The coop condo tax abatement reduces annual property taxes for qualifying apartment owners in NYC by 17.5% to 28.1%. It was introduced in 1996 and designed to level the playing field versus 1-3 family homes which are taxed at a significantly lower rate.

The apartment must be used as a primary residence for it to qualify for the coop condo tax abatement. In addition, properties purchased in the name of an LLC do not qualify. See below for the complete list of requirements.

The Cooperative and Condominium Property Tax Abatement reduces annual property taxes for qualifying unit owners by 17.50% to 28.10%. The exact percentage savings is based on a sliding scale according to the ‘Average Assessed Value’ of the unit:

Average Assessed Value |

Benefit Amount Per Year |

$50,000 or less |

28.10% |

$50,001 – $55,000 |

25.20% |

$55,001 – $60,000 |

22.50% |

$60,001 and above |

17.50% |

As you can see from the example below, this approximately 1,000 square foot condominium located in the hip Meatpacking District of Manhattan has a billable assessed value of $121,000 which means it qualifies for the lowest bracket of 17.5%.

Keep in mind that the assessed value of an apartment usually has nothing to do with actual market value. For example, this condo unit would likely sell for around $2 million or more, but has an assessed value of just over $100,000.

You can see in the quarterly property tax bill for our example condominium unit that the $2,645.52 coop condo tax abatement our example condo receives is exactly equal to 17.5% of $15,117.28, which is the annual property tax before any abatements.

How can condo owners check whether they’ve received the tax abatement?

Individual condominium unit owners can check their own quarterly property tax bills either online or by looking at the property tax bills which are mailed.

If you have a mortgage on your property, then your bank will typically be responsible for paying property taxes in a timely manner on your behalf via funds you deposit into escrow as part of your monthly payment. When you have a mortgage, your bank may receive the paper property tax bill vs you in the mail.

However, you can easily check your own property tax bill online in the link we provided above to the NYC Department of Finance website. Simply input your full address, including the unit number. Note that the site can be finicky, and may require your address to be in a specific variation (i.e. 13 Street vs 13th Street).

How can co-op apartment owners check whether they’ve received the abatement?

Coop shareholders will need to check with their managing agent on whether they’ve received the co-op condo tax abatement.

Remember that co-ops are not real property, and the coop corporation receives one property tax bill for the entire building, which it owns. Shareholders have a proprietary lease to occupy their specific apartment, and have shares of stock in the corporation, but are technically tenants of the co-op corporation’s building.

As a result, the managing agent for a co-op will typically receive any tax rebates directly on behalf of all shareholders, and the co-op boards have discretion on how best to distribute the proceeds back to the shareholders.

Often times, boards will decide to levy a co-op special assessment exactly equal to the amount of the tax rebate, so as to keep the funds in the building’s budget. Often times, this is done because the co-op boards wish to keep monthly maintenance lower for optical purposes, which arguably helps anyone trying to sell their unit.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Do I need to apply for the coop condo abatement myself?

No, condo and co-op apartment owners do not typically need to apply for the coop condo tax abatement by themselves because this is usually handled by the building’s managing agent. In fact, managing agents are legally required to renew the coop condo tax abatement for their properties each year.

Each year, the managing agent for your building will typically send around a brief questionnaire asking whether the unit is your primary residence. Managing agents have a duty to check again when apartments are sold to new owners.

Managing agents can find renewal as well as first time application forms on the NYC Department of Finance website, under subsection “How to Apply.”

What if you don’t have a managing agent?

If you don’t have a managing agent, perhaps because you live in a self-managed co-op or condo building, then the NYC Department of Finance recommends that you either call 311 or email them to learn how to apply directly.

The coop condo tax abatement is intended for home owners who live in their apartment as their primary residence. This means that investors buying property in a LLC or well-to-do people buying a second home in NYC would be excluded.

The full list of requirements is below:

-

The co-op or condo apartment must be the owner’s primary residence.

-

The unit cannot be owned by a business (i.e. LLC).

-

You cannot own more than three residential units in a building, and one of the units must be the owner’s primary residence.

-

Units owned by sponsors or their successors in interest are not eligible.

-

Units owned by a trust are only eligible if the apartment is the primary residence of the beneficiary of the trust, trustee, or life estate holder.

-

Unit owners cannot already be receiving the J-51 tax exemption, the 420c, 421a, 421b or 421g tax abatements.

-

The building cannot be an income restricted HDFC, a Limited Divided Housing Company, a Redevelopment Company, a Mitchell-Lama building or in the Division of Alternative Management Programs Program.

-

New condo owners must have filed a real property transfer tax (RPTT) form or deed with the Division of Land Records when they purchased the apartment.

As you can imagine, the inability to take the coop condo tax abatement is an important consideration for investors as well as second home buyers.

Buyers should wary of advertised maintenance or real estate tax figures on listings for sale. In NYC, these figures are almost always taxes after any abatements or assessments.

As you can imagine, assessments or abatements are often linked to the current owner’s individual situation, and a new buyer may not be able to receive the current owner’s abatements or assessments.

How long will the coop condo tax abatement program last?

The NYC condominium and cooperative abatement exists as a stopgap measure to equalize property taxes for condo and co-op apartments relative to one to three family homes, until the local government in New York introduces comprehensive property tax reform.

The co-op condo tax abatement originated in 1996 and has been renewed a total of seven times. The most recent renewal legislation (Senate Bill S7031) was signed by Governor Cuomo on July 1, 2021 and runs through June 30, 2023.

Even though the Cooperative and Condominium Property Tax Abatement was recently renewed, one should not take this tax abatement for granted.

Legislators in Albany have previously attempted to pass legislation which will significantly curtail the abatement for smaller condo and co-op buildings who cannot afford to pay a ‘prevailing wage’ to their building service employees.

This may wreck havoc with the budget of smaller buildings who do not have the means to pay a ‘prevailing wage’ to building employees, especially those who work part-time but more than eight hours per week (i.e. part-time doorman or super).

The proposed prevailing wage bill for condos and co-ops

New York Senate Bill S6219A proposes to revoke the coop condo tax abatement for any building that does not pay a ‘prevailing wage’ to their building service employees.

According to the proposed bill, a building service employee is defined as:

Fortunately, this proposed legislation was vetoed by Governor Cuomo on February 8th, 2020.

How much is prevailing wage?

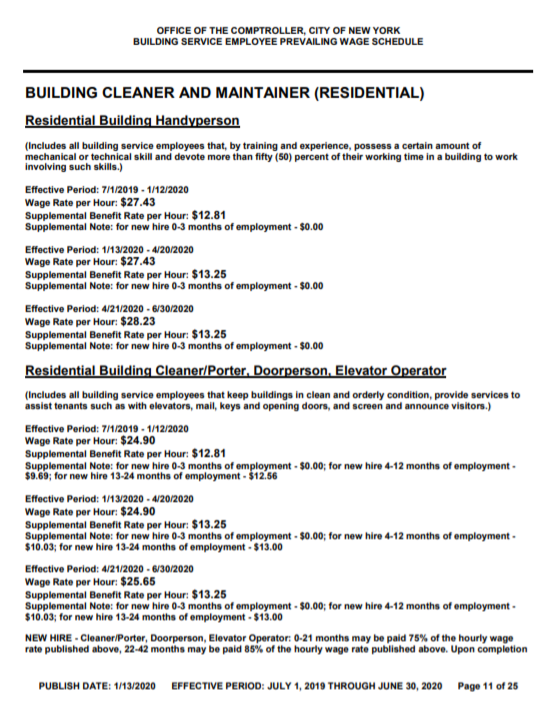

The prevailing wage in NYC for handymen, cleaners and doormen runs from $24.90 to $27.43 per hour, with additional benefits valued at $13.25 per hour depending on length of employment. These rates are set to expire and become higher on 4/20/2020.

These prevailing wages are set by the New York City Comptroller, based on the pay and benefit packages negotiated by the Service Employees International Union.

Buildings can expect to pay their service employees more than $70,000 a year if the new rules go into effect, which is more than double the minimum wage.

You can see for yourself the prevailing wages set by the New York City Comptroller on their website. Click on the subsection labeled Building Service Employee Schedule: LL Article 9, RPTL 421-a, NYC AC 6-130.

As you can see for yourself in the prevailing wage schedule above, a ‘residential building handyperson’ (i.e. building superintendent or janitor), stands to make up to $28.23 per hour, with supplemental benefits of $13.25 per hour by 4/21/2020.

A doorman, elevator attendant, cleaner or porter stands to make $25.65 per hour with supplemental benefits of $13.25 per hour by 4/21/2020.

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

Disclosure: Hauseit® and its affiliates do not provide tax, legal, financial or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, financial or accounting advice. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided.

Re: LLC Exclusion

for over 12 years I’ve own one Apt in a large condo building in NYC. The Condo Unit happens to be in the name of a single-member LLC for liability reasons, since there are Tenants there. When I initially purchased the unit, I was told by EVERYONE that it had a 25 year Tax abatement, which wouldn’t expire until well into the 2030’s. For the last 12 years, we haven’t had any issues.

DOES THIS MEAN THAT NYC IS GOING BACK ON ITS WORD AND WILL RESCIND THE 421A tax abatement for EXISITING HOLDERS who happen to be LLCs GOING FORWARD??