What is an offering plan in NYC real estate? Where can I find the offering plan for my condo or co-op building? Who pays for the offering plan? What information is in a coop offering plan?

We’ll explain everything you need to know about offering plans for condos and co ops in NYC in this article, from how to find a missing coop offering plan to who typically pays for the offering plan.

Table of Contents:

An offering plan for a condo or co-op is similar to a prospectus for an initial offering of stock or bonds.

An offering plan is typically several hundred pages in length. It thoroughly describes every aspect of a property being sold for the first time.

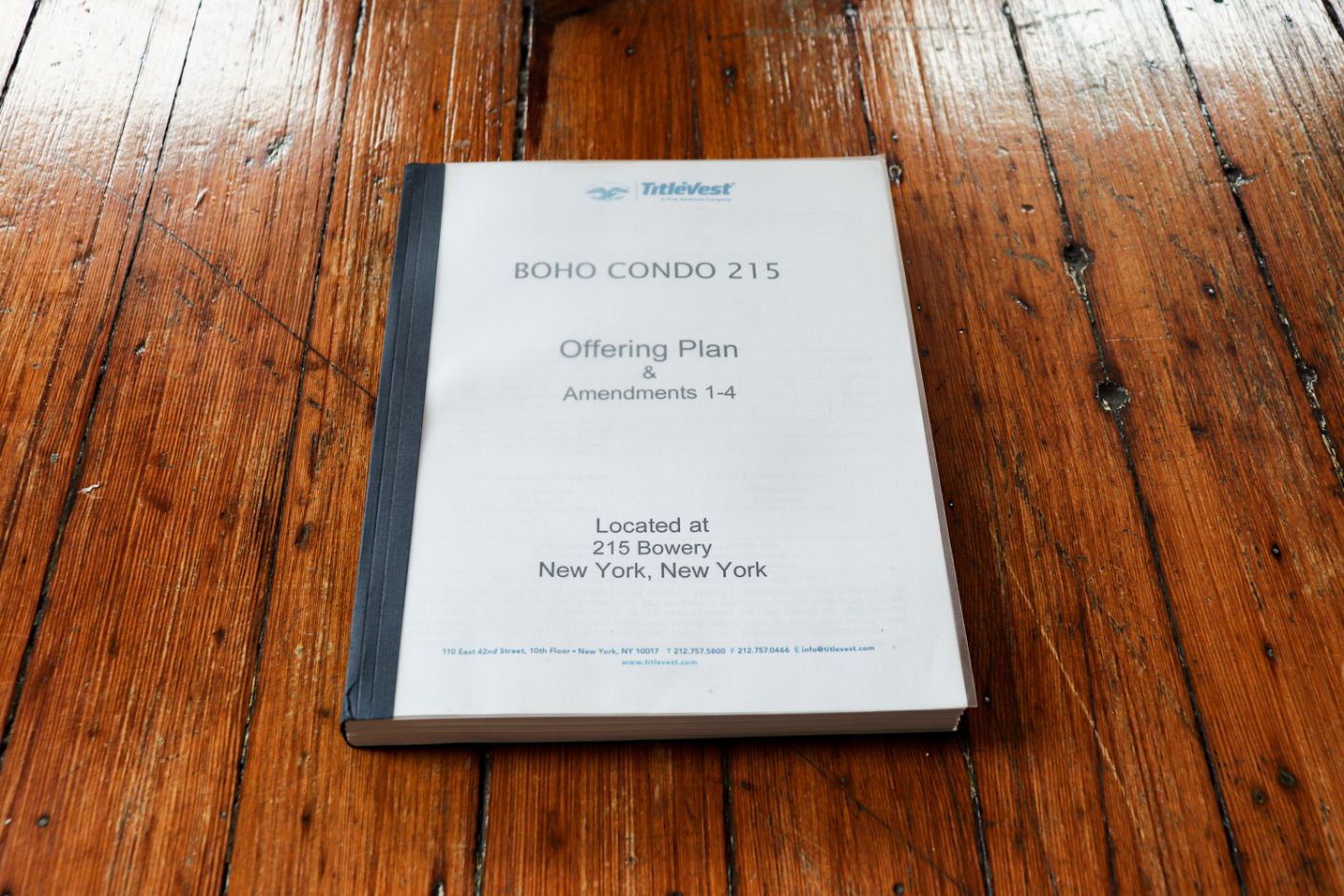

Here is what a physical offering plan looks like:

As you can see, the offering plan is rather thick and comparable in overall size to a college textbook.

An offering plan for the sale of new securities, including the sale by a sponsor or developer of interests in co-operatives or condominiums, is required per the Martin Act, a New York State law enacted in 1921 to enable the New York State Attorney General to fight all aspects of financial fraud.

No advertising, sales or promotion of the new property can take place until the Attorney General’s office has accepted the offering plan for filing.

It’s important to understand that acceptance for filing by the Attorney General does not mean it is a good investment.

Acceptance for filing simply means that the Attorney General’s office believes that the offering plan contains the full amount of disclosures required by the Martin Act. For example, the property could be a wreck, but the Attorney General cannot withhold acceptance until the property is repaired. Rather, it can only mandate that the condition be disclosed in the offering plan.

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

If you are the seller, you almost certainly received a copy of the offering plan at the time of your original purchase. You may have to dig around a bit to find it.

If you are unable to locate the offering plan, there are several ways to obtain a copy:

-

Ask the real estate attorney who assisted you with the original purchase if she or he has a copy

-

Ask your neighbors

-

Ask a board member

-

Request a copy from your building’s managing agent

Asking the managing agent for a copy should be a last resort, as they typically charge several hundred dollars to commission the printing of a physical copy.

If you’re fortunate enough to have a tech savvy (and less greedy) managing agent, they might provide you with a PDF copy for free (assuming a PDF version exists). Unfortunately however, we’ve discovered firsthand that some unscrupulous managing agents might attempt to charge you a fee for a PDF copy of the offering plan.

If all else fails, you can request a free digital copy of your building’s offering plan via TitleVest. Keep in mind however that this digital version is not downloadable and may only be viewed via a password protected online portal for a certain number of days before expiring. Moreover, this access cannot be easily shared with a 3rd party since it requires sharing your confidential TitleVest login details.

Most buyer’s attorneys won’t consider digital offering plan access via TitleVest to be a substitute for the seller’s responsibility to furnish the buyer with a physical copy or PDF of the offering plan. However, a savvy buyer’s attorney will utilize the TitleVest version so as not to delay due diligence and contract signing as you track down a physical or PDF copy of the offering plan.

TitleVest also provides an option to order a physical copy for a fee.

As a reminder, the seller is responsible for obtaining the coop offering plan and other due diligence materials (building financials, purchase application, house rules, etc.). The listing agent is responsible for sharing these documents with the purchaser and purchaser’s attorney at the time of an accepted offer.

If you are buying a condo in NYC, your attorney likely received a copy of the offering plan along with the deal sheet (which is circulated at the time of an accepted offer). If your attorney did not receive a copy of the offering plan (or any of the other due diligence documentation), simply ask the listing agent.

If you are the listing agent for a new development condo in NYC, then the sponsor will have recently filed the condominium offering plan and will have it readily available for you.

Even though most new construction apartments in NYC are structured as condominiums, you will occasionally see a co-op sponsor sale.

These coop sponsor units are either unsold shares that the sponsor has previously held back for rent, or it may even be a complete new development.

In the rare case of a coop new development, the sponsor will have just filed an offering plan for acceptance with the New York State Attorney General, in which case the listing agent will be easily be able to get it from the sponsor.

In the case of a sponsor sale for a previously converted co-op, the co-op almost certainly has a copy of the coop offering plan and any amendments.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

In the very unlikely event that the managing agent, your real estate lawyer, neighbors, board members and various online offering plan databases do not have your building’s offering plan, you can submit a Freedom of Information Law request with the New York State Attorney General’s office.

It can take 20 business days or more to receive a response to your request, so you’ll need time and patience if you choose this route.

It is important to note that it’s by no means a red flag if an offering plan cannot be located for a very old co-op building. After all, the inability to review the original coop offering time becomes less important over time as many sections of it become irrelevant or outdated.

For example, the original proposed co op or condo budget in the 1980’s (which is contained in the offering plan) has little to no relevance to a purchaser today.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Offering plans for co-ops generally are divided into two main sections.

Part one generally consists of, but is not limited to, the following:

-

Special risks

-

Definitions used in the offering plan

-

Anticipated budget for the first year of operation

-

Procedures for purchasing

-

Changes in prices and units

-

Interim leases (if the sponsor can rent out any vacant unit before closing)

-

The effective date and closing date (sale is contingent on plan being declared effective, i.e. at least 15% of units in contract)

-

Contract of sale

-

Sponsor or developer’s profits

Part two generally consists of, but is not limited to, the following:

-

Subscription agreement in the case of a former tenant making the purchase

-

The current condition of the building

-

Co-op bylaws

-

Proprietary lease

-

House rules

It’s the seller’s responsibility to furnish a copy of the offering plan to the purchaser’s attorney. If the seller cannot locate the copy she or he received at the time of the original purchase, the seller is responsible for absorbing any cost associated with obtaining a replacement copy.

In the instance that the purchaser backs out before signing the contract, the buyer’s real estate attorney will typically return the offering plan.

For new developments, the developer (also know as the sponsor) might require the buyer to purchase a copy of the the offering plan.

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

Disclosure: Hauseit® and its affiliates do not provide tax, legal, financial or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, financial or accounting advice. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided.