Congratulations on getting a signed contract for the sale of your home! Sellers often wonder what they should be doing during the contract to closing process, especially since much of the work during this time is on the buyer’s side.

The following seller closing checklist takes New York home sellers through the entire process, from clearing up any liens or violations, finding original ownership documents to what to bring on closing day. Skip to any section below using our table of contents, and leave us a comment below if you have any questions!

Table of Contents

Clear up any liens, judgments or violations

Make any repairs that the contract is contingent on

Find original ownership documents

Schedule the appraisal

Review the purchase application

Schedule the board interview

Schedule a closing date

Transfer or close utility accounts

Prepare for your move-out

Conduct the final walk-through

Bring the necessities to closing

Buyer’s attorneys will typically run a title search or a co-op lien search during the due diligence phase, before signing a contract, to determine whether there are any outstanding liens, judgments or violations. If any are found, most buyers will balk at going through with the purchase, and most buyer’s attorneys will recommend that the issues be cleared up first before proceeding.

However, in the case that the purchaser decides to proceed anyway, the buyer’s attorney will ensure that the contract not only stipulates that the property must be delivered free and clear of title, but also free and clear of any liens, judgments or violations that have been found.

Request a payoff statement for each lien or encumbrance on your property, including mechanic’s liens, tax liens and any other claims.

For example, if there’s an outstanding mechanic’s lien on your property from an unresolved dispute with your plumber, then now is the time to settle the claim. Either negotiate a discount or simply pay what is owed.

In a similar vein, you may have already gone to small claims court, lost and now have a judgment against your property. Since judgments may not be appealed, now is the time to pay the judgment and move on.

The same logic applies to any violations your home might have from the NYC Department of Buildings. Hire an expediter if need be to speed up the process of clearing up the violation.

Remember, liens and judgments can be cleared up prior to or at closing; however, buyers will generally expect and appreciate these items to be dealt with before the 11th hour.

Violations on the other hand generally need to be cleared up prior to closing, as not only might they take time, but because clearing a violation might not strictly be related to the flow of funds on closing day.

Request a payoff statement from the bank if you have a mortgage

Now is the time to also request a payoff statement from your bank if you still have an outstanding mortgage on your property. After all, your lender has perhaps the most senior lien possible, and this lien will need to be paid off at closing.

Some banks will allow you to download a payoff statement automatically from your account online. If this isn’t an option, ask your mortgage broker or bank for the payoff statement and give them a heads up that you’re selling your place. Once you get the payoff statement, hand it to your attorney.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

In New York as in many other states, homes are typically sold as is, meaning that the seller will not have to make any repairs to the property as a condition of the sale.

However, everything is negotiable, and it is conceivable in a buyer’s market that a desperate seller will agree to make repairs or even upgrades as a condition in the purchase contract.

Therefore, in the event that you have agreed to make contractual repairs prior to closing, it’s important to get multiple quotes from contractors as soon as possible.

There’s a saying that renovations always take twice as long and cost twice as much as you’re initially quoted in New York.

Repairs and fixes are common in new construction sales

It’s important to point out that while selling property “as is” is the norm when it comes to re-sales, new development sales are entirely different. In a new construction sale, defects are generally expected, and it’s customary for buyers to develop a punch-list of repairs that they wish to be done before or shortly after closing.

Once you’re in contract, you’ll need to start gathering up your original ownership documents which you’ll need at closing.

For condos and houses, this means the original deed. For co-ops, this means the original stock certificate which states how many co-op shares you own as well as the original proprietary lease.

At closing, the deed will be transferred to the new owner, and in the case of co-ops, the managing agent will cancel the old stock and lease and re-issue a new stock and lease dated as of the closing date to the buyer.

If you have a mortgage, your lender may have your original deed or stock and lease as collateral, and they’ll bring it to closing.

If you’ve lost your original ownership documents, then the closing may be delayed and additional costs may be incurred.

For example, if you own your co-op apartment outright but you’ve lost your original stock and lease, then the managing agent may require you to indemnify them with a co-op title insurance policy.

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

Assuming that the buyer is financing the purchase, then you as the seller will need to coordinate a visit from an appraiser sent by the bank.

Typically, the bank’s appraiser will reach out to the buyer’s agent or the listing agent to schedule a visit, and you’ll ultimately be contacted by your agent to figure out a time that works.

A good tip is to spend a little time figuring out some comparable sales or listings in your building or neighborhood and have them ready to present to the appraiser when he or she arrives.

The appraiser will still made an independent judgement, but any appraiser generally will not decline the free work you’ve done on his or her behalf.

The benefit of spending a little time on this is that you mitigate the risk that the appraiser misses a favorable comparable sale that you otherwise would have found.

Depending on whether your buyer has appraisal contingency language in the contract, a low appraisal can allow the buyer to back out.

Remember that the financing contingency that buyers’ agents ask for on behalf of their clients in offer emails is often a blanket term for a mortgage contingency that can be additionally negotiated to include an appraisal contingency, a minimum loan amount contingency etc.

Since the financing contingency is the most common home buying contingency utilized in transactions in NYC, you should double check with your lawyer whether the buyer has appraisal contingency language included.

If so, this step is critically important as a low appraisal price (i.e. anything below the contract price) will allow the buyer to cancel the contract and walk away with his or her deposit.

If that happens, you’re back to the negotiating table and you might become the proverbial desperate seller who will do anything to make the buyer come back, which usually means a substantial reduction of the contract purchase price.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Review the purchase application

Typically, the listing agent (or FSBO seller) will review the buyer’s purchase application before it is submitted to the managing agent. The managing agent then checks the purchase application package for completeness and then forwards it on to the building’s board of directors for review.

Why not simply allow the buyer or buyer’s agent to submit the purchase application directly to the managing agent? Well, any missing information or required documentation will cause the managing agent to reject the application, which causes more delays and a new submission.

Since the success of the deal hinges on a complete application that is submitted in a timely manner, it’s in the interests of both sides to review the application for completeness before submission.

This is especially relevant in the case of a direct buyer who may not understand how important all of this is for a successful deal.

Direct buyers may have a cavalier attitude towards the purchase application and not bother following the applications instructions and requirements to the letter, or may simply not bother paying any attention to detail.

This can be especially dangerous in the case of a co-op, as coop board approval should by no means be taken for granted.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Schedule the board interview

If you’re selling a co-op apartment, then you’ll need to prepare the buyer for the board interview after the board has reviewed the buyer’s purchase application and granted the buyer an opportunity to interview.

The board does not need to grant an interview and can reject the prospective buyer purely based on what was submitted in the co-op board package.

At this stage, the board has already reviewed the buyer’s financials, personal and professional reference letters and supporting documentation and has essentially preliminarily approved the buyer, subject to an interview.

If the board wants to meet, then you can assume that the board at least approves of the buyer’s financial qualifications.

Most of the time, the co-op board interview will simply be a meet and greet to determine whether the person that shows up matches the rosy profile presented in the purchase application. Furthermore, since you will be neighbors if approved, the board will want to make sure you’re a reasonable human being and not a crazy person.

Sometimes, the board will grant a conditional co-op board approval if they feel that the buyer’s finances are “on the edge” in terms of meeting the building’s coop financial requirements.

The co-op board has the power to reject purchasers

It’s important for you as the seller or listing agent to take this stage seriously, and to instill a sense of seriousness in the buyer because co-op boards have a right to reject prospective buyers for any reason whatsoever, without ever having to disclose the reason for rejection.

Therefore, it’s entirely possible for a co-op board to find no fault with the purchase application, invite the applicant for an interview, but then to reject the applicant post-interview simply because the board didn’t like the buyer.

Schedule a closing date

Once your attorney or the buyer’s agent has informed you that the buyer has received a mortgage commitment letter from the bank, then it’s time for all parties to coordinate and schedule a closing date.

Remember that most contracts will have “on or about” date language, which means that either party has 30 days of wiggle room to deviate from the originally anticipated closing date.

This can be extremely important if either party wants to delay the closing date for whatever reason, unforeseen or not.

For example, the buyer might have a lease that ends at a specific time, and might want to push the closing date 30 days back to line up his or her schedule better. Or perhaps the seller wants to adjust the closing date because he or she is buying or selling a house at the same time.

In terms of actual mechanics, you can leave it up to the attorneys representing both the buyer and seller to reply all in an email chain to figure out a mutually agreeable closing date and time.

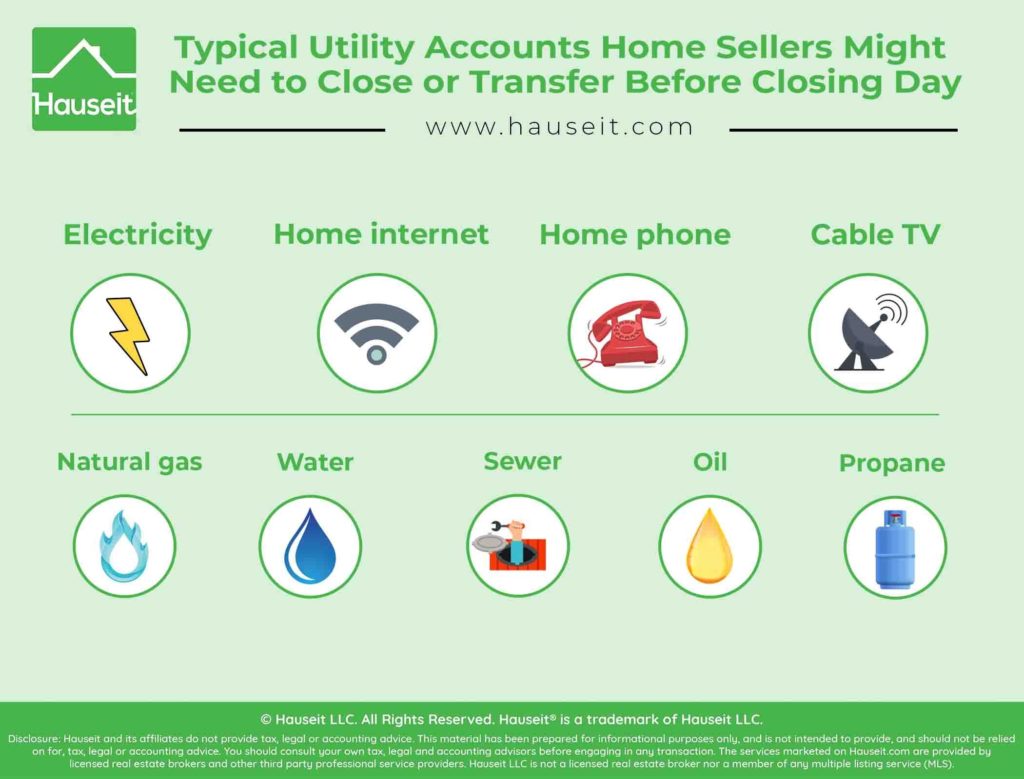

Transfer or close utility accounts

Contact utility companies and notify them of your pending sale, and arrange for a shut-off of services as of your closing date if possible. If you receive a final bill, pay it and bring it to closing as proof that you’re current on utility bills as of the closing date, or if you’ve paid in advance for part of the month on behalf of the buyer.

On the day of the closing, you may wish to physically shut off any utility valves yourself before closing to doubly ensure that no utilities are being used somehow.

If you plan to move out early or have already moved out, notify utility companies of the final service date and keep a record.

If you want, you can also arrange to transfer utility accounts to the buyer, but this may take more work and accounting.

Typical utility accounts that you might forget about:

-

Electricity

-

Home internet (i.e. WiFi)

-

Home phone

-

Cable TV

-

Natural gas

-

Water

-

Sewer

-

Oil

-

Propane

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

Prepare for your move-out

As closing day nears, it’s important to start organizing your move-out and packing up all of your belongings. Remember to not leave anything behind, which means you should double-check and go through all of your drawers, closets and storage areas. Have your spouse or a friend go through your home one more time to spot check for anything you might have left behind.

Here is a seller closing checklist and some additional things to think about in preparation for your move-out:

-

Get quotes from moving companies and schedule a move-out date

-

Cancel any newspaper subscriptions, meal delivery subscriptions etc.

-

Set-up mail forwarding with the USPS to your new address

-

Notify friends, family members and other relevant parties about your address change

-

As a courtesy, find and leave any appliance warranties, manuals and receipts

-

Cancel your home insurance policy

Remember any specific inclusions or exclusions that might have been agreed upon, such as chandeliers, curtains, blinds etc.

As a rule of thumb, if no inclusions or exclusions were specified, then what usually stays with the home is everything that is fixed in place, plus the standard appliances (i.e. refrigerator, stove, dishwasher).

A great way to visualize this is to pretend that you’ve cut the roof off of the apartment and flipped it upside down. Everything that falls out goes with you, and everything that is stuck stays with the apartment.

So this means any furniture that isn’t affixed to the property like chairs and couches go with you, while items that are fixed to the property like built-in bookshelves will stay with the property when it sells.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

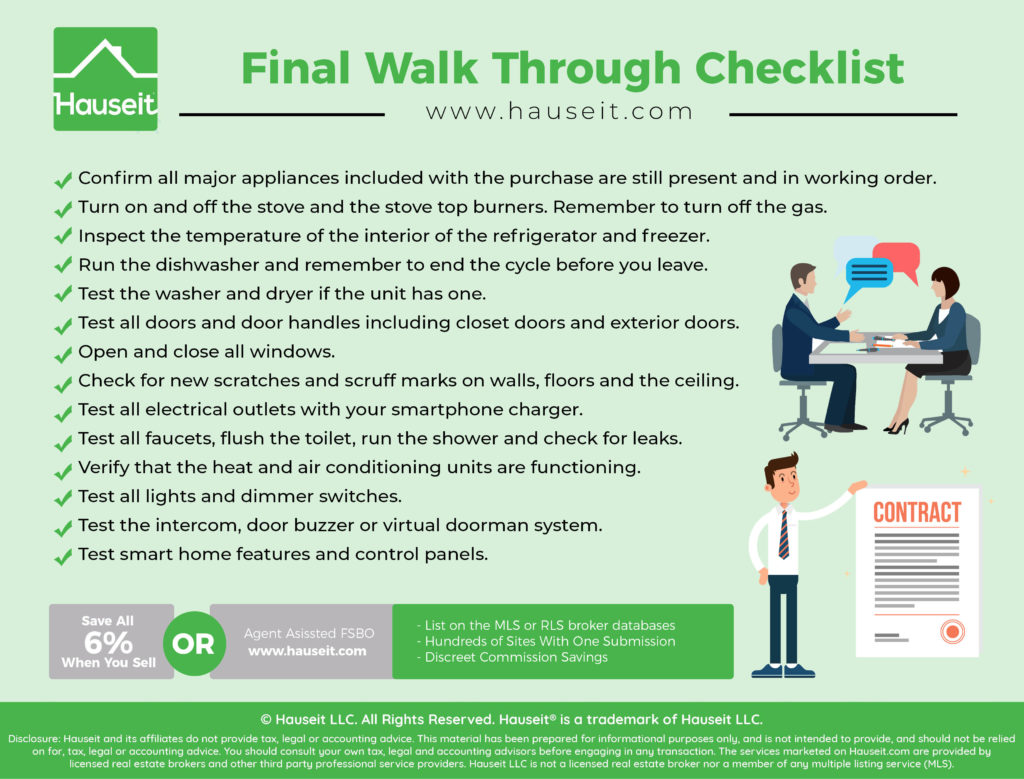

Conduct the final walk-through

The final walk-through is typically done a day or so before closing, or sometimes even a few hours before the closing on the same day.

The final walkthrough is an opportunity for the buyer to inspect the home once more before closing, to make sure that nothing about the property has changed technically since the execution of the purchase contract.

A savvy buyer might have photographic evidence from a viewing closer to the contract signing date in case the condition of the home has deteriorated in the interim.

Common reasons for why a home might have been damaged since contract signing are accidents (i.e. water leaks) or clumsy movers (i.e. movers scuffed up the walls when moving furniture).

If new damage since the date the contract was signed is detected and can be proved, then the seller must fix these issues before closing can happen.

In terms of mechanics, the final walk-through is typically scheduled between the seller’s agent and buyer’s agent, and usually the listing agent (or FSBO seller), buyer and buyer’s agent will be present at a final walkthrough.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Bring the necessities to closing

On closing day, you’ll need to bring the following necessities and essential items to the closing table:

-

All keys including front door, gate, mailbox and lobby keys

-

Garage door openers or remotes for anything you’re leaving behind

-

Current door security codes, if applicable

-

Photo IDs of all sellers

-

A personal checkbook

-

Your social security number and new address

-

The original deed for condos and houses

-

The original stock and lease for co-ops

If you’re selling a co-op, make sure either you (if you don’t have a loan) or your bank (if you have a loan) has your original stock certificate and proprietary lease.

If you have a loan, then the bank probably has your original documents in a vault somewhere. If the lender somehow loses your stock & lease, then some managing agents of co-ops will accept a Lost Stock and Lease Affidavit.

However, if you don’t have a loan and you yourself lose your original stock & lease, then your managing agent will want to be covered by title insurance, and you’ll have to pay for a Eagle 9 policy or some equivalent. Since the Eagle 9 policy covers this very narrow scenario (i.e. someone comes with the original stock & lease and tries to dispute ownership, blame the managing agent etc.), it’s a fraction of the price of a regular title insurance policy.

The most common scenarios for seeing this additional, Eagle 9 policy issued is for foreclosures, estate sales or when the seller simply lost the stock & lease.