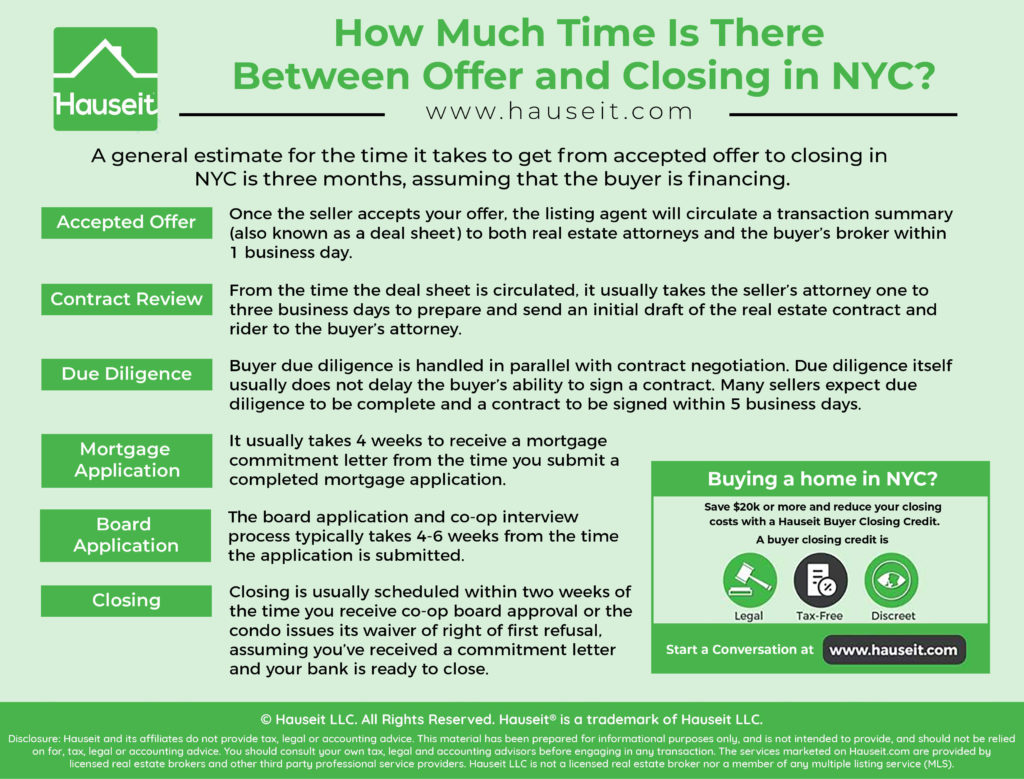

A general estimate for how much time there is between offer and closing in NYC real estate is three months.

However, the timeline from an initial offer to closing on a real estate transaction varies on a number of factors.

These variables include the property type (i.e. condo vs. co-op), whether you are taking out a mortgage, the complexity of the building’s board application, how quick the building and board process the application, and the general responsiveness of the seller and both real estate lawyers on the transaction.

Table of Contents:

Submitting an initial offer is a relatively straightforward process assuming you’ve prepared your offer documentation in advance.

The offer process itself starts with your buyer’s broker reviewing your offer terms and documentation with you. Your buyer’s agent will usually have a call with the listing agent and prepare some pricing thoughts on the property to help you formulate a negotiation strategy.

The offer itself and supporting documentation is typically emailed to the listing agent. Given the fierce competition among buyers in NYC, first movers generally have the advantage.

As a result, any seasoned buyer’s broker (or listing agent for that matter) will encourage you to get your ducks in a row the moment you become serious about buying a property in NYC.

It can take anywhere from a day to a few weeks from the time of your initial offer to having an accepted offer. How long this process takes depends on a number of factors including the amount of buyer competition and the responsiveness of the seller.

If you’re submitting an offer on a co-op apartment, the offer negotiation process usually takes a bit longer. This is because the listing agent will need extra time to review your financial documentation and proposed purchasing structure to make sure that you meet the co-op board’s financial requirements for applicants.

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

Once you’ve accepted an offer, the listing agent will circulate a transaction summary (also known as a deal sheet) to both real estate attorneys and the buyer’s broker.

The deal sheet is a non-binding summary of the terms you’ve negotiated on the deal.

The purpose of the deal sheet is to give the attorneys enough information to begin the next steps of the process, which include the drafting of a contract by the seller’s attorney and the commencement of due diligence by the buyer’s attorney.

Once the deal sheet has been circulated, the listing agent will usually provide the buyer’s attorney with the requisite due diligence documentation. These documents include the offering plan and the building financials in the case of a condo or co-op.

The buyer’s attorney may also review the board minutes, house rules and the purchase application. Finally, the buyer’s attorney will usually send the building’s managing agent a due diligence questionnaire for completion.

It’s important to understand that there is nothing binding about an accepted offer for buyers or sellers. As a buyer, this means that you could still be outbid by another buyer up until the time the contract is fully executed. As a seller, this means that you could change your mind and accept another offer.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

From the time the deal sheet is circulated, it usually takes the seller’s attorney one to three business days to prepare and send an initial draft of the real estate contract and rider to the buyer’s attorney.

The length of the contract review period can take anywhere from a few days to a few weeks. On average, it typically takes around two weeks to have a fully executed sale contract from the time the deal sheet is circulated.

There is a huge variation for how long the contract review period takes. This is because the contract review is another negotiation which can either be straightforward or incredibly arduous depending on the personalities of the lawyers, demeanors of buyer and seller and how demanding the language is in the initial contract sent out by the seller’s attorney.

In the case of a bidding war, the buyer will have very little leverage to push back on language in the contract and delay the signing of the contract itself. Many sellers mitigate the risk of a difficult contract review process by accepting multiple offers and sending out contracts to two buyers. The seller typically countersigns whichever signed contract they receive first.

Buyer due diligence is handled in parallel with contract negotiation. This means that due diligence itself usually does not delay the buyer’s ability to sign a contract. The most common delay in completion of due diligence results from the seller failing to provide a copy of the offering plan to the buyer’s attorney in a timely manner.

Buyer due diligence is also frequently delayed in the case of buildings which do not have digital versions of the minutes from board meetings.

In this instance, the buyer’s attorney needs to make an appointment to physically go to the building’s managing agent to read the building minutes.

This can add a week or more to the overall due diligence process.

In the event due diligence uncovers any potential issues, the buyer’s attorney will need extra time to address them. For example, let’s say that you are in contract to buy a co-op sponsor unit. By sponsor unit, we mean that the co-op itself owns the apartment that is being sold.

Your attorney reviews the building financials and discovers that the building has $250,000 of unpaid back taxes and water/sewer charges. The financials also reveal a $50k legal settlement, a $75k extermination bill and $45k in bad debt.

In this situation, your attorney would need to diligence the building’s legal issue, determine whether the extermination issue is ongoing and figure out where the bad debt came from. The attorney would also need to ask the building for its plan on how it intends to pay the unpaid taxes and water/sewer charges.

Fortunately, most of the financial shortfall will be solved through the proceeds of the sale of the building’s sponsor unit. However, you and your attorney will still need to see convincing evidence that the various legal issues and above-average expenses for things like extermination are non-recurring.

A Full Service Listing for 1%

Sell your home with a traditional full service listing for just one percent commission.

It usually takes ~4 weeks to receive a mortgage commitment letter from the time you submit a completed mortgage application. As is the case with contract negotiation, there is a large variation in how long it takes to receive a commitment letter depending on the specifics of any deal.

For buyers who have pre-existing relationships with a bank, we’ve heard of commitment letters being issued in a week or less. In rare instances, some buyers also go through the underwriting process before signing a contract. This means that the commitment letter itself can be issued as soon as the bank has completed the appraisal.

The mortgage application process can take more than four weeks if there are any extenuating circumstances, such as self-employment earnings or a building which has ongoing litigation or other obstacles to financing.

The board application and co-op interview process typically takes 4-6 weeks from the time the application is submitted. While most press coverage is focused on the co-op board application, the truth is that most condo buildings in NYC also have a purchase application which buyers must complete.

The condo board application is typically intertwined into the procedure for the condo building’s waiver of right of first refusal.

In short, a condo building cannot reject a buyer unless it agrees to buy the apartment on the same terms as negotiated between the seller and prospective buyer.

Condos usually have 20-30 days to prepare the paperwork whereby they waive their right to purchase the property (and thereby permit the sale to proceed).

Depending on the language in the condo’s offering plan, the building may automatically waive its right of first refusal if it does not respond within a certain period of time. If you submit a condo application and hear crickets, it may be a good idea to speak with your real estate attorney.

Our Discretion, Your Advantage

Our traditional partner brokers never openly discount which means less disruption and better execution for you.

Closing is usually scheduled within two weeks of the time you receive co-op board approval or the condo issues its waiver of right of first refusal, assuming you’ve received a commitment letter and your bank is ready to close.

Closings are subject to frequent delays, as the act of coordinating a closing requires multiple people to be available at the same date and time. These include both lawyers, buyer and seller, the bank’s attorney as well as the transfer agent in the case of a condo or co-op apartment.

Save 2% On Your Home Purchase

Save thousands on your home purchase with a buyer agent commission rebate from Hauseit

Published: 9/12/18 | Last Updated: April 15th, 2020

Disclosure: Hauseit® and its affiliates do not provide tax, legal, financial or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, financial or accounting advice. No representation, guarantee or warranty of any kind is made regarding the completeness or accuracy of information provided.