’t give the co-op board an automatic reason to reject you.

A REBNY Financial Statement provides an overview of your assets, liabilities, income and projected expenses. The purpose of the REBNY Financial Statement is to allow a listing agent and a seller to determine whether you meet the co-op board’s financial requirements for applicants.

This is an obvious red flag, as it means that the listing agent may not know very much about the co-op’s rules, policies and financial requirements. A board rejection harms everyone, including the buyer, seller and the agents, so it’s in your own best interest to complete and submit a REBNY Financial Statement along with your offer.

Once you’re in contract on a co-op, you’ll be asked to submit a more formal Financial Statement along with your co-op purchase application. In the remote instance you’re asked to prepare a post-closing Financial Statement, you can download a template and view instructions here.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Almost always. Even if you’re buying a condo, most listing agents and sellers will ask to see some basic information about your financials before seriously considering your offer. Many listing agents for both condos and co-ops will ask you to complete a submit offer form, which is a slightly less detailed financial statement compared to the REBNY Financial Statement.

Most condo buildings in NYC will also require you to complete a purchase application before you’re permitted to close. Therefore, you’ll have a very difficult time buying a condo or co-op apartment in NYC if you’re evasive and not willing to disclose financial information. If you aren’t willing to reveal anything, your only option realistically is to buy a townhouse or a freestanding house.

The main difference between the submit offer form and the REBNY Financial Statement is that the latter has an additional schedule which asks you to group and itemize your assets and liabilities. For example, you’d be asked to break down your $100k cash balance based on each account, like this: Chase – $25k, Bank of America – $55k, Capital One – $30k.

You should include all of your assets on the REBNY Financial Statement and group them by category on the first tab, such as: Cash, 401K, Stocks and Bonds and Real Estate. On the second tab, you should show an itemized breakdown of the assets based on where they’re located.

For example, let’s say you have $250k of Stocks and Bonds in two brokerage accounts. Under “Schedule B: Itemized Schedule of Stocks and Bonds,” you would specify: TD Ameritrade – $175k, Merrill Lynch – $75k.

If you own other real estate, you would specify the address on “C: Itemized Schedule of Real Estate.” It’s especially important to include the loan balance, monthly mortgage payment and carrying costs (common charge, taxes, etc.), the amount of rent you receive and the maturity date of any lease you may have with a tenant.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

The liabilities section of the REBNY Financial Statement asks you to include any outstanding debts, such as car payments, student loan payments, outstanding credit card debt or other mortgage balances.

If you pay off your credit card balances each month, it’s usually not necessary for you to include any balances on the REBNY Statement since they’re temporary.

You should include your projected mortgage payment as well as the common charges or maintenance figure on the listing you’re submitting an offer on. If you are applying with a significant other, you can divide the mortgage and maintenance figures equally between each other.

Projected expenses are meant to be forward looking and be reflective of your apartment purchase, as this will the listing agent and seller to forecast your debt-to-income ratio.

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

To download a REBNY Financial Statement Template in Excel format, click here.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

To download a REBNY Financial Statement Template in PDF format, click here.

Published: 10/29/18 | Last Updated: January 24th, 2020

Disclosure: Hauseit® and its affiliates do not provide tax, legal, financial or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, financial or accounting advice. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided.