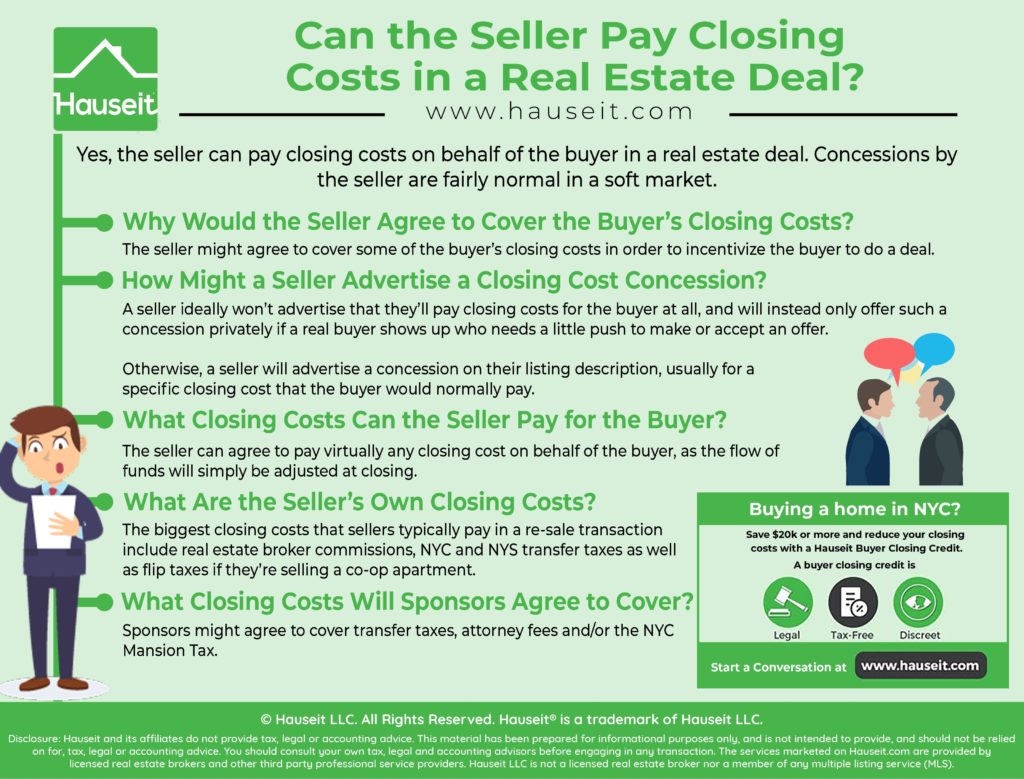

Yes, the seller can pay closing costs on behalf of the buyer in a real estate deal. Concessions by the seller are fairly normal in a soft market. Sellers may advertise a closing cost concession on their listing description, though more frequently sellers will only offer concessions privately to serious buyers who need a little push.

Table of Contents:

The seller might agree to cover some of the buyer’s closing costs in order to incentivize the buyer to do a deal.

In a slow market, otherwise known as a buyer’s market, the seller won’t have a lot of options to choose from.

Buyers will be scarce and will know that they have negotiating leverage.

No one likes or wants to cover the other party’s closing costs, but if the seller desperately needs to sell in a slow market, then he or she may not have much choice but to offer either a lower price or a closing cost concession to entice a buyer to consummate a deal.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

A seller ideally won’t advertise that they’ll pay closing costs for the buyer at all, and will instead only offer such a concession privately if a real buyer shows up who needs a little push to make or accept an offer.

The advantage of offering such a concession privately is that the seller won’t be bound to offer the same deal to everyone by default.

For example, what if the market improves later or if a foreign all cash buyer unexpectedly shows up willing to pay the full asking price? The seller obviously doesn’t want to lose the option value of getting their full listing price without any concessions.

This same logic applies to Hauseit’s partner brokers who refuse to openly discount their services. Why would they agree to permanently haircut and stifle their earnings opportunity by becoming a discount broker? Some of our partner brokerages are quite large, well known real estate brokerages with many agents.

Why would they agree to haircut commissions across the board when many of their agents get referrals for full commission? This is why our partner brokerages would never agree to convert to discount brokerages, especially since their top agents would never agree to such a proposition.

Fortunately for consumers, our highly rated partner brokerages are happy to take on additional business, even for discounted commissions, through Hauseit because our service protects their anonymity, reputation and future earnings potential. After all, which broker couldn’t use some more business, especially if it doesn’t sacrifice their ability to continue operating as normal?

The seller can agree to pay virtually any closing cost on behalf of the buyer, as the flow of funds will simply be adjusted at closing. With that said, it’s most common for the seller to agree to pay for specific, and often major components of the buyer’s closing costs.

For example, the biggest closing costs that a buyer might face in a typical resale transaction include the NYC Mansion Tax, the Mortgage Recording Tax and title insurance premiums. Other closing costs will be more minor, and can be estimated using our handy Closing Cost Calculator for Buyers in NYC.

Keep in mind that sellers will prefer to cover closing costs on behalf of the buyer that are predictable, such as the Mansion Tax which ranges from 1% to 3.9% of the transaction price for deals valued at $1 million or more. Before the legislative changes in New York in 2019, the Mansion Tax used to be a flat 1% on anything that closed at or above $1 million in consideration.

Sellers will be more hesitant to offer to cover closing costs that are unpredictable, such as the Mortgage Recording Tax which only applies if the buyer is financing with a mortgage and will vary depending on the mortgage loan amount.

In a similar vein, sellers may be hesitant to cover the buyer’s title insurance premiums because the cost of title insurance is quite complicated to calculate and will also vary depending on whether the buyer is utilizing financing.

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

While the seller can pick and choose what closing costs to offer to pay on behalf of the buyer, the seller will have closing costs of their own that are non-negotiable.

The biggest closing costs that sellers typically pay in a re-sale transaction include real estate broker commissions, NYC and NYS transfer taxes as well as flip taxes if they’re selling a co-op apartment.

The typical real estate commission in NYC is 6% of the sale price, payable by the seller. This commission is typically split equally between a buyer’s agent and the seller’s agent. If the buyer does not have an agent, the seller’s agent typically lucks out and receives the entire commission.

Combined NYC and New York State transfer taxes equal 1.825% of the sale price for deals above $500,000 and 2.075% for deals above $3 million and is typically paid by the seller in a re-sale transaction. For deals at or below $500,000 the combined rate is 1.4% of the transaction price.

Flip taxes are most commonly seen in co-op buildings, and are a tax levied against the seller to discourage speculative investments, i.e. flipping and also to build up the building’s capital reserves. Flip taxes will vary by building, and are often higher for HDFC co-op buildings. The most common flip taxes you’ll see in regular co-op buildings will be 2% of the sale price, although it’s also common to see flip taxes of anywhere from 1% to 3% of the sale price.

Other closing costs that the seller will face are relatively minor compared to the big ones we’ve discussed above. To see what these other closing costs are and to estimate your total closing costs, please check out our helpful Closing Cost Estimator for Sellers in NYC.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

It’s important to understand that buyers are typically expected to cover the sponsor’s transfer taxes and attorney fees in a new construction purchase. Even though this will get pitched to you as being customary, it is in truth negotiable just like anything else in real estate.

As a result, sponsors will often offer to pay their own transfer taxes and attorney’s fees and pitch this as a concession to buyers in a soft market. Ironic, considering that they would have had to pay their own closing costs anyway if it was a normal re-sale transaction.

The other closing cost that sponsor might offer to pay on behalf of buyers is the NYC Mansion Tax. This is a predictable closing cost, and at 1% isn’t a huge burden on the sponsor.

Keep in mind that sponsors prefer to negotiate on closing costs vs headline listing prices because of the huge amount of inventory they need to sell. The last thing they’ll want to do is to lower their prices, which might affect their ability to sell their backlog of other units.

As a result, a developer will almost always be more interested in paying closing costs on behalf of a sponsor unit buyer, or paying them some other form of a concession instead.

This preference for discretion by developers mirrors the behavior of our traditional partner brokers who’d prefer not to openly haircut their commissions, which would destroy their ability to charge commissions at regular rates forevermore.

At the end of the day, a business must be a business, and must be profitable. Anyone who argues otherwise is either lying to you or an imbecile. No one starts a for profit business that takes real work with the intention of it being a charity!

Disclosure: Hauseit® and its affiliates do not provide tax, legal, financial or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, financial or accounting advice. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided.