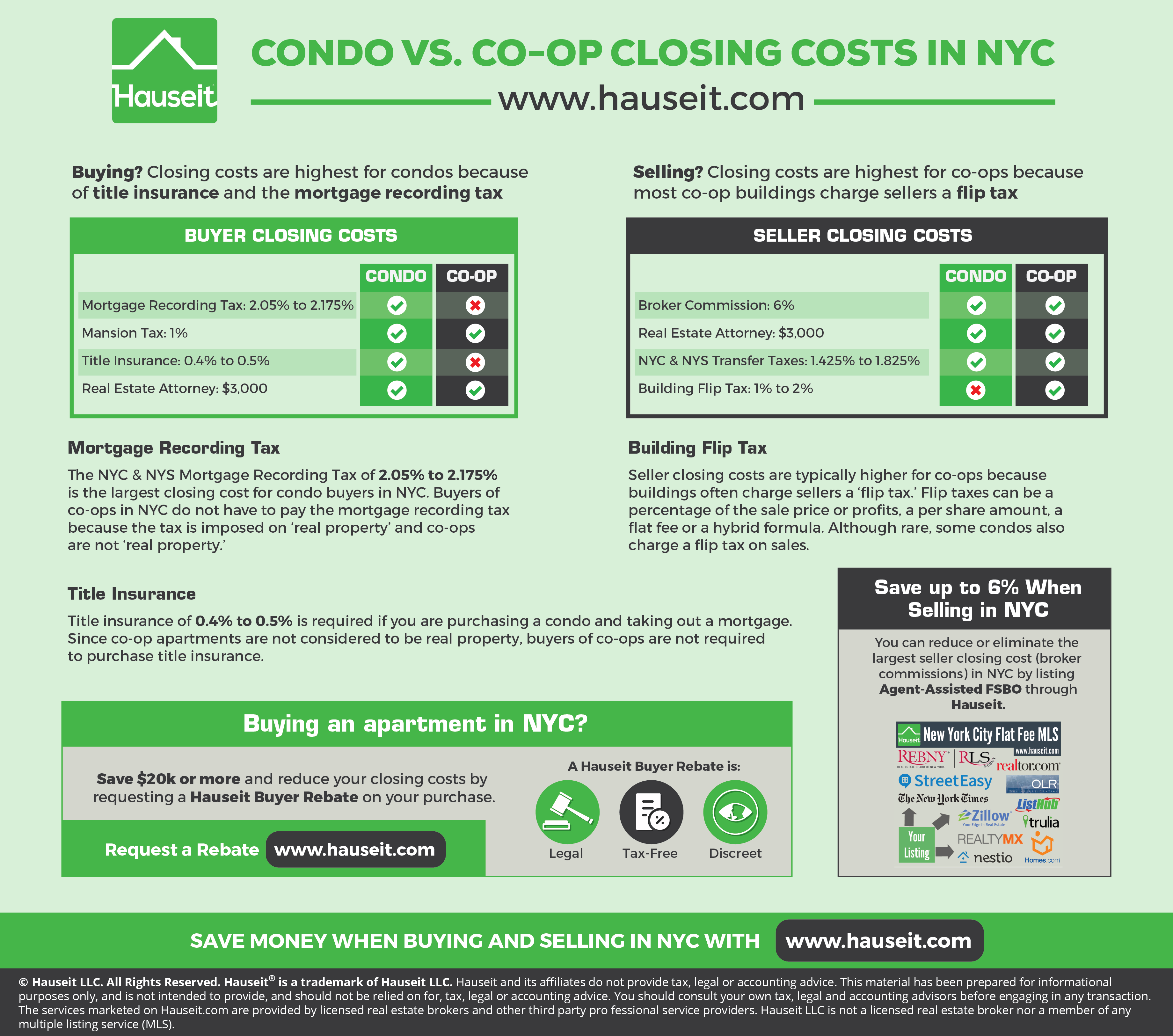

Closing costs for buyers and sellers in NYC are different for condos and co-op apartments. As a buyer, closing costs are the highest for condos. As a seller, closing costs are highest for coop apartments.

For buyers, closing costs are highest for condos because of title insurance and the mortgage recording tax.

For sellers, closing costs are highest for co-ops because most co-op buildings charge sellers a flip tax.

Table of Contents:

Title insurance protects a buyer from any defects or future claims against the title which were unknown at the time of purchase.

This means that you’ll be protected against financial loss if a former owner claims that he or she never sold the property to the seller of your property, which means the seller of the property didn’t have a right to sell it to you.

Co-ops Don’t Require Title Insurance

Title insurance is generally not applicable to co-ops because co-op apartments are not considered to be ‘real property.’

Buying a co-op means that you are buying shares in a corporation that owns the apartment building.

Each co-op apartment owner receives a proprietary lease which associates the shares purchased with your specific apartment.

Title insurance is a bank requirement if you are financing your condo purchase.

The title insurance policy comes in two parts: a lender’s policy and an owner’s policy. The lender’s policy covers the principal loan amount and decreases as you pay down the mortgage. The owner’s policy protects you against the full purchase price and does not decrease over time. If you are purchasing a co-op apartment, your real estate attorney may conduct a lien search as part of his or her apartment due diligence.

If you are buying a condo in NYC, you will also have the option to purchase a ‘market value rider’ for your title insurance policy.

The market value rider pegs the amount of your insurance coverage to the value of your apartment as it increases over time.

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

Title insurance is around 0.4% to 0.5% of the purchase price. It is the third largest closing cost for condo buyers in NYC behind the mortgage recording tax and the mansion tax.

Title insurance is comprised of a fixed fee component and variable fee element that adjusts based on the purchase price. Prior to closing you will receive a ‘good faith estimate’ from the title company which breaks down all elements of the title insurance bill.

Fixed components of title insurance include:

-

Endorsements – Condominium Owners ($50), Condominium Loan ($50), Environmental Protection Lien NYC ($50), Residential Mortgage ($50), Waiver of Arbitration Loan ($50)

-

Other Charges – Certificate of Occupancy Search ($60), Street Report ($60), Housing & Building ($60), Fire Department Search ($60), Emergency Repairs ($60), Bankruptcy Search ($60), Patriot Search ($60), Post-Closing Document Return ($30), Service Charge to Record Documents ($75)

Variable components of title insurance include:

-

Owner’s Policy Premium

-

Loan Policy Premium

-

Market Value Rider (Optional)

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

The NYC & NYS Mortgage Recording Tax of 2.05% to 2.175% is the largest closing cost for condo buyers in NYC.

Buyers of co-ops in NYC do not have to pay the mortgage recording tax because the tax is imposed on “real property” and co-ops are not ‘real property.’

How much is the mortgage recording tax?

The mortgage recording tax generated $1.889 billion in revenue in 2016 according to the NYC Department of Finance.

The New York City component of the mortgage recording tax was originally imposed in 1971 and subsequently increased in 1990 to its current levels.

A flip tax is an additional seller closing cost charged directly by the co-op or condo building on every resale transaction.

Flip taxes are most commonly seen with co-ops in NYC, however you may find an occasional condo which charges a seller flip tax (or a buyer capital contribution closing cost). Therefore, seller closing costs are typically higher for co-ops compared to condos because there’s a high likelihood that the co-op will charge a flip tax.

1-2% is a Typical Flip Tax in NYC

The most common co-op flip tax in NYC is between 1-2% of the sale price.

The amount of the flip tax varies by building, and each building’s flip tax is documented in its proprietary lease and/or building bylaws.

Flip taxes can be a percentage of the sale price or profits, a per share amount, a flat fee or a hybrid formula. Although rare, some condos also charge a flip tax on sales.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Buyer closing costs in New York City are between 1.5% to 5%.

You can reduce your closing costs by $20k or more by requesting a Hauseit Buyer Rebate. Closing costs are higher for condos than co-ops, and closing costs are always greater for ‘new construction’ (sponsor sales). In most cases, you will also pay higher closing costs if you are financing vs. making an all-cash transaction.

Buyer Closing Costs in NYC Include:

-

2.05% to 2.175% – Mortgage Recording Tax (Condo only)

-

1% – NYC Mansion Tax (on purchases at/above $1m)

-

0.4% to 0.5% – Title Insurance (Condo only)

-

$3k – Buyer Attorney Fees

-

$3k – Miscellaneous Fees

Seller closing costs in New York City are between 8% to 10%.

Fortunately, the largest closing cost (6% broker commission) is the one which you can most easily reduce or fully eliminate. You can save up to 6% by listing Agent-Assisted FSBO through Hauseit. Don’t have time to list For Sale by Owner? Consider a Traditional Full Service Listing for Just 1% Commission.

Seller Closing Costs in NYC Include:

-

6% – Average NYC Real Estate Commission

-

1% to 2% – Building Flip Tax (If Applicable)

-

1% to 1.425% – NYC Transfer Tax (RPTT)

-

0.4% – NY State Transfer Tax

-

$3k – Seller Attorney Fees

-

$3k – Miscellaneous Fees

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.