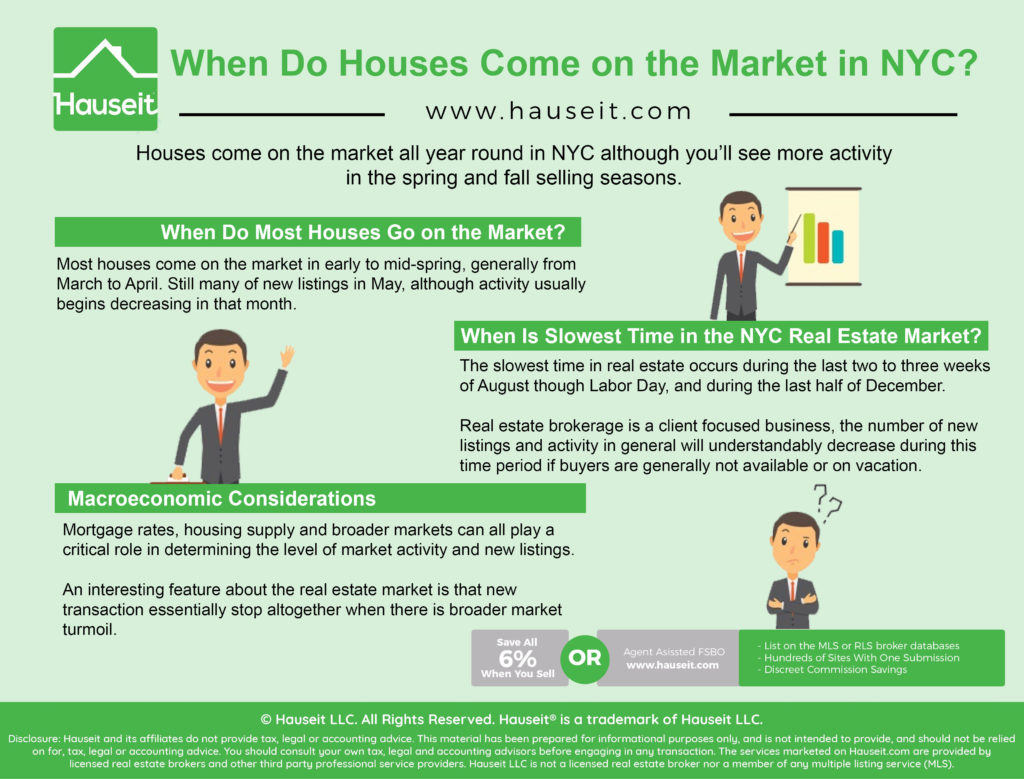

Houses come on the market all year round in NYC although you’ll see more activity in the spring and fall selling seasons.

The luxury segment of the market slows down significantly during the late summer and winter months in NYC and the seasonal rhythms of the real estate market can be severely affected by hiccups in broader markets.

Table of Contents:

Most houses come on the market in early to mid-spring in NYC, generally from March to April. You will still see plenty of new listings in May, although activity usually begins decreasing in that month.

You’ll typically see a more pronounced drop in activity on and after Memorial Day in late May because many New Yorkers will have summer houses in the Hamptons or just be out of town on the weekends.

This effect is especially pronounced for luxury listings, and even listings for more than $4 million or $5 million dollars. Even at this rather modest price range for New York City, many potential buyers will be escaping the city on the weekends, if not altogether for the summer.

The Memorial Day effect is less pronounced for more modestly priced properties, such as those costing less than $1 million or even $2 million.

For this more affordable segment of the market, the pace of new listings and buyer activity remains relative constant post Memorial Day through June and parts of July.

We’ll discuss in the next section what happens in July and August when NYC can become unbearably hot and activity slows to a crawl.

It’s important to note that autumn is an important selling season as well, even if it’s not as popular of a time as spring to list a home in NYC.

Activity usually picks back up post Labor Day in early September, and hums along at a steady pace until Thanksgiving in late November.

Once you get into December, there’s a noticeable decrease in activity which becomes especially pronounced towards the latter half of the month. We’ll discuss this slowdown in more detail in the next section.

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

The slowest time in NYC real estate occurs during the last two to three weeks of August through Labor Day, and during the last half of December.

The last two or three weeks of August are a notoriously slow period for many industries, including the finance industry which is a major part of the economy in New York City.

Furthermore, Europeans are known to take the entire month of August off which further reinforces the global slowdown that occurs during this period.

New York can get unpleasantly hot during the summers, and it’s tough to get both agents and buyers out to see properties when their shirt will become soaked through with sweat.

NYC suffers from the concrete effect, meaning the large amount of pavement and concrete present in the city absorbs sunlight and heat instead of reflecting or dissipating it.

As a result, NYC becomes dramatically hotter than the surrounding countryside.

Embarrassingly enough, the subway system in NYC is quite dilapidated and outdated for such a supposed world class city. Many of the subway stations and even subway trains do not have air conditioning, so you can imagine how hot and sweaty it can get underground if you need to take the subway to a showing!

Similarly, business slows to a crawl in NYC real estate during the last half of December and doesn’t really begin to pick back up after the first week of January.

This is quite reasonable considering that this time period is generally accepted worldwide, even by non-religious populations, as a time for vacation and to be with family.

New York can also get quite cold during the winter, and many New Yorkers will be gone during this time period and wintering in warmer havens such as the Caribbean or South America.

For some weird reasons, New York’s winters oscillate between rather mild to as cold as Siberia. You truly never know what you’re going to get in NYC.

Since real estate brokerage is a client focused business, the number of new listings and activity in general will understandably decrease during this time period if buyers are generally not available or on vacation.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Mortgage rates, housing supply and broader markets can all play a critical role in determining the level of market activity and new listings in NYC.

Any of these factors can slow a normally busy spring selling season to a crawl, or turn a slow summer market red hot.

For example, even though it’s late October as of this writing which would normally mean a robust real estate market in NYC, the market has slowed to a crawl because of macroeconomic concerns and a correction in equity markets.

An interesting feature about the real estate market is that new transactions essentially stop altogether when there is broader market turmoil.

Sure, deals that are already in contract will likely go through, unless the buyer or the seller tries to find some way out.

However, new deals stop being made if world equity markets take a nosedive.

If world equity markets experience a significant hiccup, buyers may see the value of their down payments decline significantly if they were still invested and hadn’t liquidated any stock and bond holdings yet in anticipation of signing a purchase contract.

Buyers essentially freeze when broader markets melt down. No one wants to suddenly be able to afford less because of market vagaries, and most buyers by default will want to wait until they can recoup their losses.

Furthermore, a variety of different buying opportunities in more liquid markets open up during a broader market decline.

All of a sudden, it may not be so interesting for a buyer to earn a 3% cap rate on a Manhattan condo when he or she could earn that in just the dividend yield of liquid large capitalization stock. It’s times like these when buyers really start to analyze the pros of investing in NYC real estate vs stocks.

Disclosure: Hauseit® and its affiliates do not provide tax, legal, financial or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, financial or accounting advice. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided.