Buying a coop in NYC is the most affordable path to home ownership in the Big Apple. This is because co-ops can be up to 40% less expensive than comparable condo apartments.

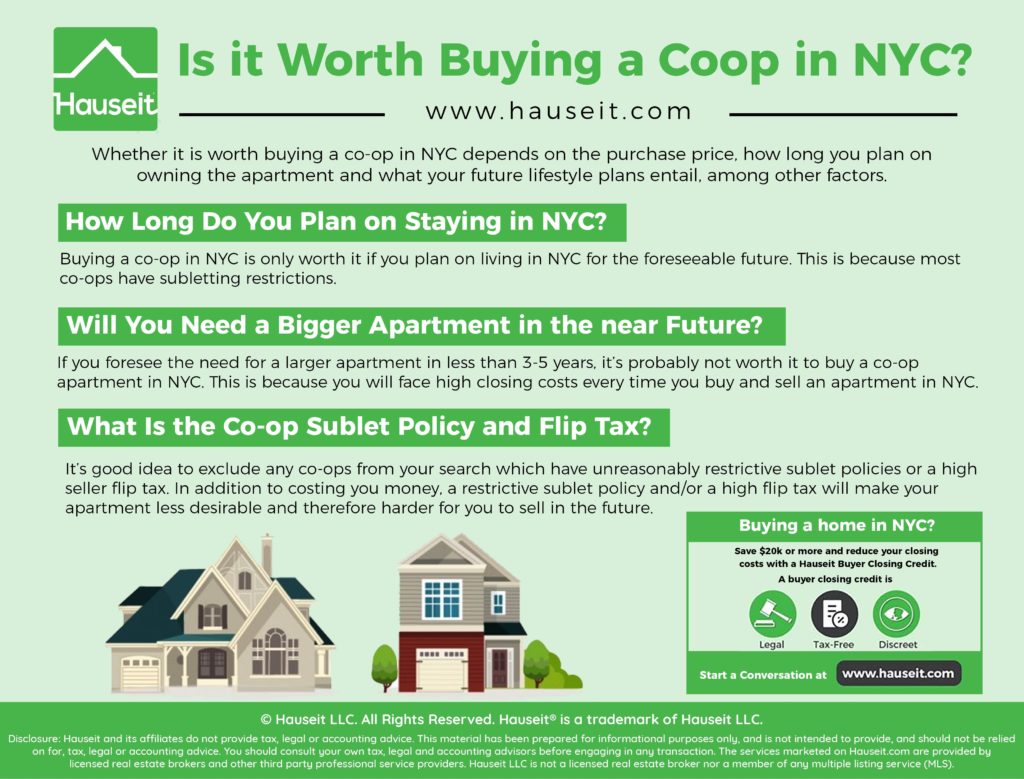

However, the answer to the question of is it worth buying a coop in NYC depends on a number of factors including how long you plan on living in the unit, the purchase price of the property and what your future lifestyle plans are.

Because most co-ops in NYC have subletting restrictions, it only makes sense to buy vs. rent if you plan on residing in the unit for the foreseeable future.

Furthermore, it’s usually not worth buying a coop if you plan on selling to upsize in just a few years. This is because buyer and seller closing costs in NYC are astronomical.

Table of Contents:

Buying a co-op in NYC is only worth it if you plan on living in NYC for the foreseeable future. The concept of a co-op is designed to encourage owner-occupancy. Therefore, most co-op buildings will only permit you to sublet your apartment every few years.

In extreme cases, some co-ops cap the number of years you can sublet during the lifetime of ownership at just two or three years.

Therefore, a co-op apartment is not designed to be held onto and rented out indefinitely should you end up moving out of NYC.

Contrast this with condos, which almost never have any limitation on the amount of time you can sublet your own apartment. As such, it’s probably not worth it to buy a co-op apartment if your job is prone to unexpected and long-term geographic relocations.

If you foresee a job transfer or other real risk of relocation, it’s probably better to rent vs. buy. This is because you’d essentially be forced to sell your co-op once you’ve maxed out the permitted amount of subletting. If the market is in a downturn, you risk losing money on the sale.

You could hold onto the unit and wait for a better market to sell into, however you wouldn’t be allowed to generate any rental income in the meantime.

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

If you foresee the need for a larger apartment in less than 3-5 years, it’s probably not worth it to buy a co-op apartment in NYC. This is because it’s incredibly costly to buy and sell apartments in NYC, especially since most sellers aren’t aware that there are alternatives to paying 6% in seller broker commission.

Because of the high closing costs, it’s generally a better idea to rent an apartment for a few additional years and save money such that when you buy you’re confident it will be your long-term home for five years or more.

If you think you’ll be able to afford to carry your apartment while also renting or buying a larger unit in the future, then it’s a good idea to buy a condo. Bear in mind that it’s nearly impossible to buy a condo and rent it out for as much as your combined monthly mortgage, real estate taxes and common charges.

As such, you will probably be at least a few hundred dollars’ cash flow negative while renting out the condo or co-op apartment you’ve purchased. Virtually all investment properties in Manhattan are cash-flow negative, excluding depreciation and other personal tax implications.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

There are good and bad deals on co-op apartments in both strong and weak real estate markets. When buying, it’s important to remember the old adage “money is made when you buy, not when you sell.”

With that said, it’s especially important to make sure that you do not overpay for a co-op apartment.

The best way to avoid overpaying is to thoroughly review the comps before submitting an offer.

An experienced buyer’s agent will be able to help you assess fair value for the co-op you’re considering and devise an offer negotiation strategy to maximize the chances of getting a good deal on the purchase.

It’s also much easier to overpay with larger, more expensive co-op apartments since they have a smaller buyer base. Luxury co-ops are also much more sensitive to market fluctuations. In a falling market, a unit above $2m will be hit much harder compared to a $500k co-op in Park Slope which simply has more inherent demand and practical use.

In addition, more expensive co-ops are less liquid and will be harder for you to sell in the future compared to more reasonably priced units. Therefore, you must pay extra close attention to the comps if you’re buying an expensive co-op apartment.

It’s good idea to exclude any co-ops from your search which have unreasonably restrictive sublet policies or a high seller flip tax. In addition to costing you money, a restrictive sublet policy and/or a high flip tax will make your apartment less desirable and therefore harder for you to sell in the future. You can experiment with the cost of a flip tax using Hauseit’s Interactive Co-op Flip Tax Calculator.

A co-op’s policies on subletting and the flip tax are also a good indication of the general mentality of the co-op. For example, one large co-op in the West Village prohibits overnight guests if you’re not also staying in the apartment. If a co-op tries to micromanage your life in this way and prohibit you from letting friends spend a night in your home, how friendly and laid back do you think the neighbors are?

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

Posted: 10/25/18 | Last Updated: January 30th, 2020

Disclosure: Hauseit® and its affiliates do not provide tax, legal, financial or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, financial or accounting advice. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided.