What exactly constitutes proof of funds when making an all cash offer on real estate? Can you get away with only submitting proof of funds or do you need to provide other documentation?

We’ll go over everything you need to know about proof of funds for property purchases in NYC, and we’ll even show you a sample proof of funds letter from a bank!

Table of Contents:

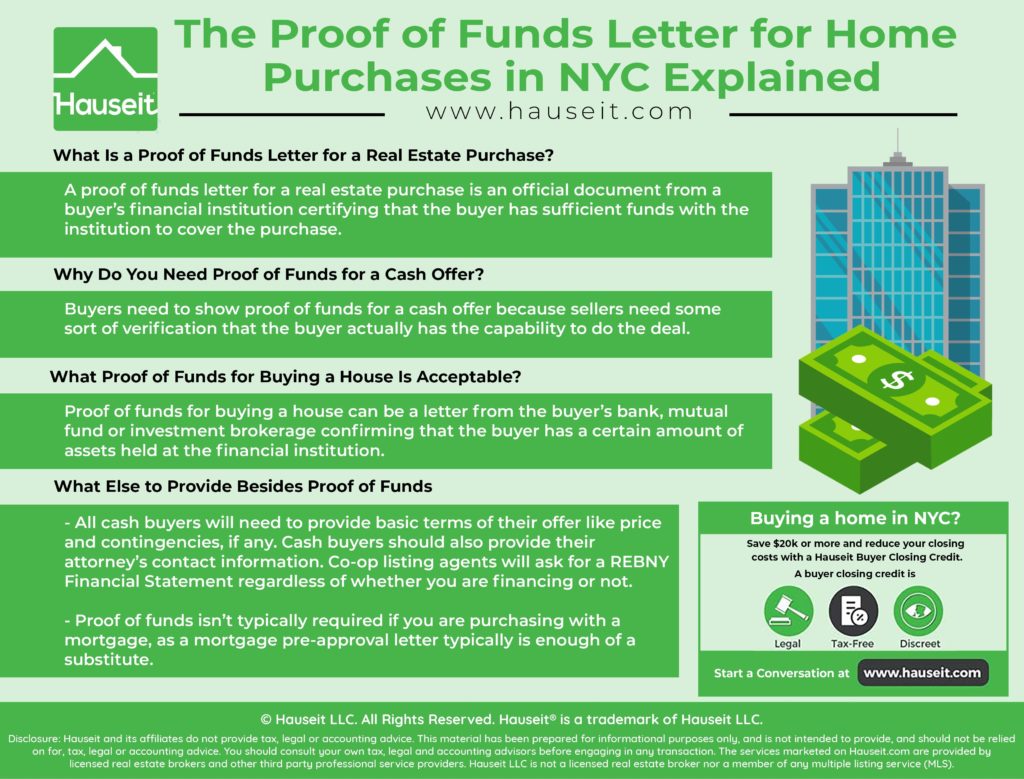

What Is a Proof of Funds Letter for a Real Estate Purchase?

A proof of funds letter for a real estate purchase is an official document from a buyer’s financial institution certifying that the buyer has sufficient funds with the institution to cover the purchase.

A proof of funds letter need not disclose the exact, total amount of funds that the buyer has with the bank or investment brokerage. It is perfectly acceptable to disclose that the buyer has funds in excess of a certain number, as long as that number covers the purchase price.

What Constitutes Proof of Funds?

A proof of funds letter from a bank is typically a formal, signed letter on company letterhead from a senior representative or officer of the bank.

The representative from the bank signing the letter can be a regional or branch manager, or it can be the buyer’s private or personal banker as well.

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

Why Do You Need Proof of Funds for a Cash Offer?

Buyers need to show proof of funds for a cash offer because sellers need some sort of verification that the buyer actually has the capability to do the deal.

Buyers who are financing a purchase do not need to provide proof of funds because they submit offers with a mortgage pre-approval letter from a bank, which essentially acts as a proof of capability to consummate the deal.

A buyer who is looking to purchase property in NYC all cash typically won’t go through the trouble of also getting a mortgage pre-approval letter.

As a result, even if the buyer submits a REBNY Financial Statement, the seller doesn’t have any sort of document from a third party institution vouching for the buyer.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

What Proof of Funds for Buying a House Is Acceptable?

Proof of funds for buying a house can be a letter from the buyer’s bank, mutual fund or investment brokerage confirming that the buyer has a certain amount of assets held at the financial institution.

Proof of funds for buying a house can also be a bank statement or investment account statement which shows that the buyer has enough funds to purchase the property all cash.

If you are providing a bank or brokerage account statement, it’s acceptable to cross out the account numbers for your privacy.

Proceeds from Your Home Sale as Proof of Funds

If you need to sell an apartment before you can buy a home in NYC, then it may be acceptable to provide a signed purchase contract on your existing home as proof of funds.

If the expected amount of proceeds from your sale will only cover a down payment, then you’ll still need a mortgage pre-approval letter from your mortgage broker or bank.

If the proceeds from your sale will entirely cover the purchase price, then the signed purchase contract may be sufficient as long as you can also prove that there is no outstanding mortgage on your property.

However, many sellers will not agree to accept an offer that has a sale or Hubbard contingency attached. That’s because the deal would be contingent on another sale closing which the seller has no control over, and such a deal will typically take longer and have a higher chance of falling through.

What Else to Provide Besides Proof of Funds

If you’re an all cash investor to looking purchase property in a LLC or foreign buyer of property in NYC, you may wish to provide as little information as possible to protect your personal privacy.

So can you get away with simply providing proof of funds for a real estate purchase?

Condo or Co op?

The answer depends on whether you are buying a condo or buying a coop in NYC.

If you are buying a condo, then the listing agent and seller may be alright with simply an offer price and proof of funds for an all cash offer.

However, listing agents for coop apartments will still ask for a completed REBNY Financial Statement even if you intend to purchase all cash.

That’s because NYC coops have their own coop financial requirements that are sometimes stricter than those of banks! Coops will want to see that you have enough liquid assets post-closing, with some coops even asking to see 1.5x the purchase price in liquid assets post-closing!

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Sample Proof of Funds Letter from Bank

May 16, 2018

NYC Brokerage LLC

Attn: Jacob Morgan

111 Fifth Avenue, 2nd Floor

New York, NY 10011

Re: The Michael Jordan 1998 Revocable Trust, Mr. Michael Jordan & Ms. Sara Jordan Trustees RT5-7163

Dear Mr. Morgan,

We are providing this letter to you at the request of our client, Michael Jordan, to confirm certain information regarding assets and funds held in the above referenced account maintained with Wall Street Investment Bank LLC.

As of the close of business on May 15, 2018, the market value of the account was in excess of $10,000,000.

This letter is provided for your information only and should be handled in a confidential manner. Market values are current as of the date set forth above and are subject to change for various reasons, including market fluctuation, client trading and withdraws. The market value provided is based on pricing and information obtained from third parties, including market data providers. As a result, while we believe the information to be reliable, it cannot be guaranteed for accuracy. The above market value does not take into consideration any liabilities or indebtedness the client may have outside of the account either at our firm or with another party.

Please let us know if we can be of further assistance.

Very truly yours,

Patrick Bateman

Senior Vice President

Wall Street Investment Bank LLC

Disclosure: Hauseit® and its affiliates do not provide tax, legal, financial or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, financial or accounting advice. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided.