Buyer closing costs for a NYC townhouse are typically between 2% to 4% of the purchase price. Exact closing costs depend on the purchase price and whether you’re financing.

Estimate your buyer closing costs in NYC using Hauseit’s interactive calculator, and consider requesting a Hauseit Buyer Closing Credit to reduce your closing costs and save money on your purchase.

The primary determinants of your NYC townhouse buyer closing cost bill are the Mansion Tax bracket (which depends on the purchase price) and the size of your loan (due to the Mortgage Recording Tax).

Consequently, closing costs may exceed 4% if you’re buying something above $5 million and financing the purchase. Closing costs may be less than 2% on the off chance you’re buying a townhouse under $1 million and paying all-cash, since neither the Mansion Tax nor the Mortgage Recording Tax would be applicable.

Please refer Hauseit’s NYC Buyer’s Guide for a comprehensive overview of the home buying process in NYC from start to finish as well as Hauseit’s separate guide to submitting an offer on a NYC townhouse.

Townhouse closing costs in NYC include the following:

-

Mansion Tax (applicable to purchases of $1 million or more)

-

Mortgage Recording Tax (if financing)

-

Title Insurance

-

Buyer Attorney Fees

-

Mortgage Related Fees

-

Miscellaneous Fees

Refer to the next section for a detailed overview of the three largest buyer closing costs for NYC Townhouses: the Mansion Tax, the Mortgage Recording Tax and title insurance.

Buyer attorney fees are fairly small and insignificant relative to the typical purchase price of a NYC townhouse. Most NYC real estate attorneys charge a flat fee of a few thousand dollars to handle the entire process including contract negotiation, buyer due diligence and the closing.

Refer to this article for an overview of the most important questions to ask when interviewing real estate attorneys in New York City.

If you’re financing, mortgage related fees include the loan application fee ($700 – $1,000), appraisal fee ($700 – 1,000), bank attorney fee (~$1,000) and mortgage recording fees (~$250).

Refer to this article for an overview of the NYC mortgage process.

Other miscellaneous buyer closing costs include survey fees and various title search related fees.

The largest buyer closing costs for a NYC townhouse include the Mansion Tax, the Mortgage Recording Tax and Title insurance.

Mansion Tax

The NYC Mansion Tax is a buyer closing cost which ranges from 1% to 3.9% of the purchase price, applicable on purchases of $1 million or more in New York City.

NYC Mansion Tax rates are as follows:

-

1% for purchases of $1,000,000 to $1,999,999

-

1.25% for purchase of $2,000,000 to $2,999,999

-

1.5% for purchases of $3,000,000 to $4,999,999

-

2.25% for purchases of $5,000,000 to $9,999,999

-

3.25% for purchases of $10,000,000 to $14,999,999

-

3.5% for purchases of $15,000,000 to $19,999,999

-

3.75% for purchases of $20,000,000 to $24,999,999

-

3.90% for purchases of $25,000,000 and above

For a more detailed estimate on Mansion and Transfer Taxes in NYC, visit Hauseit’s Interactive NYC Mansion Tax Calculator.

Mortgage Recording Tax

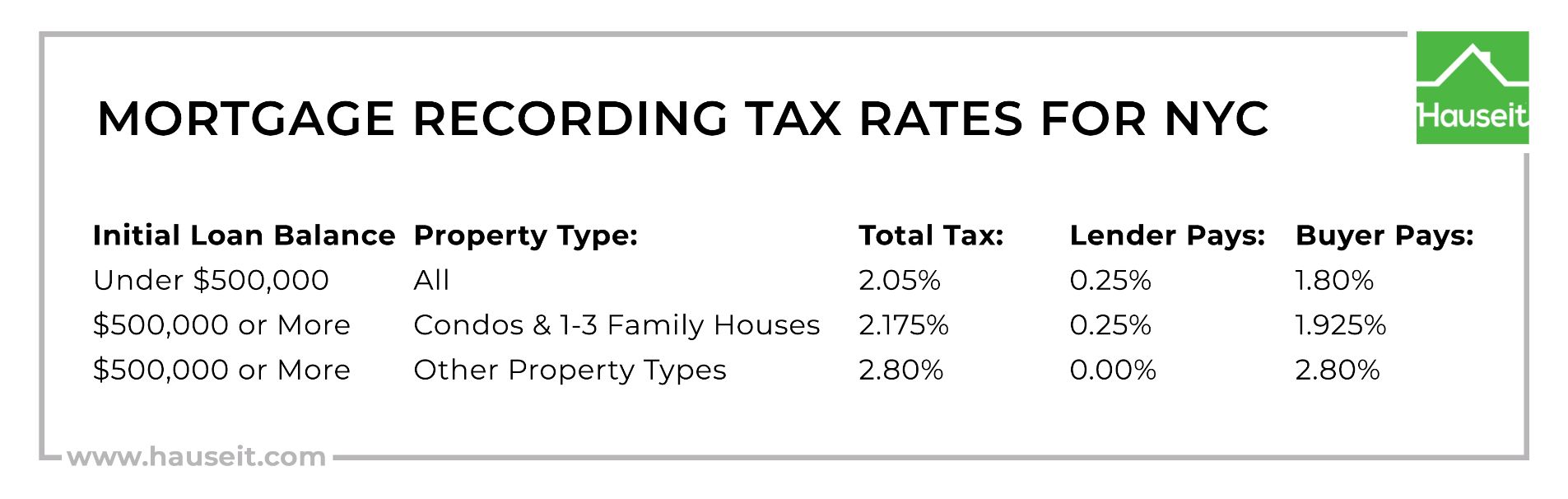

The NYC Mortgage Recording Tax (MRT) is 1.8% for loans below $500k and 1.925% for loans of $500k or more. Four or more family townhouses and commercial properties have a higher Mortgage Recording Tax rate of 2.8%.

Estimate your Mortgage Recording Tax bill using Hauseit’s Interactive Mortgage Recording Tax Calculator for NYC.

You can reduce the amount of the Mortgage Recording Tax on a townhouse purchase by negotiating a Purchase CEMA with the seller.

Title Insurance

Title insurance premiums are approximately 0.4% to 0.45% of the purchase price according to estimates given by most NYC real estate attorneys.

It’s a one-time fee which provides a buyer with an insurance policy against defects or future claims against the title of the property being purchased which were unknown at the time of purchase.

Title insurance consists of two parts: an owner’s policy and a lender’s policy (if you’re financing).

You can also purchase an additional insurance policy called a Market Value Rider which will automatically step-up the value of your Title Insurance policy to match appreciation in the market value over time.

Without the market value rider, title insurance will only cover up to your original purchase price even if market values have increased significantly.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

The easiest way to reduce your buyer closing costs in NYC is to request a Hauseit Buyer Closing Credit. We pair you with a traditional, full-service buyer’s agent who has agreed to rebate you a portion of the buyer agent commission paid by the seller upon closing.

Buyer agent commission rebates are completely legal in New York and generally considered to be non-taxable.

Other methods of lowering your buyer closing costs in NYC include the following:

-

Pay all-cash to avoid the Mortgage Recording Tax

-

Lower your budget to fall into a lower Mansion Tax bracket

-

Negotiate a Purchase CEMA with the seller